Relative Average Calculator

- Libraries

- Abdullah Tanriverdi

- Version: 1.0

- Activations: 5

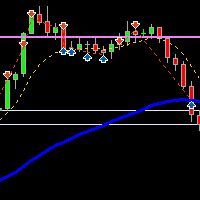

Relative Average Cost of Open Positions Indicator

Description: The “Relative Average Cost of Open Positions” indicator is a powerful tool designed for traders who engage in mean reversion strategies. It calculates the average entry price for both buy and sell positions, considering the total volume of open trades. Here are the key features and advantages of this indicator:

-

Mean Reversion Trading:

- Mean reversion strategies aim to capitalize on price movements that revert to their historical average. By calculating the relative average cost, traders can identify potential reversal points and make informed decisions.

-

Breakeven Point:

- The relative average cost price serves as a breakeven point. When the current market price crosses this level, traders can assess whether their positions are profitable or not.

- If the market price exceeds the relative average cost, it suggests potential profits.

- Conversely, if the market price falls below the relative average cost, it indicates potential losses.

-

Hedge Account Support:

- The indicator considers both buy and sell positions, making it suitable for hedge accounts.

- It calculates the weighted average entry price, taking into account the lot sizes of each position.

-

Easy Integration:

- The MQL5 app seamlessly integrates with MetaTrader 5 (MT5) platforms.

- Traders can add the indicator to their charts and customize its parameters.

-

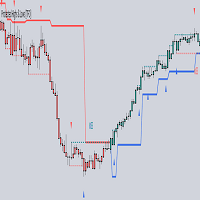

Visual Representation:

- The indicator displays the relative average cost as a horizontal line on the chart.

- Traders can visually compare the current price with this reference level.

-

Risk Management:

- Knowing the relative average cost helps traders manage risk effectively.

- It provides insights into whether existing positions are favorable or need adjustments.

Usage:

- Install the indicator in your MT5 platform.

- Observe the relative average cost line on your chart.

- Consider potential reversals when the market price approaches this level.