SwingOneshot EA

- Experts

- Manuel Lenares

- Version: 1.5

- Updated: 18 January 2025

- Activations: 5

🌟 SwingOneshot EA: Engineered with ICT Trading Principles 🌟

Harness the power of institutional trading concepts with SwingOneshot EA - your gateway to trading like the smart money! This sophisticated Expert Advisor captures high-probability setups by tracking key institutional price levels and market structure.

💫 Core ICT Features:

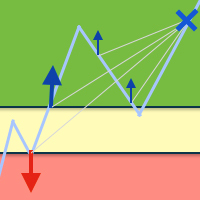

Asian Range Detection: Capitalizes on the crucial Asian session where banks set their daily ranges

Smart Money Levels: Identifies and trades from key institutional price points

Premium Liquidity Zones: Targets breakouts where institutional orders cluster

Market Structure Alignment: Trades in harmony with higher timeframe order blocks

🎯 Strategic Advantages:

Precision Entry System: Waits for clear range breaks, avoiding false moves

Advanced Risk Protocol: Uses institutional-grade position sizing and risk management

Dynamic Stop Management: Adapts to market volatility using ATR-based trailing stops

Smart Breakeven Logic: Secures profits like professional desk traders

⚡ Built for Institutional-Style Trading:

Tracks key market timing windows where smart money is most active

Implements proper risk-to-reward ratios (1:2 minimum)

Uses volatility filters to avoid choppy market conditions

Capitalizes on institutional liquidity pools

🔥 Perfect For:

ICT methodology enthusiasts

Smart money concept traders

Traders seeking institutional-grade automation

Those who understand the power of Asian session ranges

📊 Professional Features:

Multiple breakout modes for versatile trading

Advanced lot calculation based on risk preferences

Visual range indicators for market analysis

Comprehensive trade management system

Trade with confidence knowing your strategy aligns with institutional trading principles. SwingOneshot EA brings professional desk trading techniques to your platform.

Join the elite traders who understand and trade with institutional order flow!

IMPORTANT RISK DISCLOSURE Trading in the Forex market involves a high level of risk and may not be suitable for all investors. Before trading, you must carefully evaluate your investment objectives, level of experience, and risk appetite. KEY RISKS: • The use of leverage can amplify both profits and losses • Market volatility can significantly impact results • Past performance is not indicative of future results • It is possible to lose more than your initial investment SwingOneshot EA, while using strategies based on institutional concepts and advanced technical analysis, operates in highly volatile markets where conditions can change rapidly. RISK MANAGEMENT: • Always use appropriate stop losses • Never invest more than 2% of capital per trade • Maintain a disciplined approach to trading • Regularly monitor performance By using SwingOneshot EA, the user declares that they: 1. Fully understand the risks associated with automated trading 2. Accept full responsibility for their trading decisions 3. Are financially able to bear any potential losses 4. Have consulted with a qualified financial advisor