Boring Pips MT5

- Experts

- Thi Thu Ha Hoang

- Version: 4.3

- Updated: 23 November 2024

- Activations: 8

Have you ever wondered why most expert advisors are not effective in live trading, despite their perfect backtest performance?

The most likely answer is Over-fitting. Many EAs are created to ‘learn’ and adapt perfectly to the available historical data, but they fail to predict the future due to a lack of generalizability in the constructed model.

Some developers simply don't know about the existence of over-fitting, or they know but don't have a way to prevent it. Others exploit it as a tool to beautify their backtest results, they add dozens of input parameters without considering statistical significance, making the trading strategy excessively tailored to historical data and attempting to convince others that their EA can achieve similar performance in the future.

If you are interested in this fascinating subject and want to get a deeper insight into over-fitting, please refer to my articles here:

Avoiding Over-fitting in Trading Strategy (Part 1): Identifying the Signs and Causes

Avoiding Over-fitting in Trading Strategy (Part 2): A Guide to Building Optimization Processes

There are several ways to avoid losing money on an expert advisor whose only ‘edge’ is reading past data, and the easiest way is NEVER TO USE AN EXPERT ADVISOR WITHOUT LIVE TRADING RESULTS FOR AT LEAST 5 MONTHS OR 300 TRACKED TRADES, REGARDLESS OF WHETHER IT IS FREE OR HAS GOOD BACKTEST RESULTS. Monitoring the performance of live trades is the simplest way to observe the performance of an EA with data it has never seen before.

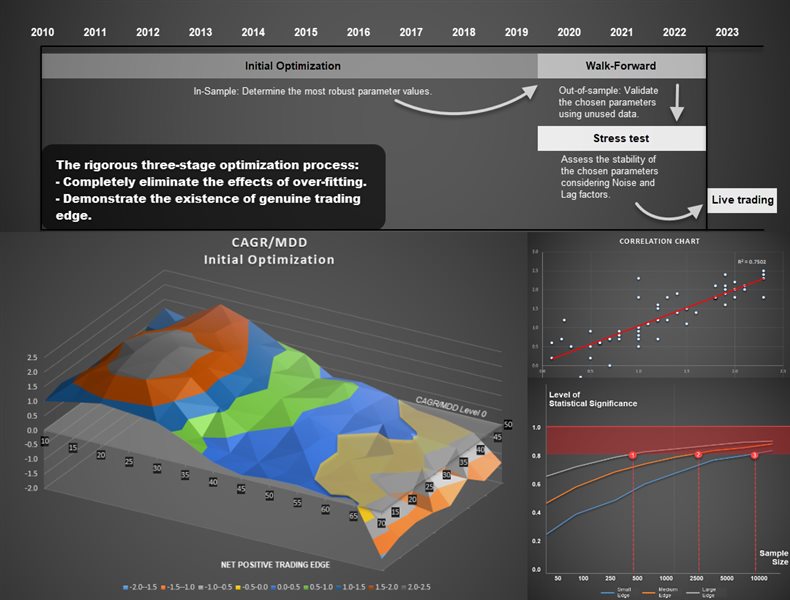

Boring Pips optimization process - A rigorous validation process that creates a difference.

Boring Pips undergoes a comprehensive and tailor-made optimization process called Anti-overfitting. This is a robust optimization process implemented to eliminate any influence of overfitting on the trading system, ensuring the generality of the constructed model. Please refer to the article linked in Part 2 above for a more in-depth look at this process.

Anti-overfitting process consists of 3 stages:

Live trading monitoring: The most robust parameter values extracted from Anti-overfitting process have been tested for trading performance with a real account since October 10, 2022. This account is being tracked via the link below.- Initial Optimization: This stage involves optimizing the Boring Pips using historical data from 2010 to 2019. The purpose of this phase is to test the initial premise of the trading strategy and extract the most robust parameters values.

- Walk-forward: In the second stage, the parameters that performed well in the first stage are tested using entirely new data ranging from 2019 to 2022. The objective is to ensure the trading system's stability with fresh data and evaluate the predictive power of the model.

- Stress testing: Parameter values that pass the first two stages will undergo Stress testing. In this final test, a simulation algorithm is used to introduce variables like Noise and Lag to the initial entry and exit points (determined by the selected parameters from Walk-forward phase). The goal is to push the system beyond its 'comfort zone' and assess the system's tolerance to random factors such as lag and noise.

Live trading performance: Live signals

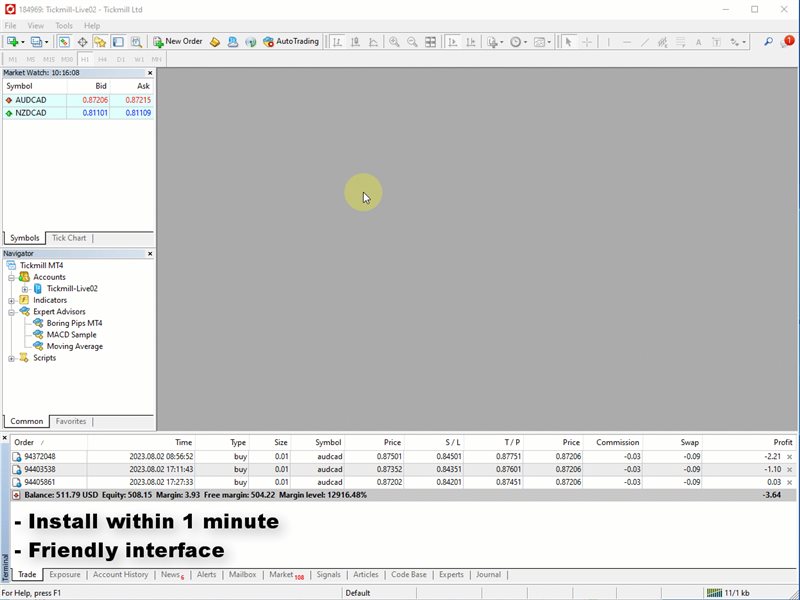

MT4 version for Boring Pips: MT4

Please refer to the Boring Pips FAQ here.

Introduction to Boring Pips algorithm

Boring Pips trading system is a blend of cutting-edge artificial intelligence algorithms and classic trading strategies involving: momentum, supply - demand zones and Fibonaci retracement. Specifically, the EA employs an advanced formula based on deep learning algorithms to simultaneously measure the momentum of prices across 4 time-frames. This analysis helps identify instances where synchronization in the decline of price momentum at potential supply and demand zones, enabling the system to make informed trading decisions. The entire process, from signal scanning to entering and exiting positions, is completely automated in 4 steps:

- Step 1: An advanced algorithm is used to continuously scan the supply and demand zones, which are potential areas where prices are likely to react.

- Step 2: Boring Pips uses a sophisticated and unique algorithm created by artificial intelligence to detect any change in price momentum after a strong price movement across different time-frames.

- Step 3: The system makes trading decisions when the price loses momentum at previously identified supply and demand zones, predicting a reversal.

- Step 4: Boring Pips manages trades based on the probability distribution rule to ensure maximum exploitation of the trading edge that the entry point brings.

Features

| Name | Boring Pips |

| Version | 4.30 |

| Platform | MT4, MT5 |

| Trading strategies | Momentum, Supply and Demand zones, Fibonaci retracement, Artificial intelligence |

| Recommended pairs | AUDNZD, NZDCAD, AUDCAD |

| Time-frame | M5 |

| MultiCurrency EA | Yes. One chart for all symbols |

| Takeprofit | Yes. Trailing |

| Stoploss | Yes. Fixed |

| Grid | Optional |

| Martingale | Optional |

| Manual Risk Manegement | Yes. Stop entrying / Close all positions |

Recommended installation

- Install Boring Pips on one of the AUDCAD/AUDNZD/NZDCAD chart, with a time-frame of M5.

- Trading symbols: select the trading currency pair (optimized for AUDCAD/AUDNZD/NZDCAD).

- Risk mode: select an appropriate risk mode (Boring, Low risk, Medium risk or High risk).

- Base balance: Choose the amount of Balance to allocate for trading.

- Personalization settings: please refer to the Detailed instructions.

- Risk Management settings: please refer to the Detailed instructions.

- It is highly recommended to perform backtesting with high modelling quality data from third-party tick providers such as Tick Data Suite or Tick story.

- Please message me after purchasing the EA to receive full support.

If you have any inquiries or feedback regarding Boring Pips, please feel free to send me a private message.

Excellent EA!