Denk

- Experts

- Ervand Oganesyan

- Version: 1.2

- Updated: 24 August 2024

- Activations: 10

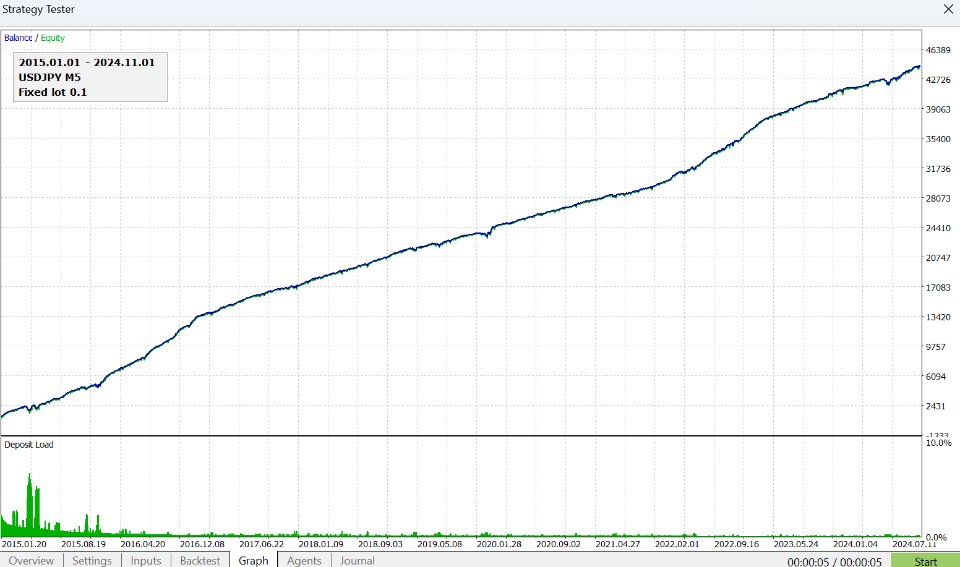

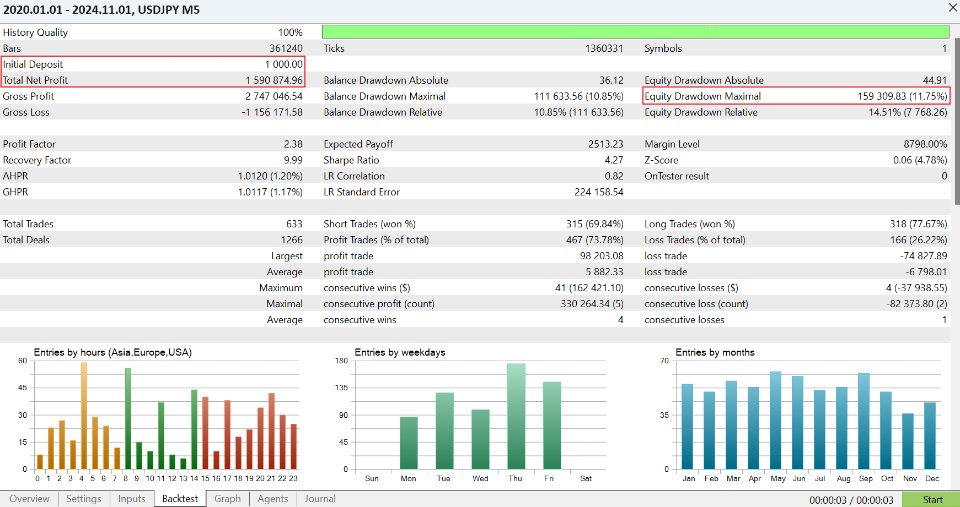

Live performance: USDJPY

Quick start

- Set the EA on M5 chart of any forex major pair.

- Make sure the time zone settings are correct. The defaults are correct for most brokers.

- Set comfortable risk level.

- Left the rest settings at their defaults, the EA is ready to trade.

Customizable trading logic

- Currency-specific intraday price actions are tracked, and depending on the nature of these actions trades are opened with an expectation of either a continuation of the price movement, or a return of the price to initial levels.

- It is up to the user whether the EA should trade trend, pullback, or both. The EA will use best optimized settings in any selected scenario.

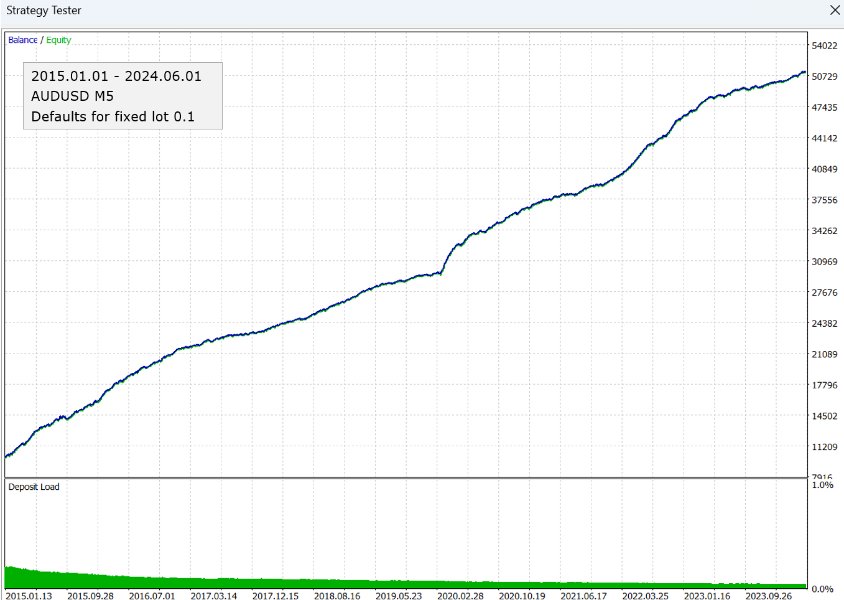

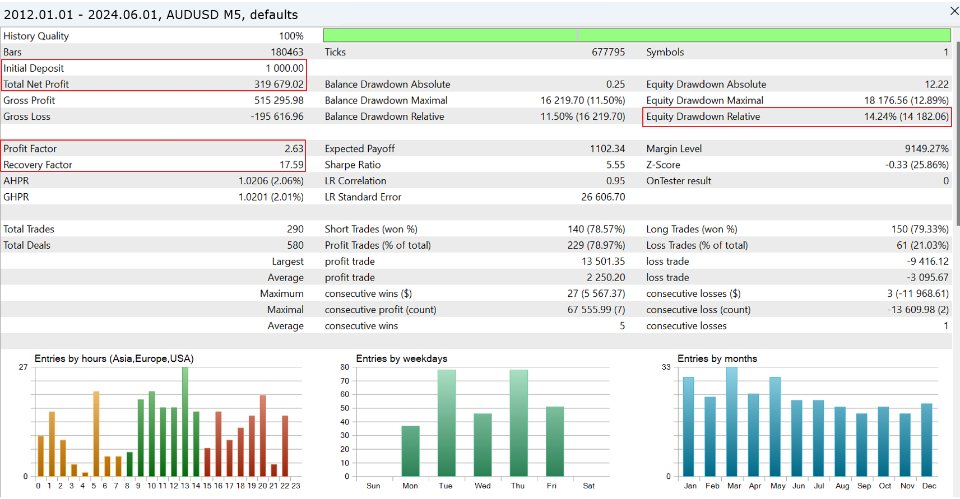

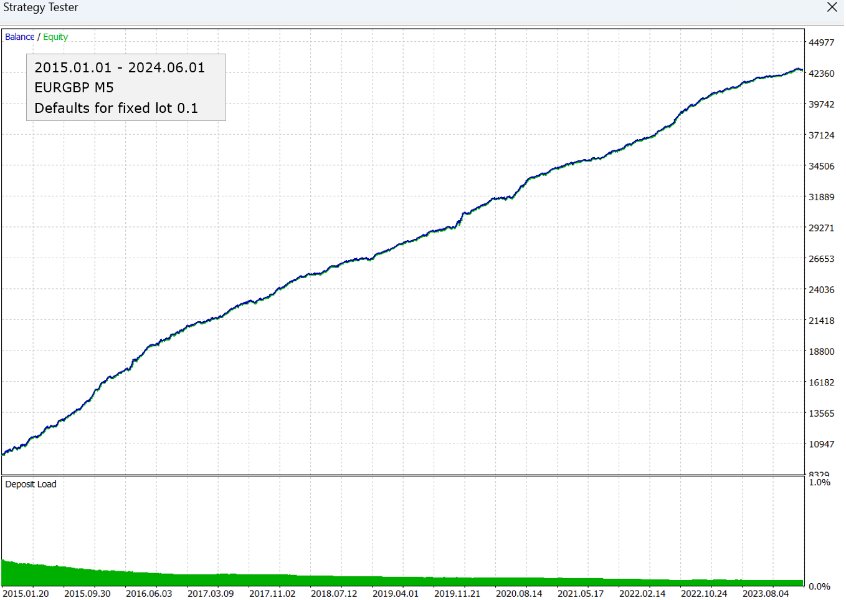

- The EA is optimized and ready made to trade any of 28 forex pairs. Most liquid majors and their crosses (EURUSD, AUDUSD, EURGBP, USDCAD) are preferable.

Easy to use

- No sophisticated settings. No need for constant monitoring. Set it and forget to start seamless 24/7 trading.

- Any broker, any account type. Low spread account types are preferable, but absolutely not critical.

- Does not require a lot of RAM. Will work on cheapest possible VPS.

Flexible risk settings

- One trade at a time only.

- Stop-loss for each trade, which makes deposit requirements for default settings minimal. Even 100 usd is fairly ok for safe min lot size trading.

- Set "Max lot size, multiples of Initial lot size" to 1 for constant risk trading with potentially high profits and low controllable drawdowns. Set it to values greater than 1 if steady moderate growth with fast recovery is more comfortable for you.

Safety

- Not sensitive to slippage. It does not trade news, and most of trades are opened on calm market.

- Not sensitive to volatility change. Stops and targets are calculated dynamically depending on chart instrument volatility. Most of trades will be closed by market. Stop-loss distance is wide enough not to constantly getting hit.

- Correct spread handling. Normally it will not skip deals on calm forex market, while it will avoid trading on untested market conditions with huge spreads.

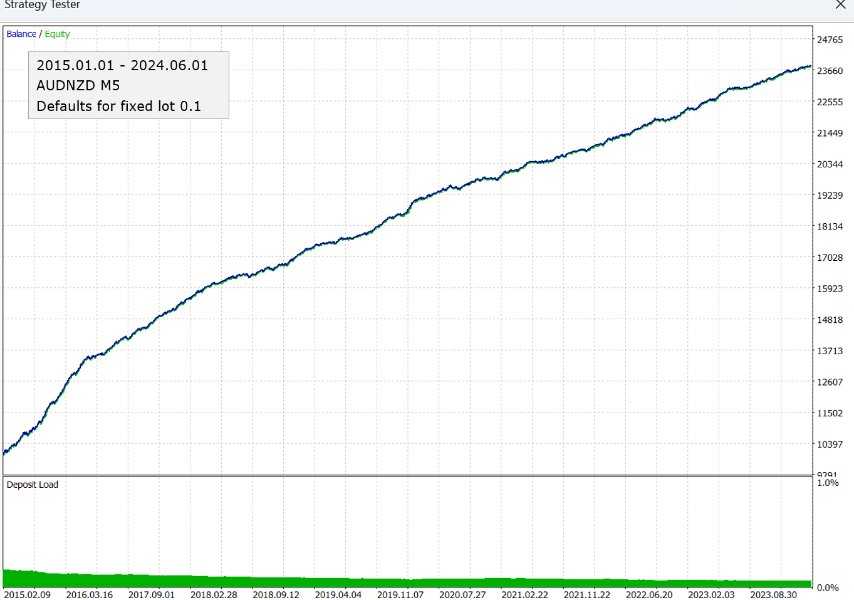

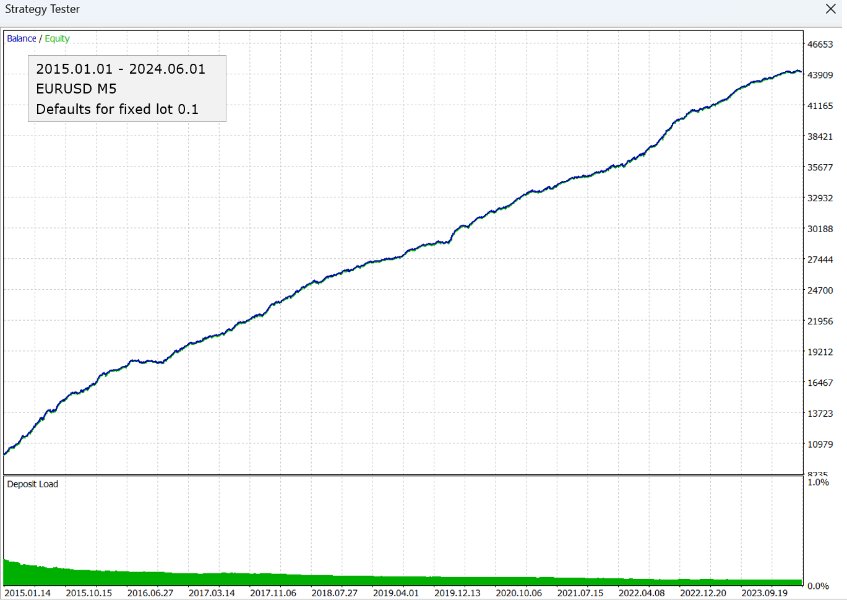

Reproducible backtests

- Backtests across different brokers will match 90-100%. Match between tester and live should be close to 100% for same broker.

- The EA trades on candle closure and may be tested with "Open prices only" mode, which is much faster than "Every tick" with essentially same results.

- Use M5 timeframe for "Open prices only" mode. For "Every tick" tester timeframe does not matter.

---

Tester or live performance in the past does not guarantee any profitability in the future. Risk settings should not be based on backtests. Low risk trading is potentially more profitable in a long-term perspective. EA default risk settings are fairly low and should not be increased too much.

---

Send a private message for any questions on EA work, installation and settings.

User didn't leave any comment to the rating