Global Market Hidden Trends EA MT5

- Experts

- Aleksandr Makarov

- Version: 2.10

- Updated: 3 March 2025

- Activations: 5

Global Market Hidden Trends EA is based on a statistical arbitrage strategy aimed at identifying hidden market patterns and assets pricing inefficiencies. Using big data analytics to comprehensively analyze the market, the EA identifies anomalies and overvalued or undervalued assets. The EA focuses on leveraging market inefficiencies and the opportunities they present.

- Discounted Price: $1,000 (Regular Price: $1,500)

- 1-Month Subscription: $50 (Regular Price: $150)

This promotional offer is valid until January 25, 2025.

Key features:

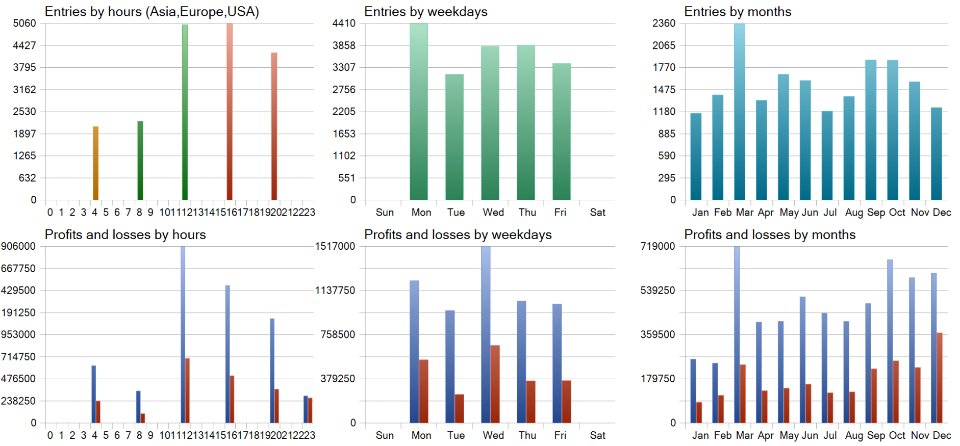

- Trading Frequency: The EA implements a medium-term strategy

- Technological Basis: The modern methodologies and technologies for developing trading systems were used to create the EA, including machine learning, AI, statistical modeling, and complex mathematical methods for analyzing and processing data.

- No Grid or Martingale: The EA does not use grid or martingale strategies, which are often associated with high risk in trading.

- Dynamic Optimization: The EA constantly optimizes its parameters and adapts to changing market conditions to maintain stable performance.

- Swap Cost Accounting: The EA algorithm selects trade sets by considering the potential profitability of the trade itself and the associated swap costs.

- Multi-Symbol Trading: The EA trades on many pairs simultaneously, allowing it to be launched on any symbol.

- Timeframe Irrelevancy: The EA algorithm is not tied to any specific timeframe and works based on the current price, which is the same across all timeframes.

- Broker Flexibility: Due to its medium-term strategy, the EA is not sensitive to spreads and does not impose strict requirements on execution speed, making it compatible with any broker.

The algorithm for selecting assets is based on market-neutral strategies, designed to reduce exposure to market volatility. This approach seeks to manage risks effectively and identify trading opportunities, regardless of market direction.

One of the features of the Global Market Hidden Trends EA is its dynamic adaptability. Unlike other EAs that rely on static optimization, this EA continually adjusts its parameters to align with changing market conditions, aiming to maintain consistent performance.

Global Market Hidden Trends EA is a full-fledged intelligent algorithm. Its creation involved the use of modern methodologies and technologies in trading system development, including machine learning, AI, statistical modeling, and complex mathematical methods for data analysis and processing. In our research, we also used the practices and ideas of hedge fund analysts that became publicly available, integrating those methods that performed well during testing into our strategy.

Our EA is the culmination of more than 5 years of intensive research, development, and constant testing. A whole team of specialists worked on the creation of the EA, including software engineers, mathematicians, practicing traders, and analysts. During this long period, the trading algorithm was constantly evolving and improving. We are now prepared to grant access to our trading system, allowing you to assess its capabilities and performance under various market conditions.

Swap

Our trading strategy focuses on the medium/long term, so swap can significantly affect the overall profitability. We have taken this into account. The algorithm of our trading system selects sets of trades considering the potential profitability of the trade itself and the associated swap costs. Often, the algorithm can open trades with a positive swap (the so-called carry trades). Over time, market conditions can change, and swap can become negative. Please note that swap can differ between brokers. The algorithm uses the swap data of the broker on which it is launched.

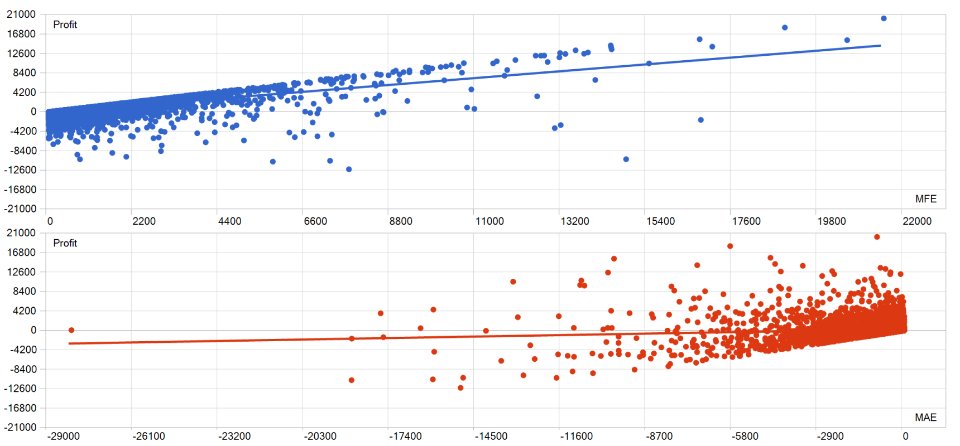

Capital and risk management

Our trading system includes numerous conditions and parameters to effectively minimize risks. The EA has a dynamic risk management module that continuously evaluates market conditions and adjusts trading parameters depending on the market situation. Although we cannot fully disclose the specifics of our risk management algorithm, we can share some fundamental aspects. One main approach is diversification, which involves distributing funds across different assets to reduce overall risk. Additionally, the EA manages risks by controlling the maximum amount of capital invested in a particular asset (max exposure per asset), reducing the likelihood of a strong drawdown in the event of an extraordinary change in the asset price.

Recommendations and settings

- Minimum deposit: The algorithm does not impose minimum capital requirements. However, the larger the capital, the higher level of diversification the algorithm can achieve. Thus, for an account with a small capital, the risk increases. For full diversification, it is recommended to use accounts with at least $50,000 USD, although the algorithm will be able to trade on an account with a capital of $10,000 USD and less.

- Account type: Hedging

- Ease of launch: No additional files are required.

-

Symbol: Any. The algorithm trades on many pairs simultaneously and can be launched on any symbol. The assets used by the algorithm include:

Currencies: USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, CZK, HUF, NOK, PLN, SEK, CNH, HKD, SGD, TRY, ZAR, MXN

Metals: Copper, XAG, XAU, XPD, XPT

Currency indices: JPYX, USDX, EURX

Country indices: UK100, US2000, US30, US500, SPA35, SWI20, SA40, NOR25, NAS100, NETH25, JPN225, MidDE50, GER40, GERTEC30, HK50, EUSTX50, FRA40, CHINAH, CN50, CA60, AUS200

- Lot size: The lot size is calculated by the algorithm based on internal data to balance the value of assets within one transaction. The trader has the option to use a lot multiplier, which is tied to the capital size. When using a lot multiplier, the algorithm will increase the calculated lots for transactions accordingly, leading to an increase in capital used for each transaction. This, in turn, decreases diversification, so using high values for this parameter is not recommended.

- Timeframe: Any. We consider the division into timeframes artificial which does not reflect the real picture of the market in any way. The algorithm is not tied to the use of any timeframe and works based on the current price, which is the same for all timeframes.

- Brokers: Any. Due to the medium-term strategy type, the algorithm:

- is not sensitive to spread, although it takes it into account in its operations;

- does not impose strict requirements on execution speed.

However, brokers with smaller spreads and high execution speeds are preferable.

- It is recommended to use a VPS for 24/7 operation of the EA.

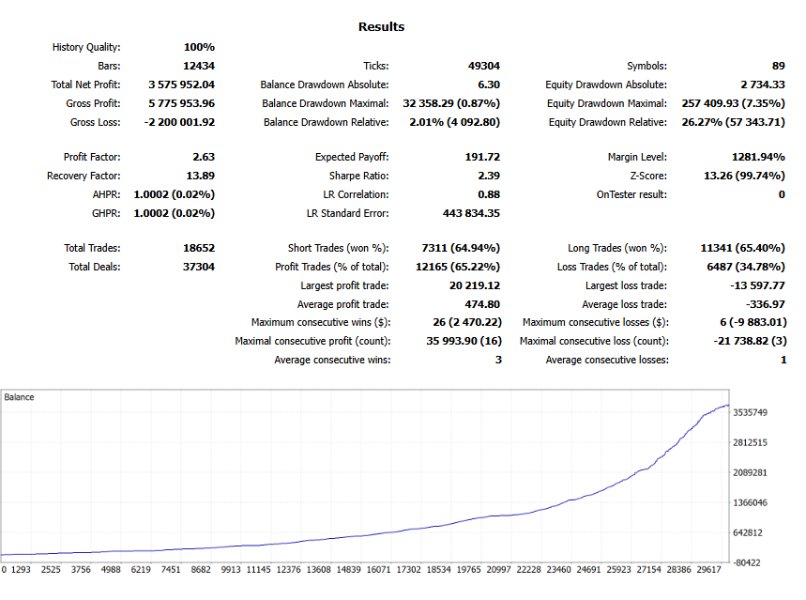

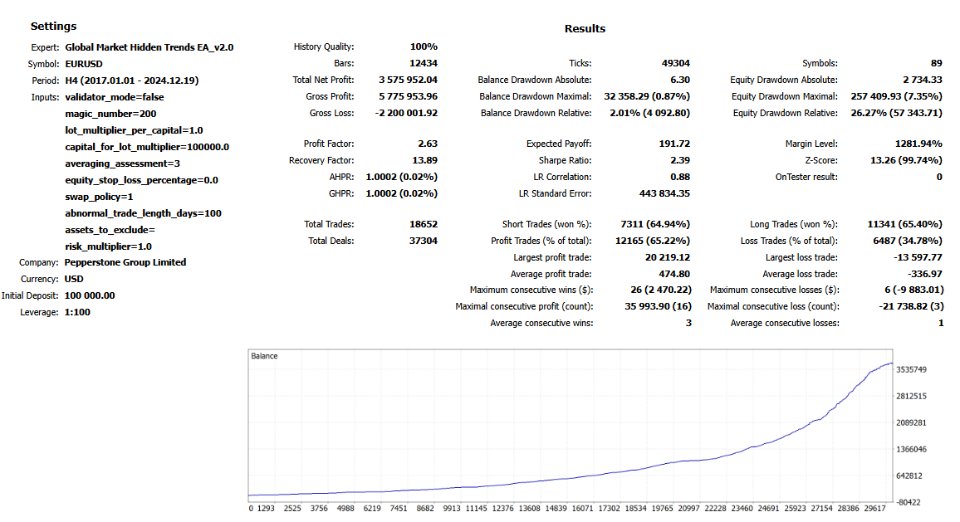

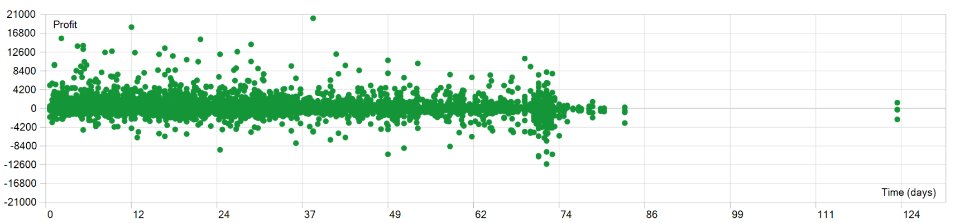

Testing on historical data

To run a test on historical data, you can specify any symbol and timeframe. We recommend running the test using the “1 minute OHLC” mode or even “Open prices only” to speed it up. This will not significantly affect the testing results. You can verify this by running a long test using the "Every tick" method (for example, over a period of one year) and comparing it with the test results using "Open prices only."

Please note that running in "Every tick" mode will require downloading a large amount of tick data (tens, if not hundreds of gigabytes, depending on the selected testing period), as the EA trades on many symbols simultaneously. Additionally, MT5 does not contain historical data on swap values, meaning the algorithm will use current swap values for testing.

Parameters

- Validator mode – Always set this to FALSE. This parameter reduces the number of assets used in a back-test to speed up the test in the MQL5 validator. Otherwise, the test takes too long, and the algorithm cannot be uploaded.

- Magic number – A unique EA identifier.

- Lot multiplier per capital – Multiplies the lots calculated by the EA. This parameter is linked with the next parameter and increases automatically as your capital increases.

- Capital for lot multiplier – Specifies the amount of capital based on which the lot multiplier will increase.

- Averaging assessment – Sets the aggressiveness of averaging your positions before the market imbalance is equalized.

- Equity stop loss (drawdown % of balance) – Closes all positions in case of a specified drawdown.

- Swap policy – Sets your swap assessment: choose to be conservative (open trades only with positive swap ) or ignore swap entirely.

- Abnormal trade length (days) – If a set of trades is not closed after this many days, the EA will focus on closing it as soon as possible.

- Assets to exclude – List assets you wish to ignore in trading. For example, after 2022, you may choose not to trade the Turkish Lira due to economic issues in Turkey. Specify assets separated by commas, e.g., "TRY,XAG,HKD" (without quotes). Note that excluding risky assets may reduce risk but also decrease gain opportunities.

- Risk multiplier – Sets your risk assessment. Each asset has a risk evaluation that limits the amount of funds that can be invested in this particular asset. By changing the risk multiplier you can reduce or increase the maximum investment per asset thus increasing your return on invested capital. Please remember that higher returns come with a higher risk (a higher potential drawdown).

- Symbols mapping – In this section you can specify the exact name of the related instrument that is used in your MT5 platform. For example, in case your broker adds a prefix or a suffix to currency pair instruments, or if any of the indices is named in your MT5 differently than it is configured in the EA.

I like it. It will be very interesting to see how the EA performs going forward. If my opinion changes, I’ll definitely update my review