Market Condition Evaluation based on standard indicators in Metatrader 5 - page 91

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Discussion of article "Several Ways of Finding a Trend in MQL5"

newdigital, 2014.06.25 20:45

How to detect forex trends

Detecting a trend is an important part of predicting direction in a currency pair. Tomorrow’s prices usually follow or continue today’s trend. There will, of course, be reversals and ranging behavior within the trend but it is easier to trade with a known trend than to predict when it changes. The task of the forex trader is to detect variations or waves of sentiment. The trader needs to ask: is there a shape to changes in sentiment and can it be detected? To answer this question, we can turn to price break charts (also called three-line break charts). In recent months, Bloomberg Professional stations added these charts. They also are available in many retail charting programs such as eSignal and ProRealTime.

Price break charts show only a new high close or a new low close. For example, if a trader using a candlestick chart of a daytime interval converts it to a three-line price break chart, he would see the price action from a different vantage point. The price break chart would only show consecutive new day high closes, or consecutive new day low closes. If no new high or new low is reached, then no additional bar would appear. But when the price reverses, it shows a new column only if the price reverses three previous highs (downward reversal) or three previous lows. This is why it is called a three-line break chart. The conditions for a bullish and bearish reversal are easily identified.

Three-line break charts enable significant insights into the shape of sentiment in the price action. A trader can detect the prevailing sentiment, how strong it is, whether a change in sentiment has occurred and project where the next trend reversal will occur. Several examples of using the three-line break as an indicator occurred in the GBP/USD pair in 2009 (see “Show me the move”).

The year started with a series of three consecutive new lows. It then reversed to a distance of four new consecutive highs. The sequence reversed back to four new consecutive lows followed by three consecutive new highs. In April, we see a very significant sentiment event, a flip-flop. This is a new downward reversal followed immediately by an upward reversal. In other words, market sentiment did not continue into a series. When a flip-flop occurs, it is rarely followed by another immediate reversal and therefore is a signal that the trend direction after the flip-flop will continue for a longer distance. This is exactly what occurred. The GBP/USD flipped from a low of 1.4252 on March 30 to a high of 1.5002 on April 15.

Also in the pound, we see a long sequence of 20 new consecutive day highs that occurred between May 1 and June 11, taking it from 1.4490 to 1.6598. While the ultimate length of the sequence is not predicable, what was clear to the trader was that the previous highest uptrend sequence before the long run up was five new consecutive highs. When a previous sequence of highs or lows is broken by a new sequence, this is an alert that the sentiment is becoming stronger than ever.

After the 20 new consecutive highs were achieved, GBP/USD no longer had the energy to repeat this sequence. It entered into a series of smaller consecutive new daily highs, and reversals into consecutive new lows. GBP/USD ended with a reversal up with two consecutive new daily highs.

Price break charts can be used for any time frame. Scalpers could use a one-minute price break to spot what is the intra-hour prevailing sentiment. While price break charts do not predict the duration, or the distance of a new trend, they reveal the strength of the prevailing sentiment. That can be enough to get an edge for the scalper or the long-term trader.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.27 10:02

2014-06-26 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Trade Balance]

if actual > forecast = good for currency (for NZD in our case)

[NZD - Trade Balance] = Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

Also Called : Overseas Merchandise Trade.

==========

New Zealand Trade Surplus NZ$285 Million

New Zealand posted a merchandise trade surplus of 285 million New Zealand dollars in May, Statistics New Zealand said on Friday - representing 6.2 percent of exports.

That topped forecasts for an increase of NZ$250 million following the NZ$534 million surplus in April.

Exports climbed NZ$528 million or 13.0 percent on year to NZ$4.60 billion - beating expectations for NZ$4.50 billion, which would have been unchanged from the previous month.

"Goods exports are high this month compared with May 2013," international statistics manager Jason Attewell said. "However, it appears the growth in exports seen in the past year has leveled off."

Exports to China, New Zealand's main export partner, were up NZ$204 million to NZ$868 million in May. This was led by milk powder, crude oil, and sheep meat. This is the first shipment of crude oil to China since July 2009.

The continued growth of exports to China has resulted in the two-way trade of goods (exports plus imports) reaching NZ$20.1 billion for the first time in the year ended May 2014. This was up NZ$4.7 billion from the previous year, with exports contributing NZ$4.0 billion to this increase.

Exports to Australia fell NZ$81 million to NZ$667 million.

Imports added NZ$283 million or 7.0 percent on year to NZ$4.32 billion versus forecasts for NZ$4.23 billion and up from NZ$3.96 billion a month earlier.

Capital goods led the rise, up NZ$186 million. This was led by trucks, cranes, and excavators.

Vehicles, parts, and accessories also fueled the increase in imports, up NZ$114 million.

Seasonally adjusted, exports added 0.5 percent on month in May, while imports jumped 2.9 percent.

Year to date, New Zealand's trade surplus was NZ$1.373 billion - topping expectations for NZ$1.350 billion and up from NZ$1.191 billion a month earlier.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.06.27

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 18 pips price movement by NZD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.02 14:07

GBP/USD Promises Push Higher Post Morning Star Candlestick Pattern (based on dailyfx article)

GBP/USD’s promises a further push higher following a Morning Star formation on the daily. With current levels not witnessed since 2008, definitive areas of resistance are not easily identifiable. This suggests traders may defer to psychologically-significant handles to look at taking profits and puts 1.7200 on the radar.

MetaTrader Trading Platform Screenshots

GBPUSD, D1, 2014.07.02

MetaQuotes Software Corp., MetaTrader 5, Demo

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.03 12:16

Trading the News: U.S. Non-Farm Payrolls

U.S. Non-Farm Payrolls (NFP) are projected to increase another 215K in June, but the European Central Bank (ECB) interest rate decision may spark a mixed reaction in the EUR/USD as market participants weigh the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Despite expectations of seeing the longest stretch of 200K+ prints since 1999-2000, it seems as though we would need a more meaningful pickup in job growth for the Federal Open Market Committee (FOMC) to soften its dovish tune for monetary policy, and the bearish sentiment surrounding the greenback may continue to take shape going into the Fed’s July 30 as Chair Janet Yellen remains reluctant to move away from the highly accommodative policy stance.

The pickup in private sector hiring along with the ongoing improvement in business confidence raises the scope for a better-than-expected NFP print, and a strong employment read may mitigate the bearish sentiment surrounding the USD as it puts increased pressure on the Fed to move away from its easing cycle.

However, the slowdown in private sector consumption paired with the persistent slack in the real economy may continue to drag on job growth, and a weak NFP figure may trigger selloff in the greenback as it raises the Fed’s scope to retain the zero-interest rate policy (ZIRP) beyond 2015.

How To Trade This Event Risk

Bullish USD Trade: NFPs Rises 215K+; Unemployment Holds Steady

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Employment Report Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Preserve Ascending Channel for Now While RSI Retains Long-Term Bearish Trend

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3790 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

May 2014 U.S. Non-Farm Payrolls

The U.S. economy added another 217K jobs in May following a revised 282K expansion the month prior, while the jobless rate unexpectedly held steady at an annualized 6.3% amid forecasts for a 6.4% print. Despite the downtick in unemployment, the EUR/USD climbed back above the 1.3650 region following the release, but the market reaction was short-lived as the pair ended the day at 1.3640.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.07.03

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 30 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

new bee

newdigital, 2013.12.23 16:51

you should read and read ...

and read articles.

No any personal consultant here sorry ... people may help but just for some concrete questions.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.08 09:19

2014-07-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - NAB Business Confidence]

if actual > forecast = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment

Acro Expand : National Australia Bank (NAB).

==========

Australian Business Confidence Strengthens In June

Australian business confidence improved in June, although conditions remained sub-trend, results of a survey by the National Australia Bank showed Tuesday.

The NAB business confidence index increased to 8 in June from 7 in May despite the government's challenging new budget. This improvement was driven by strengthened confidence in almost all the industries, with the surge in construction industry confidence contributing the most.

New orders remained stagnant in June, the same as in May.

However, the employment index weakened in June, coming in at -3, after being unchanged in May. Capacity utilization fell to 79.3 percent in June from 80.2 in May.

On the pricing front, input costs rose 0.3 percent quarter-over-quarter in June, a slower rate of increase than the 0.4 percent increase in May. Labor wages grew at a slower rate of 0.6 percent in June following the 0.7 percent increase in May. Output prices rose 0.1 percent on a quarterly basis in June, the same rate as in May.

The business conditions index increased to 2 in June from -1 in May, ending the negative trend that started in the beginning of the year. Sales and profits were stronger in June while employment remained weak.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.07.08

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 14 pips price movement by AUD - NAB Business Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.10 08:52

2014-07-10 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - Trade Balance]

if actual > forecast = good for currency (for AUD in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month. Export demand and currency demand are directly linked because foreigners usually buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

Acro Expand : Customs General Administration of China (CGAC).

==========

China trade gains momentum, but recovery patchyune exports grew 7.2% year-on-year, a touch above the 7% posted in May, but it fell short of the 10.4% that the market was hoping for. Imports rose 5.5%, improving from a dip of 1.6%, just slightly under the Bloomberg consensus forecast of 6%.

This led to China’s June trade surplus narrowing to $31.6 billion from $35.92 billion in May, and below consensus estimates of $36.9 billion.

On the news, AUD/USD dipped over 0.2% and found some support at the 0.9397 level.

There’s a bit of optimism with China’s customs office expecting exports growth to accelerate in the third quarter. Imports could also pick up based on improving signs of manufacturing and service activities over the past two months.

Still, there are concerns that the recovery has been patchy, particularly with the soft property sector and worries that the earnings season underway might turn out to be disappointing.

There is also some expectation that the government will have to do more to jumpstart the recovery with further stimulus measures to meet its 7.5% growth target. That argument got some backing when China’s June’s CPI was released yesterday, which came in at 2.3% year-on-year. This was down from 2.5% in the previous month and under the 2.4% market forecast.

China’s exports growth will also hinge on the recovery of other key economies especially the Euro Zone. The global outlook became a bit more uncertain after the International Monetary Fund warned earlier this week that global investment spending was still lacklustre.

We’ll get a better picture next week with the release of China’s Q2 GDP on Wednesday 16 July. This will perhaps be the clearest indication so far on how well China’s mini-stimulus measures have helped and how much more is needed since their roll-out back in April. The market consensus forecast for Q2 GDP is 7.4% growth, unchanged from Q1 which was the slowest in six quarters.

Indonesia will also be keenly watching China’s recovery story. Regardless who wins the election, the new president will take over a slowing economy with weakening fundamentals. With economic reforms a long term process, Indonesia’s outlook and policy decisions in the interim could hinge closely on China’s demand for commodities.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.07.10

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 17 pips price movement by CNY - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.11 15:42

2014-07-11 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

if actual > forecast = good for currency (for CAD in our case)

[CAD - Employment Change] = Change in the number of employed people during the previous month. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

U.K. CB Leading Index Rises At Stable Rate In May

U.K 's leading index, a measure of perceptions on future economic conditions, increased at a stable rate in May, results of a survey by the Conference Board showed Friday.

The Conference Board leading economic index rose 0.5 percent month-on-month in May, the same as in April. The index came in at 111.0 in May.

Six among the seven sub-indices contributed positively to the rise in the overall index.

The Conference Board Coincident Economic Index, measuring the current economic activity, came in at 106.9 and was unchanged month-on-month in May. This follows the 0.3 percent increase in April and March.

"The six-month growth rate of the Leading Economic Index for the U.K has decelerated in each of the last five months, pointing to slower growth performance for the second half of 2014 compared to the first," Bert Colijn, senior economist at The Conference Board, said.

"The slowing growth outlook is partially exacerbated by concerns about the short-term weakness in growth in emerging markets and the Euro Area."

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.07.11

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 65 pips price movement by CAD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.15 06:40

Strategy Video: Dollar, Pound and S&P 500 Probability vs Impact through Event Risk

In a dense round of event risk through the immediate future, there are scenarios where the headlines can prove exceptionally market moving...or barely tipping the needle. Expectations build up behind certain themes and markets to minimize the impact of likely outcomes and amplify the reaction to the less likely. In today's Strategy Video, we revisit this scenario analysis between 'potential' and 'probability' for Fed Chairwoman Janet Yellen's testimony, UK CPI and the general lean of a busy docket against the Dollar, Pound and S&P 500.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.07.15 09:57

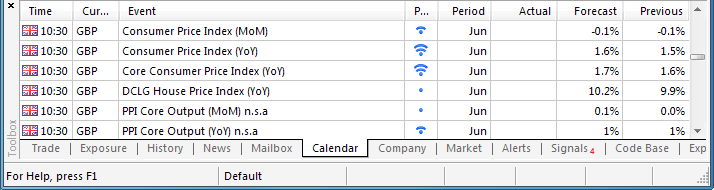

Trading the News: U.K. Consumer Price Index

A pickup in the U.K.’s Consumer Price Index (CPI) may generate fresh monthly highs in the GBP/USD as it fuels expectations for a Bank of England (BoE) rate hike later this year.

What’s Expected:

Why Is This Event Important:

The bullish sentiment surrounding the British Pound should gather pace in the second-half of the year as the BoE looks normalize monetary policy sooner rather than later, and the fundamental developments coming out of the region may continue to prop up interest rate expectations as a growing number of central bank officials adopt a more hawkish tone for inflation.

Expectations for a faster recovery paired with the ongoing improvement in the labor market may prompt a stronger-than-expected CPI print, and a marked pickup in the headline reading for inflation may generate a bullish reaction in the GBP/USD as it boosts interest rate expectations.

However, subdued wages along with the slowdown in private sector credit may drag on consumer prices, and a dismal inflation report may spur a larger correction in the GBP/USD as it dampens bets of seeing a rate hike later this year.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Inflation Climbs to 1.6% or Higher

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: CPI Falls Short of Market Forecast- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- Topside Targets Remain Favorable as Price & RSI Retain Bullish Trend

- Interim Resistance: 1.7200 Pivot to 1.7220 (100.0% expansion)

- Interim Support: 1.6890 (38.2% expansion) to 1.6900 (61.8% expansion)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

May 2014 U.K. Consumer Price Index

GBPUSD M5 : 38 pips price movement by GBP - CPI news event

U.K. consumer prices slowed to an annualized 1.5% in May from 1.8% the month prior, while the core rate of inflation narrowed to 1.6% during the same period after expanding 2.0% in April, which marked the fastest pace of growth since August 2013. The British Pound struggled to hold its ground following the weaker-than-expected CPI print, with the GBP/USD slipping back below the 1.6950 region, but the sterling regained its footing during the North American trade, with the pair ending the day at 1.6990.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.07.15

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 64 pips price movement by GBP - CPI news event