IRDeS 1 0

- Indicators

- Jan Carlos Pagano

- Version: 1.0

- Activations: 5

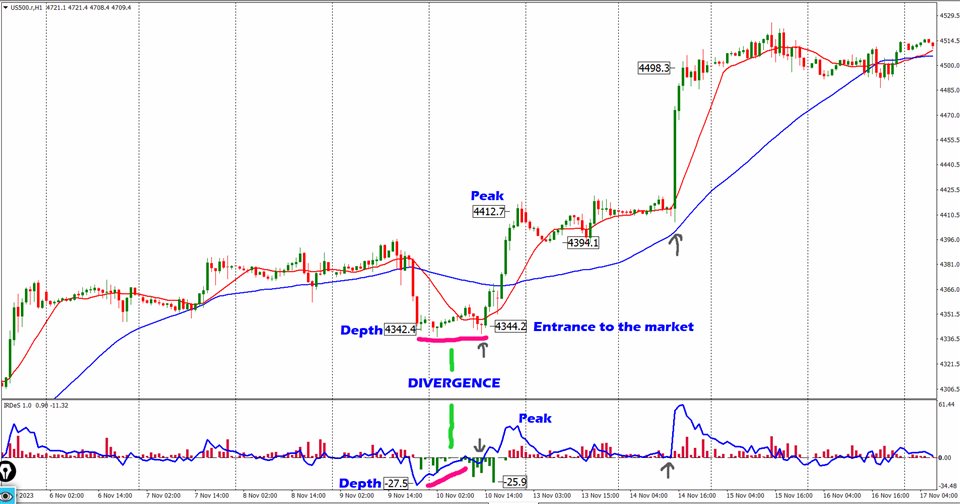

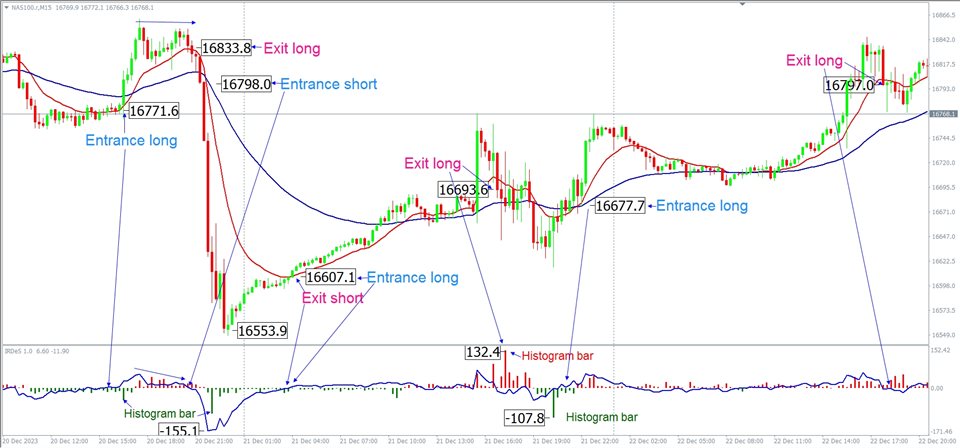

The IRDeS (Distance and Spike Detection Indicator) is a strength and distance indicator from the zero level that allows entering the market with near-perfect timing. It consists of a continuous blue line that detects the distance and volatility from the zero level and a histogram, red above the zero level and green below the zero level, measuring the intensity and strength of trading in a specific candle, generating a strong push, a "spike," at a specific point on the chart.

The IRDeS is a valuable tool for technical analysis, innovative and versatile, suitable for the times, as it incorporates two indicators in one, capable of measuring the quality of the movement's impulse after entering the market.

Despite the obvious qualities of the IRDeS, like any indicator, analysts must exercise caution and focus only on certain areas of the chart, avoiding others.

In particular, traders might be tempted to use the indicator as a way to find overbought or oversold conditions, but this does not always work. The IRDeS can take any value, making it impossible to precisely identify "excess thresholds." Following our instructions, with time and sufficient experience, almost anyone will be able to analyze data on a chart and make good use of the IRDeS.

What to Look For:

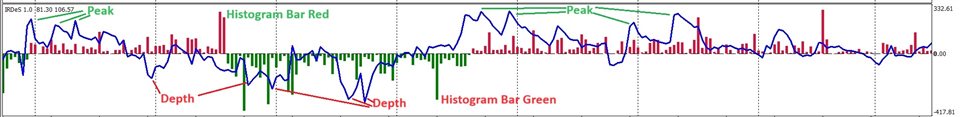

- · Peak: Continuous line above zero level;

- · Depth: Continuous line below zero level;

- · Histogram bar, red or green, visibly high;

- · Crossover of the zero level;

- · Divergence.

The Peak:

The Peak is represented by the blue IRDeS line above the zero level when it takes the form of a sharp mountain. The Peak is measured in positive values, and the highs could be mistaken for overbought levels; it would be a big mistake if the Peak were not in the chart area suitable for this purpose.

It works very well as a retracement signal until the uptrend is exhausted. The Peak, coupled with a visibly high red histogram bar, provides a very valid signal.

When the uptrend is almost exhausted, only and exclusively in this circumstance, the maximum Peak can take on the function of an overbought area, provided it is always accompanied by a visibly high red histogram bar.

The Depth:

The Depth is represented by the blue IRDeS line below the zero level when it continues to dive. The Depth is measured in negative values, and the negative highs could be mistaken for oversold levels; it would be a big mistake if the Depth were not in the chart area suitable for this purpose.

It works very well as a retracement signal until the downtrend is exhausted. The Depth, coupled with a visibly deep green histogram bar, provides a very valid signal.

When the downtrend is almost exhausted, only and exclusively in this circumstance, the Depth can take on the function of an oversold area, provided it is always accompanied by a visibly deep green histogram bar.

Histogram Bar, Red or Green, Visibly High:

Histogram bars visibly high (red) or deep (green) are a warning signal to keep an eye on. As mentioned above, red bars above the zero level and green bars below the zero level measure the intensity and strength of trading in a specific candle, generating a strong push upward or downward at a specific point on the chart.

A visibly high red histogram bar, coupled with the Peak, is a very valid signal to assess entry into the market on the downside. A visibly deep green histogram bar, coupled with the Depth, is a very valid signal to assess entry into the market on the upside.

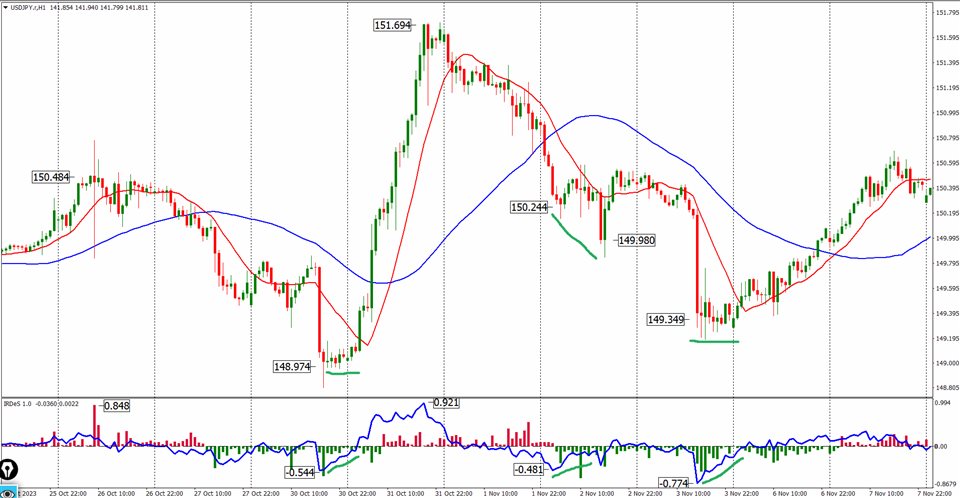

Crossover of the Zero Line:

The crossover signal from the zero level occurs when the IRDeS line crosses upward (long signal) or downward (short signal) the zero level line.

Divergence:

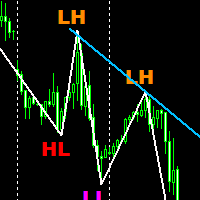

Divergence is another signal created by the IRDeS indicator. In simple terms, divergence occurs when the movement of the IRDeS and the price do not correspond.

Bullish divergence occurs when the price records a series of decreasing lows, while the IRDeS shows a progression of higher lows.

Bearish divergence is the opposite case, occurring when the price records a series of increasing highs, while the IRDeS shows a succession of decreasing highs.

We must ask a fundamental question: when can we use the signal for retracement and when for medium or long-term operations?

Detailed answers to this question can be found in the "Examples of Market Entry Signals" section. However, it is essential to specify that the indicator relies on other chart elements that are crucial for effective operation, including the 13-period moving average and the 52-period moving average.

Can the values of the moving averages be modified? We recommend keeping the value of the first one fixed, while the second one can be adjusted based on the specific needs of your operation and the market.