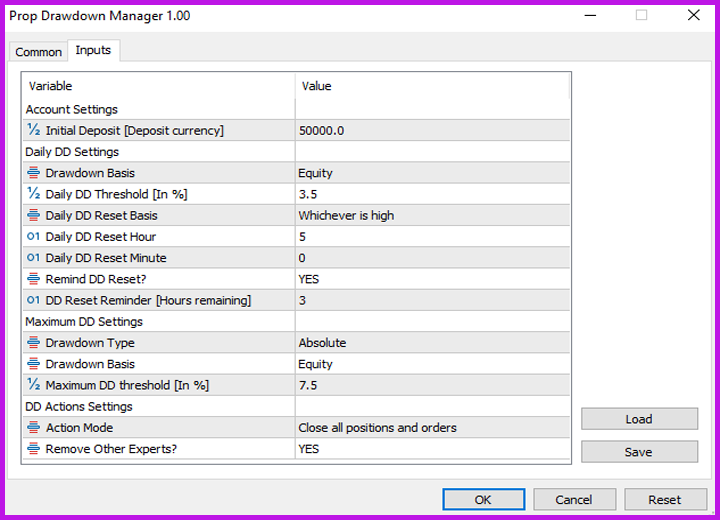

Prop Drawdown Manager MT5

- Utilities

- Elvis Wangai Muriithi

- Version: 1.2

- Updated: 30 January 2024

- Activations: 10

Prop Drawdown Manager is a sophisticated utility tool designed to assist traders in effectively managing and minimizing the impact of drawdowns within their forex trading accounts. Drawdowns, which represent the reduction in capital from peak to trough, are an inevitable aspect of trading, but they can be detrimental if not managed properly.

This utility provides traders with a suite of features aimed at controlling drawdowns and preserving trading capital:

1. Drawdown Thresholds: Traders can set customizable drawdown thresholds that trigger predefined risk management actions when breached. These thresholds serve as early warning signals, prompting the utility to take proactive measures to limit losses and protect capital.

2. Expert Remove: Another account saving feature from this utility is the ability to detect and remove other Expert Advisors from the chart when drawdown thresholds are breached. If you are using EA's with risky strategies like Grid and Martingale, no more fears, this utility already got you covered.

3. Alerts and Notifications: To keep traders informed and empowered to make timely decisions, the utility sends alerts and notifications when drawdown thresholds are approached or breached. These notifications can be delivered via a text message to the phone or through the trading platform itself.

4. Real-Time Monitoring: The utility continuously monitors the trader's account in real-time, tracking equity, balance, and other relevant metrics. It keeps a vigilant eye on account performance, enabling traders to promptly identify and respond to potential drawdown situations.

5. Automated Risk Mitigation: When the predefined drawdown threshold is breached, the drawdown manager automatically initiates risk mitigation strategies. This could involve various actions such as reducing position sizes, closing losing trades, removing other EA's or temporarily halting trading altogether to prevent further losses.

6. Dynamic Risk Assessment: This drawdown manager continuously assesses the risk exposure of the trader's positions in real-time. It considers factors such as market volatility, position sizes, and account balance to gauge the potential for drawdowns.

Notice: If you find this utility of help in your trading we encourage you to leave a good review. This helps us get better and know where to add improvement in the future versions. Wish you a profitable trading experience with our new tool.