PTS Divergence Sell Finder V2

- Indicators

- PrecisionTradingSystems

- Version: 2.0

- Activations: 10

The PTS Divergence Finder Sell Indicator by Roger Medcalf - Precision Trading Systems.

This indicator only give Bearish - Sell Indications.

First and foremost, I have been asked many times why I did not provide a sell divergence indicator while happily providing a buy signal divergence finder for many years.

I gave the answer that sell divergences are less reliable than the buy divergences, which is still true.

Some solutions to change this were found, not by giving in to peer pressure or by modification of this indicator which I made more than fifteen years ago, but by changing the default settings to be more strict.

How does the PTS Divergence Finder Sell Indicator work?

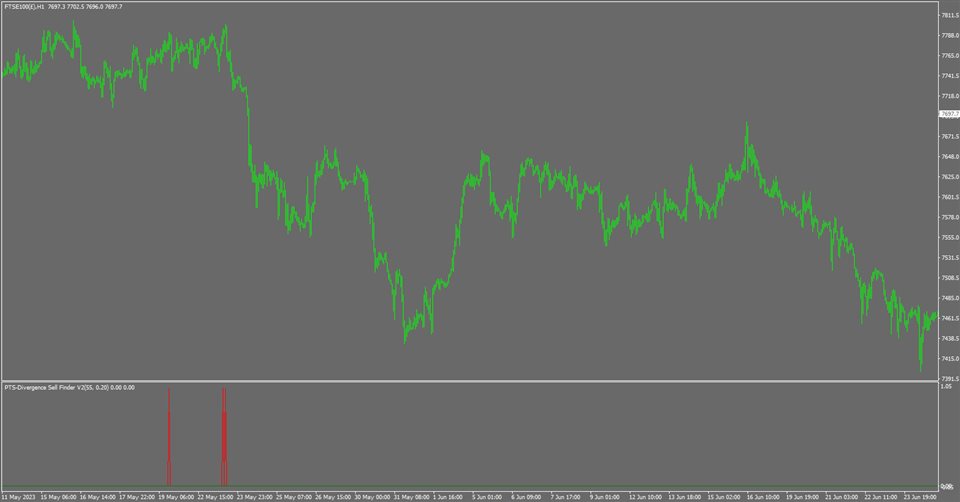

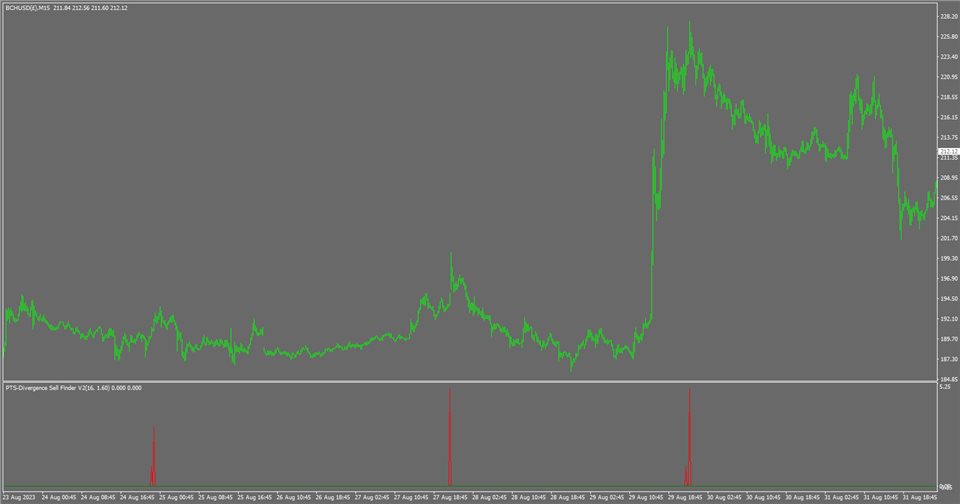

The PTS Divergence Finder Sell Indicator accurately measures the number of divergences which have occurred in Demand Index, which is a volume based

indicator. As MT4 provided tick volume rather than trade volume, the swings occurring in the underlying Demand Index indicator as about 10 times smaller so the difference input has to be reduced as stated below.

This is a histogram style indicator for subgraph two, which plots spikes which appear like stalagmites coming up from the base.

The indicator examines multiple lookback periods of the volume based Demand Index Indicator for the length that you specify. It finds high points in prices where the DI is not making a new "local" high and missing it by the "difference" setting you input.

Liquid markets where many people are voting on the market direction give the best results.

A total of twenty look back periods are scanned on every bar and these are hard coded and non adjustable. The length of Demand Index is user adjustable

but it is suggested not to wander too far below the default setting of length 55.

The second user adjustable field is difference and this represents the difference between Demand Index now and Demand Index N bars ago. (N being 20 different look back periods of various periods)

You will understand that a length 18 Demand Index produces a much more volatile plot than a 80 period plot.

For this reason you can find short lengths of Demand Index and small difference values will produce many more signals of divergences as there is higher volatility in the underlying indicator. (Statement repeated for emphasis)

You will observe this when you use it. You can set it to give hundreds of insignificant values but it is best used so you just see the significant ones by following the guidelines below.

The nature of fear and greed are entirely different as fear is fast and instinct driven at market tops as the opposite emotions of fear and euphoria can instantly lead a human brain into the survival mode of fight or flight.

In the bottoming or oversold conditions in markets greed propagates slowly in buyers as they consider picking up value purchases at market lows with a mindset of having a low expectation of success.

This is what causes the asymmetry in market tops versus bottoms. Therefore the asymmetric settings of the buy and sell versions of this product are now explained for clarity.

I have decided to release the sell divergence indicator with "stricter" default settings.

The Demand Index length used is 55 and the difference it needs to trigger a signal is 0.25. These of course are user adjustable. The strictness means there are less insignificant signals.

The results are many tops and intermediate high points defined with pinpoint accuracy. As expected there are some disastrous signals in the midst of

violent up trends which a trader can lose on if not using risk management and stops. Likewise it frequently finds the exact top.

DI Length 20 = difference of 0.95 - 3

DI Length 30 = difference of 0.85 - 2.3

DI Length 40 = difference of 0.75 - 2.1

DI Length 50 = difference of 0.25 - 1.8

DI Length 60 = difference of 0.2 - 1.5

DI Length 70 = difference of 0.15 - 1.2

DI Length 80 = difference of 0.1 - 1.1

DI Length 90 = difference of 0.1 - 0.9

DI Length 100 = difference of 0.1 - 0.8

Maximum length =100.

How to use.

Observe the divergence, then wait for the trend to break down before selling. This measurement can be defined as a 20 bar low, or a moving average turning down for example.

Timeframes which do well are varied, some good results on M1 and H1 have been recently observed.

If you have any questions, it is best to email me via my site which you can find by searching as I do not have push notifications enabled here on MT4. If you message me here it might be a week or two before I see it.