SimSim Multiple ADXWilder MT5

- Experts

- Aleksandr Tyunev

- Version: 1.40

- Updated: 6 February 2024

- Activations: 7

Expert Series: SimSim Multiple ADXWilder MT5 Advisor.

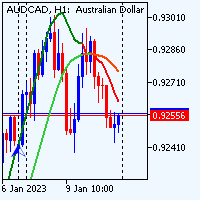

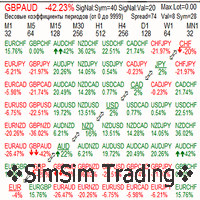

Multi-currency and multi-period, uses the ADXWilder indicator (Average Directional Movement Index by Welles Wilder).

The advisor works with data obtained as a result of optimization.

Three steps to generate source files for the advisor to work.

Step #1. We create a ????.Xml file.

T_Tf = H1 - Selection of time frame. Time frame.

K_Period = 21 - Averaging period.

P_Prof = 0 - Take Profit. Profit level.

S_Stop = 0 - Stop Loss. Stop level.

B_Bz = 0 - Breakeven setting. Breakeven level.

R_Trall = 0 - Trolling profitable trades. Profit trail.

X_Tralls = 0 - Trailing stop loss trades to breakeven. Trawl stop.

Launch the strategy tester to optimize the above parameters.

If you use different time frames, profits and stops, you will get from 1 to ???? lines with profitable results.

Save this data via export to ????.XML file for future use.

Step #2. From the ????.Xml file we generate a ????.Ini file.

Pr_Name File name optimization result. (????.Xml). Optimization result file name.

Pr_Kol Select the number of profitable results. Select the number of profitable results.

Pr_Sum Choose profit only more. Choose profit only more.

The operating mode is simple: specify the input ????.Xml file and receive the output ????.Ini file.

Several Ini files for different instruments can be combined into one and the advisor will be Multi-Currency.

Copy the generated Ini files to a shared folder:

c:\Users\???\AppData\Roaming\MetaQuotes\Terminal\Common\Files\

Step #3. Let's start the advisor.

Set Pr_Lot and Pr_Risk. All other parameters are in the Ini file.

Select the ????.Ini file and start the advisor.

Other parameters: Stop and profit levels are pips or AvHiLo

AvHiLo = 0 - Pips or AvHiLo. Choosing what to use for calculations.

Stop, Profit levels, etc. can be specified in pips or AvHiLo units.

AvHiLo unit = average value (High - Low) in pips, over the last 100 bar.

Example Stopa = 2 AvHiLo for M15=138pips Stop:138*2=276pips, AvHiLo for H1=287pips Stop:287*2=574pips

Example Profit = 5 AvHiLo for M15=138pips Profit:138*5=690pips,' AvHiLo for H1=287pips Profit:287*5=1435pips

Recommendations:

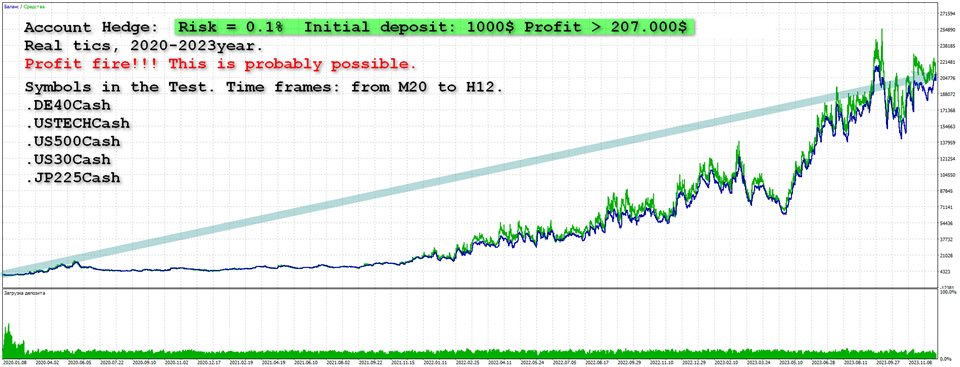

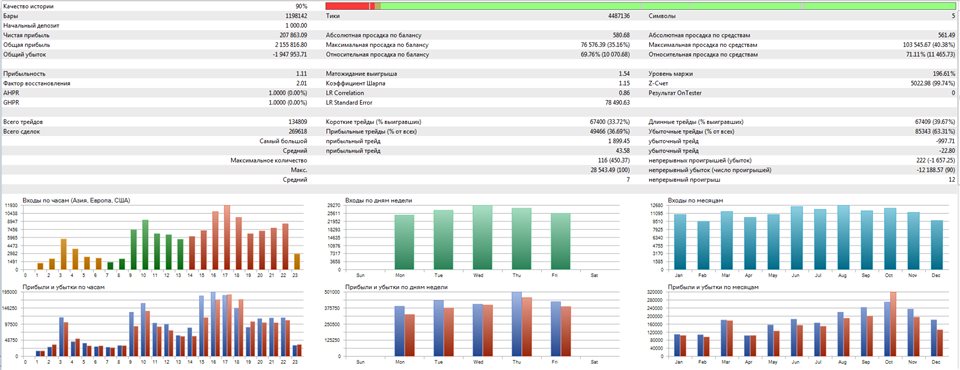

CDF indices show the best results

Timeframe: M5 - D1

Minimum deposit: $500

Account type: Hedge or Netting

Multi-currency and multi-period, uses the ADXWilder indicator (Average Directional Movement Index by Welles Wilder).

The advisor works with data obtained as a result of optimization.

Three steps to generate source files for the advisor to work.

Step #1. We create a ????.Xml file.

T_Tf = H1 - Selection of time frame. Time frame.

K_Period = 21 - Averaging period.

P_Prof = 0 - Take Profit. Profit level.

S_Stop = 0 - Stop Loss. Stop level.

B_Bz = 0 - Breakeven setting. Breakeven level.

R_Trall = 0 - Trolling profitable trades. Profit trail.

X_Tralls = 0 - Trailing stop loss trades to breakeven. Trawl stop.

Launch the strategy tester to optimize the above parameters.

If you use different time frames, profits and stops, you will get from 1 to ???? lines with profitable results.

Save this data via export to ????.XML file for future use.

Step #2. From the ????.Xml file we generate a ????.Ini file.

Pr_Name File name optimization result. (????.Xml). Optimization result file name.

Pr_Kol Select the number of profitable results. Select the number of profitable results.

Pr_Sum Choose profit only more. Choose profit only more.

The operating mode is simple: specify the input ????.Xml file and receive the output ????.Ini file.

Several Ini files for different instruments can be combined into one and the advisor will be Multi-Currency.

Copy the generated Ini files to a shared folder:

c:\Users\???\AppData\Roaming\MetaQuotes\Terminal\Common\Files\

Step #3. Let's start the advisor.

Set Pr_Lot and Pr_Risk. All other parameters are in the Ini file.

Select the ????.Ini file and start the advisor.

Other parameters: Stop and profit levels are pips or AvHiLo

AvHiLo = 0 - Pips or AvHiLo. Choosing what to use for calculations.

Stop, Profit levels, etc. can be specified in pips or AvHiLo units.

AvHiLo unit = average value (High - Low) in pips, over the last 100 bar.

Example Stopa = 2 AvHiLo for M15=138pips Stop:138*2=276pips, AvHiLo for H1=287pips Stop:287*2=574pips

Example Profit = 5 AvHiLo for M15=138pips Profit:138*5=690pips,' AvHiLo for H1=287pips Profit:287*5=1435pips

Recommendations:

CDF indices show the best results

Timeframe: M5 - D1

Minimum deposit: $500

Account type: Hedge or Netting