Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 11:58

Weekly Outlook: 2016, October 02 - October 09 (based on the article)

The third quarter ended with mixed moves in currencies. A full buildup to the US Non-Farm Payrolls, a rate decision in Australia and other figures fill the first week of the last quarter. These are the main events on forex calendar.

- US ISM Manufacturing PMI: Monday, 14:00. Manufacturing PMI is expected to reach 52.1 in September.

- Australian rate decision: Tuesday, 3:30. No change in rates is expected this time. This is the first rate decision made by the new governor Philip Lowe.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. The ADP report is expected to show a 166,000 jobs gain in September.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Non-manufacturing activity is expected to reach 53.1 in September.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to register 255,000 jobs gain this week.

- Canadian employment data: Friday, 12:30. Economists expected a smaller gain of 16,000 jobs and the unemployment rate to remain steady at 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. The number of new jobs in September is expected to be 171,000 while the unemployment rate is forecasted to remain at 4.9%. Wages are projected to rise by 0.2% m/m.

Weekly Outlook: 2016, October 09 - October 16 (based on the article)

German ZEW Economic Sentiment, US FOMC Meeting Minutes, UK Rate decision, US Unemployment Claims, US Crude Oil Inventories, US Consumer Sentiment and Janet Yellen’s speech; These are the main events on forex calendar.

- German ZEW Economic Sentiment: Tuesday, 9:00. Economic sentiment is expected to improve to 4.2.

- US FOMC Meeting Minutes: Wednesday, 18:00.

- UK Rate decision: Thursday, 11:00. The MPC expect a boost in growth during 2017 if the present economic momentum continues.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 252,000 this week.

- US Crude Oil Inventories: Thursday, 15:00.

- US Retail sales: Friday, 12:30. Retail sales is expected to gain 0.6%, while core sakes are predicted to rise 0.4%.

- US Prelim UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence is expected to climb to 92.1 this

- Janet Yellen speaks: Friday, 17:30. Federal Reserve Chair Janet Yellen will give a talk in Boston’s Annual Research Conference. She will talk about the US economic recovery and may give further clues regarding the expected rate hike timetable. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.15 09:46

Weekly Outlook: 2016, October 16 - October 23 (based on the article)

- Mario Draghi speaks: Monday, 17:35. ECB President Mario Draghi will give a talk in Frankfurt. Market volatility is expected.

- UK Inflation data: Tuesday, 8:30. UK inflation is expected to climb higher to 0.9% in September.

- US Inflation data: Tuesday, 12:30. Economists forecast a 0.3% rise in CPI and a 0.2% gain in core CPI in October.

- UK Employment data: Wednesday, 8:30. The number of unemployed is expected to grow by 3,400 in September.

- US Building permits: Wednesday, 12:30. The number of permits is expected to rise to 1.17 million units this time.

- Canadian rate decision: Wednesday, 14:00.

- US Crude Oil Inventories: Wednesday, 14:30.

- Australian employment data: Thursday, 0:30. The Australian employment market is expected to gain 15,200 jobs in September and the unemployment rate is forecasted to rise to 5.7%.

- Eurozone rate decision: Thursday, 11:45.

- US Philly Fed Manufacturing Index: Thursday, 12:30. Philadelphia region manufacturing index is expected to decline to 5.2 this time.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 251,000 this week.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.17 17:42

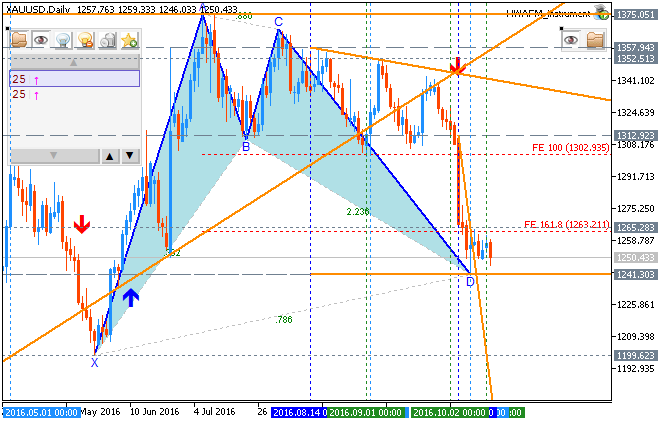

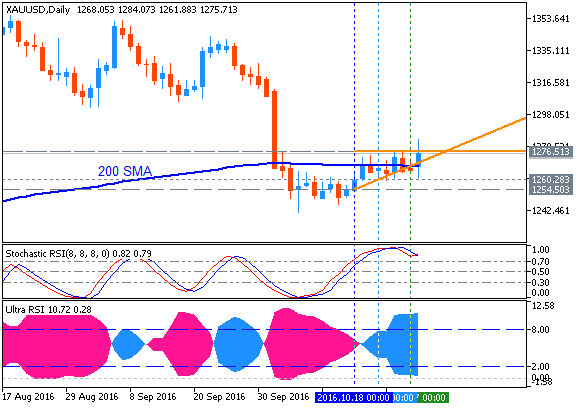

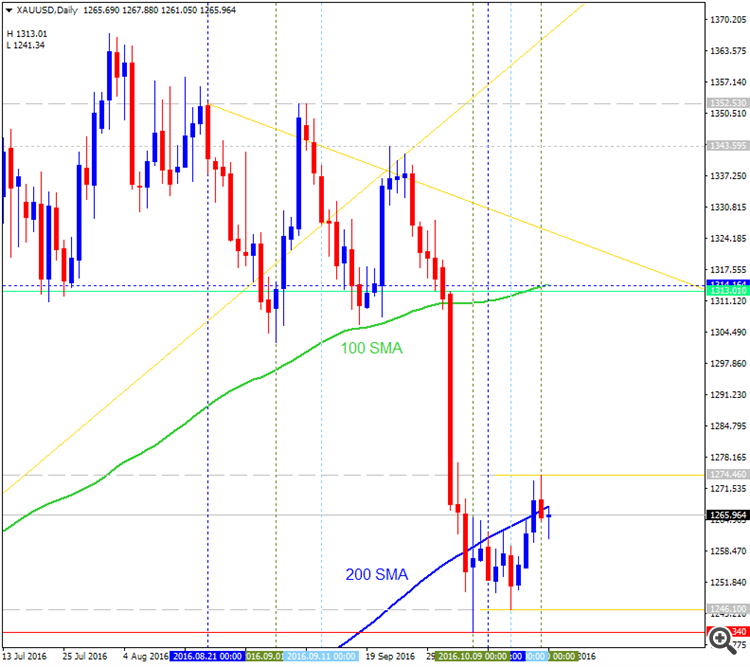

Quick Technical Overview - GOLD: price reversed to the bearish with 1,241.34 support (adapted from the article)

Daily price broke 100 SMA/200 SMA to below to be reversed to the primary bearish market condition. Fow now, the price is on ranging within narrow s/r levels waiting to be reversed back to the ranging bullish condition or for the bearish trend to be resumed.

- "Gold prices remain in a holding pattern, with the open of Mondays trading marking the 6th session of consolidation for the commodity. Key daily resistance for the price of Gold remains above $1,265.34, while support is found near $1,241.27. Traders will be looking for Gold prices to breakout this week with the release of several high importance news events. This includes US CPI data released on Tuesday with an expectations set at 1.5% (YoY) (Sep), and Australian Employment Change data released on Wednesday with expectations of +15.0K (Sep)."

- If the price breaks 1,241.34 support level to below on close daily bar so the primary bearish market condition will be continuing.

- If daily price breaks 1,264.89 resistance level to above on close bar so the reversal to the ranging bullish condition will be started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.22 13:55

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)GOLD (XAU/USD) - "Highlighting the economic docket next week is the advanced read on U.S. 3Q GDP with consensus estimates calling for an annualized print of 2.5% q/q. The Core Personal Consumption Expenditure (PCE) will be of particular interest with market expectations calling for a slowdown to 1.6% q/q from 1.8% q/q. Keep in mind that this is the Fed’s preferred gauge of inflation and a softer than expected print could weigh on expectations for a 2016 rate hike. As is stands, Fed Fund Futures are pricing in a 68% likelihood the central bank will hike in December. Look for advances in gold to remain limited as the prospect of higher interest rates weigh on demand for the yellow metal as a store of wealth."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.29 11:17

Weekly Fundamental Forecast for GOLD (XAU/USD) (based on the article)

XAU/USD Index - "U.S. 3Q GDP figures released on Friday showed the economy grew at an annualized pace of 2.9% q/q, topping estimates for a print of just 2.6%. The Core Personal Consumption Expenditure, (PCE), the Fed’s preferred gauge of inflation, also beat consensus with a print of 1.7% q/q. Still, the data is unlikely to move the needle for the monetary policy outlook, with Fed Fund Futures still pricing in just a 17% chance of a hike this month as expectations for a December rate-hike hold decision steady at nearly 75%. For gold, the implications are for more sideways price action with next week’s event risk likely to charge considerable volatility in prices."

Forum on trading, automated trading systems and testing trading strategies

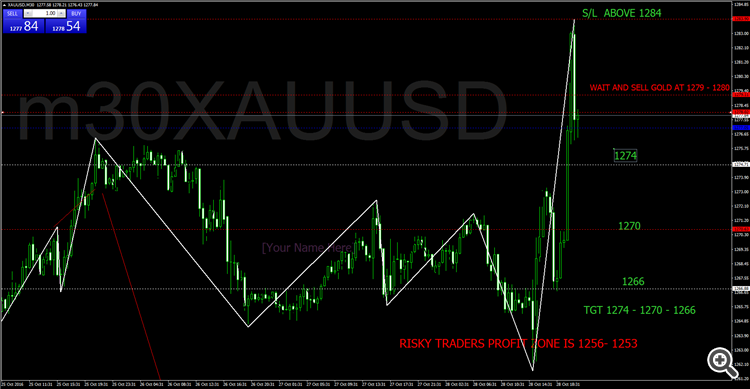

SELL GOLD

Nse signals, 2016.10.30 08:30

SELL GOLD AT 1278 - 1279

S/L 1284

TGT 1274 - 1270 - 1266

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.06 08:21

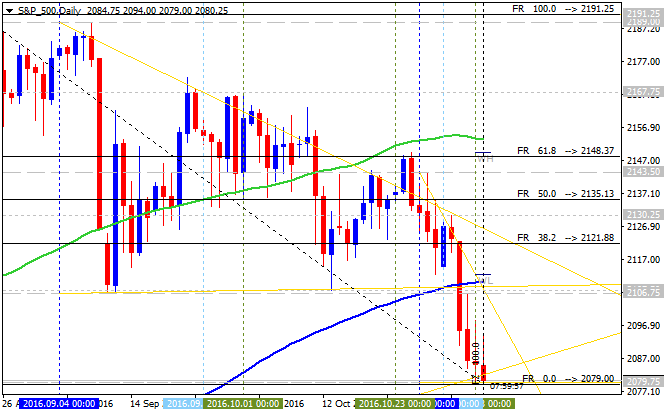

Week Ahead On Wall Street: Markets Brace For Election Results (based on Forbes article)

Monday

"British lawmakers will debate the implications of Brexit, after the High Court said that Parliament must give its approval before the country can move forward with its split from the European Union."

Tuesday

"It’s election day. Billionaire Elon Musk has begun campaigning for the merger of SolarCity and Tesla and last week promised that the tie-up would yield big financial benefits for Tesla investors."

Wednesday

"Goldman Sachs is expected to announce which of its top employees have achieved partner status. It does this every two years and in 2014 named 78 people to the position. The partnership ranks are tough to break into and represent fewer than 2% of the firm’s workers."

Thursday

"Starbucks CEO Howard Schultz, activist investor Bill Ackman, Goldman Sachs CEO Llyod Blankfein and others will speak at The New York Times’ Dealbook conference."

Friday

"Bond markets are closed for Veteran’s Day. The stock market will keep its normal hours."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.15 15:01

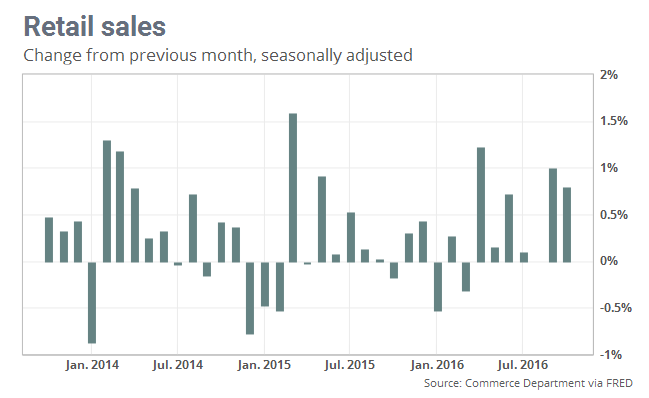

Intra-Day Fundamentals - EUR/USD, USD/CAD and GOLD (XAU/USD): Advance Retail Sales2016-11-15 13:30 GMT | [USD - Retail Sales]

- past data is 1.0%

- forecast data is 0.6%

- actual data is 0.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From Market Watch article: U.S. retail sales post biggest back-to-back sales since 2014

"Retail sales jumped 0.8% last month after a revised 1% gain in September, the government said Tuesday. Economists surveyed by MarketWatch had forecast a seasonally adjusted 0.7% advance."

==========

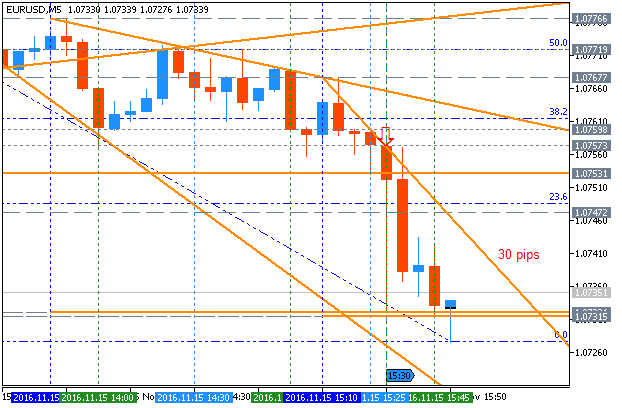

EUR/USD M5: 30 pips range price movement by U.S. Retail Sales news events

==========

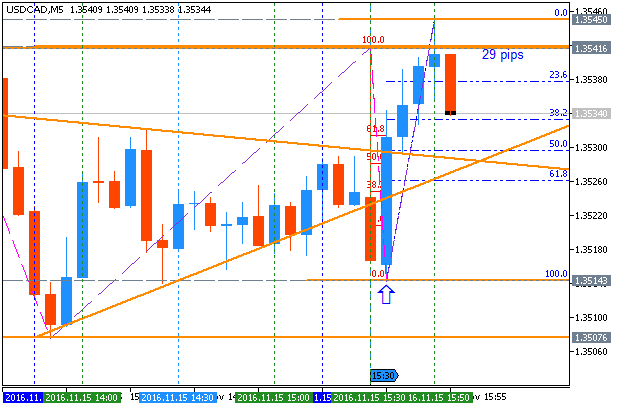

USD/CAD M5: 29 pips range price movement by U.S. Retail Sales news events

==========

GOLD (XAU/USD) M5: range price movement by U.S. Retail Sales news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

GOLD (XAU/USD) October-December 2016 Forecast: ranging for the bullish trend to be continuing or for the secondary correction to be started

W1 price is located above Ichimoku cloud in the bullish area of the chart. The price is on ranging within the following key support/resistance levels:

Descending triangle pattern was formed by the price to be crossed to below for the correction to be started, but Absolute Strength indicator and Chinkou Span line of Ichimoku indicator are evaluating the future trend as the ranging bullish condition, and Tenkan-sen line located to be above Kijun-sen line are indicating for the primary bullish trend to be continuing.

By the way, the bearish reversal level is 1171.88, and if the price breaks this level to below so the global bearish reversal will be started for this and next year for example.

Trend:

W1 - bullish ranging within the levels