Cipher Hybrid HFT Gold Trader

- Experts

- Evren Caglar

- Version: 1.3

- Updated: 30 June 2024

- Activations: 5

The Cipher Hybrid-HFT Gold Trader: The Power of Probability Theory and Price Action Principles

The vast majority of technical indicators are the same age as dinosaurs. Also, many retail traders are not aware of this fact: most technical indicators are developed for the stock market - not for the forex and not for the metals market.

The apparent fact that you can not achieve consistent success in the metal market with old technical indicator theories and with the tools developed for stock markets.

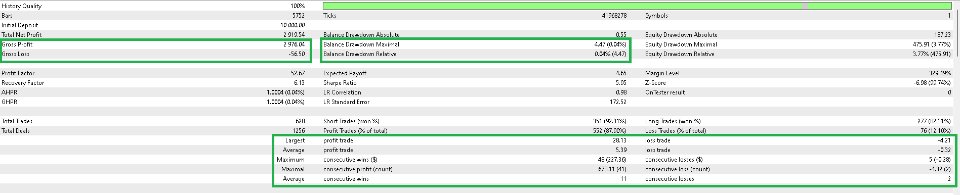

We follow the professional approach those institutions use in the development of the trading algorithm. Cipher is one of the newest generation of algo traders which relies on probability model and price action theories. It uses only ATR indicator to determine the initial take-profit and stop-loss levels.

The Cipher is equipped with an advanced trade management system in which every order managed separately from each other.

You can read my article for how to obtain x13x return with portfolio diversification.

Highly Customizable Hybrid-HFT Algo Trader Tailored for Trading Gold and our Risk Limits

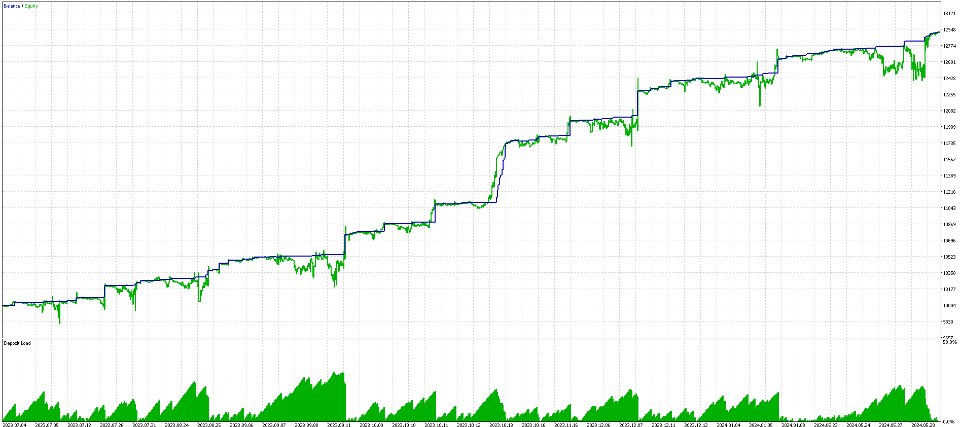

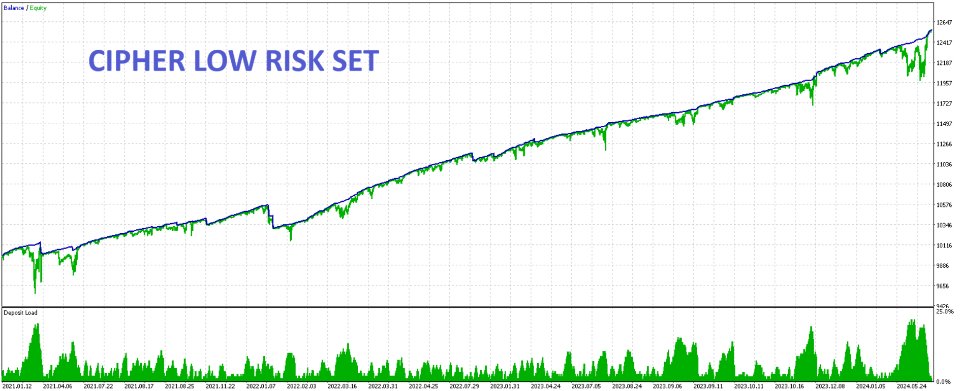

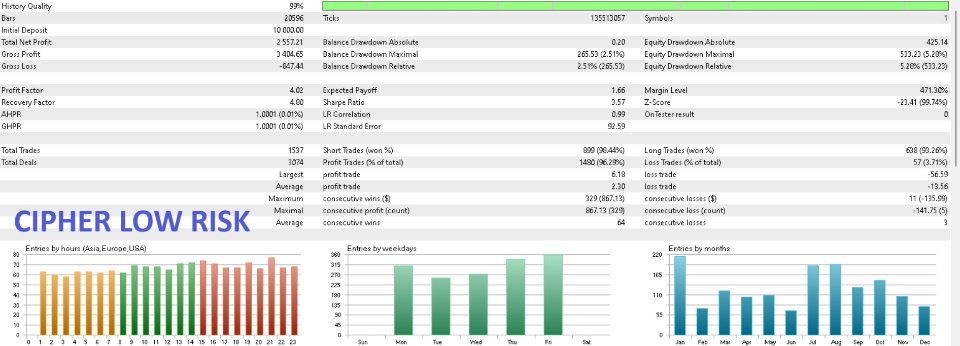

When the price is in a trading range, Cipher is an aggressive algo trader by default . However, the risk level is quite customizable given your choices. You can download the less aggressive set from here: Cipher H1 Low Risk Set_1 or

Cipher H1 Low Risk Set_2.

Every market has its own characteristics. The key to success of any trading algorithm is that in the development process, the characteristics of the instrument need to be well studied and the cycle in which the instrument in should be considered.

After its historic all-time high in 2020, gold market consolidated nearly by 4 years and in the last August something happen very significant: 3 year-length consolidation range has been breakout. Price action analysis no 101: year long consolidation periods generate year long trends in prices. That breakout has initiated the new gold bull market that will last several years.

The Cipher Hyper Trader has been developed considering the dynamics of the newest trend in gold prices.

If you don't want to take the HTF approach, you can limit the maximum trade per day in the settings. It is totally up to you.

Where Can The Cipher Be Used?

The Cipher can be used in your personal accounts, for passing the prop challenges and/or after you pass the prop challenges. It does not rely on grid and martingale strategies, every order comes with TP and SL. Many prop trading companies does not allow for hard core HFT but the Cipher is a Hybrid-HFT trader and therefore it is safe to be used with the most prop trading companies.

Below we have provided detailed information on the Hybrid-HFT approach.

If HFT is Good We Have Better: The Benefits of the Hybrid Approach

HFT trading algorithms tend to lose their effectiveness in a short period of time due to changing market conditions, shifts in investor behavior, and other factors. It requires continuous work and frequent updates on the algorithm. Without a professional team dedicated to this work, it is difficult to continuously update an algorithm.

Keeping this in our mind, we wanted to create a hybrid approach in which Cipher can operate with some flexibility. Although particular emphasis is given to the bullish bias in the gold market, Cipher can still trade in various market conditions.

Swing trading approach decides when to start trading. When the prices are in that range, The Cipher places several orders towards the same direction and tracks the orders with an advanced order trailing system.

On the other hand, the spreads and execution speeds of our retail brokers make it impossible to generate consistent HFT trading algorithms. The truly HFT bots run in milliseconds with extremely tight spreads. Retail customers can not access such markets.

Therefore, we have decided The Cipher can benefit from using the advantages of the HFT trading approach and combining it with the advantages of swing trades.

Cipher places take profit and stop loss levels at the same time and it does not use grid and martingale trading systems. Every order has been tracked individually.

Why Do Most Expert Advisors Fail In Real Trading Environment?

When you backtest an expert advisor in MetaTrader, the broker retrieves data from its servers and brokers usually store the data in a smoothed way and do not store 100% of tick data. Hence, the data flow in the strategy tester does not perfectly replicate data flow in a live trading environment.

That said, when you test an expert advisor in the strategy tester, you can have an excellent result with this ‘replicated data’ but when you run the same expert advisor in the live data stream, sooner or later you may have a trouble because small differences in data flows can create a significant impact on the performance and reliability of expert advisors.

In the development of Cipher, significant time and effort has been spent on testing procedures. Particular attention was given to the quality of the data in order that it replicates as closely as possible the real data flow environment The reliability and consistency of results across several brokers have been extensively tested to make sure it runs smoothly and problem free for many users.

You can find more information on my this article:

Before First Time Use The Cipher

We aim for 100% customer satisfaction with our products. We want Cipher to provide maximum benefits to every user. Therefore, before you purchase, you can consult us on how to setup for your broker and with your risk limits.

1. Cipher operates on H1 timeframe and ready to go on Gold charts.

2. After you purchase, you can contact me for installation and remote help. No need for set file.

3. We recommend testing Cipher in your broker without purchase and make sure it satisfies your expectations.

4. We recommend using Cipher in a demo account for at least 2-3 weeks before you put it in a real account.

5. Please make sure you have a sufficient buffer in your account before you work

6. Always double check the magic number, lot size and the time frame.

7. We offer free trading algorithms: Cybele CFD MT5 and Secutor CFD MT5 . You can improve the portfolio return by adding them in your portfolio.

8. You can join the Institution Breaker's private community after purchasing the product. Only verified users can join. Just PM me after the purchase for the details.

Parameter Description

| Parameter | Description | Settings |

|---|---|---|

| TP and SL | Both are in the forms of coefficient of ATR. | Number |

| Move Stop Out Coefficient | After a certain point gain, Cipher locks the risk. It has no green to red policy. | Number |

| Trail Stop | Dynamic stop-loss order that adjusts as the market price moves in favor of the trade. | Pips |

| TS Activation | TS Activation Level determines when the trailing stop should become active. | Pips |

| Limit Time Range | You can limit the operations of Cipher within a certain time period. You need to match time with broker's time. | Time |

| Max Number of Trades | You can limit the daily number of trades. By default Cipher places orders as long as trade signal continues. | Number |

| Exit At The End Of Range | Closes all open orders at the end of the time range. It does not consider if it is in profit or not. | True-False |

| Normalization of Data | To stabilize the operations among different brokers, we normalize the data with some coefficient. The default value is 1. | Number |

| Delay Trades In Minutes | Cipher waits placing an order by the minutes defined here. | Number |

Final Words

I kindly underline that our risk is the only thing we can control in financial markets. Therefore, appropriate risk management is the beginning of everything in financial markets. The foundation of wealth stems from the aggregation of small gains over time. We advise you do not take aggressive risks with Cipher Hybrid-HFT Gold Trader.