EAalgotrading

- Experts

- Francesco Lippo

- Version: 1.0

- Activations: 5

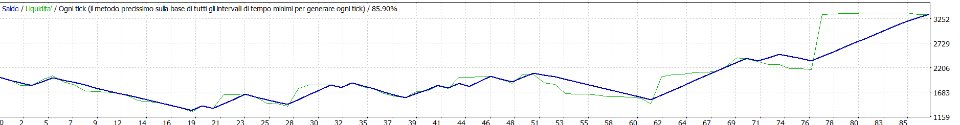

This trading bot is based on the Supply and Demand strategy, which is one of the most popular strategies in technical analysis for financial markets like Forex, used to identify key areas of support and resistance. Here are the fundamental principles and how the bot works: "It works excellently on Nat Gas with a 30-minute timeframe and a minimum capital of 1,600 euros.

Fundamental Principles of the Supply and Demand Strategy:

-

Demand Zones: These are areas on price charts where the demand for an asset (like a currency pair) exceeds supply, causing prices to rise. On a chart, these zones are typically found near recent lows.

-

Supply Zones: These are areas where the supply of an asset exceeds demand, causing prices to fall. On a chart, these zones are typically found near recent highs.

-

Zone Recognition: The bot analyzes past prices for a specified number of bars (defined by the LookBackBars parameter) to identify the lowest and highest price levels, representing the demand and supply zones, respectively.

How the Bot Works:

- Zone Identification: The bot calculates the minimum ( minLow ) and maximum ( maxHigh ) prices over a defined period ( LookBackBars ) to determine the demand and supply zones.

- Zone Visualization: These zones are visualized on the chart using rectangles, with green representing the demand zone and red representing the supply zone.

- Order Placement:

- If the current price ( Bid ) is within the demand zone (i.e., the price is less than or equal to minLow ), the bot opens a buy order ( OP_BUY ).

- If the current price ( Ask ) is within the supply zone (i.e., the price is greater than or equal to maxHigh ), the bot opens a sell order ( OP_SELL ).

- Risk Management: The bot applies Stop Loss and Take Profit levels, defined by the user, to manage the risk of the trades.

This strategy is based on the idea that prices tend to bounce when they reach significant areas of demand or supply, allowing the trader to take a position in anticipation of a market reversal or bounce.