EA algostat

- Experts

- Francesco Lippo

- Version: 1.0

- Activations: 5

Here is the English translation of the detailed description of the Expert Advisor (EA):

---

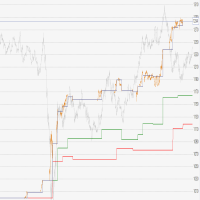

This Expert Advisor (EA) is designed to perform automated trading operations based on a series of technical criteria on a 1-hour chart for the USDCHF symbol. Here is a detailed description of its functionality:

### 1. **Lot Size and Maximum Number of Entries**

- **LotSize**: The initial lot size for each trade is set to 0.1.

- **Max_Entries**: The EA can open up to 4 trades simultaneously. For each new trade, the lot size increases proportionally (0.1, 0.2, 0.3, etc.).

### 2. **Technical Indicators Used**

- **ATR (Average True Range)**: Calculated over a period of 14 bars (1 hour each) to measure volatility. The ATR is multiplied by 2.0 to determine dynamic levels for Take Profit (TP) and Stop Loss (SL).

- **MFI (Money Flow Index)**: Calculated over a period of 14 bars. Used to identify overbought (>80) or oversold (<20) conditions.

- **ADX (Average Directional Index)**: Calculated over a period of 14 bars. Used to confirm the strength of the trend, with a threshold of 25.

- **RSI (Relative Strength Index)**: Calculated over a period of 14 bars. Used to confirm overbought (>70) or oversold (<30) conditions.

### 3. **Entry Logic**

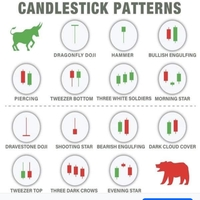

- The EA checks if there is a bullish or bearish pattern identified through specific functions (`isBullishPattern`, `isBearishPattern`).

- **Bearish Pattern**:

- The EA looks for bearish patterns like the "Shooting Star", "Bearish Engulfing", or "Evening Star".

### 3. **Entry Logic** (Continuation)

- **Bullish Pattern**:

- The EA identifies bullish patterns like the "Hammer", "Bullish Engulfing", or "Morning Star".

- If one of these bullish patterns is confirmed, and the following criteria are met:

- The ADX is above 25 (indicating a strong trend).

- The MFI is below 80 (indicating the market is not overbought).

- The RSI is below 70 (indicating the market is not overbought).

- The EA opens a buy position with the current lot size.

- **Bearish Pattern**:

- The EA identifies bearish patterns like the "Shooting Star", "Bearish Engulfing", or "Evening Star".

- If one of these bearish patterns is confirmed, and the following criteria are met:

- The ADX is above 25 (indicating a strong trend).

- The MFI is above 20 (indicating the market is not oversold).

- The RSI is above 30 (indicating the market is not oversold).

- The EA opens a sell position with the current lot size.

### 4. **Lot Size and Subsequent Entries**

- If the EA has already opened positions, the lot size for new entries increases proportionally to the number of positions already opened, up to a maximum of 4 entries. For example:

- First entry: 0.1 lots.

- Second entry: 0.2 lots.

- Third entry: 0.3 lots.

- Fourth entry: 0.4 lots.

### 5. **Dynamic Take Profit (TP) and Stop Loss (SL)**

- Both the Take Profit and Stop Loss levels are calculated dynamically based on the ATR. This allows the EA to adapt to the current market volatility:

- **TP** = ATR * ATR_Multiplier (2.0)

- **SL** = ATR * ATR_Multiplier (2.0)

### 6. **Volatility Filter**

- The EA avoids opening trades if the ADX is below 25, as this could indicate a sideways market or one without a clear direction.

### 7. **Operation on USD/CHF at 1H**

- This EA is optimized to operate on the 1-hour chart of the USD/CHF currency pair. The choice of timeframe and currency pair is important because it directly influences the performance of the automated trading. On this timeframe, the EA looks for trading opportunities based on candlestick patterns and confirms signals through the technical indicators described above.

### 8. **Conclusions**

- The EA is designed to operate in markets with a strong trend and leverages candlestick patterns to determine entry points. Risk management is dynamic due to the use of TP and SL based on the ATR, and the lot size is adaptive depending on the number of open positions.

---

This translation should help explain the functionality of the EA in English. If you have any further questions or need additional clarifications, feel free to ask!