Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 11:58

Weekly Outlook: 2016, October 02 - October 09 (based on the article)

The third quarter ended with mixed moves in currencies. A full buildup to the US Non-Farm Payrolls, a rate decision in Australia and other figures fill the first week of the last quarter. These are the main events on forex calendar.

- US ISM Manufacturing PMI: Monday, 14:00. Manufacturing PMI is expected to reach 52.1 in September.

- Australian rate decision: Tuesday, 3:30. No change in rates is expected this time. This is the first rate decision made by the new governor Philip Lowe.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. The ADP report is expected to show a 166,000 jobs gain in September.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Non-manufacturing activity is expected to reach 53.1 in September.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to register 255,000 jobs gain this week.

- Canadian employment data: Friday, 12:30. Economists expected a smaller gain of 16,000 jobs and the unemployment rate to remain steady at 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. The number of new jobs in September is expected to be 171,000 while the unemployment rate is forecasted to remain at 4.9%. Wages are projected to rise by 0.2% m/m.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.11 08:26

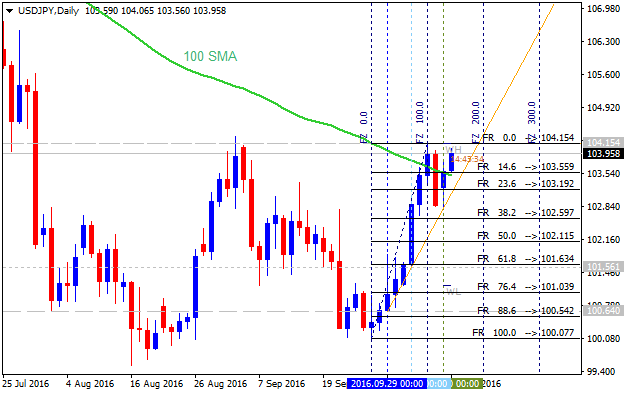

USD/JPY Technical Analysis: The Race To Debase Resumes In Asia (based on the article)

- "Some traders have looked at the move in USD/JPY post-Brexit as a triangle. That’s a valid view, but a break above 104.32 (September Opening Range High) that would invalidate such a pattern and could add to the building evidence of a pending bullish breakout. A break above 104.32 would then turn Bullish focus to the post-Brexit high of 107.48."

- "Opening Range reversals are commonplace in strong trends and should be indicative of trend continuation. In the case of October, we’d have an opening range reversal if the price of USD/JPY broke below 101.17 (Monday’s low) in the second week of October and continued lower. However, a break above the high of 104.15 on a closing basis would further embolden USD/JPY bulls. Given the significant macro-event risk of the US Presidential Election, the opening range low of 101.17 should remain on watch as an invalidation of the recent excitement."

- "A continuation through the resistance levels mentioned above could see

traders start to push the market higher in fear of missing out on the

next USD/JPY long trade."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.18 15:25

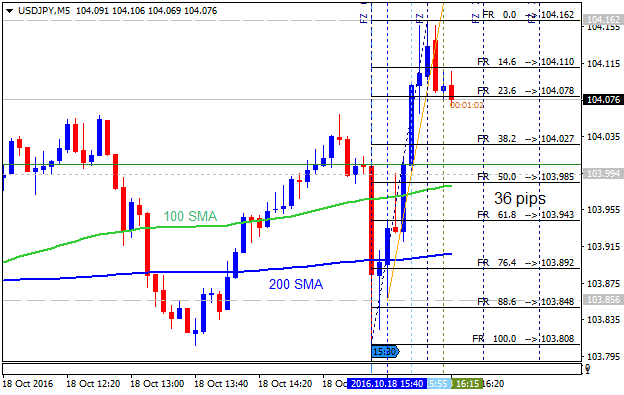

USD/JPY Intra-Day Fundamentals: U.S. Consumer Price Index and 36 pips range price movement

2016-10-18 12:30 GMT | [USD - Consumer Price Index]

- past data is 0.2%

- forecast data is 0.3%

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Consumer Price Index] = Change in the price of goods and services purchased by consumers.

==========From official report:

- "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.5 percent before seasonal adjustment."

- "Increases in the shelter and gasoline indexes were the main causes of the rise in the all items index. The gasoline index rose 5.8 percent in September and accounted for more than half of the all items increase. The shelter index increased 0.4 percent, its largest increase since May."

==========

USD/JPY M5: 36 pips range price movement by U.S. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.25 19:20

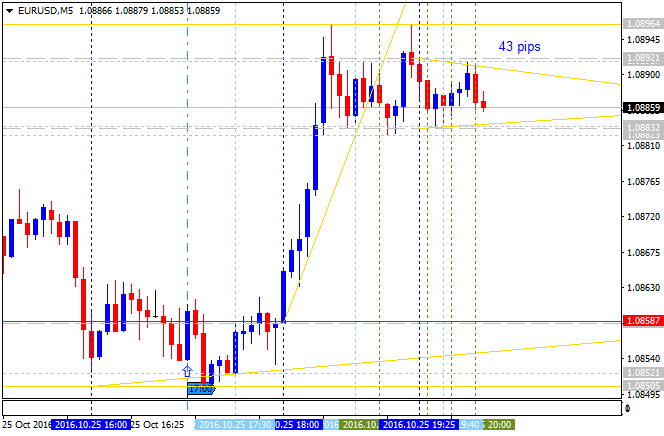

Intra-Day Fundamentals - EUR/USD and USD/JPY : The Conference Board Consumer Confidence

2016-10-25 14:00 GMT | [USD - CB Consumer Confidence]

- past data is 103.5

- forecast data is 101.5

- actual data is 98.6 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

"Consumer confidence retreated in October, after back-to-back monthly gains,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current business and employment conditions softened, while optimism regarding the short-term outlook retreated somewhat. However, consumers’ expectations regarding their income prospects in the coming months were relatively unchanged. Overall, sentiment is that the economy will continue to expand in the near-term, but at a moderate pace."

==========

EUR/USD M5: 43 pips range price movement by The Conference Board Consumer Confidence news events

==========

USD/JPY M5: 74 pips range price movement by The Conference Board Consumer Confidence news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.01 16:17

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/JPY : Manufacturing ISM Report On Business

2016-11-01 14:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 51.5

- forecast data is 51.8

- actual data is 51.9 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

image]

==========

EUR/USD M5: 23 pips range price movement by ISM Manufacturing PMI news events

==========

USD/CAD M5: 19 pips range price movement by ISM Manufacturing PMI news events

==========

USD/JPY M5: 33 pips range price movement by ISM Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.07 12:35

Weekly Fundamental Forecast for USD/JPY (based on the article)

USD/JPY - "Given the changes in the backdrop for the BoJ, we’re going to leave our forecast at neutral for the week ahead on the Yen until more information presents itself. Data out of Japan will be extremely light for next week, so expect the Yen to trade with general macro headwinds that will likely emanate from U.S. Presidential elections."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.07 18:16

USD/JPY: Scenarios & Tactical Strategies For Trading The US Elections - Deutsche Bank (based on the article)

- "Clinton victory + Republican House and Senate: Risk of continued political turmoil. Dead-locked fiscal policies."

- "Clinton

victory + Republican House + Democratic Senate: Somewhat reduced

uncertainty. Concern about political situation and fiscal

administration."

- "Trump

victory + Republican House and Senate: Heightened expectations for US

fiscal policy. Increased global political uncertainty."

- "Trump victory + Republican House + Democratic Senate: Brake on more aggressive US fiscal policy. Increased global political uncertainty."

Scenarios 1 and 2 - "We would recommend selling if USD/JPY rose to around 105 or higher."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.09 12:26

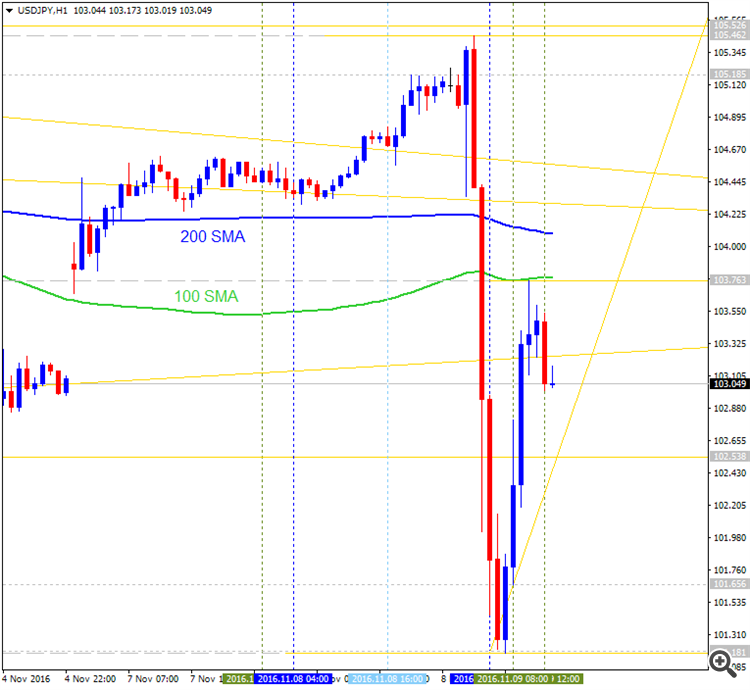

USD/JPY after Donald Trump's victory in the U.S. election (based on the article)

USD/JPY H1 timeframe: price broke 100 SMA/200 SMA levels to below for the reversal from the primary bullish to the primary bearish market condition with 101.18 support level to be testing for the bearish trend to be continuing.

"The yen climbed from an earlier session low of 105.46 to as high as 101.15 versus the dollar. As of 5:37 a.m. ET, the dollar/yen traded at 103.18."

For now, the price is bearish ranging to be bounced from 100 SMA to below for the second breakdown round to be started.Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.14 07:59

USD/JPY Intra-Day Fundamentals: BOJ Gov Kuroda Speaks and 34 pips range price movement

2016-11-14 01:00 GMT | [JPY - BOJ Gov Kuroda Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[JPY - BOJ Gov Kuroda Speaks] = Speech about Japan's economy and monetary policy at the business leaders meeting, in Nagoya.

==========

From gettyimages article: Bank of Japan Governor Haruhiko Kuroda Speech and News Conference

- "Haruhiko Kuroda, governor of the Bank of Japan (BOJ), reacts as he speaks at a business leaders meeting in Nagoya, Aichi, Japan, on Monday, Nov. 14, 2016. Given that inflation has been lower than 2% for a long time, its necessary for the public to experience it above this level so that their expectations for inflation will rise, Kuroda said."

==========

USD/JPY M5: 34 pips range price movement by BOJ Gov Kuroda Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.19 11:17

Weekly Fundamental Forecast for USD/JPY (based on the article)

USD/JPY - "In the week ahead we’ll watch any especially-large surprises out of the coming week’s release of Japanese Consumer Price Inflation figures will otherwise drive JPY volatility. Traders have shown relatively little sensitivity to Japanese economic data, however; rhetoric from the BoJ matters far more than a single economic print."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

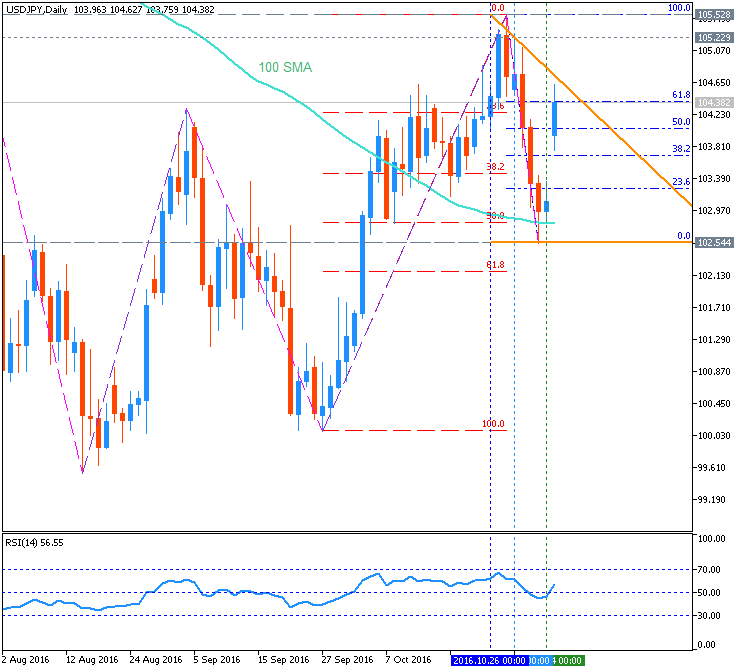

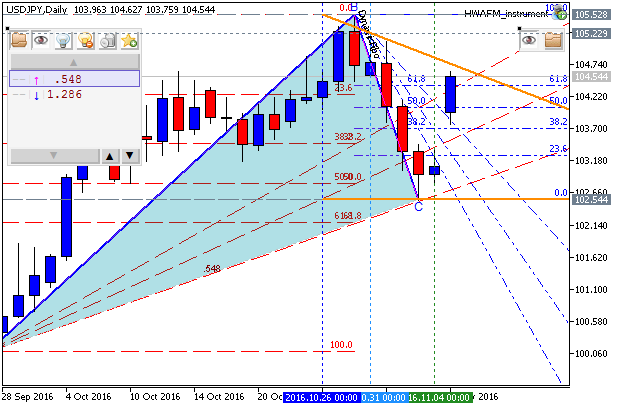

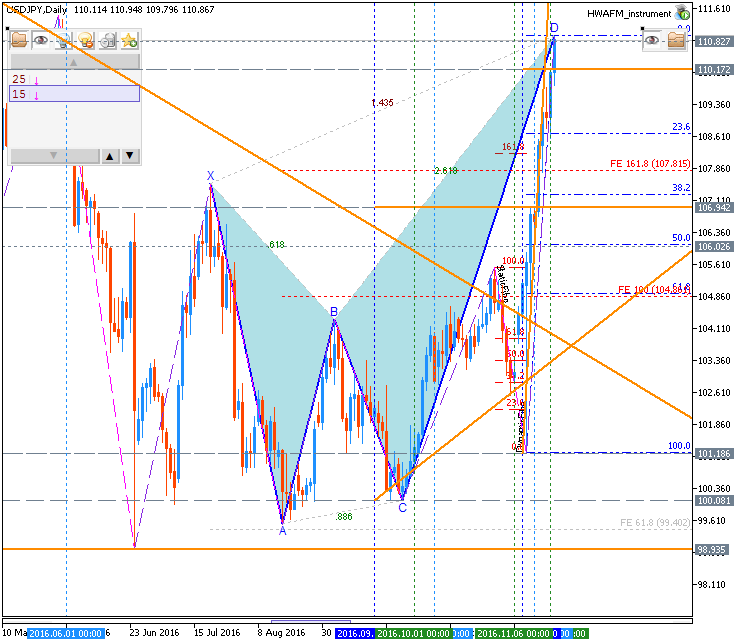

USD/JPY October-December 2016 Forecast: ranging bearish; 98.97 support to be broken for the bearish trend to be continuing

W1 price is located far below Ichimoku cloud in the bearish area of the chart. The price was bounced from 99.53 support level to above for the secondary ranging condition to be started with 98.97 key support level which is going to be broken to below in case of the bearish trend to be continuing. By the way, ascending triangle pattern was formed by the price to be crossed to above for the bear market rally to be started if 104.31 resistance is broken to above on close weekly bar for example.

Chinkou Span line is located below the price indicating the bearish trend to be continuing, Tenkan-sen line is below Kijun-sen line of Ichimoku indicator for the bearish continuation in the near future as well, and Absolute Strength indicator is estimating the trend to be ranging bearish market condition in the future.

Trend:

W1 - ranging bearish