You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2016.06.04 08:36

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2016.05.08 20:17

Welcome,

- Usually people who can't code don't receive free help on this forum, though it could happen if you are lucky, be patient.

- If you show your attempts and describe well your problem, you will most probably receive an answer from the community.

- If you don't want to learn to code, nothing bad, you can either look at the Codebase if something free already exists, or in the Market for paid products (sometimes free also).

- Finally, you also have the option to hire a programmer in the Freelance section.

Good luck.Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2013.06.04 20:32

I am on the way of preparation of the creation of some thread about Digital Filters/ So, I am inside Codebase now :) trying to find some indicators about. I found the following (it is just one of many articles about digital filters which invented by russians based on british research):

I used digital filters for the long time for MT4 ... as I remember - I created few of them (KGBP ... and it is still on MT4 CodeBase).

So, I am in big preparation for now. Just for information.

Forum on trading, automated trading systems and testing trading strategies

Largest brokers acknowledge the explosive growth of MetaTrader 5 popularity

MetaQuotes Software Corp., 2016.06.20 09:55

Recently, one of the domestic Russian brokers Solid Financial Services has launched the MetaTrader 5 trading platform with the hedging system of position accounting. Following RoboForex, Alpari, FX Choice and other companies, SFS has become one of the first foreign exchange market participants to offer traders the ability to perform oppositely directed deals on a single symbol on real accounts in the fifth generation platform.

The new accounting system has been added to MetaTrader 5 at the end of April and has already received positive feedback from market participants. For example, one of the largest international Forex brokers — Alpari has noted the significant growth of the number of new accounts. This confirms that currency traders actively use locking and prefer brokers offering such an opportunity.

The interest in MetaTrader 5 has been sparked among exchanges as well. In less than a year, the number of brokers offering MetaTrader 5 on DGCX (Dubai Gold Commodities Exchange) has increased from 1 to 10, while growing from 1 to 5 on PMEX (Pakistan Mercantile Exchange), including the largest market maker of the exchange — ACM Gold. A number of major international and national stock brokers are preparing to launch the platform in the near future, while the rest are planning its implementation.

Such an excitement among Forex and exchange brokers is quite natural since MetaTrader 5 features the complete set of tools for trading in all financial markets. Powerful trading system, versatile technical and fundamental analysis, algorithmic and social trading, as well as other advantages of the popular platform have attracted traders from the very beginning. The recent advent of the hedging system and the web version allowing traders to work via any browser have dramatically accelerated the process of switching to MetaTrader 5.

Boris Shilov, Chief Executive Officer of Alpari

"Alpari has decided to rely on MetaTrader 5 and turned out to be right" — says Boris Shilov, Chief Executive Officer of Alpari. "In May 2016, MetaQuotes has released the long-awaited MetaTrader 5 platform version with bidirectional trading. This feature is familiar to most traders and maximizes the number of available strategies. Alpari has been the first one to offer the platform version on the market. Our clients are satisfied with the high speed of order execution, while we are satisfied with the increasing number of newly opened accounts. I believe that MetaTrader 5 is a worthy alternative to highly popular MetaTrader 4, and I am sure that MetaTrader 5 will become the key platform for our clients worldwide".

Vitaly Avtaykin, managing director of RoboForex

"The ability to open hedge accounts has been much anticipated by brokers and traders. RoboForex team believes that MetaQuotes has made the right decision by adding this functionality to their MetaTrader 5 platform. We have no doubts that this step will contribute to the shift of industry standards from MetaTrader 4 to MetaTrader 5 in the near future" — states Vitaly Avtaykin, managing director of RoboForex. "This is already confirmed by our actual experience: we are offering MetaTrader 5 hedge accounts since May 26, and they already comprise 54% of the total number of accounts, while their turnover is much higher compared to netting accounts".

"Successful companies always meet the needs of their clients" — states Gaies Chreis, COO of MetaQuotes Software Corp. "We are glad that many brokers were quick to see traders' needs and start offering the MetaTrader 5 trading platform. In doing so, they demonstrated their understanding of market trends and desire to provide traders with the most advanced technology".

How to Trade - Forex Leverage (based on the article)

Leverage in forex is expressed as ratios - for example as the following: 1:1, 1:50, 1:100, 1:200, 1:400.

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

"Leverage has been in use from the early dawn of our civilization primarily to cope up with daily necessities. In the medieval era leverage was employed probably just to lift heavy stones to build houses. But in the modern era leverage has been used extensively in finance and commerce. When I am buying one million dollar house with only 10% down payment, I am essentially using leverage. Leverage adds glamor to forex trading. It is what makes so many traders gravitate to forex trading as compared to equities and other securities market."

"Hence, leverage in forex is the secret behind huge wind fall profits in forex trading. Be that as it may, leverage can magnify losses in losing trades. This is also why leverage is considered double edged sword. If I make winning trades using leverage then my profits are huge. Likewise if I make losing trades my losses are also huge."

----------------

Change leverage for published signal: post #3

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.01.23 11:01

Margin Call (adapted from dailyfx.com article)

To get a grasp on what a margin call is, you should understand the purpose and use of Margin & Leverage. Margin & Leverage are two sides of the same coin. The purpose of either is to help you control a contract larger than your account balance. Simply put, margin is the amount required to hold the trade open. Leverage is the multiple of exposure to account equity. Therefore, if you have an account with a value of $10,000 but you would like to buy a 100,000 contract for EURUSD, you would be required to put up $800 for margin in an account leaving $9,200 in usable margin. Usable Margin should be seen as a safety net and you should protect your usable margin at all costs.

Causes of a Margin Call

To understand the cause of a margin call is the first step. The second and more beneficial step is learning understanding how to stay far away from a potential margin call. The short answer as to understand what causes a margin call is simple, you’ve run out of usable margin.

The second and promised more beneficial step is to understand what depletes your usable margin and stay away from those activities. In risk of oversimplifying the causes, here are the top causes for margin calls which you should avoid like the plague (presented in no specific order):

What Happens When A Margin Call Takes Place?

When a margin call takes place, you are liquidated or closed out of your trades. The purpose is two-fold: you no longer have the money in your account to hold the losing positions and the broker is now on the line for your losses which is equally bad for the broker.

How to Avoid Margin Calls

Leverage is often and fittingly referred to as a double-edged sword. The purpose of that statement is that the larger leverage you use to hold a trade greater than some large multiple of your account, the less usable margin you have to absorb any losses. The sword only cuts deeper if an over-leveraged trade goes against you as the gains can quickly deplete your account and when your usable margin % hits, zero, you will receive a margin call. This only gives further credence to the reason of using protective stops while cutting your losses as short as possible.

Forum on trading, automated trading systems and testing trading strategies

Indicators: SpreadInfo

Sergey Golubev, 2014.02.13 06:31

Spreads Can Cause Margin Calls (based on dailyfx article)

At this point in our trading education, we should be aware of the fact that FX spreads are variable and can widen to levels several times larger than their typical spreads. These spread increases are most often seen during news releases and can affect our positions rapidly. But, what is the best way to weather the storm during times of widening spreads?

How to Truly Protect Ourselves Against Widening Spreads

The only way to protect ourselves during times of widening spreads is to restrict the amount of leverage used in our account (which in my opinion, should be less than 10x leverage). Spreads can only hurt us when a trade is being opened or closed. If we aren’t opening or closing a trade during a news events, we won’t be affected. Prices will eventually go back to normal and at some point we will close on our own terms.

The only time the market can force our hand to liquidate our positions is with a margin call. If we reduce our leverage, we reduce our chances of liquidation.

The “Hedging” Myth

Helping traders around the world means that I have seen many different methods to trade this market, both good and bad. One of the most damaging methods I’ve come across is the idea of ‘hedging’ a Forex trade by opening an opposing trade in the same currency pair and holding both long and short positions simultaneously. This not only incurs greater trade cost (by paying additional spread) but does not protect your position against additional losses.

Hedgers attempt to lock-in their profit or loss on a trade by opening an opposing trade, but if the spread widens, this negatively affects both sides of the trade. If the trader is over leveraged on these trades, a wider spread could incur a margin call and liquidate both positions. Worst of all, you would most likely be filled at the widened spread prices, adding insult to injury.

So now we know, hedging is not the proper way to secure a profit or a loss. Only the closing of a position can do that. Hedging also can be dangerous around widening spreads and can cause margin calls, so we need to limit the amount of leverage we are using to 10x or less.

Good article for someone with Mac :

MetaTrader 4 on Mac OS

Forum on trading, automated trading systems and testing trading strategies

Something Interesting

Sergey Golubev, 2016.06.26 07:07

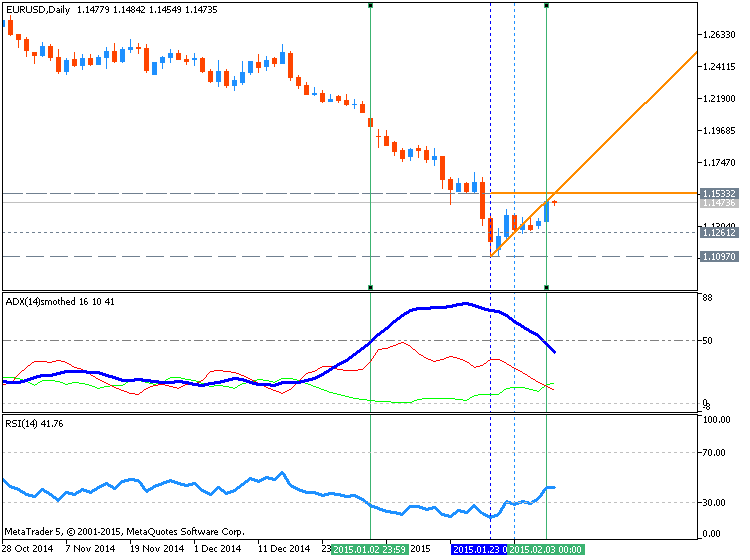

How To Trade: ADX 50 trend trading strategy (adapted from the article)

Finding a strong directional move is the first priority of any trend trader. However, when having to select a currency pair to trade, it can be difficult to identify the best trends. For the ADX 50 strategy we will be using the ADX (Average Directional Index) indicator for this process. First, add a 14 period ADX to the 4Hour chart, using Daily periods.

Remember, ADX is not identifying the direction of the trend, only its intensity. If a currency pair’s trend is weak or if the pair is consolidating, ADX will read significantly lower than a strong directional market. For the ADX 50 strategy, we will only be looking for currency pairs with an ADX value of over 50! If Daily ADX reads over 50, you can then begin to move to the execution phase of the strategy.

Once a strong trend is found, it is time to plan an entry into the market. The ADX 50 trend trading strategy uses an RSI (Relative Strength Index) indicator with a 14 period setting on a 4Hour chart.

In a downtrend, new sell positions should be entered only when ADX reads over 50 and RSI closes below 30 (oversold). Conversely buy positions will be initiates when ADX reads over 50 and RSI closes above 70.Traders should always have a plan for managing their position. Eventually trends will come to an end and any existing trades should be exited. When initiating a buy order, stop orders should be placed at a 14 period low on the 4Hour chart. That way if a new low is created, all existing buy trades will be closed. Conversely if a trader is selling in a downtrend, stops can be placed at a 14 period high again using the 4Hour chart.

Just some important information and the changes related to Virtual Hosting

1. Why Virtual Hosting On The MetaTrader 4 And MetaTrader 5 Is Better Than Usual VPS

2. How to Prepare a Trading Account for Migration to Virtual Hosting

3. 64-bit Metatrader only to use Virtual Hosting:

Forum on trading, automated trading systems and testing trading strategies

Mt5 VPS

Slawa, 2016.06.28 16:25

It must be 64-bit client terminal to use virtual hosting

4. Trailing stop in virtual hosting - by EA only:

Forum on trading, automated trading systems and testing trading strategies

Trailing stop on virtual server

Slawa, 2016.06.28 16:59

No. Trailing stops are not supported by virtual hosting terminal

You can move your stop levels with EA only

5.We can run multiple EAs on one virtual hosting for now:

Forum on trading, automated trading systems and testing trading strategies

MQL5.com VPS hosting

Slawa, 2016.06.28 16:36

You can run multiple EAs on one virtual hosting server right now. Without additional pay.

Why do You want pay more money? There are no plans to multiply payments for virtual hosting

Activations (Market with MQL5 VPS):

How to Prepare a Trading Account for Migration to Virtual Hosting

Products purchased on the Market and launched on the chart are also moved during migration. They remain completely functional, and the number of available activations is not decreased. Automatic licensing of purchased products without spending available activations is provided only for the virtual terminal.

Forum on trading, automated trading systems and testing trading strategies

Meta 4 Robot help

Sergey Golubev, 2018.04.05 18:18

MQL5 VPS is for Metatrader 4 and Metatrader 5 - Forex VPS for MetaTrader 4/5

So, you can check only the following: your EA (robot) is using dll, or not (because dll is not supported by MQL5 VPS).

...

Forum on trading, automated trading systems and testing trading strategies

Is 'Allow DLL import' and 'Allow modification of signal setting ' in MQL4 Indicators dangerous?

Sergey Golubev, 2017.09.09 06:05

Rules of Using the Virtual Hosting Service MetaTrader (Forex VPS)

No DLLs are allowed on a Virtual terminal. There is no physical capacity to use DLLs there.

If a program launched on a Virtual terminal tries to call a function from any DLL, this EX4/EX5 program is immediately stopped due to a critical error. Any DLL calls are forbidden.

Forum on trading, automated trading systems and testing trading strategies

hello .. i need help .. i need to know

Eleni Anna Branou, 2018.08.07 16:30

Unsubscribe or unsynchronize with the signal (untick the: enable real time signal subscription, in signal settings and synchronize with VPS) and close the trade.

If you don't use a VPS, just untick the: enable real time signal subscription, in signal settings and close the trade.

Forum on trading, automated trading systems and testing trading strategies

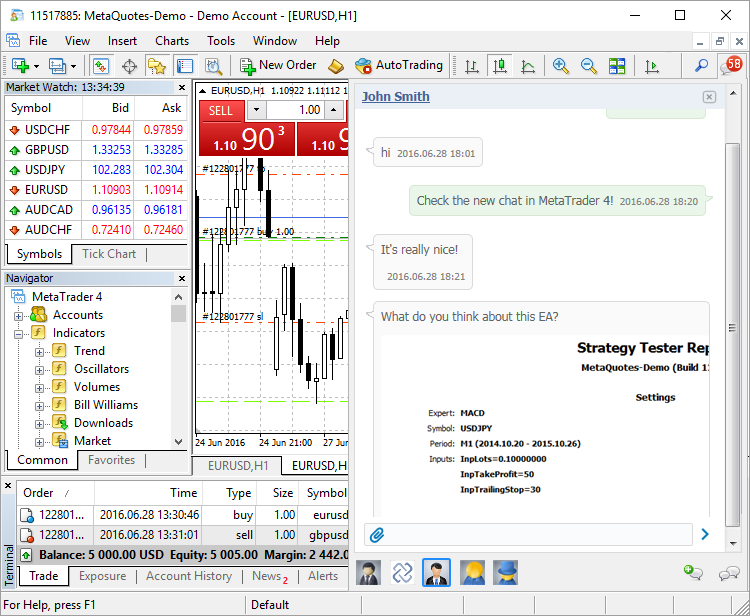

New MetaTrader 4 build 985: Built-in MQL5.community Chat

MetaQuotes Software Corp., 2016.06.29 17:32

New MetaTrader 4 build 985: Built-in MQL5.community Chat

MetaTrader 4 platform update is to be released on Friday, July 1, 2016.

...