Eurusd Maverick P Weekly Indicator

- Indicators

- GEORGIOS VERGAKIS

- Version: 1.0

- Activations: 5

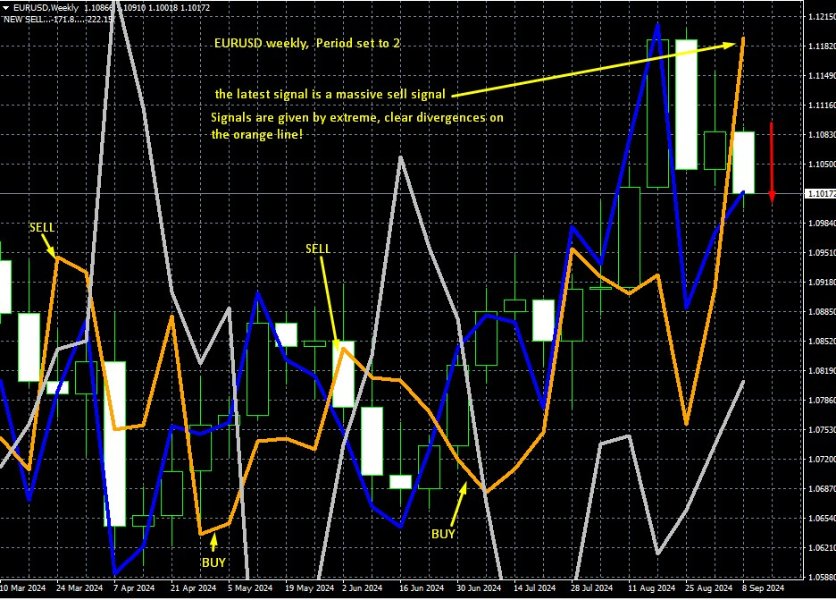

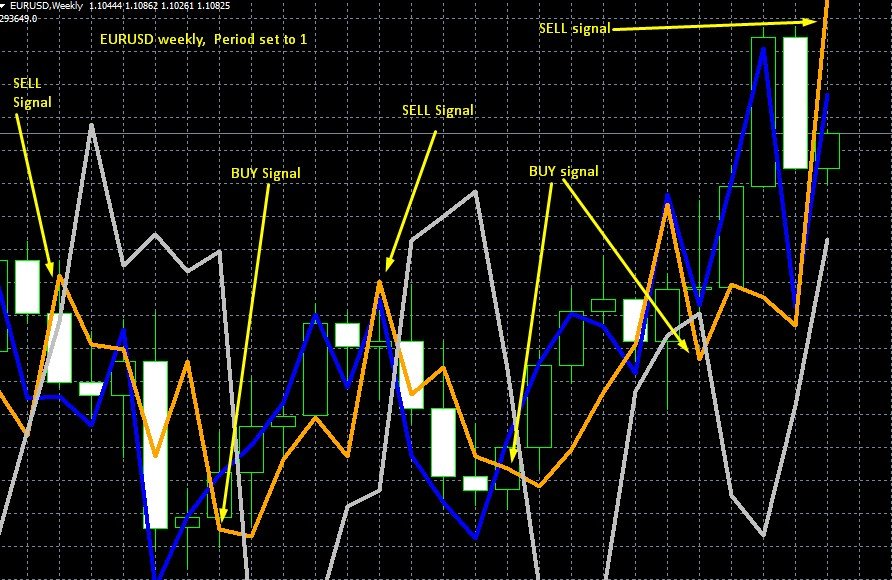

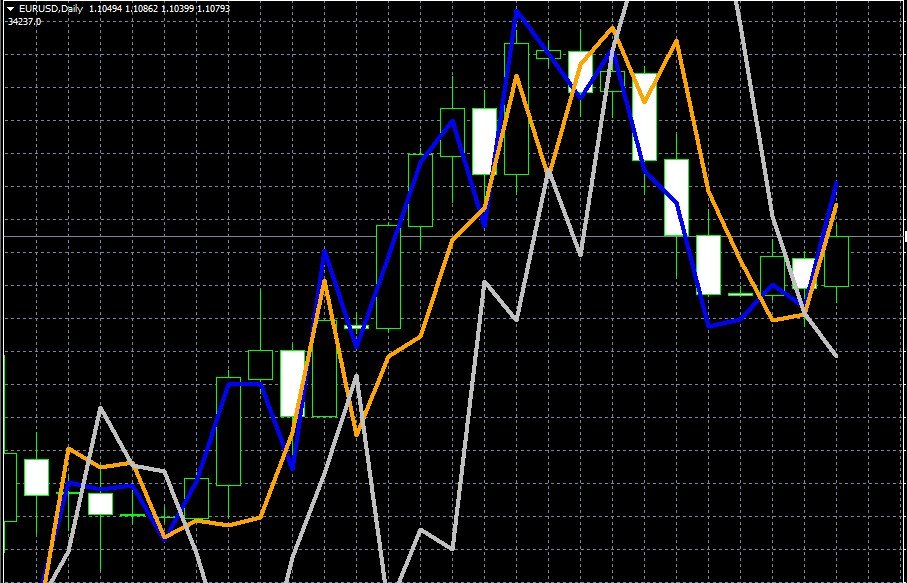

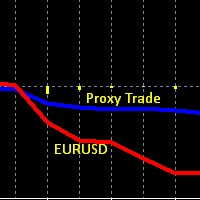

Development of this indicator goes back several years, we have successfully used this latest algorithm since 2019, and it generally works well enough to be profitable. It was originally attempted to make it work on the daily chart, but as you will see in practice it doesn't work so well on the daily chart, while it works extremely well on the weekly chart, for the period setting between 0 and 2, (0 is the latest running week candle, 1 is the latest candle plus the previous one, 2 weeks combined, and a setting of 2 is 3 weeks).

A consistently perfect indicator is impossible to make, due to the dynamic nature of the market, but this is as close as we can get to it. And it is on the weekly chart, where we can gain insight into the pinnacle of the total market action.

This is an indicator that senses major trend reversals BEFORE they occur and before even swing trading signals! It's not perfect, you will see that, and it couldn't be better. Nonetheless, it's profitable enough to turn around your trading.

Limitations and Realistic Results:

it tends to give back 20-30% of the gains on all good moves, while in more rare times you get a signal, and then the next week you may get an opposite signal. This problem is more profound on the daily and smaller time frames, this is why we ended up using it on the weeklys only.

Sometimes the signals lead the market by far, resulting in 100% profitability, but not always. Nonetheless even with 20-30% reduction of profits you still end with massive profits, but also because first and foremost you avoid the wrong side of the market, and getting trapped in endless losses.

Despite these natural limitations, the indicator can sense the dynamic and almost impossibe to predict EURUSD market allowing for massive profits over the weeks where the signals are clear!

Who is this indicator for? This indicator is a serious intermarket indicator suitable for investment funds that want to have greater insight into the market, beyond just momenutm and price action.

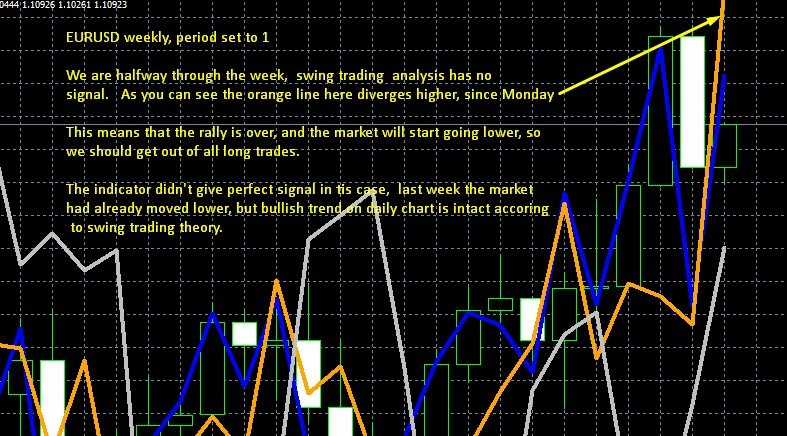

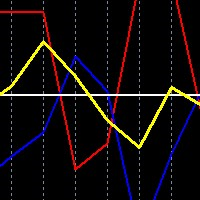

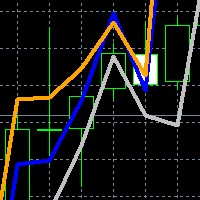

Signals reading is very simple, you neet to plot the indicator on 3 different weekly charts, with period set from 0 to 2 respectively. Then

each Monday of the week (typically signals can but rarely ever change through the week), you just watch for divergences on the orange line.

If the orange line divergeses away from the other two lines, if to the down side it's a BUY signal, if on the up side it's a SELL signal.

Signal formation can happen slowlly or fast, if for example EURUSD has been rallying for few weeks, and then the orange line starts pushing higher, it means the end of the rally is near, if on one Monday, it shows up diverging on the up side extremely, then the SELL signal is in place, and this won't change even if Monday is a bulllish day.

We use all 3 period setings from 0 to 2, while usually, but not always the setting of 1 gives us most signals.

Conflicting signals on different time frames - conflicing signals can occur, but the time frame signal where divergence is greater, will prevail over conflicting signal where divergence is smaller or barely visible. The more the orange line divergences away, the better the signal in that week.

#eurusd, #investing, #slow trading, #high probability, #eurusd weekly