Version 2.40

2025.04.21

(FIX) Tester TARGET mode

Version 2.39

2025.04.19

(UPD) TRB min sl filter

(FIX) Time Inputs reInit()

Version 2.38

2025.04.13

(FIX) updateTRBtime()

(FIX) selectMarketSl()

Version 2.37

2025.04.07

(FIX) Timer()

Version 2.36

2025.04.07

- (FIX) CheckTradingPlan() tp case

- LOG() update

Version 2.35

2025.04.06

- INPUTS() update

- LoadBSMCHNdata() update

- (FIX) CustomSessions()

Version 2.34

2025.04.06

- (FIX?) MemoryCheck()

- (FIX) Parser()

Version 2.33

2025.04.04

- timeshift inputs for manual time detection

- (FIX) Updload Inputs

- symbols update

Version 2.32

2025.04.01

(FIX?) Parser()

(half-FIX?) ServerOffset()

Version 2.31

2025.03.27

(FIX) TradeServerOffset()

Version 2.30

2025.03.26

Inputs hotfix

Version 2.29

2025.03.26

- (FIX) auto mode switch button

- (FIX) checkAndUpdatePosInfo

Version 2.28

2025.03.26

Updates have significantly affected Auto Mode

- Expanded logical section

- TRB logic updated and extended

- ДAdded TRB entry model

+ TRB-logic update

+ Qauntiles-logic

+ NewsDays-logic

+ TRB second confirm (balanced case)

+ DayOfWeeks

+ Expanded visualization capabilities for key BSMCHN levels, integrated updated research data

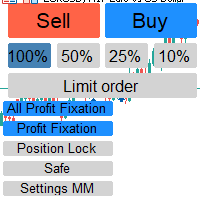

+ Selection of position management mode (OFF / HLT / ALL)

(FIX?) dst/cest server offset

(FIX) body/wick trb mode

(FIX) trading plan inv case

- log input + update

Version 2.27

2025.03.12

(FIX) TRB_reInit() on TF changing

Version 2.26

2025.03.04

- (FIX) deactivate trading plan by trb off case

Version 2.25

2025.02.27

the updates did not affect the auto mode.

New Features:

- Market Structure [MS] Entry Model

- LOGIC: Added a customizable logic section that allows configuring the base logic, enabling full automation on any asset.

- TIME RANGE BREAKOUT: A mechanism for selecting a chart section, where a price breakout beyond its boundaries triggers a position entry and optionally sets the direction for position search → activates entry models (LONGS/SHORTS).

Fixes & Updates:

- (FIX) thisIdeaDealsOpen()

- User comment input

- Market Structure model logic: BuyMS(), SellMS()

- Time Range structure: update, switch, entry & management logic

- updatePosInfo() TRB type update

- Inputs logic update

- getSetup() update

- Log update

- findPositions() update

- slcheck() update

- tradeMarket() update

Version 2.24

2025.02.19

- (FIX?) ptt semi-auto (rr target) scenario checkPartitials()

Version 2.23

2025.01.19

- (FIX) poi end checkTradingPlan()

Version 2.22

2024.12.18

- log hotfix

- AUTOMODEaddPosition() update

Version 2.21

2024.12.17

Updates have affected the auto mode:

- A more conservative stop-loss search policy (implying overnights) has been implemented to reduce allowable drawdowns.

- The number of scenarios (logical ideas) has been increased.

- Transitioned to a single position with partial fixes, where 1 scenario = 1 position.

- Global input settings are in effect: risk per trade, break-even triggers, daily drawdown limits, percentage distribution for take profits, and a news-based rule (!).

- The "biasmachine algo" section, which previously contained auto-mode settings, has been delisted along with the option to disable scenarios.

Algo:

- Added an input parameter to define how many minutes before the end of the day to perform actions such as moving trades to break-even and closing positions.

- parser arrays update

- log update

- (!) updateTempArrays() update

- (FIX2) DayEnd

- (FIX) DrawQuantiles

- (!) LT model no structure case: if(sl == -1 && _lt_sl_max > 0) sl = en - _lt_sl_max * 1/MathPow(10, S.Digits);

- dailyLossFilter() update

- (FIX) GlobalAverages() update issue

Version 2.20

2024.12.12

Algo:

- (FIX) DayEnd

Version 2.19

2024.12.11

- (!) The lo + lo reversal scenarios in Auto Mode have been removed for a major rework due to unstable behavior.

- Manual and semi-auto modes have been combined; the "area of interest" and "invalidation" logic is now available for any combination.

- It's now possible to select a new invalidation and a new POI without disabling position search (the new POI will automatically pause operations until it is reached).

- A new logic for calculating the daily loss has been implemented, taking into account the broker's Maximum Daily Loss reset TIME.

Algo:

- (FIX) findOpenLoss() + CalculateTodayProfitLoss() update

- Day End -> Max Day Loss Resets Time logic rework

- Inputs update

- SA and MANUAL modes logic update

- market btn logic update + log update

- LONG and SHORT buttons logic update

- new poi without shutting down algo

- new invalidation without shutting down algo

- OnClickStatusButton() update

- poiSelect update

- selectMarketSl() update

- defineTP() update

- findTP1(), findTP2() update

- updatePosInfo() update

- checkTradingPlan() update

- resetTradingPlan() update

- activateTradinPlan() update

UI:

- targetButton update

- keyboard 119 update

- lst update

- (FIX) market trading plan

- new visualization logic

Other:

- defineSymbol() upd

Version 2.18

2024.12.05

Algo:

- GetServerOffset() update

- (FIX) findOpenLoss() + CalculateTodayProfitLoss() update

Other:

- (FIX) sessions Visual funcs update

Version 2.17

2024.12.05

Algo:

- LT Sweep range filter - new input for LT models

- LT MODEL: MathAbs(cur.ltl-lastTick) < LT_Sweep_range_filter * S.Add2sl

Other:

- auto mode log upd

Version 2.16

2024.12.04

- timeDefine upd

- auto mode log upd

Version 2.15

2024.12.04

(FIX) LW structure visual

Version 2.14

2024.12.03

Updates affected auto mode

accelerated structure determination mechanism, smr and dr input models are determined more accurately

Algo:

- (AUTO MODE) time check

- stop loss limiter (inputs) -> uniqSl()

- updateCurrentSwing() new swing update

- (FIX) _lt_sl_max

Version 2.13

2024.12.02

Algo:

- AUTO MODE defineRisk() update

- AUTO_MODE new_1_hour() Log update

Version 2.12

2024.12.02

Algo:

- switch(taskIndex)

- (FIX) OnTimer() periodSeconds = PeriodSeconds(PERIOD_M1);

Other:

- defineSymbol() upd

Version 2.11

2024.12.01

Updates affected Auto Mode:

- Updated news parser logic: integrated error detection and rescanning mechanisms, improved logging.

- (AUTO MODE) Changes were made to the mechanisms for determining key pools and targets, optimized quantiles for entry. This impacted the equity curve, making it less broker-dependent (less profitable according to ICM compared to HLT versions 2.06–2.10, but more profitable on alternative high-quality tick history). These changes affected all position search scenarios.

Algo:

- AUTO MODE logic update & scenario cross-brokers optimization

- fileOpenAttempts

- defineGlobalTimes() -> +parser_time

- defineGlobalTimes() -> -findNYM();

- new_1_hour() -> if(TimeCurrent() == global_time_NYM ) findNYM();

- LT model sl max input //(TICKS) if not 0, sets the maximum stop-loss size in ticks. This value is used if the current stop-loss is further from the entry point than the specified threshold (in ticks).

Version 2.10

2024.11.27

Other:

- onTester() update

- onTesterInit() update

- onTesterDeinit() update

Version 2.9

2024.11.26

Updates did not affect the auto mode:

Expanded options for input models and timeframes (for manual and semi-auto modes). Any input model can now be used simultaneously across multiple timeframes.

Configuration of constants for input models: entry specifics and stop selection, stop-loss range corridor, PD levels, additional volatility coefficients.

Algo:

- slcheck() update

- correctSl() update

Other:

- New inputs

- (FIX) SEMIAUTO_MODE tp _optimization_RR_target

- Log update

Version 2.8

2024.11.25

Other:

(FIX) GetServerOffset() exeptions

Version 2.7

2024.11.25

Other:

- (FIX(?)) GetServerOffset(): baseOffset serverTime() -- > TimeLocal()

- (FIX(?)) GetServerTimeFromNY(): serverTime = TimeLocal()

- (FIX) custom sessions inputs description

- defineSymbol()

Version 2.6

2024.11.21

Updates (!) Impacted the AUTO MODE, added NON-NEWS DAYS, updated the news fetching mechanism, and extended the BSMCHN news date database.

(!) Removed the settings for "Aggressive," "Normal," and "Conservative" modes. Instead, users can now select specific timeframes for entry models. Previously:

"Aggressive mode" corresponded to M5 SMR, M1 DR, M1 LT.

"Normal mode" corresponded to M15 SMR, M5 DR, M5 LT.

"Conservative mode" corresponded to H1 SMR, M15 DR, M15 LT.

Added a Market Entry button: Similar to HME(https://www.mql5.com/ru/market/product/88750). After selecting a stop-loss, a position will open with the specified input volume (%) and intermediate take-profits, activating the trading plan.

For manual mode: The trade will start from the current price up to the take-profit level, which needs to be selected with a second click on the chart.

For semi-auto mode: Trading will start in the desired direction based on inputs without requiring a take-profit level to be selected on the chart.

UI:

- MARKET button

Algo:

- DR models: + prev.direction == planned_direction (!)

- LT models shorts fix, sl updated (!)

- candleTradingPlanCheck(PERIOD_M1);

- new_1_minute() -> checkStopTrading(); checkStartTrading(); checkBeTime(); checkClose(); TrailingSL(); CloseAllPositions();

Other:

- cdata.LastSTH(); cdata.LastSTL(); cdata.LastSTHTime(); cdata.LastSTLTime();

- defineSymbol()

- (FIX) on/off automode

- (FIX?) parser_time

-(FIX) out of range in 'Algo_Nasdaq.mqh' (546,16) (!!!)

BsmchnDataBase:

- last date 30/11/2024

Version 2.5

2024.11.19

Algo:

- checkSessions() --> new_1_minute()

- checkSessions() globalTimings

Other:

- new defaults

Version 2.4

2024.11.19

Algo:

- (HOTFIX) GetServerOffset() revision 2.01

Other:

- defineSymbol() SymbolInfoString(inp, SYMBOL_DESCRIPTION)) update

Version 2.3

2024.11.17

- Added basic configuration of input models and timeframes (optional): continuation models have been grouped under "DR," structural models under "LT," and "SMR" has been separated as a standalone category.

Algo:

- S.Add2Sl = ADD2SL_COEF * lenght / 15; // new formula // ADD2SL_COEF = 0.9

- double sl = perv.low - DR_COEF * (perv.high-perv.low); // new formula DR models//DR_COEF = 1.1

- entry models logic update

UI:

- Display of session times (optional)

Other:

- (FIX) https://discord.com/channels/1231581033242038393/1231595983213957212/1306701437354381403

- (FIX) updateAdd2Sl(tf)

- (FIX) active_trades

- INPUTS getSetup()

- (FIX) serverOffset , ShowNymVertical(GetServerTimeFromNY("00:00"));

Version 2.2

2024.11.14

- (FIX) tester optimization

- (FIX) auto mode symbols

- defineSymbol() update

- (ON/OFF) Emulate user using random delay (INPUT)

- algo update

- (TESTER INIT) ShowVertical(GetServerTimeFromNY("20:00")) * not NYM

Version 2.1

2024.11.09

https://www.mql5.com/ru/market/product/116079

v 2.01

AUTO && Semi-Auto mode & BSMCHN (1.18) integration

Algo:

- SEMI-AUTO mode

- AUTO mode (BSMCHN)

- BSMCHN connection

- BSMCHN db init

- BSMCHN DB data import (us100, us500, dax, eur, gbp)

- BSMCHN real time update

- Tester Visual Mode DB connect

- OPENING TIME DEFAULTS sessions NY local timings [BSMCHN sessions/macro] + custom sessions

- BSMCHN LEVELS switches

- High-impact news trading rule

UI:

- BSMCHN LEVELS VISUALIZATION Macro & Sessions Highs-Lows, Nym, Sessions Quantiles 60,90(*)

- ModeButton: M(Manual), SA(SemiAuto), A(Biasmachine Auto)

- SemiAuto Long & Short Buttons

- BSMSCHN key levels && sessions

Other:

- BSMCHN symbols

- BSMCHN database 19.10.2024

- TESTER HLT OPTiMIZATION :: TARGET (v1.26)

- TESTER HLT OPTiMIZATION :: RR TARGET

- TESTER HLT OPTiMIZATION :: MODE

- TESTER INIT :: timeShift

- (FIX) TradingPlan target tap visualization

(*) avaible only for BSMCHN symbols

Version 1.27

2024.08.18

Algo:

- CONTINUATION models update :: prevPrevSwing.direction == tradingPlan.direction

- fiboSlDeviation :: 1.43

- Day End close positions (MODE)

Other:

- TESTMODE :: MQLInfoInteger(MQL_VISUAL_MODE) UI update

- (FIXED) be==0 wrong sl calc

- (FIXED) tester mode OFF tradingPlan.active bug

Version 1.26

2024.06.24

Algo:

- trailing stop :: RR | TICKS | $$

- sessions trading :: ASIA, LO, AM, PM

- time default params :: HH:MM

- fiboSlDeviation :: 1.717

Other:

- TESTMODE :: manual target

- trial

Version 1.25

2024.06.08

Other:

- TESTMODE : on/off + longs/shorts

- MarketEntry betterEntry update

- log update

Version 1.24

2024.05.18

Algo:

- stop loss min-max default // candles + dynamic mode-based, auto

- manual sl min-max (ticks , all assets) // возможность выбрать длину стоп лоса в ручном режиме, в тиках для всех активов

- additional entry check // история с пропуском позы

- trading time + be time + close time // органы управления и логика для выбора времени торговли, перевода всех позиций в б.у , закрытия всех открытых позиций

- updateAdd2Sl() onInit - ontimer - structure.candes

- async positions finder (!) // во избежание ситуаций с задержками между терминалом и брокером

UI

- TimeStopButton + TimeStopXButton(s)

- TimeStartButton + TimeStartXButton(s)

- TimeBeButton + TimeBeXButton(s)

- TimeCloseButton + TimeCloseXButton(s)

- CHARTEVENT_CHART_CHANGE dynamic buttons size (all)

- ESC cancel time choose

Other:

- risk 5% , 10%

- log update

Version 1.23

2024.05.15

Algo:

- stop loss MIN-MAX --> candle size // для использования на аккаунтах с минимальным или отсутствующим спредом (raw счета icm , cryptofundtrader и др где спред близок или равен нулю)

Other:

- log update

Version 1.22

2024.05.15

algo:

- (hotFIX) дополнительная проверка на деактивацию при достижении таргета

Version 1.21

2024.05.13

Algo:

- (hotFIX) путаница с перманентной активацией пои при запуске

- (FIX) onTimer posInfo rebuild

Other:

- log update

Version 1.20

2024.05.13

Algo:

- sl_min / sl_max более не нуждаются в настройке: вычисляются автоматически на основе текущих значений спреда. коридор от 4-16 для агрессивного режима, дальше через мультипликаторы

- timerSet, timerDelay --> +randomDelay RandomLinear(15) // немного рандома относительно действий вокруг открытия новой свечи, рандомится при первой инициализаци\перенатягивании HLT на чарт

- active_trades // (целое число) настраиваемый параметр, количество одновременно открытых сделок на эту торговую идею , по умолчанию 0 - без ограничений

- uniqSL() && betterentry check update

Visual:

- (FIXED) пропадающий poi::end при смене тф

Other:

- experts log update

- slcheck() полный реворк под новую систему подсчета sl_min / sl_max

- uniqSl() полный реворк под новую систему подсчета sl_min / sl_max

- additional swings.arraySize check in structure.updateData() // в тч для обновленных в 1.19 параметров

Version 1.19

2024.05.09

Algo:

- SMR // swings --> reversal detection schema update

- BE -> RR // перевод в безубыток после указанного(любого) RR (0 - не переводить в бу, 2 - по умолчанию)

- checkTradingPlan() case 2: bid -> ask // рисует по биду. столкнулся с тем что у icm могут различаться значения "стакана"(ontick) и свеч по факту: теперь понятно как меня крыло в воздухе при спреде 0

- candleTradingPlanCheck() // дополнительная проверка активации пои по значениям последней закрытой свечи

Other:

- updatePosInfo() optimization update

- getSetup() update

Version 1.18

2024.05.07

https://www.mql5.com/ru/market/product/116079

v 1.18

Algo:

- dailyloss --> если указать <10 то это будут проценты от депозита, в остальных случаях - доллары как и прежде .

- dailyloss by default = 5%

- correctSL rework //-->> там все еще остаются **несколько **скамных активов у которых неправильно вычисляется min_sl/max_sl, например SWI20 и XRPUSD - по факту для них значения будут не в $ а в копейках. не критично в целом, но надо будет поправить: пока не придумал как сделать по уму без проверки тикеров. остальные 99% активов теперь работают правильно - тики для FX, доллары для не фх.

Other:

- onTrade() log update

- checkPartitials() log update

- tradingPlan reset btn log update

- printStats()

Version 1.17

2024.05.05

Algo:

- smr 041-092

- smr ihigh --> ilow

- updatePosInfo() skip by ticket check

- updatePosInfo() HLT check && "" check

Other:

- additional stats info stats.wr

- getSetup() --> new setup

- new parameters output groups

- esc active by default //no input

- default rpt 025

- correctSL fix

Version 1.16

2024.05.02

lgo:

-smr htf

Bugs:

- (FIXED) Hedge

Version 1.15

2024.05.02

Algo:

- POI activation , longs case - ask<-->bid

Other:

- log clear

Bugs:

- (TEST) Hedge --> при торговле на одном активе в разные стороны проявляется баг в тейк партишолах: видимо алго путается в переменных// updatePosInfo() --> if(PosInfo[size-1].direction == tradingPlan.direction)

Version 1.14

2024.05.01

UI:

- !tradingPlan.active && status=W8 {...}

Bugs:

- (FIXED) Positions.mqh FATAL

Other:

- CheckPatitials() log update

Version 1.13

2024.04.30

UI:

- PoiEndButton tf change w8 case

- slcheck(true/false) for testers buttons

Bugs:

- (FIXED) tp1 multiple on checkPartitials(); // vol1,2 = -1;

- (TEST-2) Positions.mqh 875 FATAL !!!! // swing --> _swing

Other:

- tradingPlanPrint()

- sl_min/sl_max US, XAG test OK

Version 1.12

2024.04.29

Hotfix:

- tradingPlan.direction

Bugs:

(TEST-3) tp1 multiple on checkPartitials(); // vol1,2 = -1;

(TEST-2) Positions.mqh 875 FATAL

Version 1.11

2024.04.29

UI

- tradingPlanCheck() !active

Bugs:

- (TEST-2) tp1 multiple on checkPartitials(); // vol1,2 = -1;

- (TEST) Positions.mqh 875 FATAL

Version 1.10

2024.04.29

Bugs:

- (FIXED) при нескольких окнах на одном активе: открытие новой позы активирует пересмотр птт по всем открытым -> может спровоцировать ситуацию "лишних" партишелов.

- (TEST) tp1 multiple on checkPartitials(); // vol1,2 = -1;

Other:

- risk 0.1 - 2%

- tp, poi, inv logs

Version 1.9

2024.04.28

Bugs:

- (FIXED) при dir="down" выключало сразу если tradingPlan.invalidation не указан

- (TEST) при нескольких окнах на одном активе: открытие новой позы активирует пересмотр птт по всем открытым -> может спровоцировать ситуацию "лишних" партишелов.

UI:

- clr centralized

- poi start/end clr

- testersButtons

Algo:

- dataFree() //StatusbtnClick, checkTradingPlan

Other:

- symbolCurrent() log check

- positionTp()

- Tp1,2 check

Version 1.8

2024.04.26

UI

- tradingPlanCheck() + onTimer()

Bugs:

- (FIXED) _ptp2

- (FIXED) openLoss()

- (DETECTED) при нескольких окнах на одном активе: открытие новой позы активирует пересмотр птт по всем открытым -> может спровоцировать ситуацию "лишних" партишелов.

Other:

- hide show

Version 1.7

2024.04.25

UI:

- min buttons size (adaptive)

- min fontsize (adaptive)

- poi:start

- poiEndButton full logic

Algo:

- poi end trigger

Bugs:

- (FIXED) min_rr

- (TEST) OpenLoss() //реализовано через подсчет стоимости незафиксированного тика - получает значения с отклонениями около 1% без учета комсы на круг

Other:

- S.LastTick = MathAbs( (SymbolInfoDouble(S.Name, SYMBOL_ASK)+SymbolInfoDouble(S.Name, SYMBOL_BID))/2 );

- Settings+ print onInit()

Version 1.6

2024.04.25

min_rr bug hot fix

Version 1.5

2024.04.25

UI

- ::CAppDialog (bad idea, killed)

- poiButton full logic

- targetButton full logic

- statusButton full logic

Other

- risk 0.1-0.5

- preset info

- tradeIdeaCheck()

- tradingPlan.active check

- betterentry || slcheck()

- stop trading after tradingPlan.tp triggered

- ui HME type

- ui dynamic size

- delete dir from settings

- tradingPlan.active = max for posInfo

- min_rr (not tested)

- ChartEventKeyboardDown

- (esc) logic

- first init () tradingPlan

Bugs:

- при валюте расчетов != валюте депозита openProfit считается некорректно (not fixed) , кастыль вместо openLoss

Version 1.4

2024.04.22

- managing loss calc

- loss restriction update

- MarketEntry -> better entry

Version 1.3

2024.04.21

stats - profits hotfix

- deviation tets OK

Version 1.2

2024.04.21

data ups

model +tf

posinf +c

min/max sl tf switch

new part schemas

+stats

sl deviation lines

Version 1.1

2024.04.18

- sl check

- symbol check

- log ups

входил в число бета-тестеров, без ошибок и багов удалось поработать на релизном продукте (или около него) трое суток. Работа была в тупую: один актив, евро. В Лонг и в шорт без указания пои, просто видишь формацию - открываешь сделку, что меня удивило, что в результате 13 сделок за трое суток софт отторговал в +1.5% к депозиту, при том, что торговля была от балды и цена только один раз дошла до таргета, весь плюс был на частичных фиксах. Софт хорошо считывает формации и использует модели входа и контроль рисков с частичной фиксацией, со своей задачей справляется на ура Спустя неделю торгов на демо взял проп, не могу теперь представить свою торговлю без ХЛТ) Огонь, Георг - жму руку)