Abiroid Golden MA Levels

- Indicators

- Abir Pathak

- Version: 1.1

- Updated: 11 July 2024

Similar to logic used in: Golden MA MTF TT

Overview

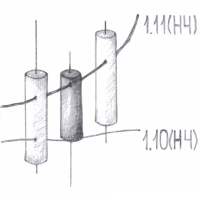

"Golden MA" indicator for OB/OS levels. It's based on High/Lows of higher timeframe (HTF) previous bar. Only useful in swing trading or scalping.

Best for at least M15+. For lower timeframes you'll need to change StartPips to lower value to get consistent lines. Because lower timeframes will have smaller pip distances.

Features

- Define Higher Timeframes for Current Timeframe:

Use a comma-separated list to define the higher timeframe for the current chart timeframe.

Example: M1=H1,M5=H4,M15=D1,M30=W1,H1=W1,H4=MN1,D1=MN1,W1=MN1

- Get Levels values in Buffers

Max Past Bars:Specify the maximum number of past bars to calculate levels for.

Refresh After Given Number of Ticks

DrawLevels On/Off:Toggle to draw the calculated levels on the chart.

Draw End Of Period: Draw vertical lines at the end of each higher timeframe period.

Best Trades:

Indicator default settings are best for H1. For smaller timeframes like M5,M15 you will need to make StartPips a lot smaller. Because smaller timeframes will have smaller point distances.

So to draw the lines more appropriately. Use crosshairs tool to figure out the best distances.

Volatility should be good. Usually for pairs which have market open.

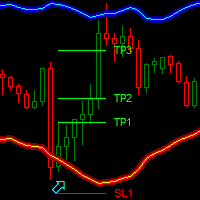

Wait for price to cross Mid Line. And then during next few bars, price should cross the Buy or Sell Start Line. A strong volume candle is preferrable. (get attached VolumeCandles to detect good volumes)

Make sure that price hasn't gone too far in breakout bar and crossed multiple levels. Because really long bars might then have a retracement or enter a range. So be careful:

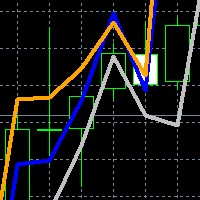

Always trade in direction of overall higher timeframe trend.

If scalping, wait for price to cross Buy/Stop End levels. And then place a trailing stop. Definitely close by Warning OB/OS or at max by Danger OB/OS.

Place a stop loss near Mid line. And Keep take profits at least 1.5-2 times Stop Loss. If price is moving well, keep shifting your Take Profit. If price seems like it is ranging, then close trade early. And never be too greedy :)

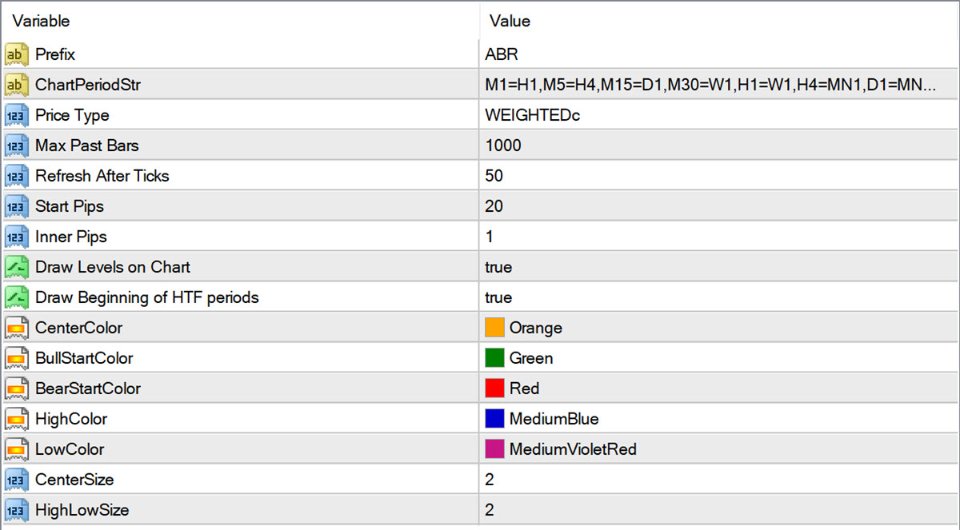

Input Parameters

- Prefix: Prefix for object names.

- ChartPeriodStr: String to define higher timeframes for the current timeframe.

- PriceType: Used to calculate the previous bar Mid. See below calculations section

- MaxPastBars: Maximum number of past bars to calculate.

- RefreshAfterTicks: Number of ticks after which the indicator should refresh.

- StartPips, InnerPips: Used to calculate all Upper/Lower levels for OB/OS Conditions

- DrawLevels: Boolean to toggle the drawing of levels on the chart.

- BeginningEndOfPeriod: Boolean to draw vertical lines at the start and end of higher timeframe periods.

- CenterColor: Color for the center level line.

- BullStartColor: Color for the start of bullish levels.

- BearStartColor: Color for the start of bearish levels.

- HighColor: Color for high levels.

- LowColor: Color for low levels.

- CenterSize: Width of the center level line.

- HighLowSize: Width of the high and low level lines.

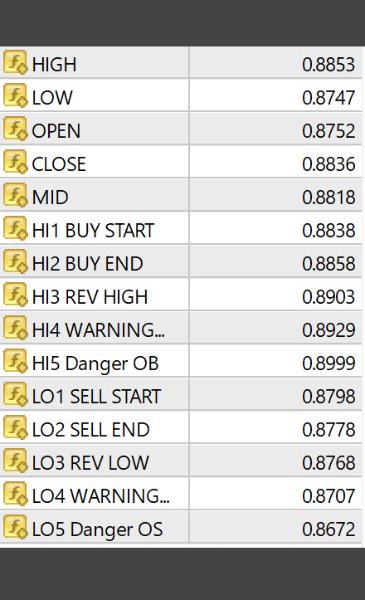

Buffer Values

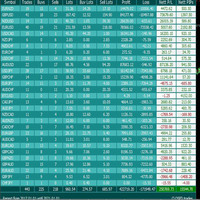

The indicator uses multiple buffers to store calculated values. See screenshot for buffer names.

Overbought/Oversold Levels:

The indicator defines various levels to identify potential market conditions:

- HI1 BUY START: Starting point of buy.

- HI2 BUY END: End level if scalping

- HI3 REV HIGH: Represents a high reversal point.

- HI4 WARNING OB: Signals a warning that the market is near overbought conditions.

- HI5 DANGER OB: Indicates a dangerous overbought condition, high potential for reversal.

Price Types Calculations:

The Golden MA Indicator offers various price calculation methods. Here's how each price type is calculated:

OCLH:

Average of Open, Close, Low, and High prices.

MEDIANco:

Average of Close and Open prices.

MEDIANhl:

Average of High and Low prices.

TYPICAL:

Average of High, Low, and Close prices.

WEIGHTEDo:

Weighted average giving more weight to the Open price.

WEIGHTEDc: Weighted average giving more weight to the Close price.

Upper/Lower OB/OS Levels:

It uses StartPips for levels. E.g. the first High1 level is Mid level + (StartPips * POINT)

Final Notes:

This indicator does not perform well for a slow sideways ranging market. So be careful. Better to use forex core pairs.

Ideal times to trade will be good volatility markets. Be careful during news events. And careful when market it choppy or whipsawing.