The Pinnacle Of Moving Average

- Experts

- Daniele Fughelli

- Version: 1.2

- Updated: 25 June 2024

- Activations: 5

Aren't you sick of algorithms that promise impossible returns that then never really work in real trading?

If that's the case, then this algorithm may be what you have been looking for. Everyone else who prefers the illusions of senseless gains in short periods of time is better off ignoring this page. Once this has been cleared, let's talk about the algorithm.

This algorithm is completely different from what I've seen in the market so far. This is a long-term algorithm, thought to resist short-term changes in the financial environment and still provide profitability over the long term. Thus, don't expect to make millions in a year or a day (no one would sell an algorithm really capable of doing that, it wouldn't make sense). It's almost impossible for an algorithm that shows 10000% in a year to keep working over the medium/long term.

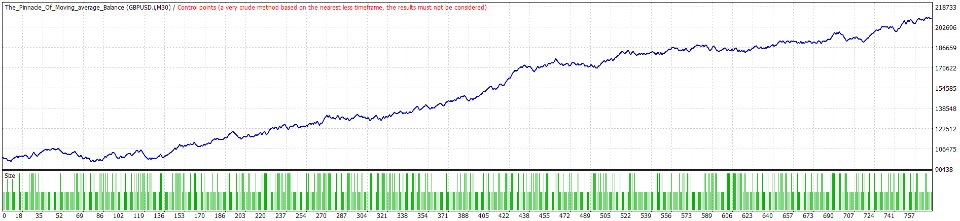

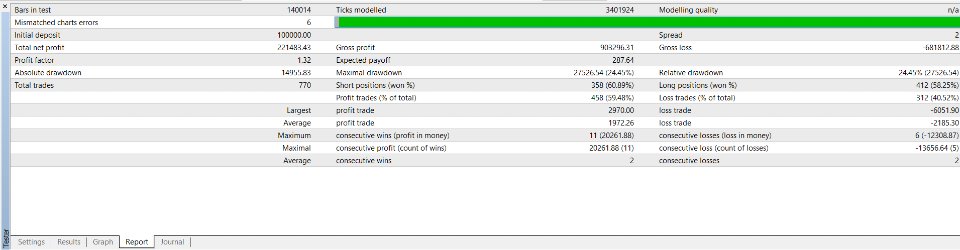

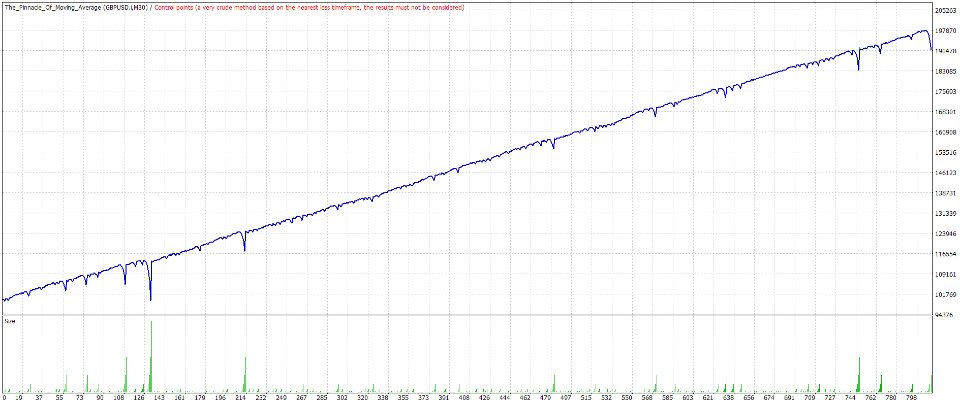

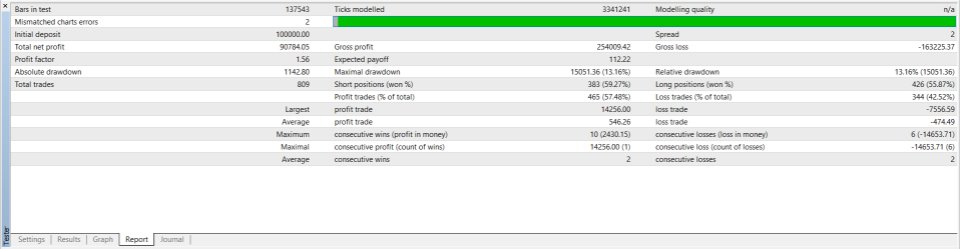

This algorithm shows good average yearly returns, based on the risk you are willing to take. The backtest below is done with a 2-lot size per order in a 100k account. The result is 221.483$ net profit (+221%) in 12 years (from 2012 to 2024) for an average of more than 18% yearly with a maximum drawdown of 27.526$ (27.5%).

Out of sample of 2 years: the parameters have been calculated on a backtest running from 2012 to 2021. From 2022 to 2024, I simulated how reliable the algorithm would have been out of the used data. This is the closest simulation to real trading I could do.

The size per order can only be changed manually. I want everyone to be able to choose the size they feel more comfortable with.

But the best part has yet to come.

Expected payoff of 142$ per lot size used over 12 years. This means the algorithm is stable and can resist overnight fees and a decent amount of spread.

I ran the algorithm even between 2003 and 2012 just out of curiosity and it was profitable even in that period of time. It's unusual for an algorithm to work even backward in time. This means it's good at adapting to market changes. The equity curve was dirtier but still in a good profit. This means this algorithm was profitable in a backtest of 21 years. I didn't include the photo of the 2003-2012 equity line but if you'll ask for it, I'll include it.

Martingale can be used but at your own risk. The equity line I posted below (the straight one) is using martingale with a 0.3 lot size. You can use it but please be careful and use it only if you know what martingale is. if you don't, ask me and I'll explain to you how it works and what are the pros and the risks involved with that probabilistic strategy. The algorithm works well even without it.

Of course, no one can predict the market. Trading is always dangerous and can lead to liquidation if done improperly. So, please, use the algorithm thoughtfully. Do not increase the size to absurd amounts compared to the money you are using, since the algorithm may have deeper drawdowns in the future than the backtest has shown and compromise your capital.

Based on the backtest and the out-of-sample, this algorithm can help you reach your goal of becoming profitable with trading. Being profitable only for 1 year is useless. What matters is the long term.

Expect to have negative years some here and there. Don't write me saying the algorithm doesn't work if not even 3 years have passed since you bought it. I won't reply to those messages.

For any questions or problems, you can always contact me. I'll reach out to you as soon as possible.

The algorithm works with a simple moving average and other parameters. It's kept as simple as possible to make it more resistant to future changes in the market. There is a restriction on the trading hours but the stop loss and take profit can still be hit outside of them, so a VPS is highly suggested (it's dangerous not to use one).

Timezone: GMT+2 Please, change GMT value accordingly to your broker's timezone. This is fundamental. If you don't do so, the algorithm will almost certainly collapse!

Always backtest before trading with a real account to check if the timezone is set correctly.

Market instrument: GBPUSD ONLY!!!

Time frame: 30min only!

Inputs:

-GMT --- you need to put your broke's GMT value. Do not touch it unless for a different timezone as said above.

-multiplier --- martingale parameter: default is 1 (martingale is inactive). Change to 2 if martingale is needed. Be careful to check if the right number has been set. Do not put other numbers (no error is given if you do so, the algorithm will think it's your choice to use another multiplier). Please, remember to change both "Trailing_Stop" and "Balance_Average" to "false" (you can do so by double clicking on "true" and select "false").

-Size --- lot size: default is 1 (low risk). I highly discourage using more than 3. These lots are for a 100k account. Divide them by 10 if you have a 10k account.

Example: size=0.1 for 10k account and 0.01 for 1k account

Use size=2 ; 0.2 ; 0.02 (based on an account size of 100k, 10k, 1k) if you want similar performances to the pictures below.

-Trailing_Stop --- uses some sort of trailing stop (added with version 1.1). Default is true (so it is active). It helps improve performance (change to false if you don't want it).

-Balance_Average --- doubles the lot size used based on internal parameters (added with version 1.2). Default is true (so it is active). It helps improve performance (change to false if you don't want it). Please, change it to false if you use other algorithms or trade manually with the same account.

The price will certainly increase. No date is set. It may be the next week or the next month but it will surely happen based on external reasons. The full price is set to be around 2000$. You don't need to buy it immediately unless you want to immediately get the benefits of this algorithm while also sparing a good amount of money.

Also, the algorithm has been in drawdown in the last 2 weeks, so it is likely to be profitable over the next days. It's not certain but the backtest would suggest so.

Can be used with prop-firms. I've seen an algorithm that makes you pass some prop-firm challenges here in the market. Not sure if that works but my algorithm is surely better to be used after the challenges (it might take quite some time or increased risk to pass the challenges while respecting the drawdown limitations). You can use it for challenges too of course though. Actually, i added the martingale with the idea of passing the challenges. Just be careful and know you might fail a couple before actually succeeding in passing 2 challenges and then get an account.

This said, I wish you success.