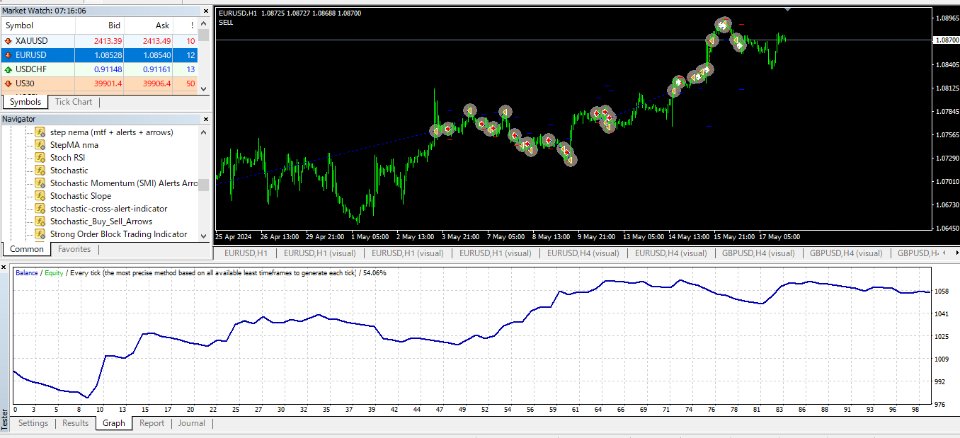

SMI Forex father

- Experts

- Hong Ling Mu

- Version: 1.0

EA_SMI is based on SMI indicator.

The Stochastic Momentum Index (SMI) is a technical indicator used to assess the momentum and direction of a trend. It is an improved version of the traditional Stochastic Oscillator, designed to provide a more accurate reflection of price changes. Below is an explanation of the basic concepts and usage of the SMI.

Basic Concepts of SMI

- Calculation Method:

- The SMI measures where the current price stands relative to the range of prices over a specific period, considering the highest high and the lowest low.

- First, the median price of the specified period (average of the highest high and the lowest low) is calculated.

- Then, the deviation of the current price from this median is determined and normalized over the range of that period.

- Based on these calculations, two moving averages are used to compute the SMI.

- Formulas:

- Median Price (MP): MP=Highest High+Lowest Low2MP=2Highest High+Lowest Low

- Deviation: Deviation=Current Price−MPDeviation=Current Price−MP

- Moving Average of Deviation (D): D=SMA(Deviation,K)D=SMA(Deviation,K)

- Moving Average of Range: Range=SMA(Highest High−Lowest Low,K)Range=SMA(Highest High−Lowest Low,K)

- SMI: SMI=100×DRangeSMI=100×RangeD

Features of SMI

- Zero Line: The SMI fluctuates between +100 and -100, using the zero line as a reference point to indicate upward (positive values) or downward (negative values) trends.

- Trend Strength: Higher values indicate a stronger trend, while lower values suggest a weaker trend.

- Overbought/Oversold: Generally, values above +40 indicate overbought conditions, and values below -40 indicate oversold conditions, though specific thresholds can be adjusted.

How to Use SMI

- Trend Confirmation:

- When the SMI crosses above the zero line, it indicates the start of an upward trend.

- When the SMI crosses below the zero line, it indicates the start of a downward trend.

- Buy/Sell Signals:

- A downward turn in the SMI from overbought levels can be seen as a sell signal.

- An upward turn in the SMI from oversold levels can be seen as a buy signal.

- Divergence:

- If prices form a new high or low but the SMI does not follow suit, it suggests a potential trend reversal (divergence).

Stoploss is automatically placed based on last swing low/ high (input Barback to scan candlestics)

Takeprofit is made by Risk Ration input parameter.