ST Bearish Engulfing

- Indicators

- Curtis Daniel Jr -

- Version: 1.0

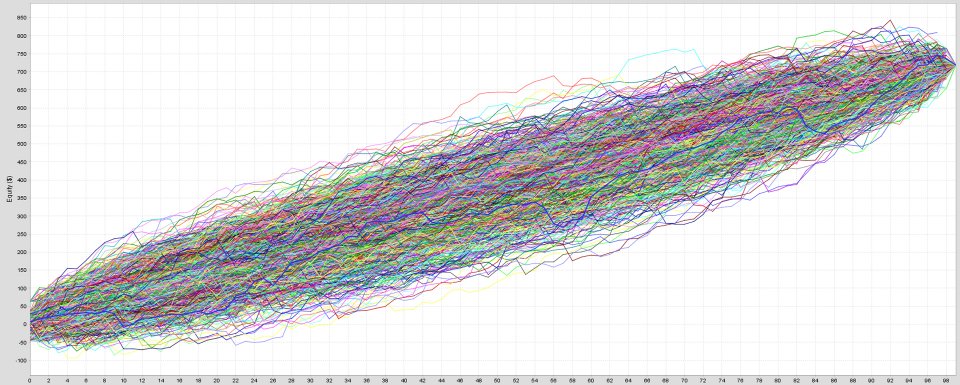

In a departure from the conventional approach, traders can leverage the bearish engulfing candlestick pattern as a buy signal for short-term mean reversion trades. Here's how this alternative strategy unfolds:

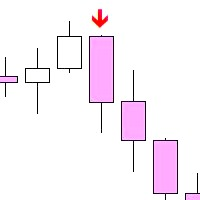

The bearish engulfing pattern, (typically signaling a reversal of bullish momentum), is interpreted differently in this context. Instead of viewing it as a precursor to further downward movement, we perceive it as an indication of a potential short-term bounce or mean reversion in prices.

Upon identifying the bearish engulfing pattern on the price chart—a large bearish candlestick engulfing the preceding bullish candlestick—we initiate buy trades or long positions. The rationale behind this unconventional decision lies in the expectation that the extreme bearish sentiment represented by the engulfing pattern may lead to a temporary oversold condition, prompting a countertrend movement.

In this scenario, we establish a rule to exit the buy trade when today's closing price exceeds yesterday's high. This exit condition serves as a means of managing risk and locking in profits. If prices rise above the previous day's high, it may indicate the potential exhaustion of the bearish momentum and a shift towards renewed bullish sentiment, prompting us to close our long positions.

Risk management remains a critical aspect of this alternative strategy. You can implement stop-loss orders to limit potential losses if prices move against their positions.

In summary, this supplementary trading strategy offers a straightforward yet effective approach to diversifying your trading activities. By leveraging the bearish engulfing pattern in this alternative manner, you can potentially capitalize on short-term price movements while maintaining a balanced and resilient portfolio. With its minimal time commitment and potential for added profitability, this strategy represents a valuable addition to your trading toolkit.

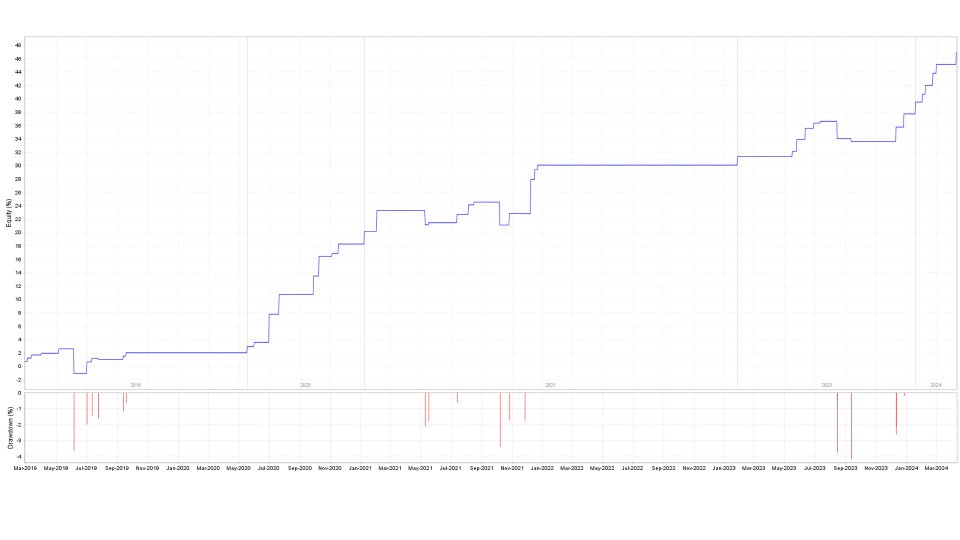

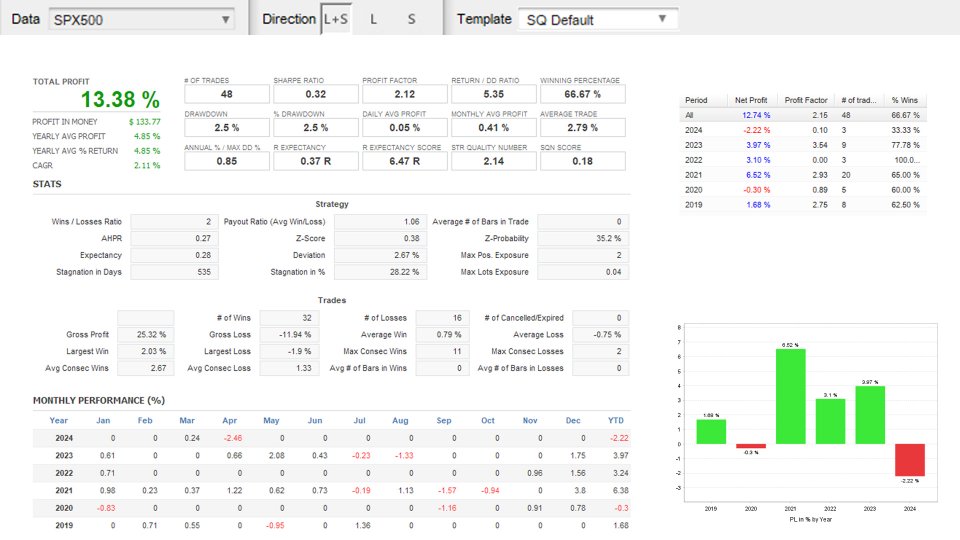

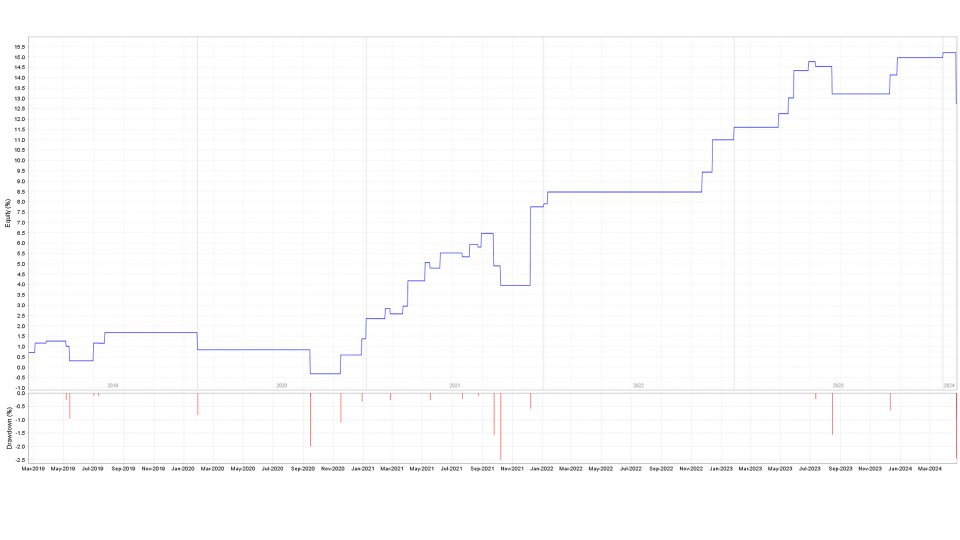

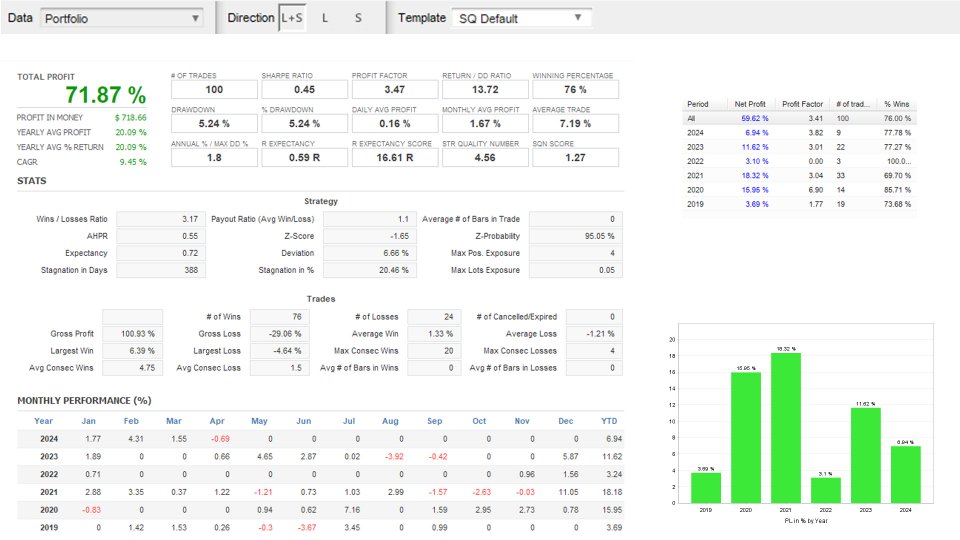

Recomendations Based on Backtest:

- Daily timeframe

- Nasdaq, S&P500

- 1 micro or 0.01 lots per $1000 balance (Based on 1:200 leverage - Nasdaq)

- 2 micro or 0.02 lots per $1000 balance (Based on 1:200 leverage - S&P500)

- No Stoploss

- EightCap broker

An Ea would be Available soon. Join the discord to stay up to date