Rejection Block Trader

- Experts

- Usiola Oluwadamilol Olagundoye

- Version: 2.3

- Updated: 25 January 2025

- Activations: 20

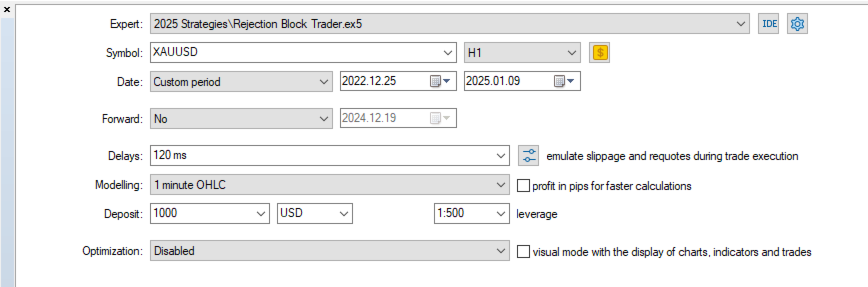

Timeframe: H1 Only.

Symbol: XAUUSD

Check the comment section for the .set file dated 18th Jan, 2025

Introducing the "Rejection Block EA," a specialized trading solution meticulously crafted for ding GOLD (XAU/USD) with unparalleled precision and efficiency on the 1 timeframe. This expert advisor leverages the power of rejection candle blocks identified on both the H1 timeframe, providing traders with strategic entry and exit points to capitalize on GOLD's unique market dynamics.

Key Features:

-

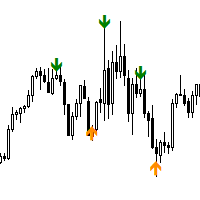

Rejection Candle Analysis: The EA employs advanced algorithms to identify and analyze rejection candle blocks on the H1 timeframe, enabling traders to pinpoint high-probability trading opportunities in the GOLD market.

-

Multiple Trailing Stop Systems: Choose from several distinct trailing stop systems, allowing traders to tailor their risk management approach to suit their trading style and adapt to changing market conditions with ease.

-

Visual Customization: Customize chart plots according to individual preferences, enabling traders to create a personalized trading environment that enhances clarity and efficiency.

-

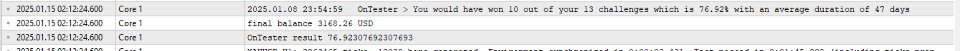

Trading Challenge Simulator: The simulator works in realtime and in backtest. It allows the user to select values for maximum daily drawdown, Total equity drawdown and Profit target.

-

News Trading Switch: This settings allows the user to enable/disable the EA on days of Major economic release like NFP, FOMC, GDP and CPI

With its robust feature set and specialized focus on trading GOLD, the "Rejection Block EA" offers traders a comprehensive solution for navigating the intricacies of the GOLD market with confidence and precision. Experience the ultimate trading experience with this innovative expert advisor tailored specifically for GOLD traders.

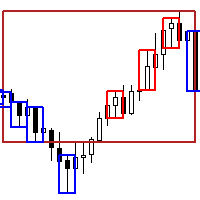

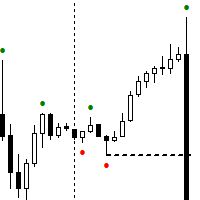

Documentation

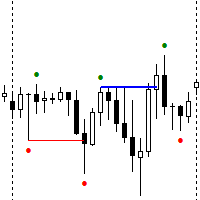

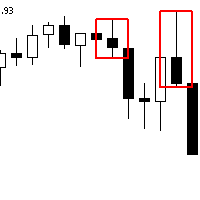

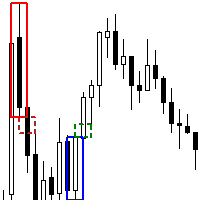

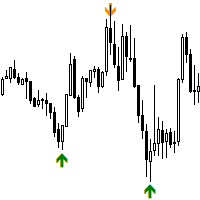

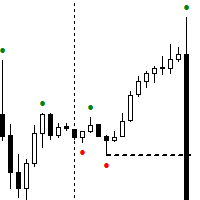

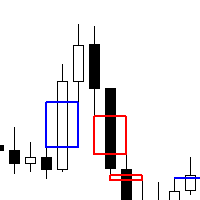

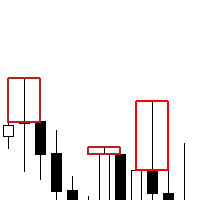

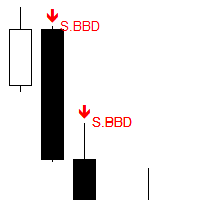

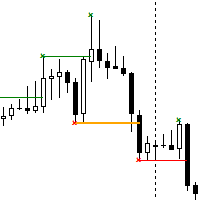

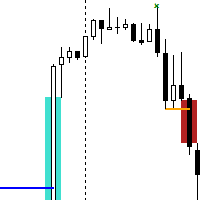

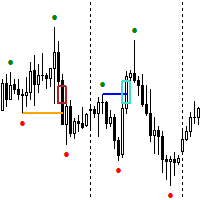

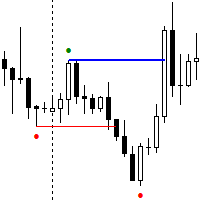

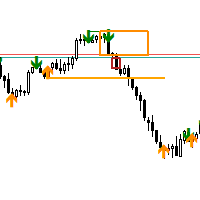

Rejection Blocks are candlestick patterns with long wicks, signaling price attempts to breach a level before reversing within the candle's range. They appear at key support or resistance zones, indicating market indecision and potential reversals. Rejection blocks are highly reliable, capturing all available data about recent reversal points, making them more dependable than other price references like yesterday's or weekly closing prices, especially during thin trading volumes at the late USA session.

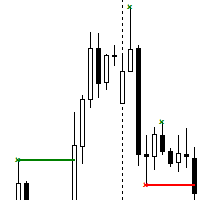

A Consolidation Box is a candlestick that encapsulates the opening and closing prices of all subsequent candles within its range. For instance, if the daily candle on April 29, 2024, engulfs the opening and closing prices of all subsequent candles, it forms a Consolidation Box candlestick.

To utilize the Maximum Position Function, start by setting the maximum position to 1. Increase it only when the bot secures the position with a trailing stop and deems it risk-free. Gradually increase the maximum position as desired, ensuring each new position is adequately secured.

Slippage refers to the difference between the expected and actual trade execution prices. It occurs commonly during high volatility or low liquidity, leading to trades being filled at less favorable prices. Slippage can impact trading outcomes, increasing costs or reducing profits, especially in fast-moving markets or with large orders.

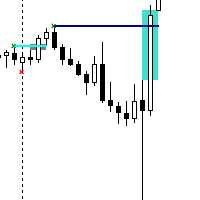

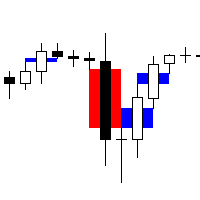

BreakevenX settings, when enabled, allow for a high win rate but may close trades prematurely. Users should experiment with these settings, noting their impact on trading outcomes, particularly during testing on the strategy tester.

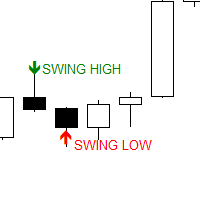

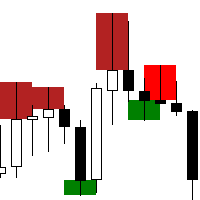

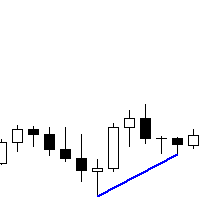

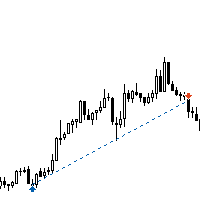

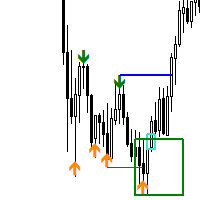

Swing Extreme sets the trailing stop to the lowest or highest of the previous swing on the selected timeframe, providing an effective means of securing profits.

Z Candlestick sets the stop loss to the lowest price of the specified number of candlesticks on the selected timeframe . For example, setting it to 4 ensures the trailing stop remains at the lowest price of the last four candlesticks on the selected timeframe, offering a dynamic approach to managing risk.

User didn't leave any comment to the rating