MA Trend Following Indicador 2 Timeframes

- Indicators

- Raul Canessa Castameda

- Version: 1.1

- Updated: 8 May 2024

- Activations: 8

Both time frames use the 5, 8 and 13 period EMAs, but the trader can change any EMA calculation period to make a custom combination.

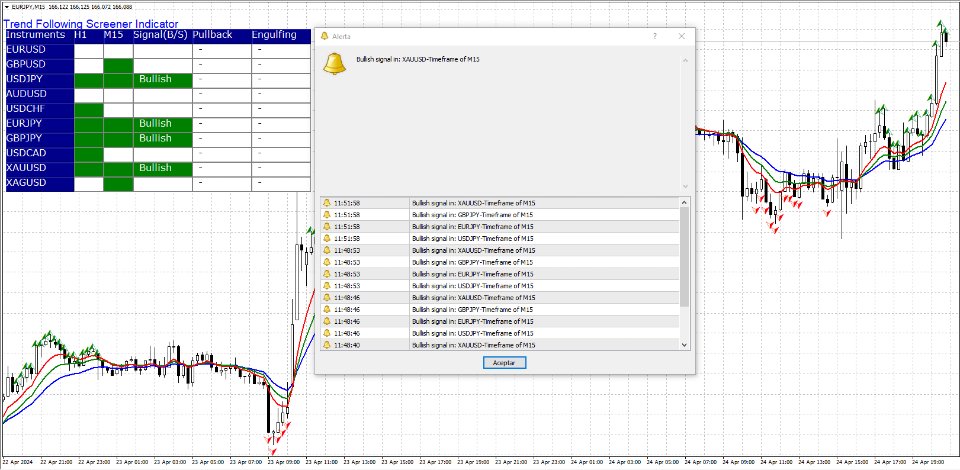

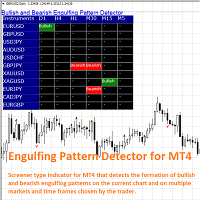

Simple price action in the form of price retracements or corrections and engulfing candlestick patterns displayed on the screener are mainly used to confirm bullish or bearish signals.However, we include the RSI as an optional confirmation indicator that will filter out signals where the RSI value is not overbought or oversold.

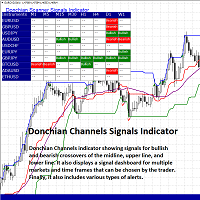

In summary, the indicator displays a screener with:

- Multiple currency pairs chosen by the trader.

- Bullish or bearish signals provided by the alignment of 3 moving averages on 2 chosen time frames (H1 and M15 by default)

- Signals of price retracements that indicate when there is a bearish reversal in a bull market or a bullish retracement in a bear market.

- Signals of engulfing candlestick to confirm the trend signals.

Additionally, the trader can activate signal alerts via email, push notifications and an alert window on MT4.

Once the tool indicates a possible buy or sell signal the trader can click on the corresponding cell of the currency pair which will immediately open a chart of the currency pair in the shorter time frame for the trader to evaluate the validity of the signal on their own.

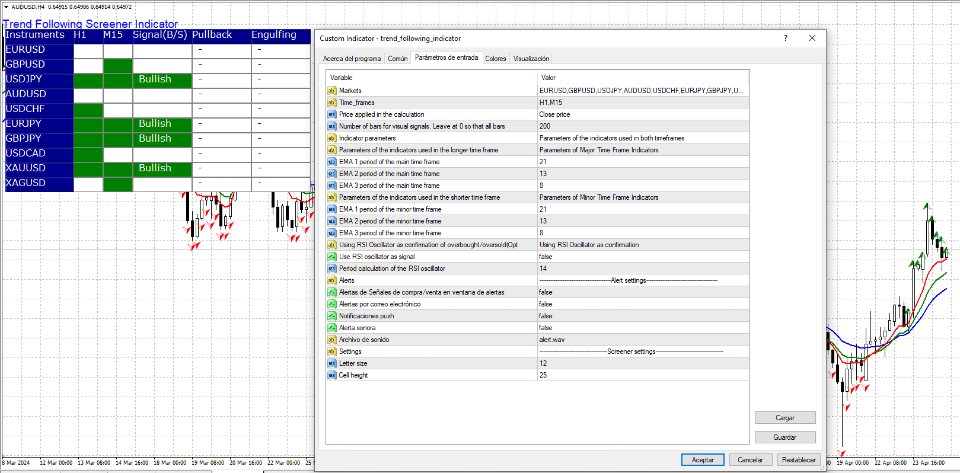

The parameters that can be configured in the MA Trend Following Indicator for MT4 are the following:

- Markets: In this parameter the trader indicates the currency pairs that he wants to follow using the indicator.

- Time frames (default value: H1 and M15): Here we indicate the major time frame and the minor time frame that are going to be followed.

- Price applied in the calculation: It is the price type used to calculate the moving averages.

- Number of bars for visual signals: The number of price bars used to show the visual signals in the current price chart where moving averages line up or down.

- EMA 1 period of the main time frame: The calculation period of the major EMA of the longer timeframe.

- EMA 2 period of the main time frame: The calculation period of the medium EMA of the longer timeframe

- EMA 3 period of the main time frame: The calculation period of the minor EMA of the longer timeframe.

- EMA 1 period of the minor time frame: The calculation period of the major EMA of the shorter timeframe.

- EMA 2 period of the minor time frame: The calculation period of the medium EMA of the shorter timeframe.

- EMA 3 period of the minor time frame: The calculation period of the minor EMA of the shorter timeframe.

- Use RSI oscillator as signal: Here we indicate if we want to use the RSI as a signal filter (avoid signals where the RSI is overbought/oversold).

- Period calculation of the RSI oscillator: The number of periods used to calculate the RSI.

- Buy/sell signals alerts in alert window

- Email Alerts

- Push notifications

- Sound alerts

- Soud file

By itself, this indicator should not be used as a trading system as moving average crossover signals are not 100% reliable, as is the case with any technical indicator, but it is a useful support tool.

-To add new currency pairs in Markets, we write the symbol of the pair, for example, XAUUSD, without the “/” symbol and separated by a comma (no spaces).

User didn't leave any comment to the rating