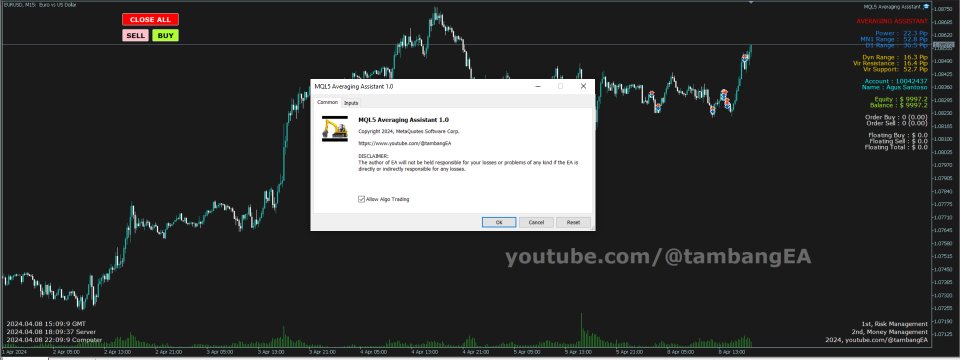

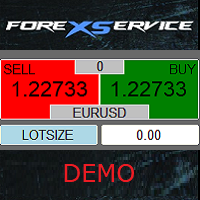

Averaging Assistant MT5

- Utilities

- Agus Santoso

- Version: 1.3

- Updated: 9 November 2024

Please leave a 5 stars rating if you like this free tool! Thank you so much :)

The "Risk Management Assistant" Expert Advisor Collection is a comprehensive suite of tools designed to enhance trading strategies by effectively managing risk across various market conditions. This collection comprises three key components: averaging, switching, and hedging expert advisors, each offering distinct advantages tailored to different trading scenarios.

This EA is a development of standard risk management strategies on the market

1. "Averaging Assistant" EA:

2. "Switching Assistant" EA :

3. "Hedging Assistant" EA :

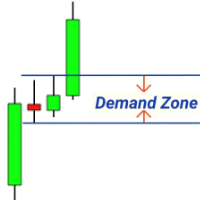

The "Averaging Assistant" Expert Advisor (EA) utilizing the averaging method is a sophisticated tool designed to help traders manage their risks effectively in the forex or financial markets. This EA employs an averaging strategy, which involves opening multiple positions at different price levels to mitigate the impact of market volatility and potential adverse movements.

Here's a detailed description of the key features and functionalities of this EA:

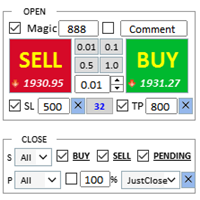

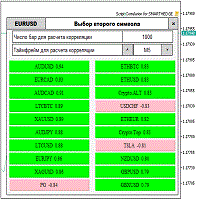

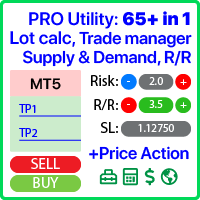

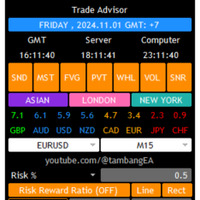

Risk Management Parameters: The EA allows traders to define their risk management parameters, including the maximum risk per trade, total exposure limit, and stop-loss levels. Traders can set these parameters based on their risk tolerance and trading strategies.

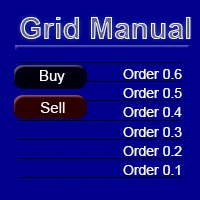

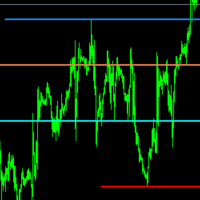

Averaging Strategy: The core of this EA is its averaging strategy. When a trade is initiated, and the market moves against the position, the EA will open additional positions (averaging down) at predetermined intervals or price levels. These additional positions are aimed at reducing the average entry price of the overall position, thus potentially improving the chances of the trade eventually turning profitable.

Dynamic Position Sizing: The EA dynamically adjusts the position sizes of the averaging trades based on market conditions and the trader's risk management parameters. It may increase or decrease the size of subsequent positions to ensure that the total risk exposure remains within predefined limits.

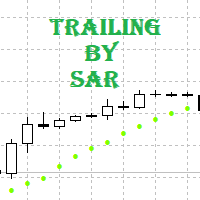

Stop-loss Management: The EA incorporates intelligent stop-loss management to limit potential losses. Traders can set trailing stop-loss levels that automatically adjust as the trade moves in their favor. Additionally, the EA may close out all positions if the cumulative loss reaches a certain threshold to prevent excessive drawdowns.

Profit-taking Strategies: In addition to managing losses, the EA also includes profit-taking strategies. Traders can set take-profit levels for individual positions or for the entire basket of trades opened by the EA. This helps lock in profits and prevent giving back gains during volatile market conditions.

Risk Monitoring and Reporting: The EA continuously monitors the overall risk exposure, individual trade performance, and account balance. It provides real-time reporting and alerts to keep traders informed about their portfolio's risk profile and performance.

Customization Options: The EA offers a high degree of customization, allowing traders to fine-tune parameters such as averaging intervals, maximum number of averaging trades, and risk-reward ratios to suit their trading preferences and market conditions.

Backtesting and Optimization: Before deploying the EA in live trading, traders can conduct extensive backtesting and optimization to evaluate its performance under various market scenarios and parameter settings. This helps validate the effectiveness of the averaging strategy and fine-tune the EA for optimal results.

Overall, the Risk Management Assistant Expert Advisor using the averaging method is a powerful tool for traders seeking to manage risks effectively while implementing a disciplined and systematic approach to trading in the financial markets. By combining sophisticated risk management techniques with the averaging strategy, this EA aims to enhance the overall profitability and resilience of traders' portfolios.