Quantum GridMaster

- Experts

- Itumeleng Mohlouwa Kgotso Tladi

- Version: 1.0

- Activations: 5

Quantum GridMaster Expert Advisor

Overview

The Quantum GridMaster Expert Advisor is a powerful automated trading system designed to maximize trading opportunities using an advanced grid trading strategy. This Expert Advisor (EA) is developed for traders seeking a structured and adaptive approach to the forex market, leveraging grid-based order execution, trend analysis, and risk management methodologies.

By utilizing two key exponential moving averages (20 EMA and 200 EMA), the Quantum GridMaster EA intelligently adapts to market trends and conditions, ensuring a balanced approach between profit potential and controlled risk exposure. Designed for both experienced traders and beginners, this EA removes the emotional aspect of trading and provides a disciplined, systematic approach to market execution.

Trading Strategy: Grid-Based System

The Quantum GridMaster EA operates using a grid trading strategy, which involves placing a series of buy and sell orders at predefined price intervals. This methodology is particularly effective in volatile and ranging markets, as it allows the EA to capitalize on price fluctuations by systematically opening and closing trades.

How the Grid Strategy Works:

- Grid Setup: The EA places a sequence of buy and sell orders at specific price intervals (grid levels) based on market conditions.

- No Need for Prediction: Unlike trend-following strategies that rely on market direction, the grid strategy profits from price oscillations, reducing reliance on precise forecasting.

- Averaging Mechanism: When the price moves against a position, additional trades are placed at predetermined intervals, allowing for a more favorable average entry price.

- Profit Targeting: As price fluctuates, the EA systematically closes profitable trades, capturing small but frequent gains.

- Adaptability: The system dynamically adjusts its grid size and trade volume based on market conditions, reducing drawdown risks and optimizing trade efficiency.

The grid system is designed to work best in ranging markets, but with the integration of trend analysis, it can also adapt to trending conditions effectively.

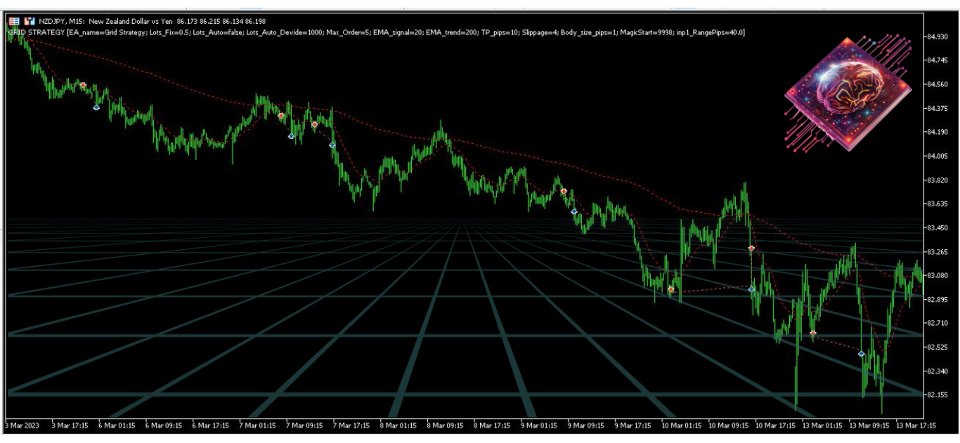

Trend Identification: 20 EMA & 200 EMA Strategy

To enhance the effectiveness of the grid trading approach, the Quantum GridMaster EA integrates Exponential Moving Averages (EMA) to determine overall market direction and filter trades accordingly.

Trend Detection and Execution:

- Bullish Market Condition:

- The EA identifies an uptrend when the 20 EMA crosses above the 200 EMA.

- Buy grid orders are prioritized, reducing the frequency of sell orders.

- Bearish Market Condition:

- The EA identifies a downtrend when the 20 EMA crosses below the 200 EMA.

- Sell grid orders are emphasized, limiting buy trades.

- Sideways Market Condition:

- If price action fluctuates around the 200 EMA, the EA switches to a balanced grid approach, placing both buy and sell orders.

This EMA-based trend analysis allows the Quantum GridMaster EA to optimize trade execution and reduce exposure to unfavorable trends.

Risk Management: Netting System

A key component of the Quantum GridMaster EA is its built-in risk management system, which ensures that trades are executed responsibly and that losses are controlled.

Netting Risk Control:

- Dynamic Trade Volume: The EA adjusts position sizes based on equity and market volatility.

- Smart Lot Sizing: Users can set lot multipliers to manage risk exposure efficiently.

- Equity Protection: The EA incorporates automatic stop levels to protect against significant drawdowns.

- Trend-Based Filtering: The grid strategy adapts based on market trends to prevent excessive trading in unfavorable conditions.

- Take Profit & Stop Loss Mechanism: Each grid trade is assigned a predefined take profit level to systematically lock in gains, while stop loss levels prevent excessive risk accumulation.

- Account Balance Protection: If market conditions become extremely volatile, the EA can reduce its trade frequency or temporarily pause trading to safeguard capital.

The combination of these risk management features ensures that the Quantum GridMaster EA operates with a balanced and controlled approach.

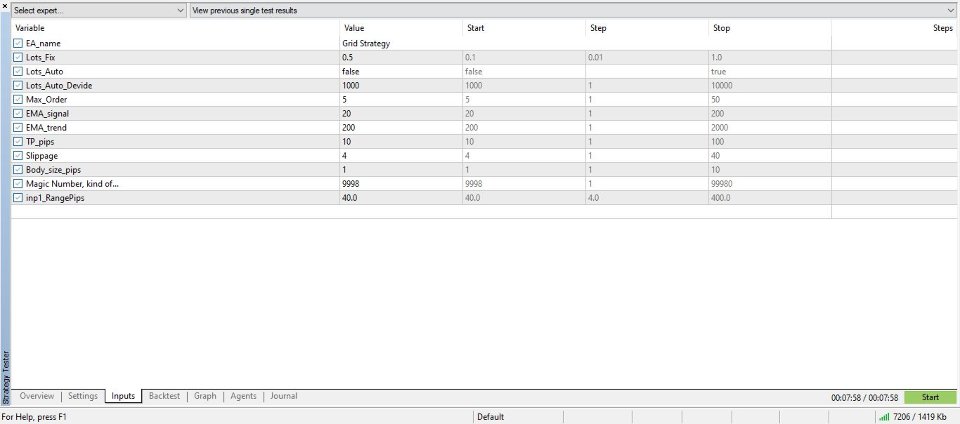

System Parameters & Customization

The Quantum GridMaster EA offers a variety of customizable settings, allowing traders to adjust the system according to their preferences and market conditions:

- Grid Spacing: Adjustable distance between grid orders.

- Lot Size Management: Choose between fixed lot sizes or dynamic risk-based lot sizing.

- Maximum Orders: Control the number of grid orders to limit exposure.

- Take Profit & Stop Loss: Configurable levels for risk management.

- Trend Filter Activation: Enable or disable EMA-based trend filtering.

- Trading Sessions: Select active trading times based on market hours.

- Slippage Control: Adjust settings to prevent execution issues during volatile periods.

These customizable parameters provide flexibility while ensuring the EA operates within the trader's defined risk tolerance.

User Experience & Benefits of an Expert Advisor

The primary goal of the Quantum GridMaster EA is to deliver the best possible user experience by offering a structured, reliable, and automated trading approach. Here are the key benefits of using this Expert Advisor:

- Automation & Efficiency: Eliminates the need for manual trading by executing trades systematically based on pre-set rules.

- Emotion-Free Trading: Avoids emotional decision-making, ensuring disciplined execution.

- Optimized Grid Strategy: Captures market fluctuations to generate frequent trade opportunities.

- Smart Trend Filtering: Integrates EMA-based analysis to enhance trade selection.

- Risk Management Controls: Implements dynamic trade management features to protect capital.

- User-Friendly Interface: Designed with an intuitive dashboard for easy configuration.

- Adaptability: Works effectively in both trending and ranging market conditions.

- Scalability: Suitable for different account sizes, from small retail traders to professional investors.

By leveraging the Quantum GridMaster Expert Advisor, traders can benefit from a structured and automated approach to forex trading, ensuring consistent execution without constant market monitoring.

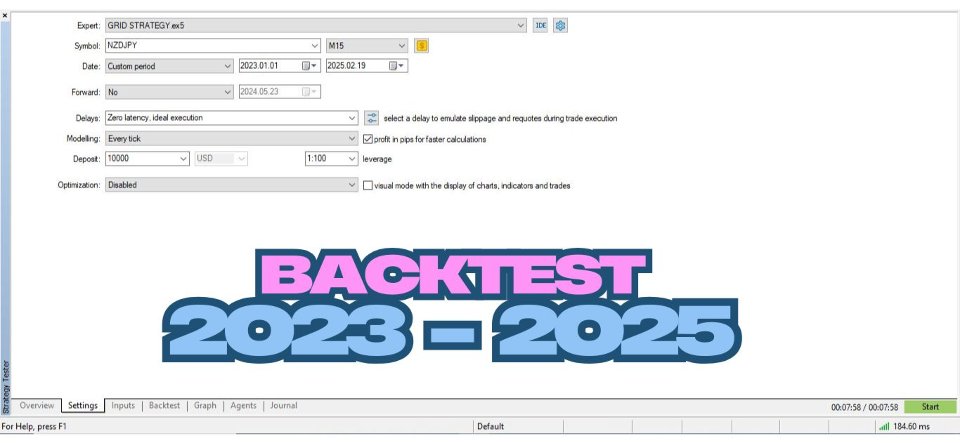

Backtest Performance Breakdown

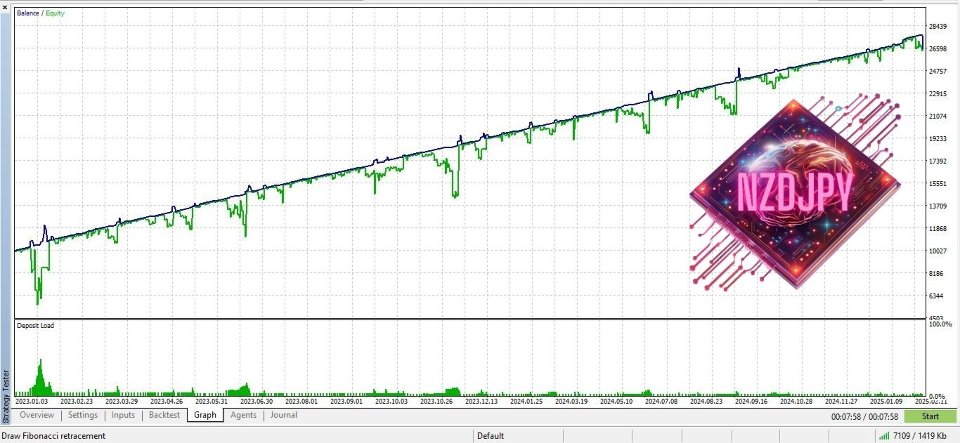

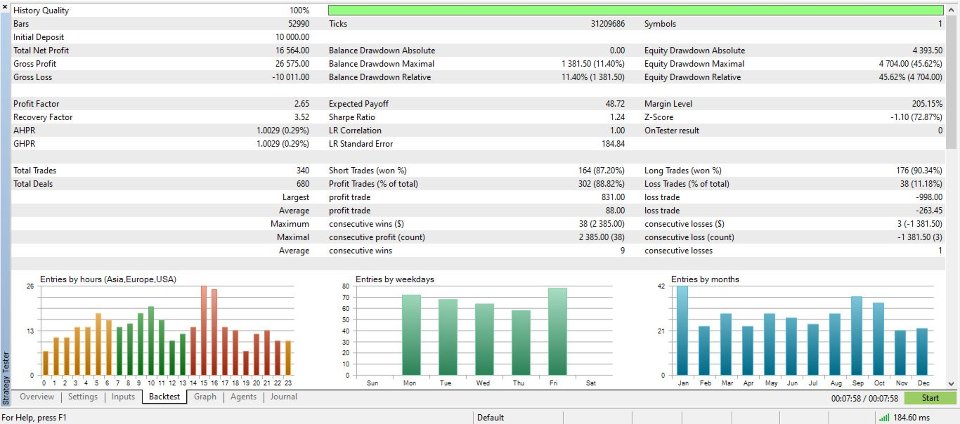

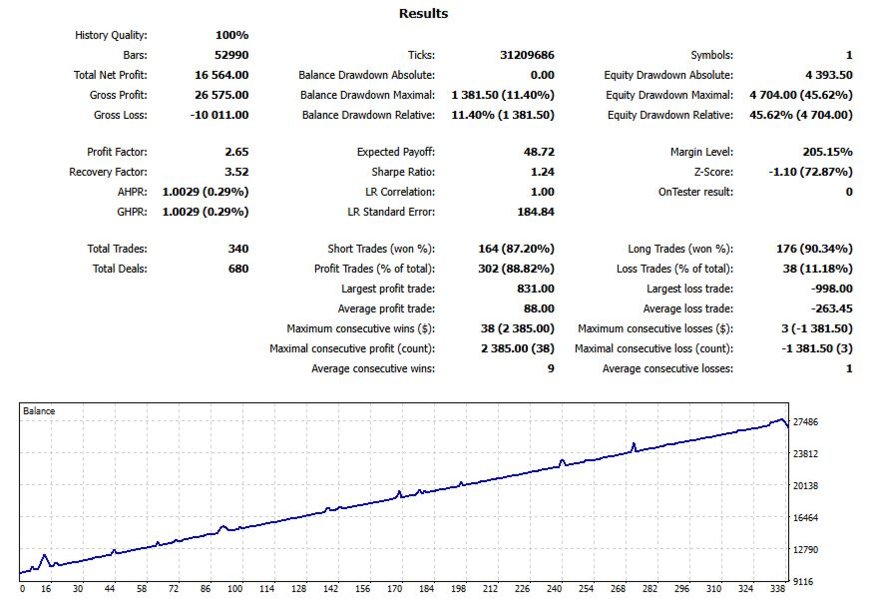

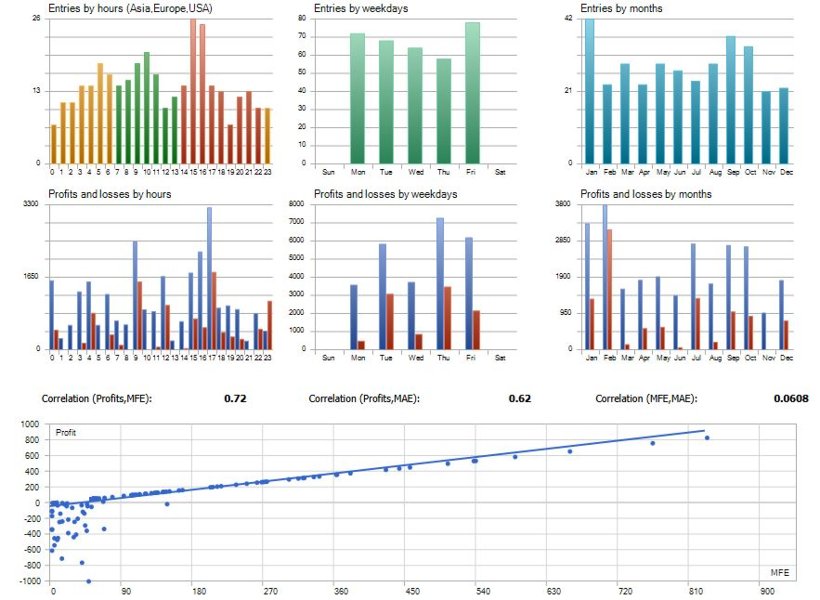

To help traders understand how the Quantum GridMaster EA performs, here’s a breakdown of a backtest conducted on NZDJPY (M15 timeframe, 2023.01.01 - 2025.02.19):

Key Performance Metrics:

-

Total Net Profit: $16,564

-

Profit Factor: 2.65 (profits are 2.65 times greater than losses)

-

Total Trades: 340

-

Win Rate: 88.82%

-

Largest Profit Trade: $831

-

Largest Loss Trade: -$998

-

Expected Payoff: $48.72 per trade

Risk Metrics:

-

Max Balance Drawdown: 11.40% ($1,381.50)

-

Max Equity Drawdown: 45.62% ($4,704.00)

-

Sharpe Ratio: 1.24 (risk-adjusted return)

These metrics highlight the EA’s ability to generate consistent returns while maintaining an effective risk management framework.

User Experience & Benefits of an Expert Advisor

The primary goal of the Quantum GridMaster EA is to deliver the best possible user experience by offering a structured, reliable, and automated trading approach. Here are the key benefits of using this Expert Advisor:

-

Automation & Efficiency: Eliminates the need for manual trading by executing trades systematically based on pre-set rules.

-

Emotion-Free Trading: Avoids emotional decision-making, ensuring disciplined execution.

-

Optimized Grid Strategy: Captures market fluctuations to generate frequent trade opportunities.

-

Smart Trend Filtering: Integrates EMA-based analysis to enhance trade selection.

-

Risk Management Controls: Implements dynamic trade management features to protect capital.

-

User-Friendly Interface: Designed with an intuitive dashboard for easy configuration.

-

Adaptability: Works effectively in both trending and ranging market conditions.

-

Scalability: Suitable for different account sizes, from small retail traders to professional investors.

By leveraging the Quantum GridMaster Expert Advisor, traders can benefit from a structured and automated approach to forex trading, ensuring consistent execution without constant market monitoring.

Disclaimer: Trading in the forex market involves risk, and past performance does not guarantee future results. The Quantum GridMaster EA is designed to enhance trading efficiency but should be used with proper risk management practices.