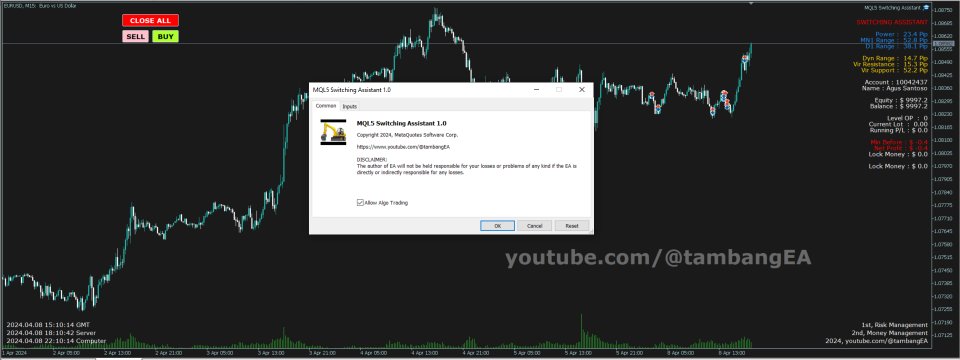

Switching Assistant MT4

- Utilities

- Agus Santoso

- Version: 1.3

- Updated: 9 November 2024

Please leave a 5 stars rating if you like this free tool! Thank you so much :)

The "Risk Management Assistant" Expert Advisor Collection is a comprehensive suite of tools designed to enhance trading strategies by effectively managing risk across various market conditions. This collection comprises three key components: averaging, switching, and hedging expert advisors, each offering distinct advantages tailored to different trading scenarios.

This EA is a development of standard risk management strategies on the market

1. "Averaging Assistant" EA:

2. "Switching Assistant" EA :

3. "Hedging Assistant" EA :

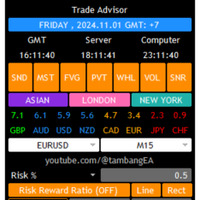

The "Switching Assistant' Expert Advisor (EA) utilizing the switching method is a sophisticated tool designed to enhance risk management within trading strategies, particularly in the realm of algorithmic trading in financial markets. This EA operates within the MetaTrader platform, leveraging its capabilities to automate risk management decisions based on predefined parameters and market conditions.

Here's a breakdown of its key features and functionality:

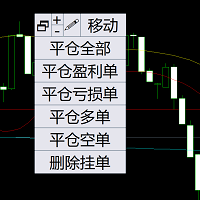

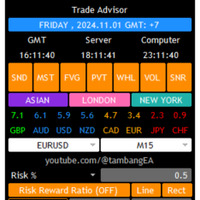

Dynamic Risk Adjustment: The EA employs a dynamic risk adjustment mechanism that continuously evaluates market conditions, account size, and other relevant factors to determine the appropriate level of risk for each trade.

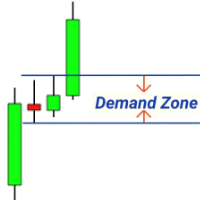

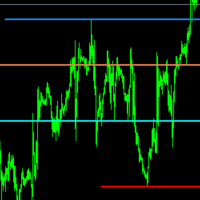

Switching Methodology: At the core of this EA is the switching method, which involves dynamically switching between different risk management strategies based on predefined criteria. These strategies may include fixed lot size, percentage risk per trade, or other custom risk management approaches.

Trade Analysis: The EA conducts real-time analysis of each potential trade, considering factors such as volatility, correlation, and market sentiment to assess the risk-reward profile before executing a trade.

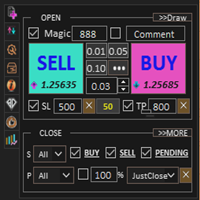

Customizable Parameters: Users have the flexibility to customize various parameters, including risk thresholds, trade size limits, and switching criteria, to align with their specific trading objectives and risk tolerance.

Risk Monitoring and Reporting: The EA continuously monitors account equity, drawdown levels, and other risk metrics, providing real-time alerts and comprehensive reporting to help traders stay informed about their exposure and performance.

Position Sizing Optimization: By dynamically adjusting position sizes based on market conditions and risk parameters, the EA aims to optimize risk-adjusted returns and mitigate the potential for significant drawdowns.

Backtesting and Optimization: Prior to deployment, the EA allows users to conduct extensive backtesting and optimization to assess its performance under various market scenarios and fine-tune its parameters for optimal results.

Compatibility and Integration: The EA seamlessly integrates with MetaTrader platforms, ensuring compatibility with a wide range of brokers and trading instruments, including forex, stocks, commodities, and indices.

Risk Control Mechanisms: In addition to dynamic position sizing, the EA may incorporate additional risk control mechanisms such as stop-loss orders, trailing stops, and hedging strategies to further mitigate downside risk.

Overall, the Risk Management Assistant Expert Advisor utilizing the switching method empowers traders to implement a disciplined and adaptive approach to risk management, helping to safeguard their capital while maximizing the potential for long-term profitability in the dynamic and often unpredictable world of financial markets.