Force Directional

- Indicators

- Jan Carlos Pagano

- Version: 2.0

- Activations: 5

Force Directional

The Force Directional technical indicator is based on the idea of assembling a set of elements that can be used to assist the trader in measuring the relative strength of price movement and, at the same time, identify and follow the directionality of the trend.

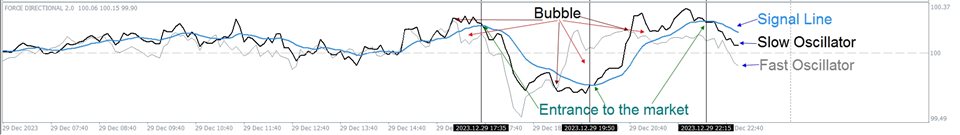

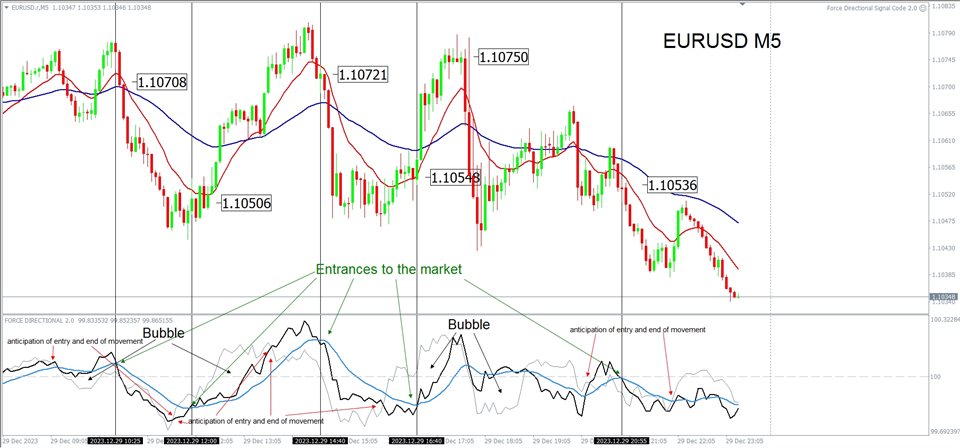

The indicator consists of a slow oscillator (black line), a fast oscillator (gray line), and an exponential midline with reduced values that acts as a signal line (blue line), identifying reversals in movement and also serving as a directional guide. The indicator's oscillators move above or below the value of 100, comparing, in different terms and timeframes, the closing of the last price with a previous closing, regardless of the time horizon.

This indicator is particularly effective in identifying trend reversals and can be successfully used on any timeframe. However, it is advisable to use it on longer time frames to more accurately assess the strength of a movement or trend in order to make more informed decisions.

How to Use:

The recommended strategy is to enter long when the slow oscillator crosses the signal line upwards with a value below 100 and short when it crosses the signal line downwards with a value above 100. The greater the extension of the value, the more effective the entry will be. Maintain a long position as long as the slow oscillator is above the signal line, and short as long as the slow oscillator is below the signal line.

Key Patterns:

The Bubble: Often anticipates trend reversal or highlights position unwinding. It forms when the fast oscillator crosses the slow one upwards (predicting an upward trend) or downwards (predicting a downward trend). Bubbles are valuable indicators of trend strength and an impending end to them.

Divergence: When Force Directional diverges from price movements, it can be interpreted as a leading indicator of potential highs (when Force Directional decreases while prices rise) or lows (when Force Directional rises while prices fall).