Wall Reversal

- Utilities

- Justin Ray Martin

- Version: 1.0

- Activations: 5

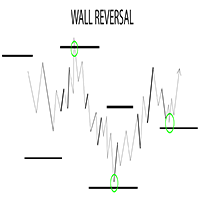

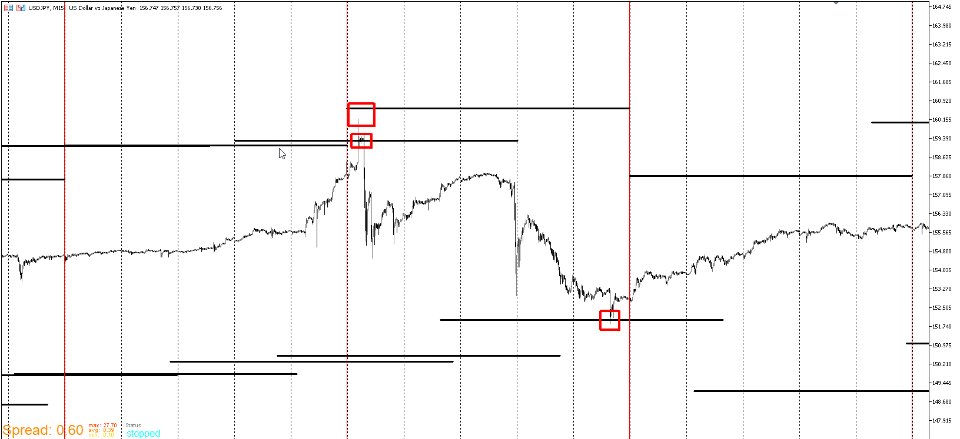

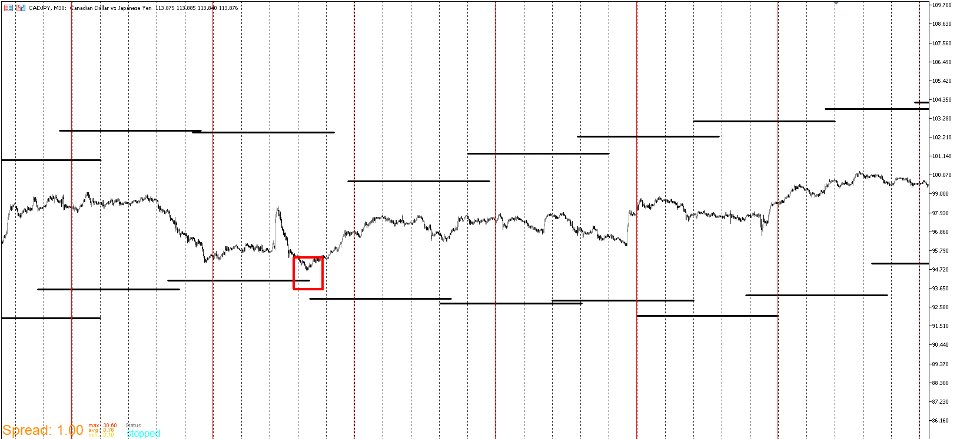

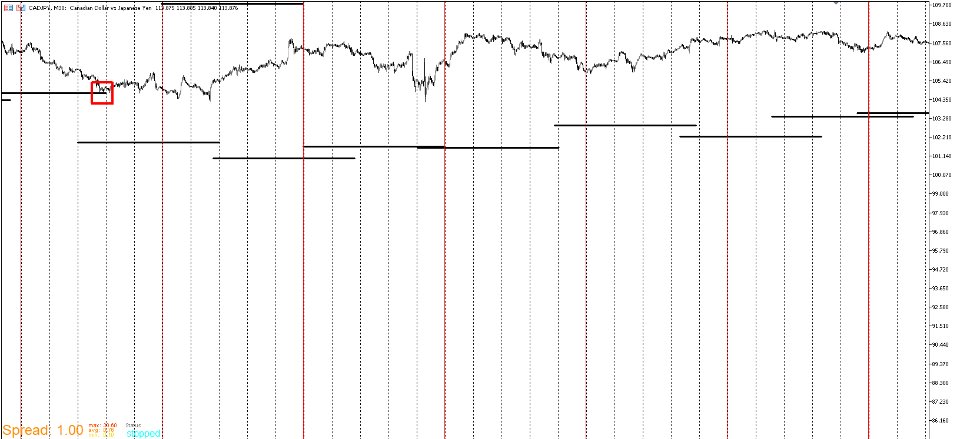

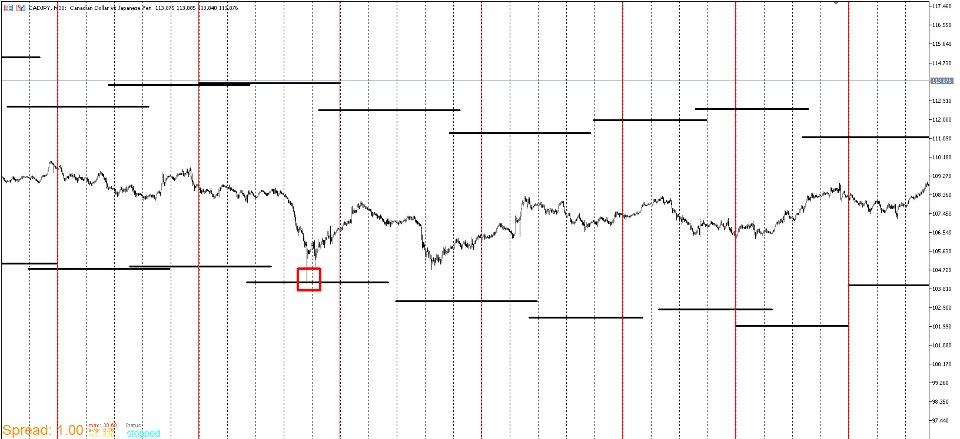

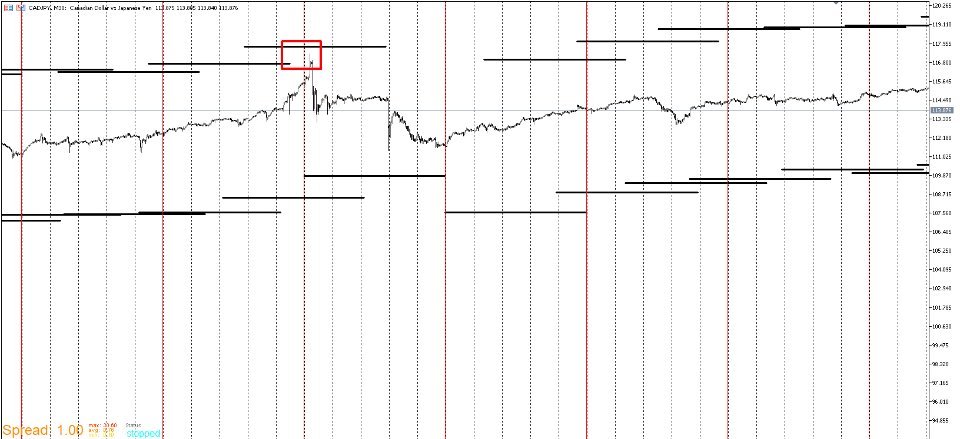

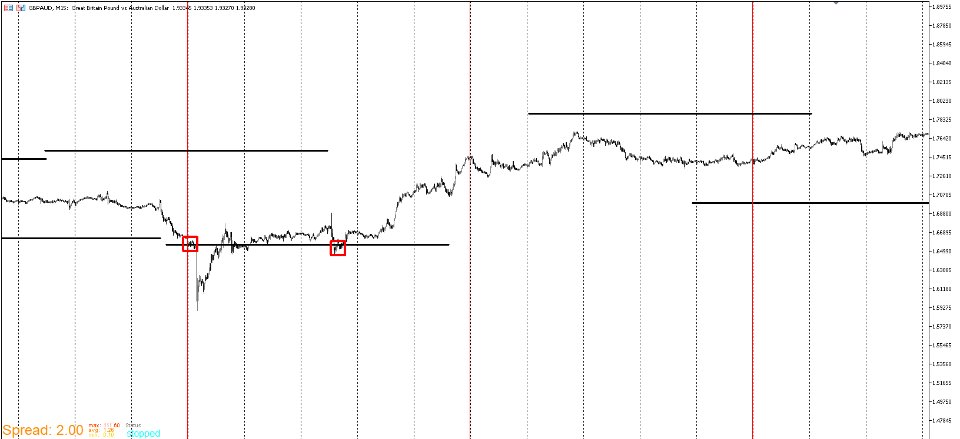

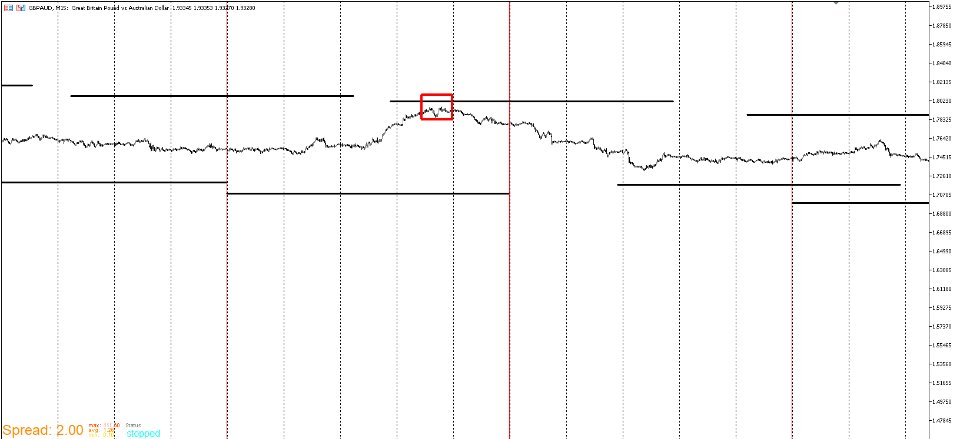

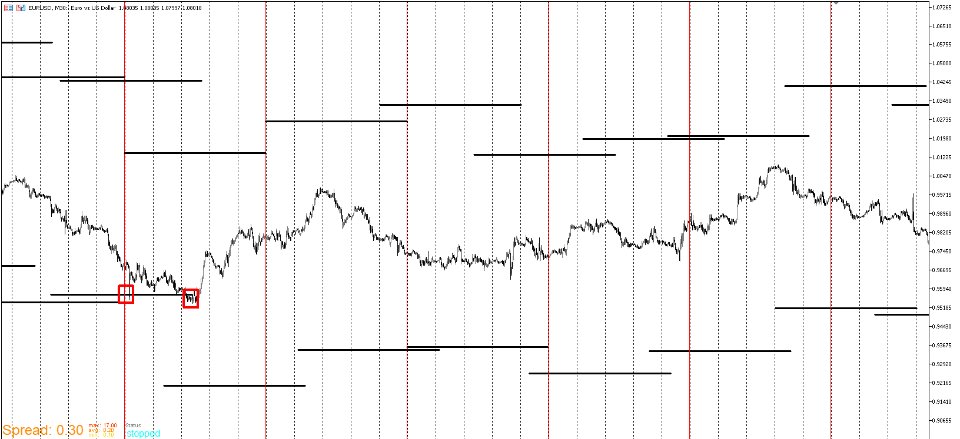

This EA runs a strategy that places lines above/below price. When price reaches these lines, There is a high likelihood of a reversal either before, at, or past the line. Very rarely price breaks the line and continues. Tops/Bottoms are usually put in around these lines.

How to use: It's not necessary to place this EA on a live chart. Run it in the backtester preferably at least a year or two back and get the price values of the most recent lines and mark them on a live chart. Use the 1 minute OHLC setting. You can even save the template and apply it to a live chart and observe how price later reacted to the lines when price did near them. The strategy places the line forward into the future so it's not lagging and therefore the most up to date lines are viable.

What this is: This is an advisor that gives a heads up that price is likely over extended. Price can continue, but it's rare and if it does, the likelihood of a reversal becomes much stronger.

What this isn't: This isn't an EA that takes trades and it's not a pinpoint at the line entry trade. It's purely discretionary and primarily for swing/positional traders who uses other confluences in their decision making.

Pairs: It's fitted only for major/minor forex pairs. Exotics, indices, etc won't yield the same results. Pairs that are more volatile can extend further past the line than less volatile ones. Meanwhile less volatile may not reach the line for a long time. Most pairs will offer opportunities within a years time.