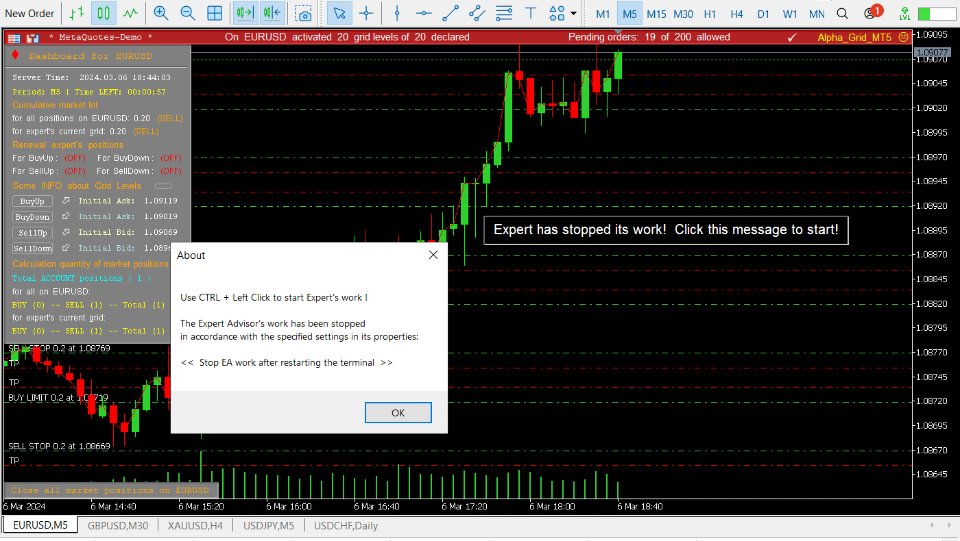

Alpha Grid MT5

- Experts

- Aliaksandr Charkes

- Version: 1.9

- Updated: 8 October 2024

- Activations: 10

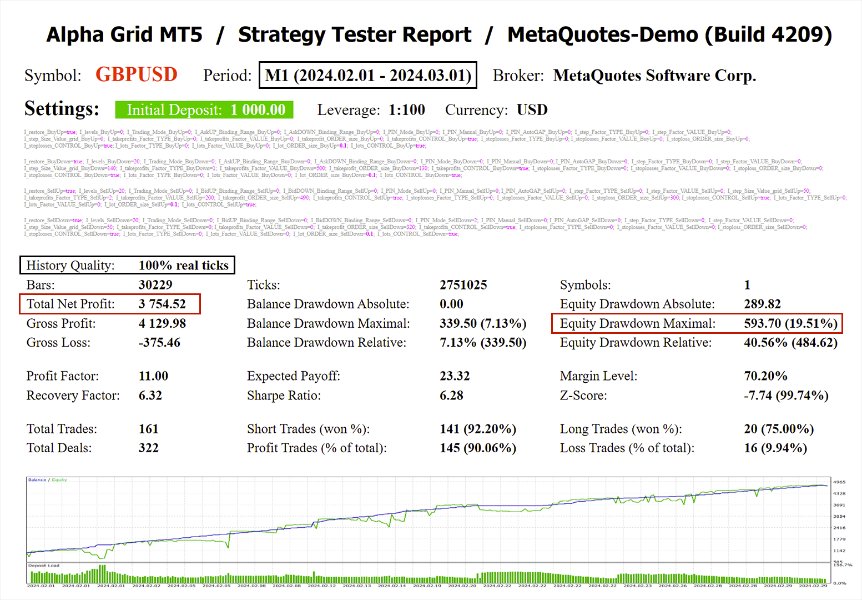

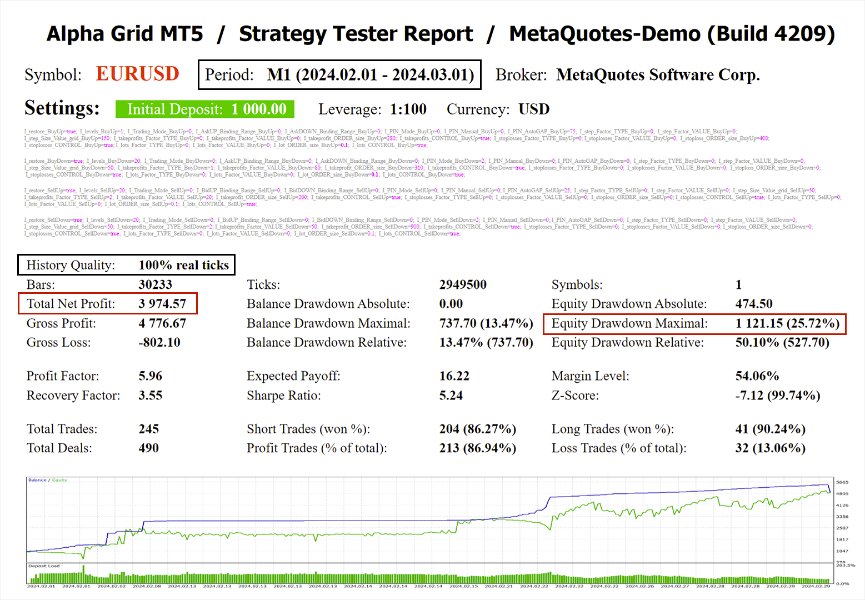

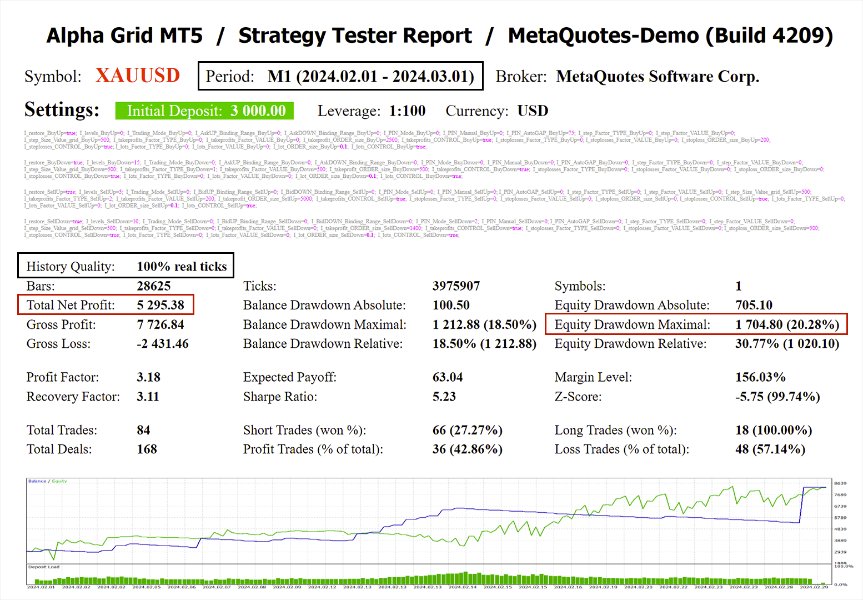

Alpha Grid MT5 is a multifunctional advisor designed to fully or partially automate various ideas related to grid trading (on a hedging account). At the same time, it can be considered as a general strategy designer, the capabilities of which allow you to set up not only grid trading, but also create something more complex and individual, if you understand its functionality well. That is, the strategy used does not necessarily have to be grid-based or fully automatic.

The Expert Advisor can trade on any timeframe, on any currency pair, on several currency pairs, on any number of signs. It does not interfere with manual trading, trading of other Expert Advisors, or the operation of any indicators.

Allows you to adjust your settings on the fly, by default it works only with your own positions and orders, but with certain settings it can interpose not only with manual trading, but also with the trading of other advisors. It has a powerful information system with which it is possible to control the overall trading situation for the entire account.

Brief description of the main features of Alpha Grid MT5:

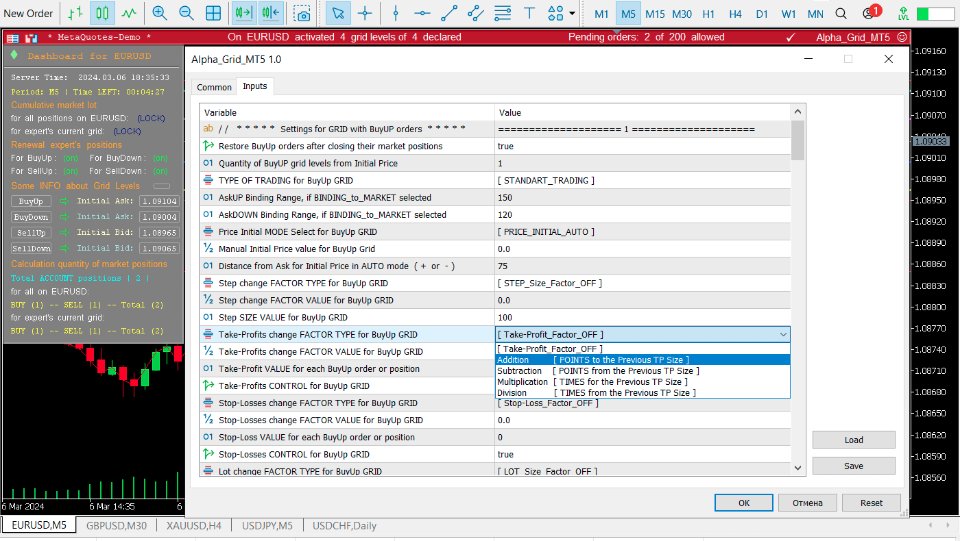

4 types of grids can be supported simultaneously:

- BuyUp - a grid of pending orders of the BUY type, which unfolds UP from the initial price

- BuyDown - a grid of pending orders of the BUY type, which unfolds DOWN from the initial price

- SellUp - a grid of pending orders of the SELL type, which unfolds UP from the initial price

- SellDown - a grid of pending orders of the SELL type, which unfolds DOWN from the initial price

- Grid step size (supports various types of coefficients)

- Take-Profit size for each grid order or position (supports various types of coefficients)

- Stop-Loss size for each grid order or position (supports various types of coefficients)

- Lot size for each grid order or position (supports various types of coefficients)

The multiple trading mode is a continuation of the development of the idea of tracking the trader’s funds and makes it possible not only to automatically restart the standard mode the required number of times, but also to track the total profit for all restarts.

This approach significantly expands the trading capabilities of the advisor, allowing you to implement various multi-staps strategies, including in the strategy tester! For example, relatively safely, you can use aggressive grid settings with small Take-Profit and Stop-Loss values for one-time trading and large ones for multi-time trading.

- Trading only within a given price range

- Placing a grid of pending orders when approaching a given price (or 1 order)

- Trailing stop of specified price limits

- Closing positions and deleting orders of a given type when going beyond the specified price limits

- The ability to use this type of trading simultaneously with any other types of trading that the advisor supports.

The general principle of this mode is that only closest pending orders to the current market prices are placed (above and below) and this continues as long as the market prices are within the grid. At the same time, the entire mesh can be visualized at any time using special lighting.

It is important that this mode can work correctly even with an uneven distribution of grid levels (when the step factor is used).

For each grid, in the settings you can set the range for binding the initial grid price to current market levels. That is, as soon as the market price moves away from the initial price by a given distance, and this distance will accommodate an entire grid step (or several steps), the initial price will automatically move as close as possible to the current market price.

Further, the rest of the grid will be rebuilt after it - unnecessary pending orders will be deleted, and market positions that fall out of it will be considered obsolete. In this case, it is important to consider that without changes, the grid will only work if the step factor is not used. Otherwise, it is better to use phantom mode.

Also, using this functionality, you can implement some non-grid strategies. For example, if you specify only 1 grid order in the grid settings, then when moving the initial price, the advisor will place a new pending order each time and delete the old one (except for market positions). This is exactly how, for example, you can organize a trailing-stop of a single pending order (by grid steps) until it turns into a market position.

Other strategies are also possible...

- The advisor can be launched simultaneously on any currency pairs or even on the same one with different settings. Each order or position is marked with an individual comment, which contains both the opening price and the name of its instrument. You can also add a trader’s personal mark to the comment.

- The advisor is not afraid of any interruptions in his work. With each new launch and unchanged settings, it picks up all its orders and issues a report on what happened to them during its inactivity. Alpha Grid also has a separate system of various alerts (text and graphic) that help you quickly understand what exactly is happening with your trading at any given time.

- The informational (and some trading) capabilities of the advisor can be used during regular manual trading. At the same time, most information panels, buttons and notifications can be freely moved around the chart, some of them can be minimized and scaled. The color settings of the panels can be used for quick visual identification of a working advisor when used simultaneously on different charts.

i really fit with this ea, seller is fast response too