EurUsd H1 portfolio

- Experts

- Robin Obrusnik

- Version: 1.0

- Activations: 10

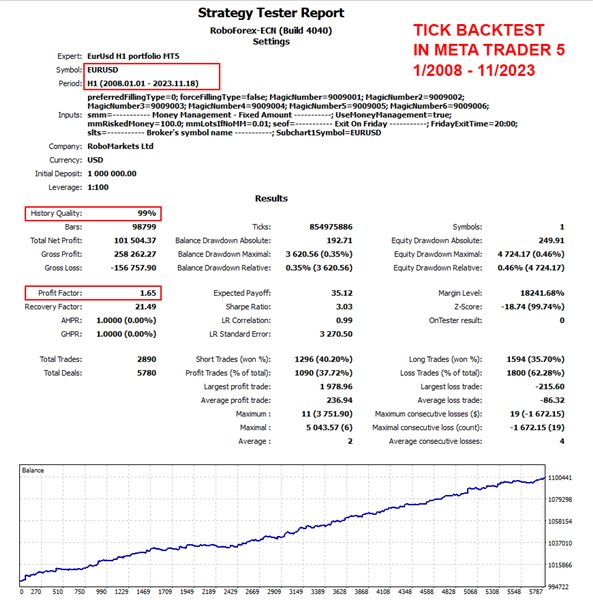

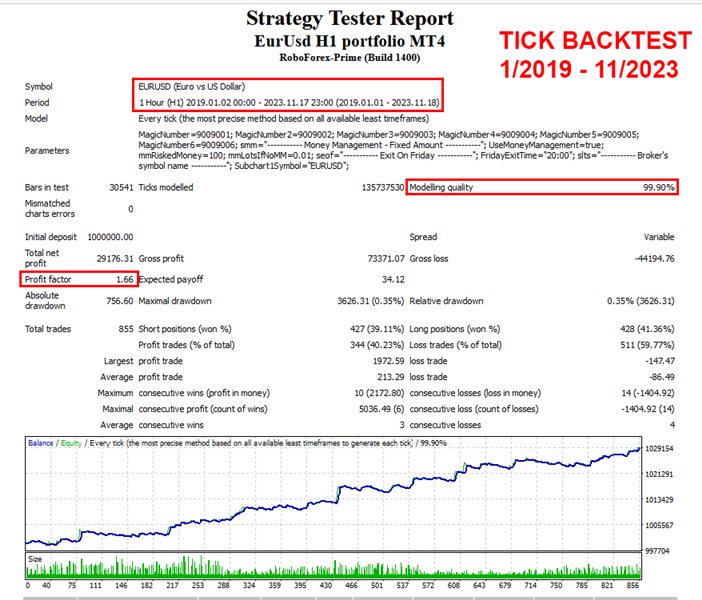

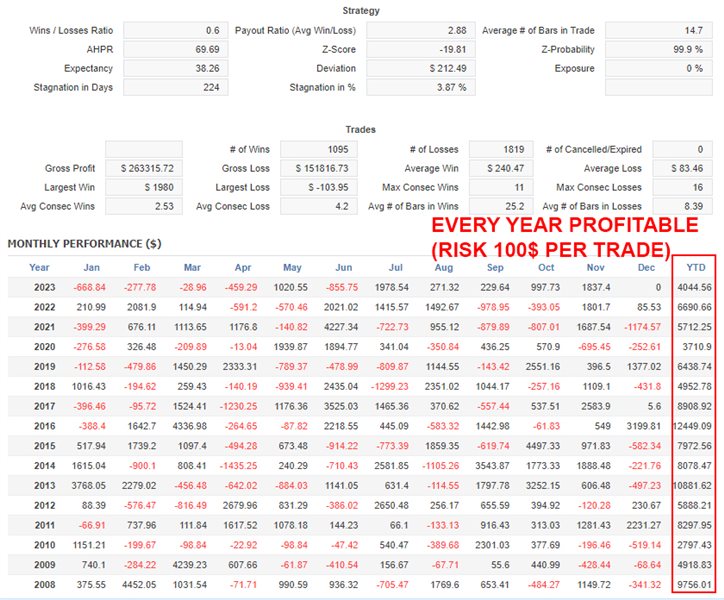

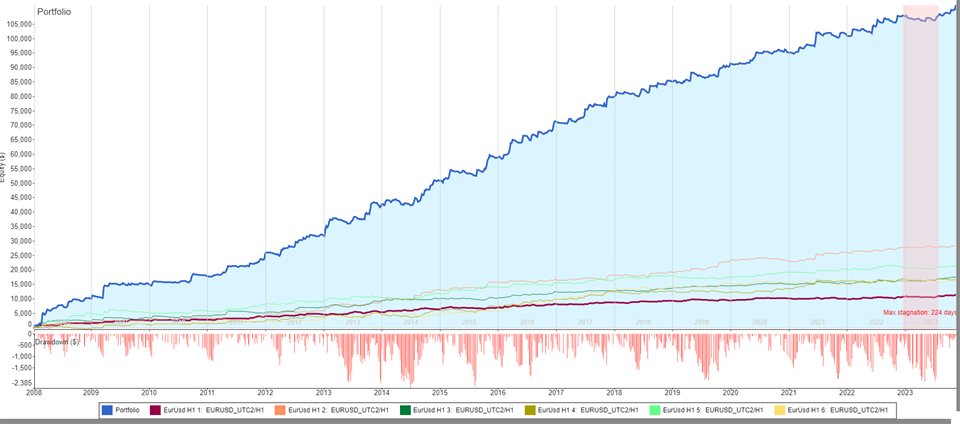

The portfolio was developed for the currency pair EURUSD time frame H1. The portfolio consists of 6 strategies - each with different logic merged into one. It is designed for intraday/swing trading - no scalping, martingale, grid, etc. The EA pass through rigorous testing of robustness and is tested on over 15 years of data with 99% modeling quality!

- Intended for EURUSD H1.

- Each strategy has its own logic - a different approach, different rules.

- EA is designed for UTC+2 timezone with New York DST (EST+7).

- This is a long-term strategy - if you want more trades, more profits, risk diversification and a smoother equity curve, I recommend portfolioing more strategies from my product offering HERE.

- The strategy of EA goes through rigorous robustness testing - a series of simulations of various market conditions and situations on historical data over the last 15 and more years (testing on OOS data, tests in other markets, Monte Carlo tests for higher spread, slip, volatility, omission and shuffling of trading orders, Walk- Forward Matrix tests etc.).

- EA has been tested on demo and live accounts for a long time before it was released.

Functions:

- Each trade is always protected by StopLoss!

- Money management can use a fixed amount or a fixed lot size.

- No martingales, grids or other dangerous money management methods are used!

- All settings optimized.

- Long-term strategy!

- At 20:00 (UTC+2) we close trading every Friday to avoid weekly gaps.

In order to diversify the risk, increase the number of trades, increase profits, reduce the maximum drawdown and reduce the stagnation time, I trade the EA in a portfolio with the other EAs that I offer HERE.

Settings:

MagicNumber = - Choose your number to distinguish strategy, or keep default.

UseMoneyManagement = false/true – If you want to trade only fixed lots use FALSE. If you want to risk fixed money you need to set this to TRUE

mmRiskMoney = 100 - If UseMoneyManagement is set to TRUE, you set the risk in Fixed money.

mmLotsIfNoMM= 0,01 - If UseMoneyManagement is set to FALSE, you set the Fixed Lotsize here.

FridayExitTime = 20:00 - Every trade will be closed at this time every Friday to prevent weekly gaps. This time is UTC+2, adjust this time by your broker timezone.

I recommend you looking at MY OTHER PRODUCTS because the benefits of the portfolio are diversification through the markets, time frames, etc. Portfolio strategies work better together in combination

Disclaimer: Past results are no a guarantee of future results.