BullsEye Signal NoRepaint

- Indicators

- Martin Alejandro Bamonte

- Version: 1.1

- Updated: 14 June 2024

- Activations: 10

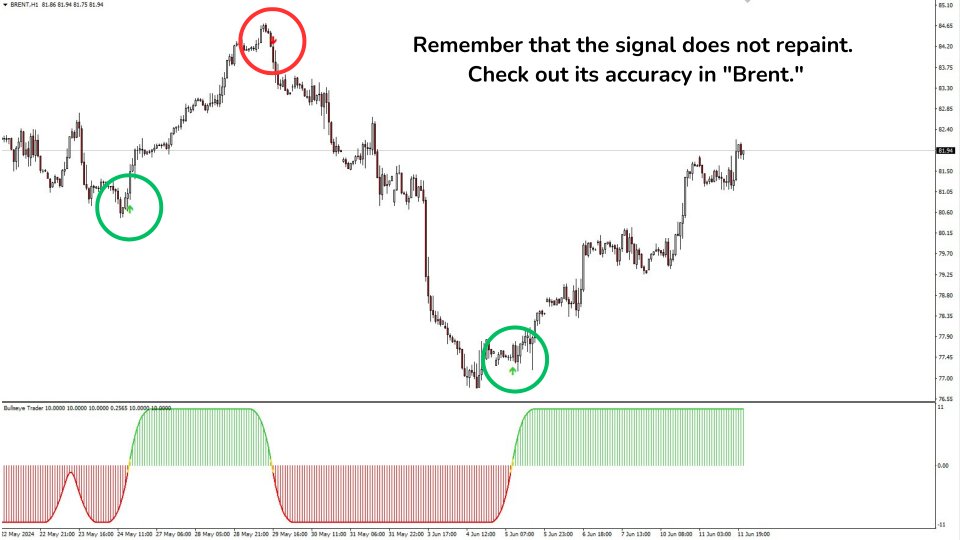

BullseyeSignal – NoRepaint is a signal that, as the name suggests, never repaints under any circumstances. The signal is issued on the same candle observed in the image. It is ideal for highly volatile markets such as forex, cryptocurrencies, stocks, indices, and futures.

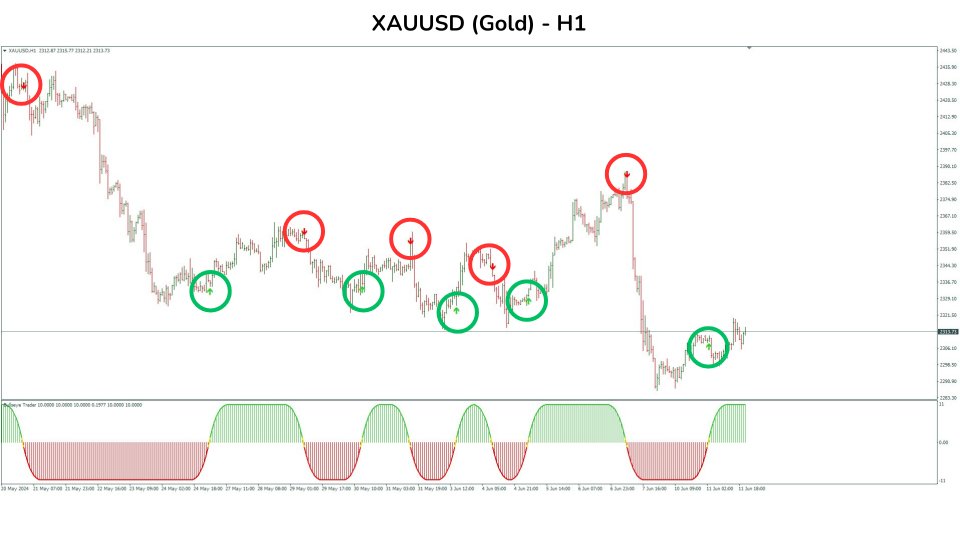

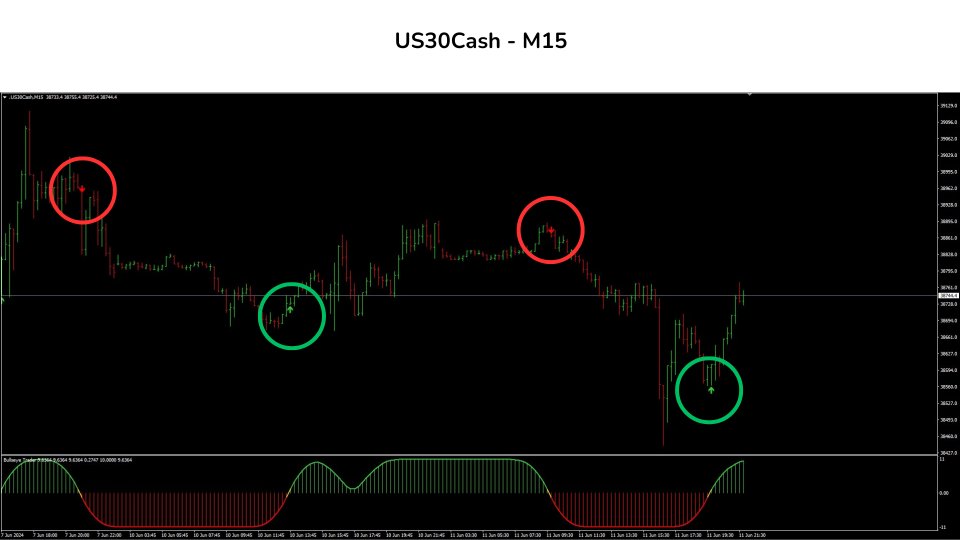

You will only see a green arrow for buying and a red arrow for selling, but there are many indicators working together behind them to provide a more simplified trading experience.

It is specifically designed to provide precise entries, not a large number of them, but specific entries when our indicator shows a trend change and crosses the 0 level in the opposite direction of the previous trend. To achieve more accurate

trades, the indicator waits for the first pullback to confirm the trend change, thus avoiding false reversals. So, after the break of the previous trend and the pullback confirmation, the signal will be issued.

This is a very cautious approach to trading, so it is important to follow these tips (both new and more advanced traders can use this strategy):

It is advisable to use the New York, London, or the overlap of both markets. If you need to trade in another market, such as the Asian market, it is essential to check in advance that the pair to be traded is not in a very narrow range. Range markets: Can you trade them? Yes, but to trade any pair that is in a range, you must observe the pair and the range length. For example, if you are on M5, an appropriate range would be around 200 pips (between highs and lows). If the range is smaller, we will get very few pips or we might even encounter a double signal. Below is a table of minimum pips to calculate if there is enough "space" to take trades in that pair: M1: 100 M5: 200 M15: 250 M30: 500 H1: 500-600 H4: 900 D: 1500 Although it can be used in any TF, keep in mind the pips you expect to get per day. I recommend starting with an M5 TF or higher, as although M1 is much faster, the range of movements is smaller, and therefore, the number of pips obtained is also smaller. The signal will never be issued at a “Top or Bottom,” as these are always less reliable signals. The confirmation of the pullback (zero cross) will be awaited. Open several pairs, load the indicator and take a minute to observe them. Trade in those that you see have more uniform movement, there is no need to trade in a pair that does not have a wide range of movements.

When to take trades:

In image 1, we can observe, on an M5 chart, how and when the signals are issued.

Number 1: Buy signal. When our indicator crosses the 0 line from bottom to top, changes from red to yellow, and the green arrow (buy signal) is issued without delay. Very positive result.

Number 2: Sell signal. When our indicator crosses the 0 line from top to bottom, changes from green to yellow, and the red arrow (sell signal) is issued. A big move in our favor.

Number 3: New buy signal, following exactly the same procedure as in number 1. Beautiful trade.

Number 4: New sell signal, also perfect.

Number 5: Clear example of a double signal. A buy signal appears on one candle and a sell signal on the next candle. In this case, you probably opened a trade on the first buy signal, and upon seeing the next candle with a sell signal, you close your first trade (practically not losing anything as both signals are issued at the same place) and DO NOT TRADE that pair for a while.

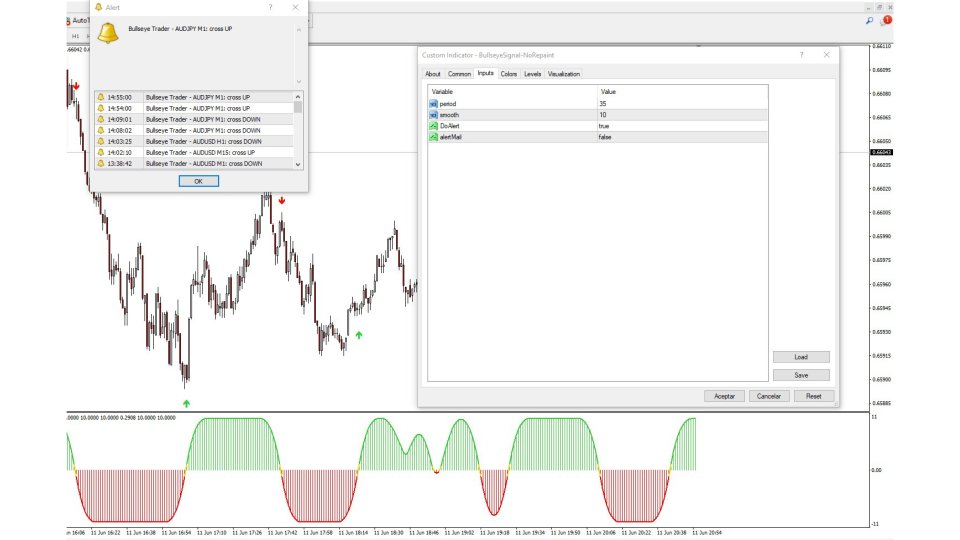

Alerts to open trades:

In all cases, you will receive a sound alert with a message indicating the pair, TF, and the type of operation you should perform. There is nothing to guess or think about, you just need to have verified first that the pair is in a wide range of movement.

When to close trades:

You have 3 options:

- Wait for the next opposite signal to close the operation.

- Predefine a TP (realistic, based on the TF you are in).

- Implement a trailing stop to secure profits while allowing the trade to continue if the market moves in your favor.

What SL to use:

You also have options depending on your preference (see image 2):

- If you are going to open a buy trade: Place your SL BELOW the last support (see green SL rectangle).

- If you are going to open a sell trade: Place your SL ABOVE the last resistance (see red SL rectangle).

- You can also use a fixed SL (be realistic). For example, if you expect to get 100 pips of profit, an SL of 50 pips will be correct. Keep in mind that if you are trading, for example, on H1, a minimum realistic SL would be 200 pips, expecting to get 400 or 500 pips if the trade goes well. This is a realistic and adequate SL for the TF you are trading. If you cannot sustain a 200-pip SL, it is advisable to move to a smaller TF to require fewer pips of SL.

buongiorno volevo ringraziarti per il tuo lavoro fatto.indicatore speciale beb fatto otttimo lavoro mi cambia totalmente il mio commercio in positivo grazie...