PTS Demand Index MT5

- Indicators

- PrecisionTradingSystems

- Version: 2.0

- Activations: 10

PTS Demand Index code by Precision Trading Systems

Demand Index was the creation of James Sibbet and uses complex code to make simple work of the interpretation of volume and price as a combination.

Understanding volumes is never an easy task but this beautiful piece of programming certainly makes like a lot easier.

There are several ways in which this indicator can benefit traders and investors alike.

Divergences (As a Leading indicator)

Having studied many technical indicators over the years I have formed the opinion that Demand Index is one of kings for finding meaningful divergences.

If the price of the market is making a new high and the Demand Index is not this is known as a bearish divergence. There are several drastic photos on my website showing extreme cases of divergences to help you understand what to look for. The more the difference of the divergence the more significant it is in terms of a pointer to forecast a trend change event.

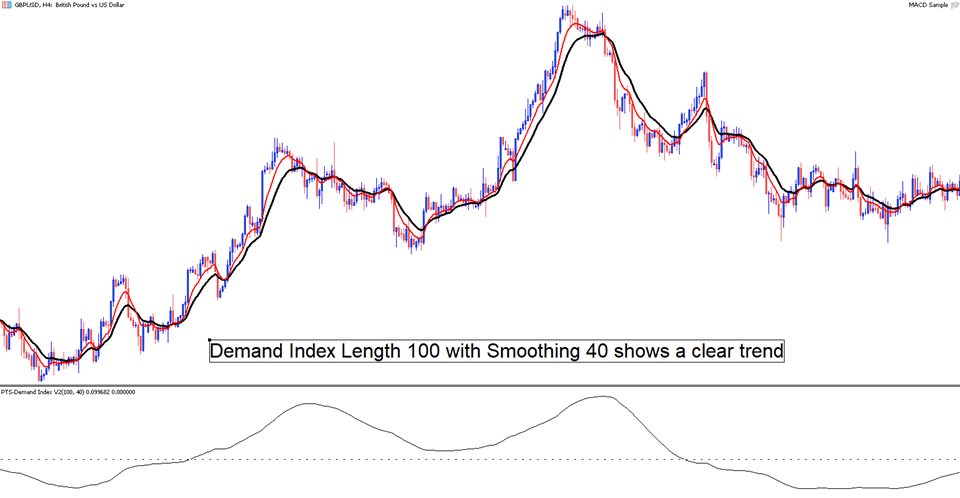

Trend detection (As a Lagging indicator with a built in alert feature)

The crossing of the zero line is an indication of net selling or buying over the length you have specified, it must be noted that in this manner the indicator is acting as a lagging indicator and longer lengths are required with some smoothing to give meaningful results. I suggest lengths of at least >40 for this purpose with some smoothing > 5 added to reduce fake signals.

To enable the alert for the crossing of zero, click on the indicator properties, inputs, use alerts = true.

When the alert triggers the message window will pop up showing the symbol name and the message "Demand Index has crossed above (or below) zero".

The default setting for the alert is set to false.

Notwithstanding the above it is important to understand the difference between a "real crossing of zero" trend change move and a false signal.

If Demand Index is hovering and fluctuating around zero it does not mean much at all, but a decisive break though which stands out is the kind of move that one needs to look for. It is volume that drives prices by causing a supply or demand imbalance creating a situation where there are more aggressive buyers or sellers leading to a market move in the direction of the indicator.

This product is designed to display exactly that information in the clearest possible way.

Break outs (As a Leading indicator)

When a range or tight congestion area can be seen in the Demand Index indicator it is well worth noting that when a definitive break out from this range occurs, it will likely be followed by a break out in the same direction of the underlying market.

As with the above it is also important to know the difference between "noise" and a real break out pattern, this must be an obvious observation and if you have to spend time asking yourself if it is real or not then it probably is not a signal worth taking action with.

Prediction of next movement (As a Leading indicator)

When an extreme upward peak in Demand Index occurs it implies serious buying and this is usually followed by one more move up to a higher peak from the market.

The same is true in reverse when a large peak pointing downwards occurs it implies the market will make another new lower low.

Frequently these moves are followed by a divergence which then leads to a reversal in trend.

Extended divergences over a period of time (As a Leading indicator)

When a market continues to trend down and the Demand Index continues to trend up this is a sign of a major bottom forming and vice versa.

I have identified five new rules that can be used with Demand Index which can be found on my website by searching. Many graph examples illustrate these clearly.

If you have any questions please do not message me here as I wont see it for a few weeks. Email me via my website for a faster reply

A big thank you to Iron Condor for helping to prepare these files for MT5