Dvv

- Indicators

- Andriy Sydoruk

- Version: 1.0

- Activations: 5

The DVV indicator is a multifaceted informative indicator for the Forex market or the Cryptocurrency market. The indicator gives clear and reliable signals without redrawing. The indicator can be used in bots by taking readings from its zero buffer.

Please note that for different currency pairs, the settings must be selected separately, this is not difficult.

Changing the input parameters greatly affects the display. I will show four options for using the indicator. The indicator has only one output informative buffer (zero when used in automatic systems). But it can be interpreted in different ways based on the indicator settings. I will describe four options.

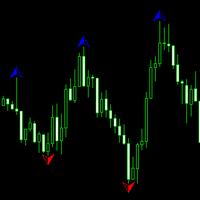

The first option for interpreting the indicator readings.

The indicator can filter past 'bad' history from future 'good' history. A 'bad' or 'good' history should be understood as informative and correct historical data. To see how it works, look at the first screenshot. In place of the 'bad' history, the indicator displays positive results. In place of a 'good' history, the indicator displays negative results. Thus, you can only test your bot or indicator in the correct history zone. This is a very convenient way to use it because testing a bot on a 'bad' history doesn't make sense and filtering just by time isn't correct, so using this indicator is the only correct way to get the correct historical zone to test your bot with. Use on a weekly chart!

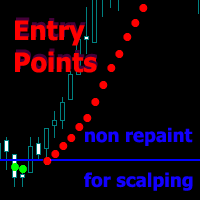

The second option for interpreting the indicator readings.

The indicator displays the price transition from one level to another. This can be seen and understood from the second screenshot. Note that the default parameters have been changed, which can be seen in the screenshot, also the timeframe is one hour and not a week as in the previous example. In this case, the work in certain squares and the transition to another square are clearly visible. This can be interpreted as certain price levels, and the beginning of another square as a new price level.

The third option for interpreting the indicator readings.

Using the indicator for clustering. This can be seen and understood from the third screenshot. Note that the default parameters have been changed, which can be seen in the screenshot, as well as the timeframe is one hour. This is similar to the previous interpretation, but we are not tied to price levels, but to the very sections of history as clusters. This can be used as a signal to view the parameters of your Expert Advisor or a signal to close the series in losses or profits. That is a signal in order to view the current state of affairs and make the necessary adjustments. For example, re-optimize your bot.

The fourth option for interpreting the indicator readings.

Using the indicator to search for patterns. This can be seen and understood from the fourth screenshot. Note that the default parameters have been changed, which can be seen in the screenshot, as well as the timeframe is one hour. In this case, we can see a certain figure displayed by the indicator and this can be used as a unique pattern. Through this pattern, you can recognize the behavior of the price after its appearance.

Options.

- LengthVolatility - number of bars for volatility analysis,

- LengthVolumes - the number of bars for analyzing tick volumes,

- StepDigits - accuracy step in volatility analysis,

- CoefficientSynchronization – synchronization coefficient,

- CoefficientDivision - divisor to bring to a normal state,

- StepDigitsDifference - step of accuracy when reflecting the buffer,

- VisualDateRange - permission to analyze a specific section of history and not the whole,

- StartDate – start date of history analysis,

- FinalDate - end date of history analysis.