Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.23 12:29

Weekly Outlook: 2016, October 23 - October 30 (based on the article)

- German Ifo Business Climate: Tuesday, 8:00. Economists expect a further rise to 109.6.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence is expected to decline to 101.5 this time.

- Mark Carney speaks: Tuesday, 14:35. BOE Governor Mark Carney will speak in London before the House of Lords Economic Affairs Committee about the economic consequences of the Brexit Vote.

- Mario Draghi speaks: Tuesday, 15:30. ECB President Mario Draghi will make a speech in Berlin. Market volatility is expected.

- US Crude Oil Inventories: Wednesday, 14:30.

- UK GDP data: Thursday, 8:30. The third quarter growth rate is expected to reach 0.3%.

- US Durable Goods Orders: Thursday, 12:30. Orders for durable goods are expected to increase be 0.1% in September, while core orders are predicted to gain 0.2%.

- US Unemployment Claims: Thursday, 12:30. The number of new unemployment claims is expected to reach 261,000 this week.

- US GDP data: Friday, 12:30. The estimates for GDP growth in the third quarter are around 2.5%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.24 07:13

EUR: Weekly Outlook - Morgan Stanley (based on the article)

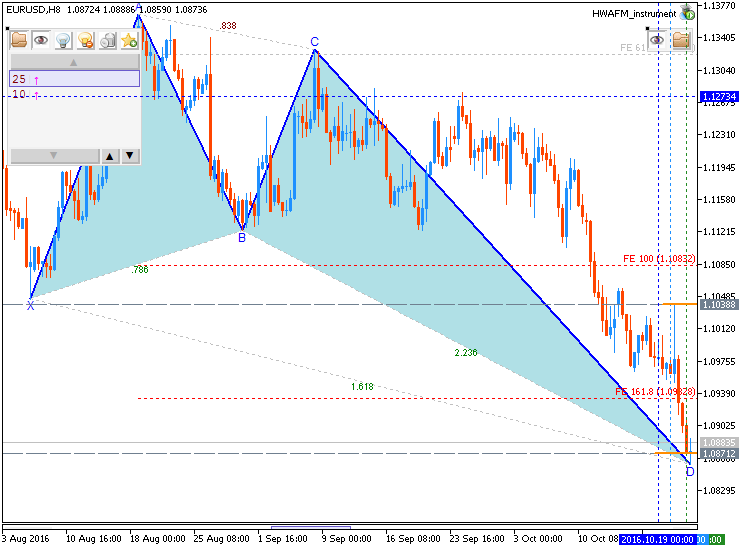

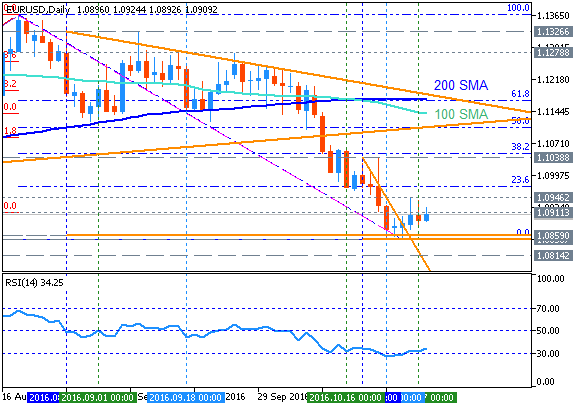

H4 price is continuing with the bearish breakdown by 1.0858 support level to be tested for the bearish trend to be resumed while Morgan Stanley is suggesting for the traders to be in neutral with this pair for the week:

"The latest ECB meeting did not reveal any new information and put all attention on the December meeting instead. EURUSD break below the Jun low of 1.0913 could open downside to the February/March low of around 1.0820. On the crosses, however, EUR is likely to remain supported. Should global and EMU inflation continue rising, ECB tapering talk could come back into focus and the current rate cut priced by the markets may be reduced, supporting the currency. In this scenario, global yield curves may also continue steepening, which could hit risk appetite, providing further support for EUR crosses."

Anyway, if H4 intra-day price breaks 1.0858 support to below on close bar so the bearish trend will be continuing, otherwise the price will be on bearish reanging within narrow s/r levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.25 15:30

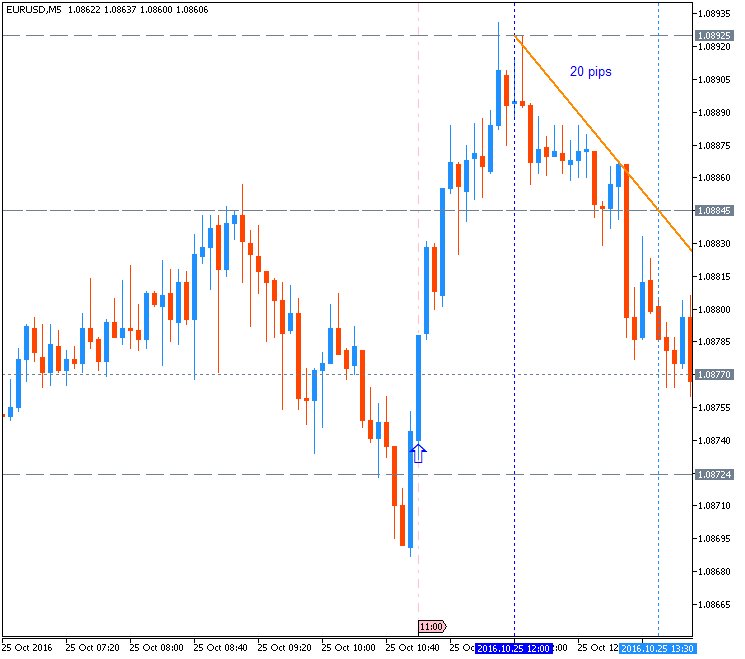

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 20 pips range price movement

2016-10-25 08:00 GMT | [EUR - German Ifo Business Climate]

- past data is 109.5

- forecast data is 109.6

- actual data is 110.5 according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

From official report:

==========

EUR/USD M5: 20 pips range price movement by German Ifo Business Climate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.25 19:20

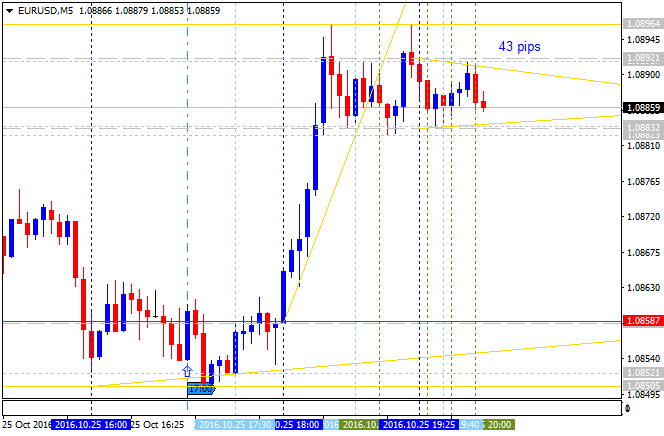

Intra-Day Fundamentals - EUR/USD and USD/JPY : The Conference Board Consumer Confidence

2016-10-25 14:00 GMT | [USD - CB Consumer Confidence]

- past data is 103.5

- forecast data is 101.5

- actual data is 98.6 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

"Consumer confidence retreated in October, after back-to-back monthly gains,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current business and employment conditions softened, while optimism regarding the short-term outlook retreated somewhat. However, consumers’ expectations regarding their income prospects in the coming months were relatively unchanged. Overall, sentiment is that the economy will continue to expand in the near-term, but at a moderate pace."

==========

EUR/USD M5: 43 pips range price movement by The Conference Board Consumer Confidence news events

==========

USD/JPY M5: 74 pips range price movement by The Conference Board Consumer Confidence news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.26 16:33

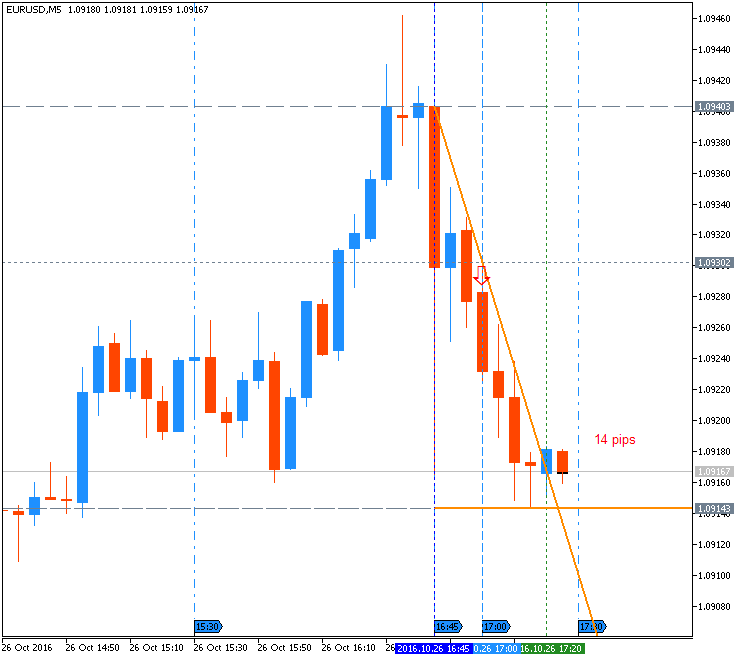

EUR/USD Intra-Day Fundamentals: New Home Sales and 14 pips range price movement

2016-10-26 14:00 GMT | [USD - New Home Sales]

- past data is 575K

- forecast data is 601K

- actual data is 593K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - New Home Sales] = Annualized number of new single-family homes that were sold during the previous month.

==========

From market watch article: New-home sales run at annual 593,000 rate in September as market grinds slowly higher

- "Sales ran at a seasonally adjusted annual rate of 593,000, the Commerce

Department said Wednesday. That was 3.1% higher than August’s figures,

which had originally been reported as 609,000. Sales in September were

29.8% higher compared to a year ago."

- "Despite robust demand, builders haven’t ramped up construction of new homes since the recession. Many continue to report difficulties in finding affordable labor and lots. But some analysts note that builders can reap fatter margins by keeping inventories lean and targeting higher-end customers."

==========

EUR/USD M5: 14 pips range price movement by New Home Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.27 14:58

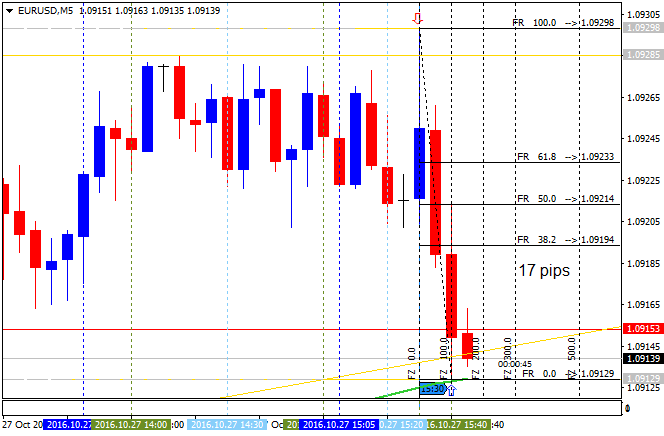

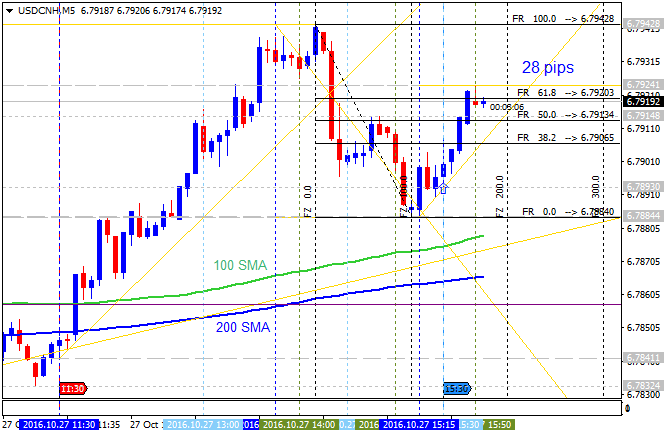

Intra-Day Fundamentals - EUR/USD and USD/CNH : Durable Goods Orders

2016-10-27 12:30 GMT | [USD - Durable Goods Orders]

- past data is 0.1%

- forecast data is 0.1%

- actual data is -0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders soften in September

- "Orders for long-lasting goods made in the U.S. fell slightly in

September, largely because of lower demand for military hardware and

computers."

- "Core orders slumped 1.2% last month and they are down 4.1% over the past year."

- "Weak business investment has contributed to slower U.S. growth in 2016

and there’s little sign that a pickup is around the corner. Inventories

did rise for the third straight month, however, after a slump earlier in

the year."

==========

EUR/USD M5: 17 pips range price movement by Durable Goods Orders news events

==========

USD/CNH M5: 28 pips price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2016

Sergey Golubev, 2016.10.28 08:36

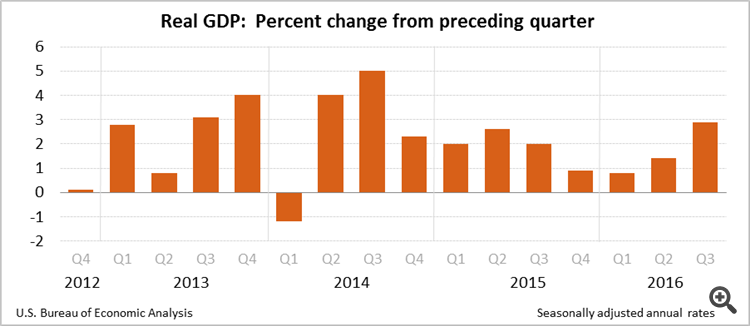

How to Trade the GDP Number

A lesson on what traders of the stock, futures, and forex markets look

for when the Gross Domestic Product (GDP) Number is released.

As we have learned in previous lessons there are many components of the

US Economy which can affect overall economic growth and inflation

expectations. Some of the major examples here are how many people are

employed in the economy vs. unemployed, how much the housing market is

growing in different parts of the country, and at what rate the prices

for different products in the economy are seeing increases.

As all of these things are so important to the economy and therefore to

the markets, there are no shortage of economic reports which are

released to try and help people gauge how things are going with

different pieces of the economy. It is important for us as traders to

understand the major reports here as even if we are trading off of

technicals, understanding what is happening in the market from a

fundamental standpoint can help establish a longer term bias for

trading. In the short term an understanding of these numbers will also

help to assess the erratic and sometimes extreme movements which can

occur after economic releases.

The granddaddy of all economic reports is the release of the Gross

Domestic Product (GDP) number for the economy. The Gross Domestic

Product for the US or any other country is the final value of all the

goods and services produced in that economy. Essentially what you get

after calculating GDP by adding up the value of all goods and services

produced in the economy is a measure of the size of the overall economy.

It is for this reason that market participants will watch the GDP

number closely as the rate of growth in this number represents the rate

of growth in the overall economy.

As a side note here, GDP also allows a comparison to be made of the

sizes of different economies from around the world, as well as their

growth rates. To give you an idea of just how large the US Economy is,

2007 GDP for the United States was estimated at 13.7 Trillion dollars.

This is in comparison to the next largest economy in the world, Japan

which has a GDP of under 5 Trillion Dollars.

Quarterly estimates of GDP are released each month with Advance

Estimates which are incomplete and subject to further revision being

released near the end of the first month after the end of the quarter

being reported. In the second month after the end of the quarter being

reported preliminary numbers (which basically means more accurate than

advanced) normally are released and then finally the final GDP number is

released at the end of the 3rd month after the end of the quarter being

reported on.

Traders are going to focus heavily on the growth rate released in the Advanced number and markets will also move on any significant revisions made in the preliminary and final GDP numbers.

--------------

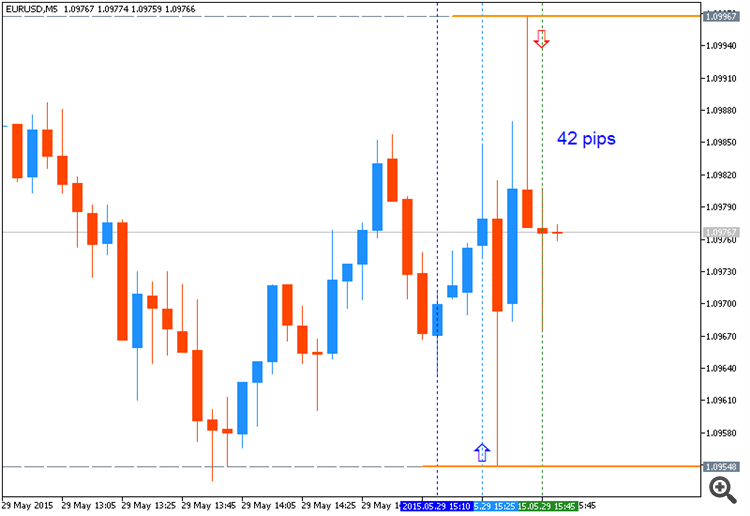

GBPUSD M5: 59 pips range price movement by USD - GDP news event:

--------------

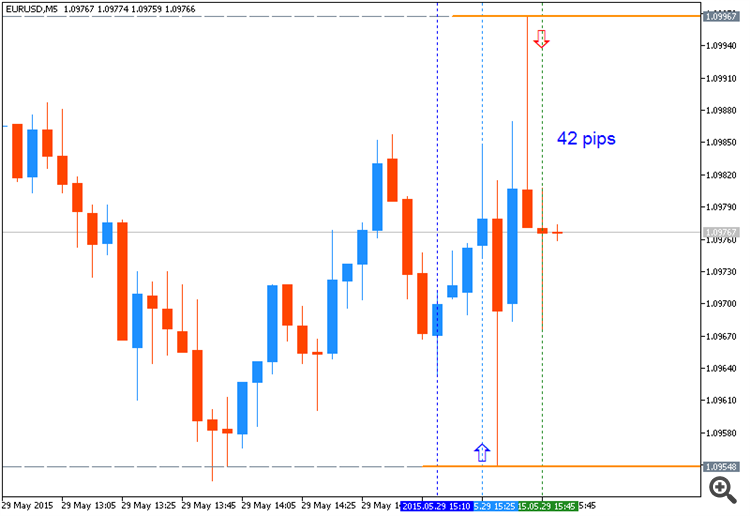

EURUSD M5: 42 pips rangeprice movement by USD - GDP news event:

--------------

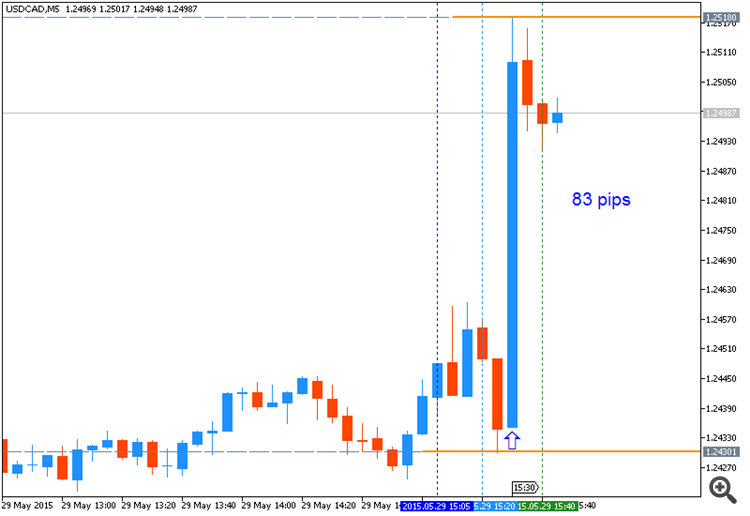

USDCAD M5: 83 pips price movement by USD - GDP news event:

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2016

Sergey Golubev, 2016.10.28 08:59

The Components of the Gross Domestic Product (GDP)In addition to looking at the growth or lack thereof in the overall GDP number, traders will also look at the growth or lack there of in the different components that make up the number. As GDP represents the value of everything in an Economy you can imagine the amount of data that goes into compiling the number, much of which is published for market participants to view. By looking at the different pieces which make up GDP we can get a good picture of what is happening not only with the overall economy but with all the different components of the economy which are reported on to come up with the final number.

EURUSD M5: 33 pips price movement by USD - GDP news event:

Now we could spend many lessons going over all the data that is in this report. The goal here however is to build a framework for understanding the major components so we as traders can understand what is going on when the market reacts to certain pieces of the report and will recognize when to dig deeper for more information on what is happening in a certain sector. The broad categories that it is important to have an understanding of are:

1. Personal Consumption Expenditures -- as over 65% of the US economy is made up of this category, what the individual consumer is doing ie the growth or lack thereof in their consumption, as well as on what goods and services they are spending their money on is heavily focused on.

2. Private Investment - This includes purchases of things such as computers, equipment and inventories (known as fixed assets) by businesses, purchases of homes by individuals, and of businesses investing in inventories of goods to sell. These are all obviously important things, as how much businesses are investing is a good indication of how they feel about future growth prospects, and how much growth the housing market is experiencing is also an important component of the economy.

3. Government Spending -- this includes pretty much everything the government spends money on besides social programs.

4. Exports -- Imports -- an important number which shows how wide the gap is between how much the country exports and how much it imports.

What the GDP number is going to give you a feel for is how much each of the above grew for the quarter and what their overall contribution to the economy was. The above numbers will then be broken down into more detailed numbers which go into compiling the final number for the above 4 categories.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.28 11:16

Trading the News: U.S. Gross Domestic Product (GDP) (adapted from the article)

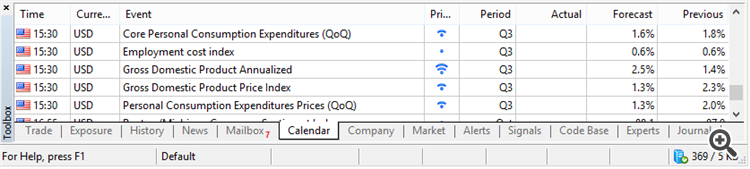

- "The U.S. economy is projected to grow an annualized 2.5% in the third-quarter of 2016, and a marked pickup in the Gross Domestic Product (GDP) may boost the appeal of the greenback and trigger a near-term decline in EUR/USD as it fuels speculation for an imminent Fed rate-hike."

- "It seems as though the Federal Open Market Committee (FOMC) is following a similar path to 2015 as a growing number of central bank officials endorse a December rate-hike, but the majority may continue to endorse a ‘gradual’ path in normalizing monetary policy as ‘survey-based measures of longer-run inflation expectations were little changed, on balance, while market-based measures of inflation compensation remained low.’ With that said, a marked slowdown in the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, may spark a bearish reaction in the greenback as it drags on interest-rate expectations."

Bullish USD Trade: U.S. Expands Annualized 2.5% or Greater

- "Need a green, five-minute candle following the report to favor a long EUR/USD trade."

- "If market reaction favors a long sterling trade, buy EUR/USD with two separate position."

- "Need a red, five-minute candle to favor a short GBP/USD trade."

- "Implement same strategy as the bullish dollar trade, just in reverse."

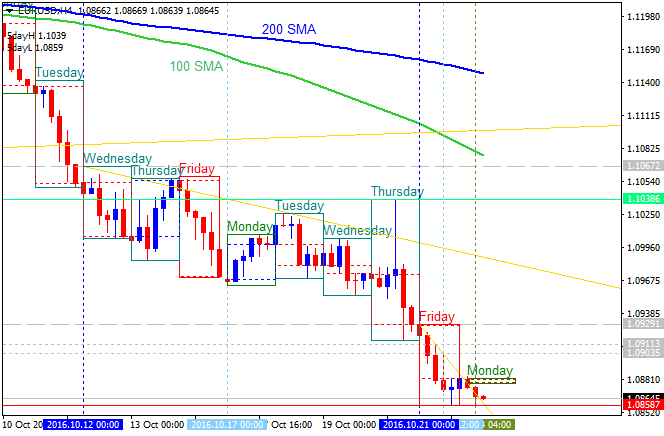

Daily price is located below 100-day SMA (100 SMA) and 200-day SMA (200 SMA) for the bearish area of the chart for the ranging within the narrow support/resistance levels: the price is testing 1.0859 support level to below for the bearish trend to be continuing with 1.0814 nearest daily target to re-enter. Descending triangle pattern was formed by the price with 1.0859 support level to be crossed for the bearish trend to be resumed.

- If D1 price breaks 1.0859 support to below on close bar so the primary bearish trend will be continuing with 1.0814 nearest daily bearish target.

- If price breaks 1.1038 resistance level to above on close daily bar so the local uptrend as the bear market rally will be started.

- If not so the price will be on bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.28 14:59

Intra-Day Fundamentals - EUR/USD and USD/CAD : U.S. Gross Domestic Product (GDP)

2016-10-28 12:30 GMT | [USD - GDP]

- past data is 1.4%

- forecast data is 2.5%

- actual data is 2.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

==========

EUR/USD M5: 24 pips range price movement by U.S. Gross Domestic Product news events

==========

USD/CAD M5: 39 pips range price movement by U.S. Gross Domestic Product news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on located to be below Ichimoku cloud in the bearish area of the chart: the bearish breakdown will be continuing for the week in the secondary ranging way - price is breaking 1.0911 support level to below for 1.0814 bearish daily target.

Chinkou Span line is located below the price for the bearish breakdown, and Absolute Strength indicator is evaluating the trend as a ranging bearish market condition in the near future.

If D1 price breaks 1.0911 support level on close bar so the primary bearish trend will be continuing with 1.0814 bearish target.If D1 price breaks 1.0968 resistance level on close bar from below to above so the local uptrend as the bear market rally will be started.

If D1 price breaks 1.1141 resistance level on close bar from below to above so we may wee the reversal of the daily price movement from the bearish to the primary bullish market condition.

If not so the price will be on bearish ranging within the levels.

SUMMARY : bearish

TREND : breakdown