Sentinel Heikin Ashi

- Experts

- Daniel Eduardo San Martin

- Version: 2.0

- Updated: 14 January 2025

- Activations: 10

Looking to maximize your profits and minimize risks? SENTINEL Heikin-Ashi combines Heikin-Ashi signals with the robust risk management of the SENTINEL module, optimized to provide you with advanced yet user-friendly tools.

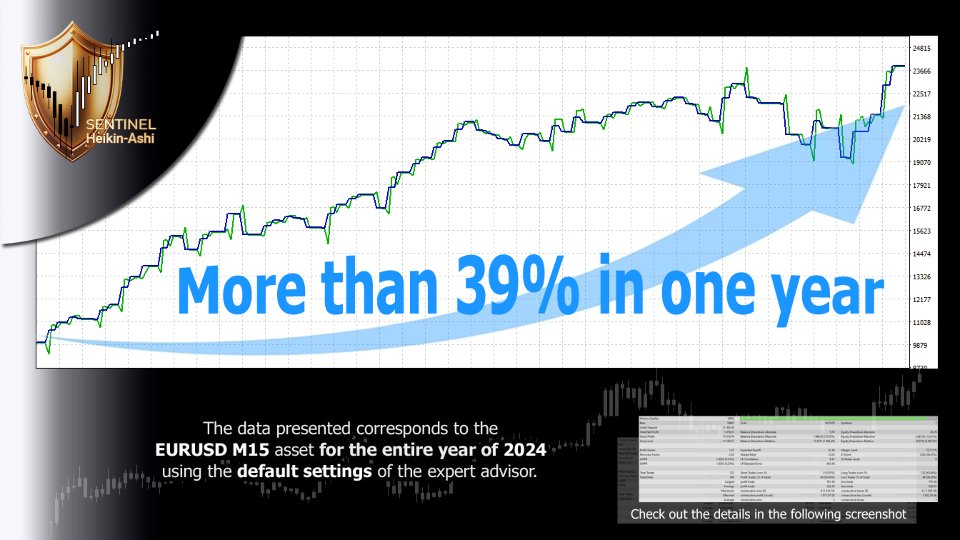

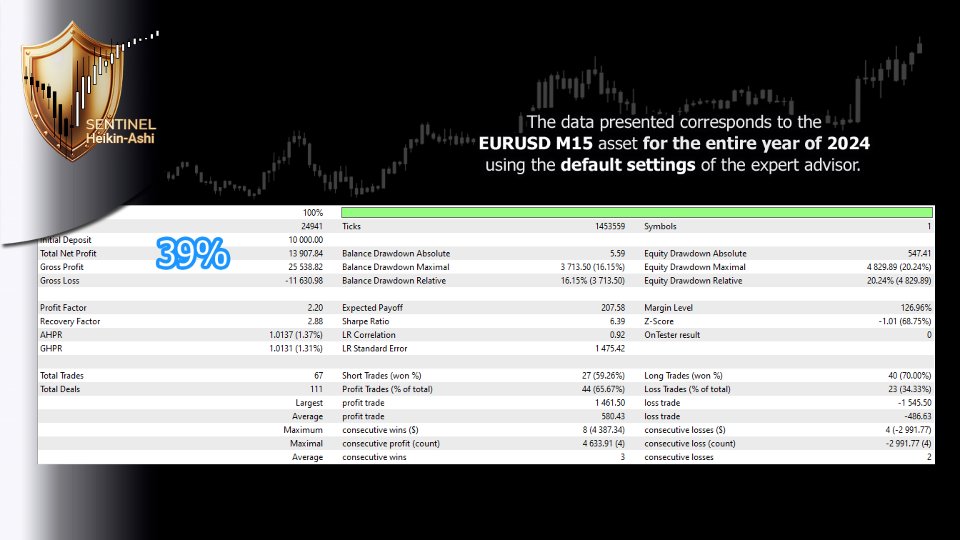

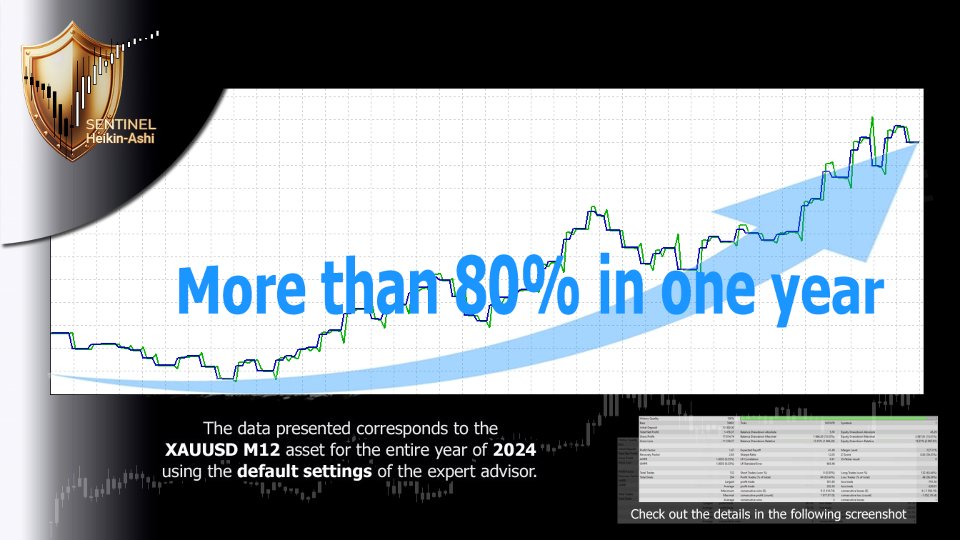

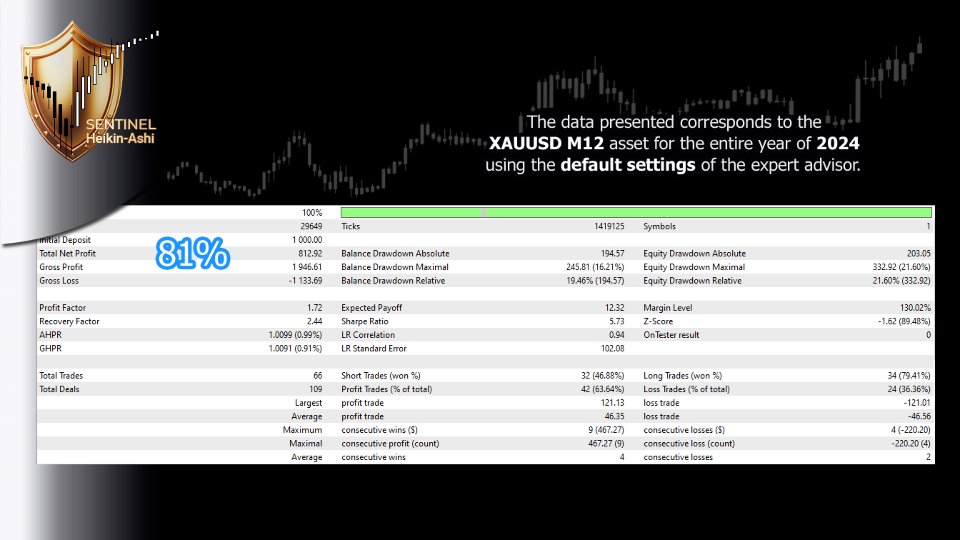

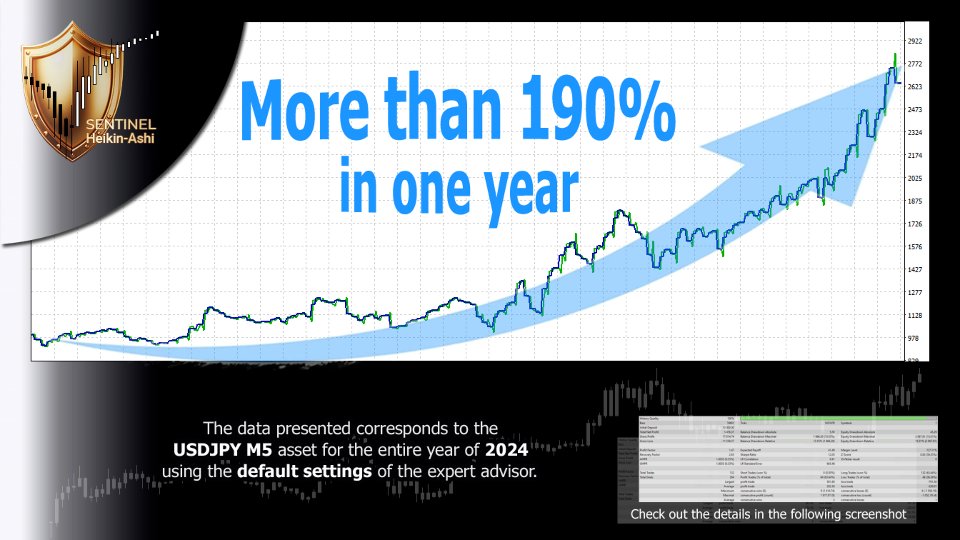

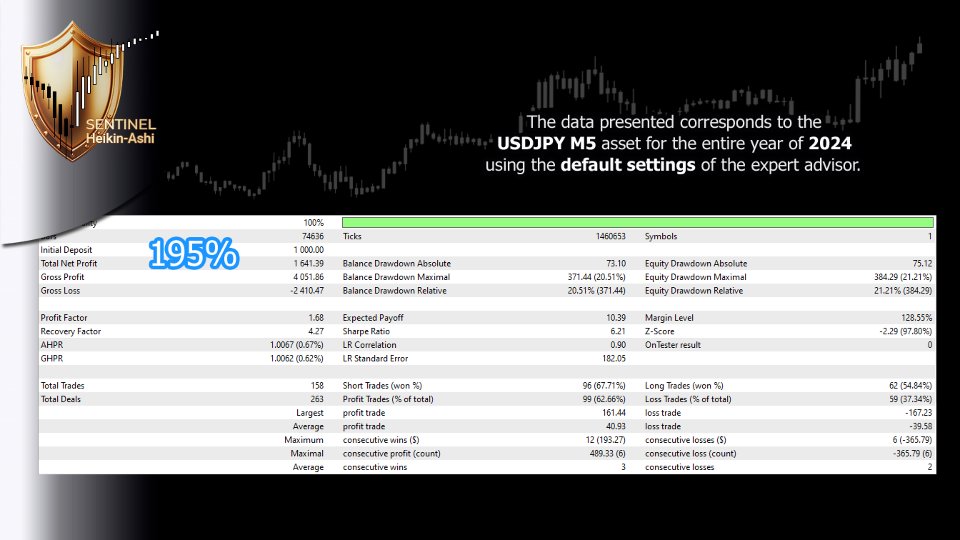

Starting points (backtested in 2024): EURUSD M15, XAUUSD M12, USDJPY M5 · Adaptable to various assets and timeframes

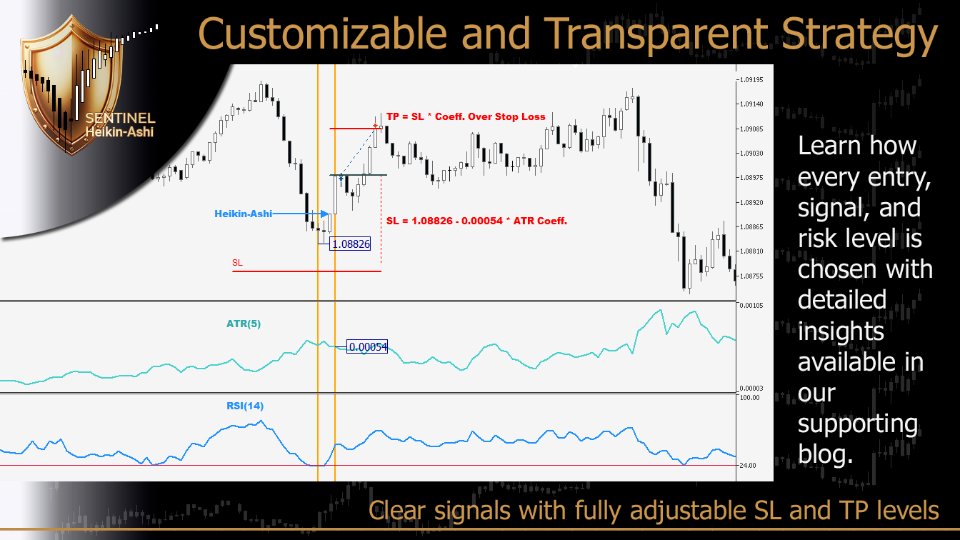

Identify precise opportunities: Capture profitable trades thanks to the combination of Heikin-Ashi signals, RSI, and the new moving averages crossover filter.

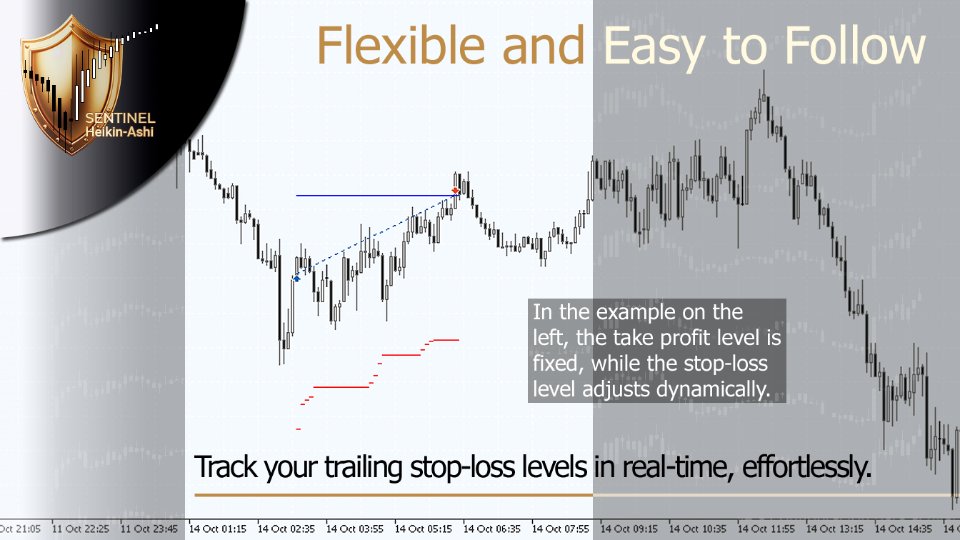

Optimized risk management: Enjoy advanced options such as volatility-based dynamic stop losses, classic or innovative trailing stops, and the ability to set stop losses based on a fixed number of points.

Control and ease of use: New pre-configured menus simplify backtesting, reducing unnecessary combinations so you can optimize faster and more efficiently.

Adapt to your style: Whether you're a conservative or aggressive trader, SENTINEL lets you adjust key parameters like position size, stop levels, and custom partial exits through the Partial Profits menu.

Diversify with confidence: Implement long and short strategies on the same symbol, manage multiple independent instances, and apply configurations tailored to different assets and timeframes.

Visualize with clarity: View dynamic stop loss, take profit, and trailing stop levels directly on the chart, while the Volatility Buffer menu automatically adjusts settings based on market volatility.

Key features:

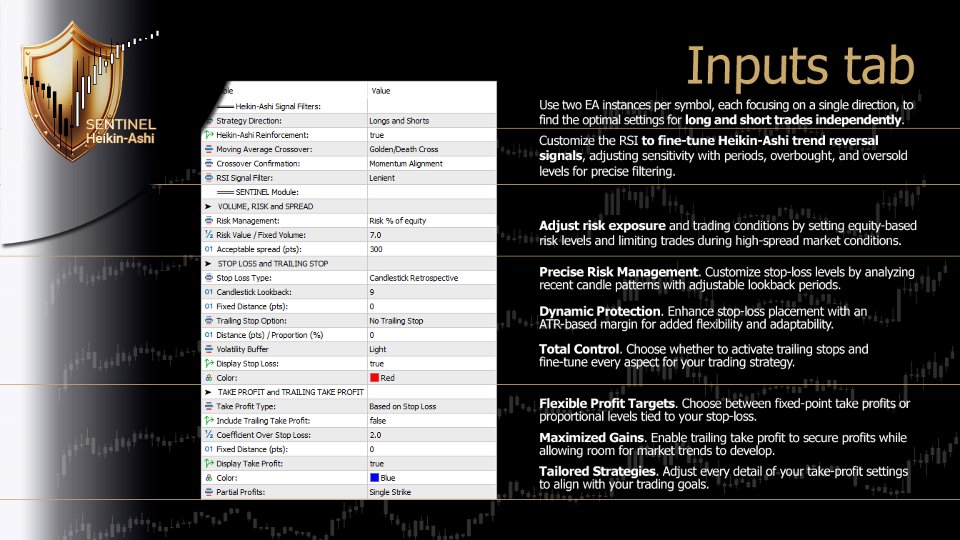

- Flexible configuration: Customize overbought/oversold levels, RSI period, and strategy direction

- Advanced risk and profit management: Includes new options for trailing stop and partial exits

- Automatic position sizing: Adjusts the size of each order automatically based on your risk level

- Manage multiple instances on the same terminal, even on the same symbol

- Volatility protection: Limits entries when spreads are too high

- Automatic stop loss levels: Based on previous candles or fixed ranges, supplemented by volatility adjustments

- Take profit levels: Based on stop loss range or a fixed number of points

When you purchase SENTINEL Heikin-Ashi, you get:

- Activations on multiple PCs

- Lifetime license

- Free updates

- Optimized sets

- Direct support from the developer

Also, these User Guides.

SENTINEL Heikin-Ashi Set Collection

Explore our collection of .set files optimized for a balanced approach to risk and performance. Outstanding results often come with much higher risks; this collection offers configurations focused on effective risk management and long-term stability. It's an ideal choice for traders committed to sustainable and reliable strategies for their investments.

And remember: buying at a low price is key. Secure this EA at the best price now, as its value will only increase with each improvement—and updates are always free!