AW Turtles MT5

- Experts

- AW Trading Software Limited

- Version: 1.0

- Activations: 15

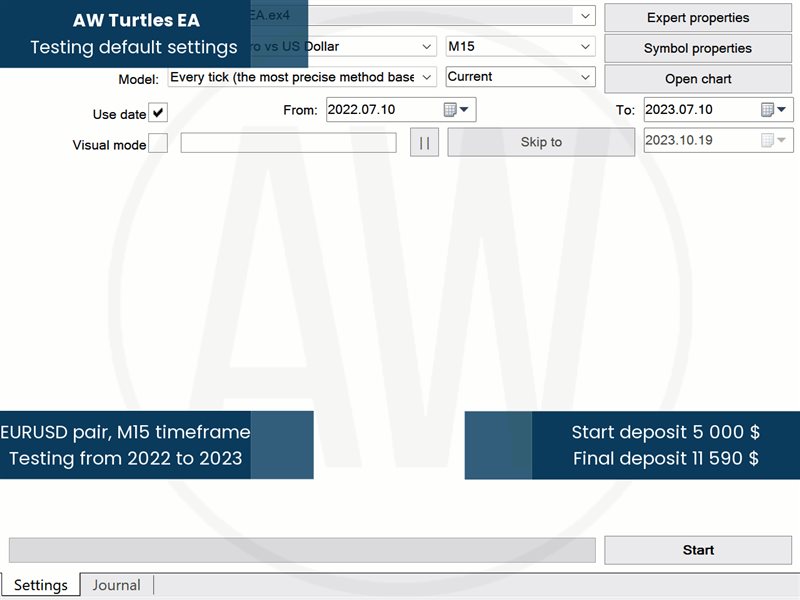

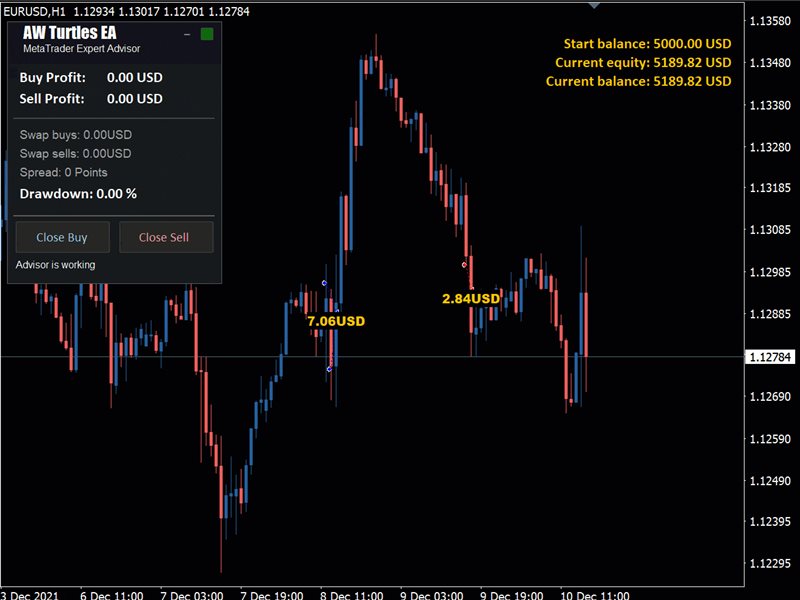

An automated trading system based on the "AW Turtles" indicator strategy. Signals to enter a position at the moment of breakdown of the support or resistance level. The advisor has the ability to average, the function of closing the first and last orders of the basket, and the function of automatic lot calculation. There are different scenarios for exiting a position using several StopLoss, Traling and TakeProfit options.

Instructions -> HERE / MT4 version ->HERE

Advantages:- Connectable automatic volume calculation

- Several scenarios for working with stop loss

- Various options for working with or without averaging

- Built-in trailing system with adjustable pitch

- System of covering the first order with the last one

- Ability to send all types of notifications

- Setting up indicator signals built into the advisor

AW Turtles EA works based on signals from the free AW Turtles indicator. In addition, additional functions are built in to allow you to more flexibly customize your trading strategy to suit the individual needs of the trader.

Opening orders- This product allows you to open orders using several averaging options or work without averaging.

Available work options:

- Without_averaging - When selecting this option, the advisor will not use the averaging strategy. That is, only one order will be opened.

- Fixed_Step - This option will allow you to use a fixed step between opened orders and use an averaging strategy. You can adjust the step between orders, measured in points. The lower the value, the more often the advisor's orders will be opened.

- Step_by_ATR - When choosing this option, the advisor will calculate the distance between orders in the basket based on the volatility calculated by the ATR indicator. The recommended distance value is at least every 0.5 ATR.

An order basket can be opened with orders of the same size, or the multiplication function can be used for the orders in the basket. If "Multiplier" = 1.00, then do not use a multiplier. If "Multiplier" > 1.00, use the multiplication strategy, that is, increase the volume of each subsequent order in the basket.

Closing orders- This advisor has different options for working with TakeProfit StopLoss and the Trailing function.The advisor has a built-in virtual type TakeProfit, measured in points, make sure that the TakeProfit size is greater than the spread on the instrument used. The lower the value, the faster the advisor will be able to close open positions, but the smaller the profit from each closing. TakeProfit when using order baskets will be calculated from the breakeven price of the entire basket.

StopLoss - The trader can choose his strategy from those presented below:

- Without_StopLoss - If you select this option, the advisor will not use StopLoss. That is, orders will be closed only when TakeProfit is reached.

- Fixed_StopLoss (From first order) this option uses a virtual StopLoss from the opening price of the first order, works for a whole group of orders in the same direction. Calculated in points.

- StopLoss_by_ATR - Use StopLoss based on indicator signals. This option is not available when using the averaging function, meaning it only works for each individual order. This type of StopLoss is set immediately after opening an order, and is physical and not virtual. This value is dynamic and changes depending on the current volatility. The recommended distance value is not less than 1 ATR.

- Trailing_by_Turtles_middle_line - When choosing this option, at the moment an order is opened, a physical stop loss is set on the middle line, set for each individual order. Trailing moves StopLoss to follow the price when the price begins to move towards profit. Movement occurs with a step distance in points. Trailing will follow the price an unlimited number of times as long as the unidirectional trend continues. After the price reversal, Trailing will close the position with a profit.

Setting up the built-in indicator:

The indicator works according to the Turtle system; entry is made at the moment of breakdown of the support or resistance level. The indicator is configured in the input settings of the advisor.

Maximum_bars_Turtles - Number of bars for calculating indicator statistics. Entry is made at the moment of breakdown of the support or resistance level.

Period_Donchian - The most important parameter for setting up signals is the channel period. Based on the previous, specified number of candles, from the lower to the upper price level. On channel breakouts, the built-in indicator receives signals about a trend reversal. The lower the value, the more indicator signals. The higher the value, the stricter the filtering and the fewer signals.

Note! Graphic elements of the indicator are not displayed in the advisor!

Input variables:Main_Settings - Setting up volumes for opening positions. In this section, you can adjust the volume of orders to open, and also choose the ability to work using the automatic lot calculation function.

Signals_Settings - This section configures the built-in Turtles indicator.

Averaging_Settings - Selects a strategy when opening orders, using or without averaging. When choosing to work with averaging, this section allows you to configure the functions of averaging and volume multiplication.

TakeProfit_Settings - Setting up TakeProfit and the overlap function when closing positions.

StopLoss_Settings - Variations and settings are selected when working with the StopLoss or Trailing function.

Protection_Settings - Adjustment of protective functions when opening positions.

Advisor_Settings - Setting up graphical functions and basic functions of the advisor.

Notifications_Settings - Section for setting up notifications when closing orders.