Market Condition Evaluation based on standard indicators in Metatrader 5 - page 94

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.08.26 12:31

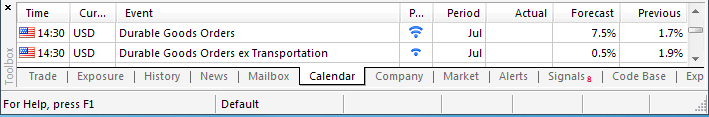

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

A 8.0% rise in demand for U.S. Durable Goods may spur a bullish reaction in the greenback (bearish EUR/USD) as it raises the scope for a stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is running out of arguments to retain its highly accommodative policy stance amid the ongoing improvements in the world’s largest economy, and the bullish sentiment surrounding the dollar may gather pace throughout the coming months should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

The pickup in household sentiment along with the resilience in private sector consumption may generate increased demand for U.S. Durable Goods, and a positive print may heighten the bullish sentiment surrounding the dollar as it raises the outlook for growth and inflation.

However, sticky inflation paired with subdued wage growth may drag on demand for large-ticket items, and a dismal development may serve as a fundamental catalyst to spur a larger correction in the reserve currency as it weighs on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Orders Increase 8.0% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Durable Goods Report Disappoints- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as long as RSI holds in oversold territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

Impact that the U.S. Durable Goods report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

June 2014 U.S. Durable Goods Orders

GBPUSD M5 : 15 pips price movement by USD - Durable Goods Orders news event

NZDUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

Orders for U.S. Durable Goods accelerated at a rate of 0.7% in June, exceeding estimates for 0.5% rise. The print was also much better than that in May, which showed a revised 1.0% contraction. The strength mainly came from increase in demand for commercial aircraft and machinery. However, the better-than-expected figure had a limited impact on the dollar. During the rest of the North America trade, the EUR/USD fluctuated around 1.3430 and closed at 1.3429.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.08.26

MetaQuotes Software Corp., MetaTrader 5, Demo

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.02 17:51

2014-09-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]if actual > forecast = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

U.S. Manufacturing Index Unexpectedly Climbs To Three-Year High In August

Activity in the U.S. manufacturing sector unexpectedly grew at an accelerated rate in the month of August, according to a report released by the Institute for Supply Management on Tuesday, with the index of activity in the sector climbing to a three-year high.

The ISM said its purchasing managers index climbed to 59.0 in August from 57.1 in July, with a reading above 50 indicating growth in the manufacturing sector.

The increase by the manufacturing index came as a surprise to economists, who had expected the index to edge down to 56.8.

With the unexpected increase, the ISM said the manufacturing index rose to its highest level since reaching 59.1 in March of 2011.

The unexpected increase by the headline index was partly due notably faster growth in new orders, as the new orders index climbed to 66.7 in August from 63.4 in July.

The production index also advanced to 64.5 in August from 61.2 in July, while the backlog of orders index rose to 52.5 from 49.5.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.09.02

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video September 2014

newdigital, 2014.09.03 14:24

Strategy Video: ECB Strategy for EURUSD and Euro Crosses

In a crowded week for scheduled event risk, the ECB rate decision tops my list for potential market impact. Not because the central bank will introduce a new wave of easing. Rather, whether the policy authority increases accommodation or stays its hand; a large segment will be caught off gaurd and have to readjust. In other words, this event is likely to be market moving and/or develop trends regardless of its outcome. In today's Strategy Video we discuss what to look for from this event and which Euro-based pairs may be best suited to different scenarios.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.05 09:55

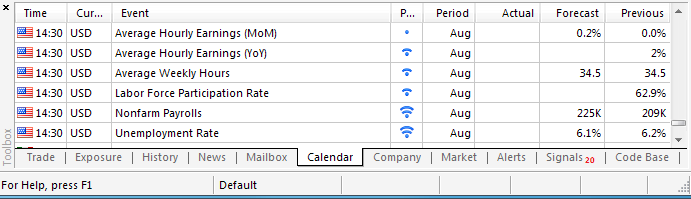

Trading the News: U.S. Non-Farm Payrolls (adapted from dailyfx)

The EUR/USD may face a further decline over the next 24-hours of trade as the U.S. Non-Farm Payrolls (NFP) report is expected to show the world’s largest economy adding another 230K jobs in August while the jobless rate is expected to narrow to an annualized 6.1% from 6.2% the month prior.

What’s Expected:

Why Is This Event Important:

Signs of a more robust recovery may further boost interest rate expectations as the Federal Open Market Committee (FOMC) is expected to halt its asset-purchase program at the October 29 meeting, and the bullish sentiment surrounding the U.S dollar may gather pace throughout the remainder of the year as a growing number of central bank officials show a greater willing to normalize monetary policy sooner rather than later.

The pickup in economic activity paired with the highest ISM employment prints for 2014 may highlight a further expansion in job growth, and an above-forecast NFP figure may spur fresh monthly lows in the EUR/USD amid the deviation in the policy outlook.

On the other hand, the recent slowdown in private-sector consumption - one of the leading drivers of growth - may generate another weaker-than-expect print, and a soft employment reading may spur a more meaningful pullback in the greenback as it dampens the outlook for the world’s largest economy.

How To Trade This Event Risk

Bullish USD Trade: NFPs Climb 230K or Greater While Jobless Rate Slips to 6.1% or Lower

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Job Growth Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as RSI pushes deeper into oversold territory.

- Interim Resistance: 1.3350 (61.8% expansion) to 1.3370 (50.0% retracement)

- Interim Support: 1.2870 (50.0% expansion) to 1.2900 (1.618% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

EURUSD M5 : 44 pips price movement by USD - Non-Farm Payrolls news event:

AUDUSD M5 : 46 pips price movement by USD - Non-Farm Payrolls news event:

The U.S. economy added 209K jobs in July, following a revised 298K increase the month prior. The print was below the average estimate of 230K. The jobless rate unexpectedly rose to 6.2% from 6.1% in June as discouraged workers returned to the labor force. Nevertheless, the greenback lost ground following the below-forecast print, with the EUR/USD rallying to a high of 1.3443 going into the European close.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.09.05

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 39 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.17 11:37

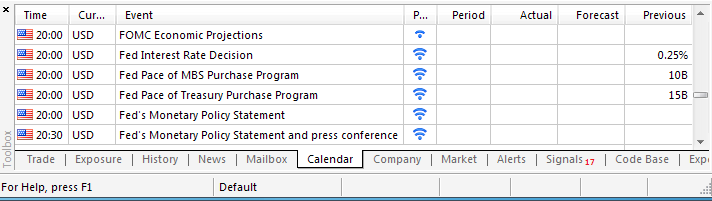

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision (based on dailyfx article)

The Federal Open Market Committee (FOMC) interest rate decision may spur a bearish reaction in the dollar (bullish EUR/USD) if the central bank remains reluctant to move away from the zero-interest rate policy (ZIRP).

What’s Expected:

Why Is This Event Important:

Even though the Fed is widely expected to conclude its asset-purchase program at the October 29 meeting, we would need a more hawkish twist to the forward-guidance for monetary policy to favor further USD strength.

The dollar may come under pressure should we get more of the same from the Fed, and the greenback may face a larger correction over the remainder of the month should Chair Janet Yellen see greater scope to retain the highly accommodative policy stance for an extended period of time.

Nevertheless, sticky inflation paired with the uptick in wage growth may spur a greater dissent within the committee and push the FOMC to lay out a more detailed exit strategy as the central bank looks to move away from its easing cycle.

How To Trade This Event Risk

Bearish USD Trade: FOMC Remains Reluctant to Normalize Monetary Policy

- Need green, five-minute candle following the policy statement to consider a long EUR/USD position

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish USD Trade: Policy Statement Shows Larger Dissent & Shift Away from ZIRP- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Risks Larger Topside Correction as the Relative Strength Index (RSI) Threatens Bearish Momentum

- Interim Resistance: 1.2990 (23.6% retracement) to 1.3025 (23.6% expansion)

- Interim Support: 1.2858 (Monthly low) to 1.2870 (50.% expansion)

Impact that the FOMC rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

EURUSD M5 : 32 pips price movement by USD - Federal Funds Rate news event:

The Federal Open Market Committee (FOMC) voted to reduce its asset-purchase pace to $25B from $35B in July amid the sharp economic rebound in the second quarter. However, the Fed also highlighted the significant underutilization of labor resources and reiterated that it is appropriate to maintain the current fed fund rate for a considerable period of time even after the quantitative easing program ends. The Fed’s dovish tone dragged on the greenback, with EUR/USD climbing above 1.3400, but we saw limited follow-through behind the initial reaction as the pair ended the day at 1.3395.

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2014.09.17

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 61 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2014.06.23 12:54

The article about Digital Filters: HowTo and How to Use

Forum on trading, automated trading systems and testing trading strategies

Chart Patterns

newdigital, 2013.09.08 15:33

Look at the following post :

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.23 21:05

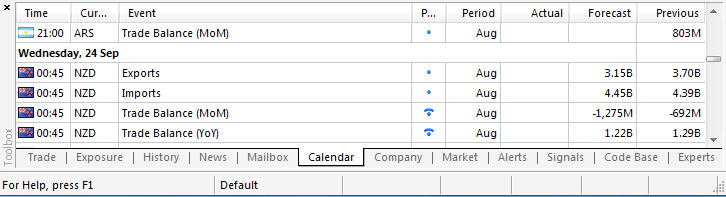

Trading the News: New Zealand Trade Balance (adapted from dailyfx article)

A marked expansion in New Zealand’s trade deficit may spark fresh monthly lows in the NZD/USD as it dampens the outlook for growth and inflation.

What’s Expected (MQ Metatrader 5 time as GMT+2):

Why Is This Event Important:

The weakening outlook for global trade may drag on interest rate expectations as the Reserve Bank of New Zealand (RBNZ) adopts a neutral tone for monetary policy, and Governor Graeme Wheeler may keep the cash rate on hold throughout the remainder of the year in an effort to combat the downside risk surrounding the real economy.

The trade report may highlight a weakening outlook for growth as business confidence deteriorates, and a marked expansion in the trade deficit may keep the RBNZ on the sidelines as the central bank continues to weigh the impact of the rate hikes from earlier this year.

However, the improved terms of trade along withexpectations for a faster recovery may generate a better-than-expected print, and we may see central bank Governor Wheeler show a greater willingness to further normalize monetary policy should the data dampen the downside risks surrounding the New Zealand economy.

How To Trade This Event Risk

Bearish NZD Trade: Deficit Widens to NZD1.125B or Greater

- Need red, five-minute candle following the release to consider a short NZD/USD trade

- If market reaction favors a long dollar trade, short NZD/USD with two separate position

- Place stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish NZD Trade: Trade Balance Tops Market Expectations- Need green, five-minute candle to favor a long NZD/USD trade

- Implement same setup as the bullish dollar trade, just in opposite direction

Potential Price Targets For The ReleaseNZD/USD Daily

- May see the bearish trend continue to take shape should RSI dip back into oversold territory

- Interim Resistance: 0.8370 (38.2% expansion) to 0.8390 (38.2% retracement)

- Interim Support: 0.7970 (50.0% retracement) to 0.8000 pivot

Impact that New Zealand Trade Balance has had on NZD/USD during the last release(1 Hour post event )

(End of Day post event)

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.09.24 06:01

New Zealand Has NZ$472 Million Trade Deficit

New Zealand posted a merchandise trade deficit of NZ$472 million in August, Statistics New Zealand said on Wednesday - representing 13 percent of exports.

That beat forecasts for a deficit of NZ$1.125 billion following the downwardly revised NZ$724 billion shortfall in July (originally NZ$692 million).

Exports were worth NZ$3.52 billion, topping expectations for NZ$3.20 billion and down from NZ$3.69 billion.

Live animals led the rise in exports, due to live cattle. Milk powder, butter, and cheese exports also contributed to the increase, led by higher quantities. The 16-percent rise in milk powder, butter, and cheese was led by milk fat and cheese.

"Cattle, milk fat, and cheese contributed to the rise in exports," international statistics manager Jason Attewell said. "It is the first time in three years that a rise in dairy was not led by milk powder."

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.09.24

NZDUSD M5 : 22 pips price movement by NZD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

newdigital, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :