Order Block Tracker MT5

- Indicators

- Suvashish Halder

- Version: 2.0

- Updated: 23 September 2024

- Activations: 10

Order Block Tracker is here to solve one of the biggest challenges traders face: identifying order blocks. Many traders fail to spot these critical zones, often missing out on key market entries. But with Order Block Tracker, you no longer have to worry about that. This advanced indicator automatically highlights these crucial zones for you, giving you the confidence to enter the market at the right time.

MT4 Version - https://www.mql5.com/en/market/product/123358/

Key Features of Order Block Tracker:

-

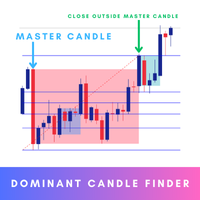

Automatic Detection of Order Blocks: The indicator automatically identifies and highlights order blocks on the chart, saving traders time and effort.

-

Precise Entry and Exit Points: By marking areas of potential price reversal, the indicator helps traders determine ideal entry and exit points with greater accuracy.

-

Real-Time Alerts: Stay updated with real-time alerts when the price enters or exits an order block zone, ensuring you never miss a trading opportunity.

-

Customizable Settings: Order Block Tracker allows traders to adjust parameters such as timeframes and sensitivity to fit their trading style and preferences.

-

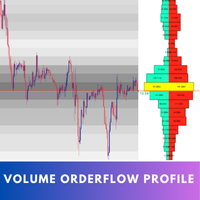

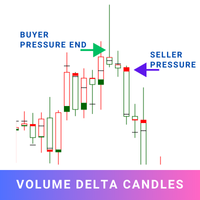

Clear Visual Representation with Volume Data: Each order block not only highlights key zones but also shows the associated volume, providing traders with additional insights into the strength of the block. You can also check previous order block zones with volume, helping you understand past price movements and better predict future trends.

-

Historical Order Block Analysis: By reviewing past order blocks and their corresponding volume, traders can gain a clearer understanding of market patterns, improving their decision-making process.

Benefits:

- Enhanced Market Insight: Understand where institutional players are placing their orders, providing you with deeper insights into market dynamics.

- Improved Risk Management: With precise order block identification, traders can manage risk more effectively by setting stop-loss and take-profit points based on key zones.

- Volume-Driven Strategy: Using volume data alongside order block zones allows traders to evaluate the strength of potential reversals or breakouts.

- Adaptable to Various Market Conditions: Whether trading forex, stocks, or commodities, Order Block Tracker adapts to different markets and timeframes, providing reliable signals in any environment.

By using Order Block Tracker, traders can gain an edge in the market by leveraging institutional-level insights, volume data, and past order block history to make smarter, more strategic trades.

If you need any assistance with Order Block Tracker, don't hesitate to contact me. Thank you!