Comprehensive Moving Average

- Indicators

- Mehran Sepah Mansoor

- Version: 1.70

- Updated: 16 June 2024

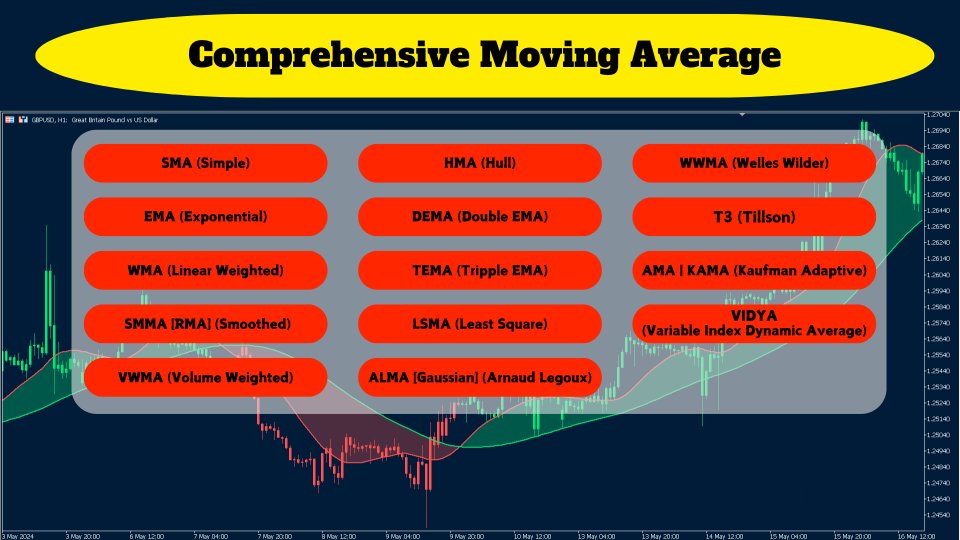

Access a wide range of moving averages, including EMA, SMA, WMA, and many more with our professional Comprehensive Moving Average indicator. Customize your technical analysis with the perfect combination of moving averages to suit your unique trading style / MT5 Version

Features

- Possibility to activate two MAs with different settings.

- Possibility to customize chart settings.

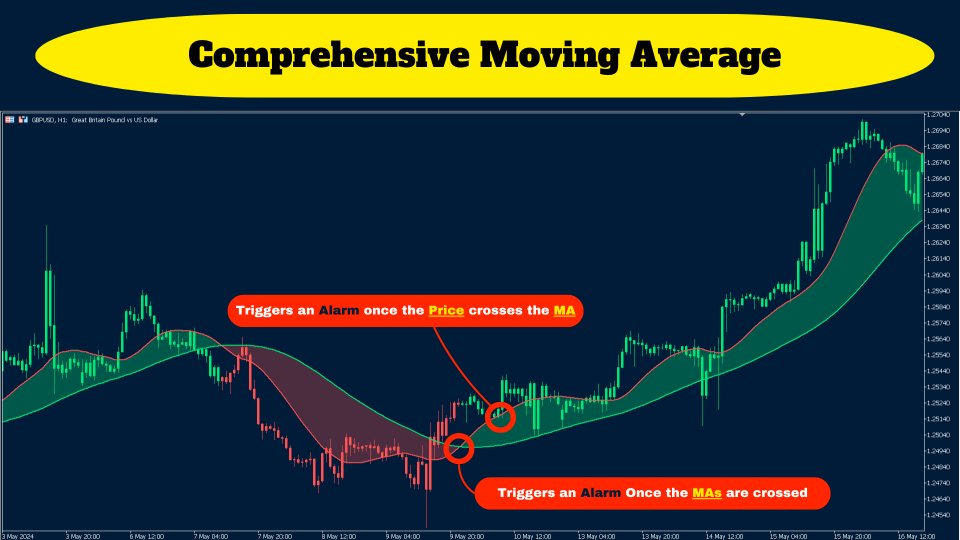

- Possibility to change the color of the candlesticks depending on crossed MAs or price crossed with MAs.

- Sending of alerts in case of crossed MAs or price crossed with MAs.

Types of moving averages included

- SMA --------------------> (Simple)

- EMA --------------------> (Exponential)

- SMMA [RMA] ----------> (Smoothed)

- WMA -------------------> (Linear Weighted)

- DEMA ------------------> (Double EMA)

- TEMA ------------------> (Triple EMA)

- VWMA -----------------> (Volume Weighted)

- HMA -------------------> (Hull)

- LSMA ------------------> (Least Square)

- ALMA [Gaussian] ----> (Arnaud Legoux)

- WWMA ----------------> (Wilder's MA)

- T3 ----------------> (Tillson)

- AMA (KAMA)----------------> (Kaufman Adaptive)

- VIDYA ----------------> (Variable Index Dynamic Average)

Main inputs

- Length: this parameter refers to the number of periods used to calculate the moving average. For example, if you set the length to 20, the moving average will be calculated using data from the last 20 periods.

- Offset: the offset refers to the number of periods forward or backward you want to move the moving average. For example, if you set the offset to 2, the moving average will be shifted two periods forward on the chart.

- SIGMA (ALMA mode): in ALMA (Arnaud Legoux Moving Average) mode, SIGMA represents the smoothing factor that controls the sensitivity of the moving average to changes in the input data. A higher value of SIGMA will produce a smoother moving average, while a lower value will cause the moving average to react more quickly to changes in the input data.

- MAs cross each other alert: this input triggers an alert when two selected moving averages cross each other. You can set this option to receive a notification when the shorter-period moving average crosses above or below the longer-period moving average, which may indicate a change in trend.

- Price cross MAs alert: this feature generates an alert when the price of an asset crosses above or below one or more selected moving averages. This type of alert can be useful for identifying entry or exit points based on price interaction with moving averages.

- Pop-up alert: alert to the MT4 terminal

- Email alert: email alert

- Push notification alert: alert to phone

- Alerts after candle close: this setting determines whether alerts will be triggered immediately when a specific condition is met or whether they will be postponed until the current candle closes. Choosing to trigger alerts after the close of the candle can help confirm the validity of a trading signal before making a decision, as it allows you to evaluate the price action over the entire candlestick period.

My admiration for you is as vaet as the surging river!!!