The Bank Trader

- Indicators

- Thomas Bradley Butler

- Version: 2.0

- Updated: 10 November 2023

- Activations: 5

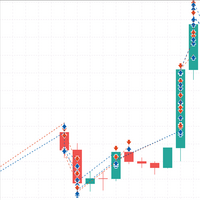

Daily supply and demand levels for breakouts or reversals. Use on 1 Hour charts

No nonsense, for the confident trader who trades price action supply and demand levels with daily projections without the fluff using 1 Hour charts.

MT5 Version: https://www.mql5.com/en/market/product/108522

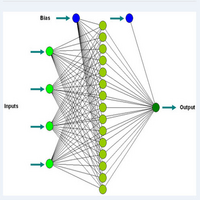

The Bank Trader Indicator is a sophisticated tool employed by institutional traders, particularly those in banking institutions, to navigate the complex world of forex markets. Rooted in the principles of daily supply and demand, this indicator seamlessly integrates with price action strategies, providing invaluable insights for strategic decision-making.

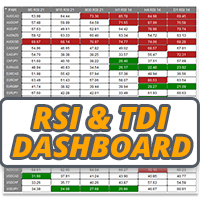

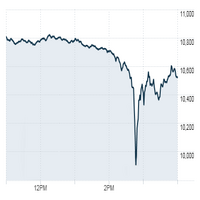

Bank traders utilize this indicator to identify key levels of supply and demand in the market. Supply zones represent areas where institutional selling is likely to occur, while demand zones signify regions where buying interest is concentrated. The daily nature of these indicators ensures that traders are equipped with timely and relevant information, crucial for aligning with the broader market sentiment.

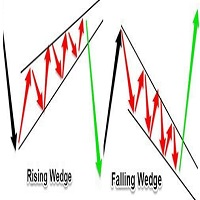

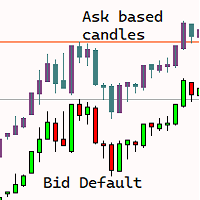

In the daily supply and demand trading approach, price action plays a pivotal role. Bank traders closely analyze candlestick patterns, chart formations, and overall market dynamics to decipher potential market movements. By combining the precision of supply and demand indicators with the nuances of price action, bank traders gain a holistic understanding of market trends and reversals.

One of the primary strategies employed by bank traders is to capitalize on price imbalances created by shifts in supply and demand. When a significant imbalance is detected, bank traders strategically enter or exit positions to ride market trends or profit from potential reversals.

The Bank Trader Indicator stands out for its ability to adapt to changing market conditions. It facilitates real-time decision-making by offering clear signals based on the interplay of supply and demand levels with price action cues. This adaptability is crucial for bank traders who need to navigate diverse market scenarios and execute trades with precision.

In essence, the Bank Trader Indicator empowers institutional traders to decipher the language of the market. It goes beyond mere technical analysis by incorporating the strategic elements of supply and demand dynamics and price action. Through this comprehensive approach, bank traders leverage the indicator to make informed and strategic decisions, maximizing their potential for success in the dynamic forex landscape.