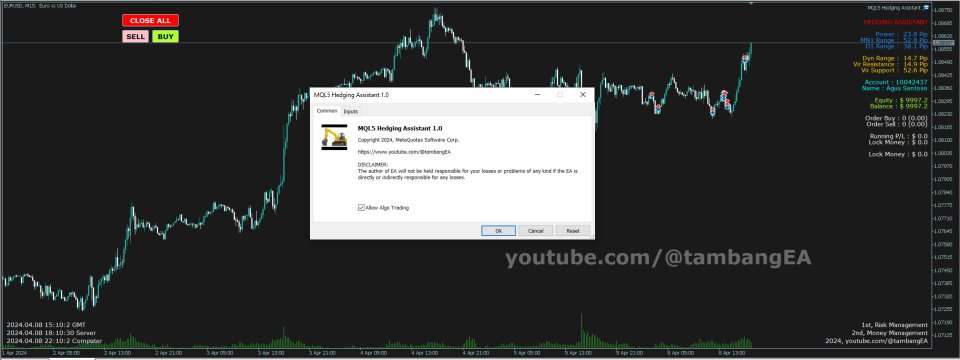

Hedging Assistant MT5

- Utilities

- Agus Santoso

- Version: 1.3

- Updated: 9 November 2024

Please leave a 5 stars rating if you like this free tool! Thank you so much :)

The "Risk Management Assistant" Expert Advisor Collection is a comprehensive suite of tools designed to enhance trading strategies by effectively managing risk across various market conditions. This collection comprises three key components: averaging, switching, and hedging expert advisors, each offering distinct advantages tailored to different trading scenarios.

This EA is a development of standard risk management strategies on the market

1. "Averaging Assistant" EA:

2. "Switching Assistant" EA :

3. "Hedging Assistant" EA :

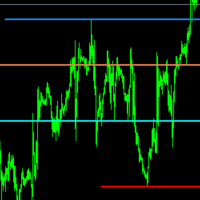

The "Hedging Assistant" Expert Advisor with Hedging Method is a sophisticated tool designed to assist traders in managing their risk exposure effectively within the volatile world of financial markets. Utilizing advanced algorithms and hedging techniques, this expert advisor aims to minimize potential losses while maximizing profit potential.

Key Features:

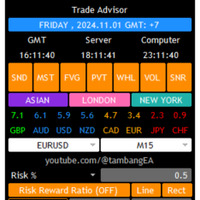

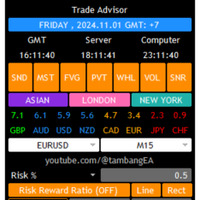

Risk Assessment: The advisor evaluates the trader's risk tolerance, account balance, and market conditions to determine appropriate risk levels for each trade. It considers factors such as volatility, liquidity, and correlation to make informed decisions.

Dynamic Position Sizing: Based on the risk assessment, the advisor dynamically adjusts position sizes to align with the trader's risk parameters. It ensures that each trade's exposure is proportional to the trader's account size and risk tolerance.

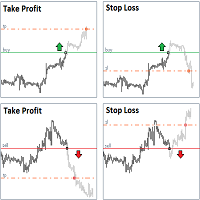

Hedging Strategy Implementation: The advisor employs hedging strategies to mitigate potential losses in adverse market conditions. By opening offsetting positions, it aims to neutralize downside risk while allowing for continued participation in market movements.

Real-Time Monitoring: The advisor continuously monitors market conditions and the trader's positions to identify potential risks and opportunities. It provides real-time alerts and notifications to prompt action when necessary, ensuring proactive risk management.

Customizable Parameters: Traders can customize various parameters such as stop-loss levels, take-profit targets, and hedging thresholds to suit their individual trading preferences and risk appetite. This flexibility allows for personalized risk management strategies.

Backtesting and Optimization: The advisor offers robust backtesting capabilities, allowing traders to evaluate the effectiveness of different risk management strategies over historical data. Through optimization, traders can fine-tune parameters to enhance performance and adapt to changing market conditions.

User-Friendly Interface: The advisor features an intuitive interface that makes it easy for traders to monitor their positions, adjust settings, and analyze performance. It provides clear visualizations and reports to facilitate informed decision-making.

Benefits:

Enhanced Risk Management: By utilizing advanced algorithms and hedging techniques, the advisor helps traders minimize potential losses and preserve capital during adverse market conditions.

Improved Profitability: The dynamic position sizing and proactive risk management strategies employed by the advisor aim to optimize profit potential while mitigating downside risk.

Time Efficiency: The advisor automates many aspects of risk management, allowing traders to focus on strategy development and analysis rather than manual monitoring and intervention.

Versatility: Whether trading forex, stocks, commodities, or other financial instruments, the advisor can be adapted to various markets and trading styles, providing flexibility for traders with diverse preferences.

In conclusion, the Risk Management Assistant Expert Advisor with Hedging Method offers traders a powerful tool to navigate the complexities of financial markets with confidence. By combining advanced risk management techniques with automated execution, it aims to empower traders to achieve their financial goals while minimizing exposure to market volatility.