Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 10:41

Week Ahead On Wall Street: Jobs Report, Google Product Unveil (based on the Forbes article)

Monday

- "Ford, General Motors and other U.S. automakers report their September sales figures. While sales have softened this year, the seasonally adjusted annual sales rate is still expected to top 17.6 million, according to analysts surveyed by Bloomberg. Last year, Americans bought a record-breaking 17.5 million vehicles."

Tuesday

- "Google will show off its new products."

- "U.S. Federal Reserve Bank of Richmond President Jeffrey Lacker will speak at a conference in West Virginia."

- "Darden Restaurants and Micron, which has struggled mightily due to falling demand for its memory chips, are out with earnings."

- "Vice presidential nominees Mike Pence and Tim Kaine will take the debate stage for their turn in the limelight. Presidential nominees Donald Trump and Hillary Clinton went head to head last week."

Wednesday

- "The U.S. Supreme Court, which begins its term this week, will hear arguments on an insider trading case. The decision could alter the way in which regulators define insider trading."

- "U.K. Prime Minister Theresa May will give the keynote speech at the Conservative party conference and will likely touch on Brexit."

- "Monsanto, which was just bought by Bayer for $66 billion, reports earnings in the morning. It will be followed in the afternoon by Yum, the parent company of KFC, Pizza Hut and Taco Bell."

- "The Fed’s Charles Evans and Jeffrey Lacker will speak at separate events."

Thursday

- "Some of Wall Street’s biggest names, including Jaime Dimon, James Gorman, Michael Corbat and Mohamed El-Erian, will speak at a meeting held by the Institute of International Finance that continues through Saturday.

- "The European Central Bank will release the minutes from its policy meeting in September, at which President Mario Draghi said there was no change to their monetary policy.

Friday

- "It’s time to take another pulse of the labor market. U.S. employers are expected to have added 175,000 jobs in September and the unemployment rate should be steady at 4.9%."

- "The IMF and World Bank convene their 2016 annual meeting in Washington, D.C. Among the scheduled speakers are former Treasury Secretary Tim Geithner and Bank of England Governor Mark Carney. On Sunday, IMF Managing Director Christine Lagarde will have a one-on-one conversation with financial journalist Michael Lewis, author of “The Big Short” and “Boomerang,” which will be live streamed here at 10 am ET."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 20:20

Intra-Day Fundamentals - EUR/USD and DAX Index: Fed Chair Yellen Speaks at the Federal Reserve Bank

2016-10-14 17:30 GMT | [USD - Fed Chair Yellen Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - Fed Chair Yellen Speaks] = Speech named "Macroeconomic Research After the Crisis" at the Federal Reserve Bank of Boston’s Annual Research Conference.

==========

From Bloomberg article: Yellen Sees ‘Plausible Ways’ Hot Economy Could Heal Growth

- "Federal Reserve Chair Janet Yellen said there are “plausible ways” that running the U.S. economy hot for a while could fix some of the damage caused to growth trends by the Great Recession."

- "Increased business sales would almost certainly raise the productive capacity of the economy by encouraging additional capital spending,” Yellen said Friday in the text of a speech to a Boston Fed conference on the elusive economic recovery. “A tight labor market might draw in potential workers who would otherwise sit on the sidelines."

- "Yellen pondered whether a “high-pressure economy” could reverse some of

the damage done in the recession, including declines in research

spending and labor force participation. In effect, that has been the

Federal Open Market Committee’s bet this year, though Yellen cautioned

that running a low-rate policy for too long “could have costs that

exceed the benefits” by increasing financial risk or inflation."

==========

EUR/USD M5: 24 pips price movement by Fed Chair Yellen Speaks news events

==========

DAX Index M5 price movement by Fed Chair Yellen Speaks news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.25 10:42

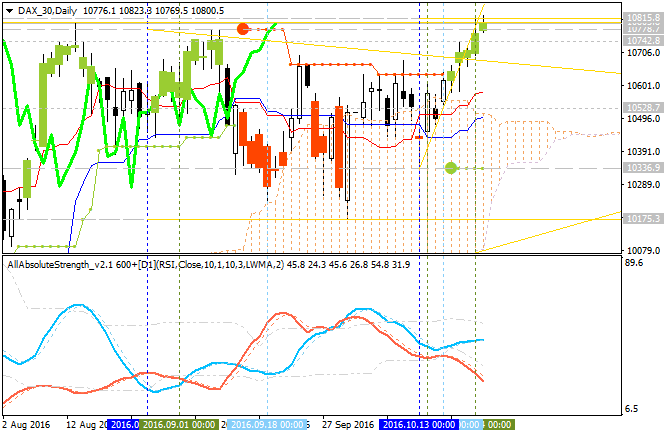

Dax Index: Bullish breakout (adapted from the article)

Daily price is on bullish breakout with 10,815 resistance level to be tested for the bullish trend to be continuing.

- Chinkou Span line of Ichimoku indicator is located above the price for the bullish breakout to be continuing in the near future.

- Absolute Strength indicator is estimating the trend as the bullish to be continuing.

- "In the short-term, even if new year highs can’t be maintained there will still likely be support around 10700, which is also where the cross-through trend-line off the June lows lies. The trend-line off the June lows was broken on a couple of occasions, and while it passes through a lot of price action the market has still responded to it in recent weeks, so we will continue to view it with some importance."

- "Ahead at 10860 lies the swing high created on Dec 29, and beyond there we will have to look to 11k (psychological level) and a top-side trend-line (~11050) spanning over the April and August peaks."

If the daily price breaks 10,815 resistance to above on close daily bar so the bullish trend will be continuing.

If the daily price breaks 10,336 support level to below on close bar so the bearish reversal will be started.

If not so the price will be on bullish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.31 14:04

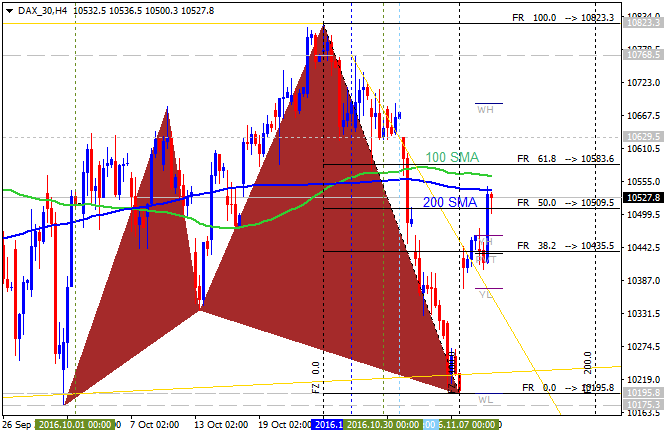

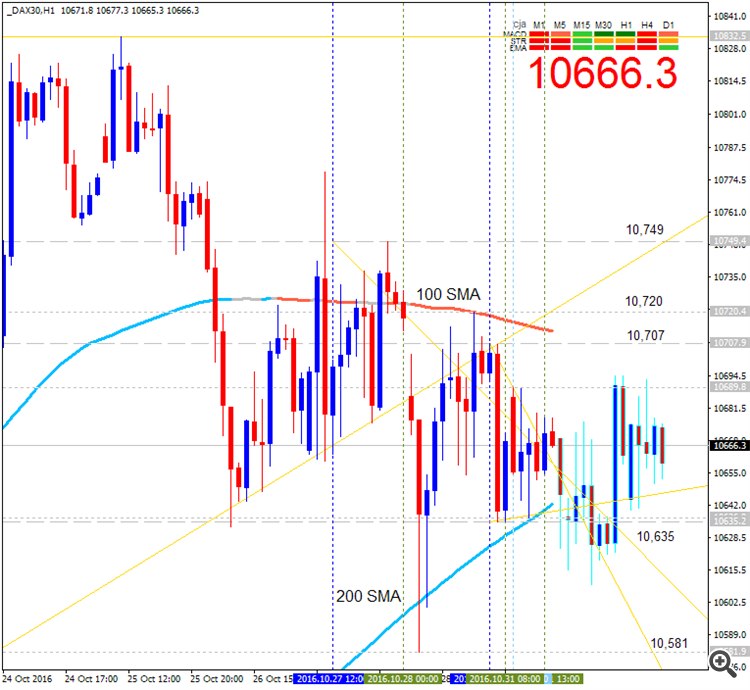

DAX Index: Short-Term Levels for direction of the trend (adapted from the article)

H1 price is located within 100 SMA/200 SMA ranging levels in the bullish area of the chart to be above 200 SMA levels.

- "In this choppy trading environment, turning views into money has proven difficult for the swing-trader; it’s been like this for several months now. But for traders who operate on time-frames of a couple of days or less (day-traders) there are still levels and technical developments which we can operate off of."

- "Dropping down to the hourly chart: A steady set of parallels (channel) is forming off the 10/25 highs. This keeps the immediate picture turned lower with lower highs and lower lows in place. The market needs to overcome the top-side parallel and Friday high at 10716 before any sort of upward momentum can potentially kick in. Beyond there we will look to 10773 and the year at 10827."

- "Continued trade below the upper parallel keeps the bias pointed lower to neutral at best, and could bring into play the Friday low at 10583 and a trend-line extending back to the 9/30 Deutsche Bank-induced swing low."

If the price breaks 10,707

resistance level on close hourly bar to above so the primary bullish trend will be resumed with 10,720/10,749 bullish targets.

If H1 price breaks 10,635 support level on close bar to below so the reversal of the price movement from the ranging bullish to the primary bearish market condition will be started with 10,581 target.

If not so the price will be on bullish ranging within the levels.

| Resistance | Support |

|---|---|

| 10,707 | 10,635 |

| 10,720 | 10,581 |

Trend:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.06 08:21

Week Ahead On Wall Street: Markets Brace For Election Results (based on Forbes article)

Monday

"British lawmakers will debate the implications of Brexit, after the High Court said that Parliament must give its approval before the country can move forward with its split from the European Union."

Tuesday

"It’s election day. Billionaire Elon Musk has begun campaigning for the merger of SolarCity and Tesla and last week promised that the tie-up would yield big financial benefits for Tesla investors."

Wednesday

"Goldman Sachs is expected to announce which of its top employees have achieved partner status. It does this every two years and in 2014 named 78 people to the position. The partnership ranks are tough to break into and represent fewer than 2% of the firm’s workers."

Thursday

"Starbucks CEO Howard Schultz, activist investor Bill Ackman, Goldman Sachs CEO Llyod Blankfein and others will speak at The New York Times’ Dealbook conference."

Friday

"Bond markets are closed for Veteran’s Day. The stock market will keep its normal hours."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.09 07:49

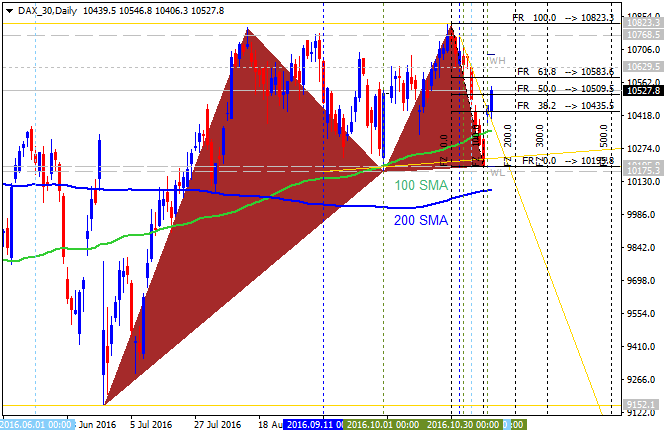

German DAX - from bear market rally to the bullish reversal irrespective off the analytics forecasts (adapted from the article)

Some analytics are forecasting for Dax Index to be in bearish market condition with 10,000 strong support level as a nearest bearish target for the price to be bounced to above:

"DAX is turning strongly to the downside from a new high, so we believe that index is trapped in a new corrective pattern; a very complex one that can either be an Elliott Wave flat or an Elliott Wave triangle. As things stands at the moment, we favor the flat that is pointing down for wave five of C which could then form a bottom at 10000-10100 area."

But, anyway, the intra-day H4 price was bounced from 10,195 support level to above for the breakout as a bear market rally. For now, the price is testing 10,583 resistance level to above for the bullish reversal to be started.

Daily price broke 100-day SMA/200-day SMA reversal area to above to be reversed to the primary bullish market condition. The price is breaking 50.0% Fibo level at 10,509 to above for the primary bullish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.09 08:17

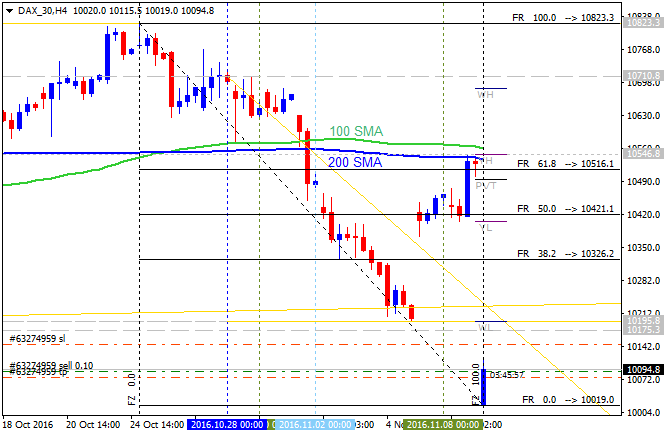

Market opened with some interesting situation: H4 price was bounced from 100 SMA/200 SMA reversal levels to below for 10,019 support level to be testing for the bearish breakdown to be continuing. So, it means that analytics was right concerning Dax price movement:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.17 14:57

Intra-Day Fundamentals - EUR/USD, S&P 500 and Dax Index: U.S. Consumer Price Index and Residential Building Permits2016-11-17 13:30 GMT | [USD - CPI]

- past data is 0.3%

- forecast data is 0.4%

- actual data is 0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

2016-11-17 13:30 GMT | [USD - Building Permits]

- past data is 1.23M

- forecast data is 1.19M

- actual data is 1.23M according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From official reports:

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.6 percent before seasonal adjustment."

==========

EUR/USD M5: 38 pips range price movement by CPI and Building Permits news events

==========

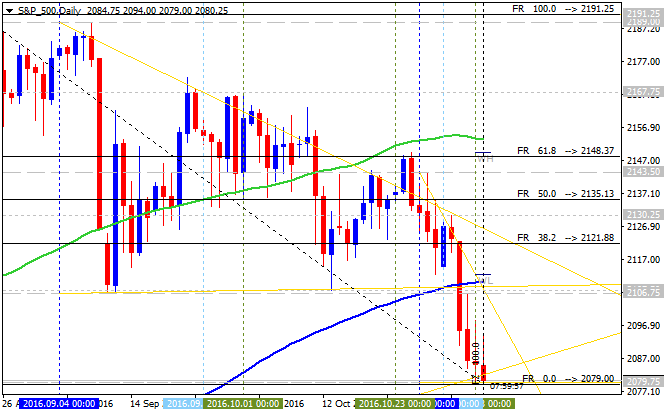

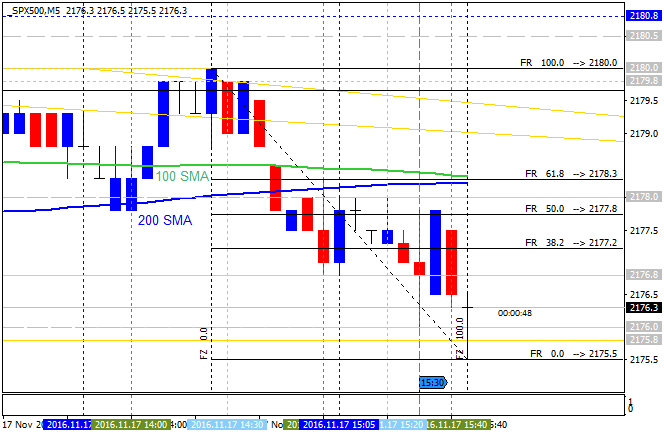

S&P 500 M5: range price movement by CPI and Building Permits news events

==========

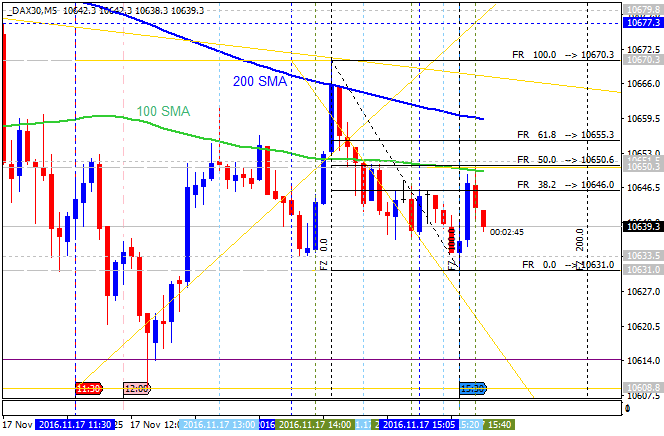

Dax Index M5: range price movement by CPI and Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.23 15:35

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: U.S. Durable Goods Orders

2016-11-23 13:30 GMT | [USD - Durable Goods Orders]

- past data is -0.3%

- forecast data is 1.2%

- actual data is 4.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From Market Watch article: Durable-goods orders see jet-fueled 4.8% gain in October

- "Orders for long-lasting goods made in the U.S. soared 4.8% in October largely because of stronger demand for commercial aircraft, but business investment is still not showing much spark."

- "Although these orders have picked up slightly in the fall, they are 4% lower compared to a year ago. Businesses have skimped on investment for years, undermining the ability of the U.S. economy to break out of a straitjacket that has limited it to 2% annual growth or less."

==========

EUR/USD M5: 49 pips range price movement by Durable Goods Orders news events

==========

GOLD (XAU/USD) M5: bearish price movement by Durable Goods Orders news events

==========

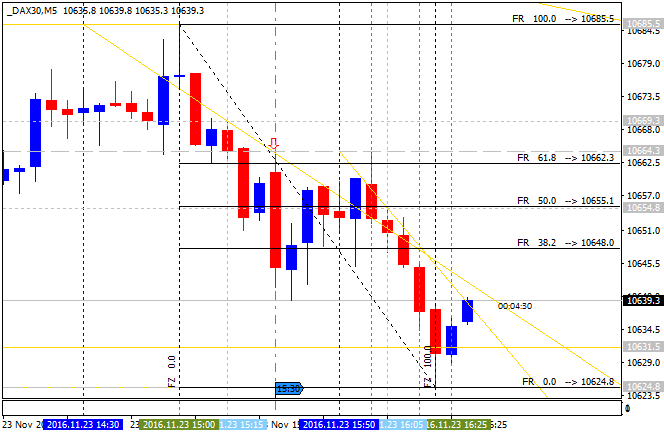

Dax Index M5: range price movement by Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.29 18:23

Intra-Day Fundamentals - EUR/USD, GOLD (XAU/USD) and Dax Index: The Conference Board Consumer Confidence

2016-11-29 15:00 GMT | [USD - CB Consumer Confidence]

- past data is 100.8

- forecast data is 101.3

- actual data is 107.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report:

"The Conference Board Consumer Confidence Index®, which had declined in

October, increased significantly in November. The Index now stands at

107.1 (1985=100), up from 100.8 in October. The Present Situation Index

increased from 123.1 to 130.3, while the Expectations Index improved

from 86.0 last month to 91.7."

==========

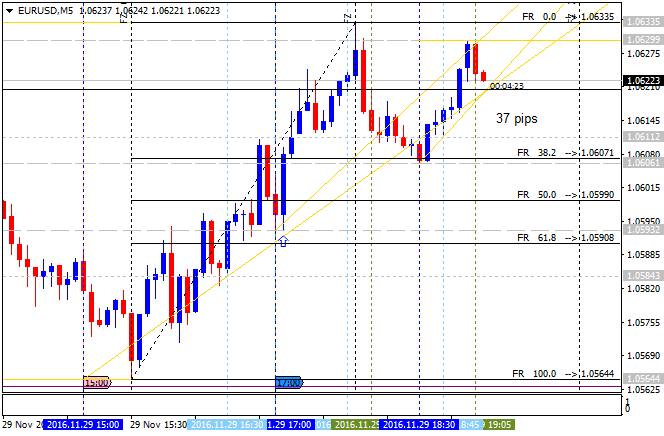

EUR/USD M5: 37 pips range price movement by CB Consumer Confidence news events

==========

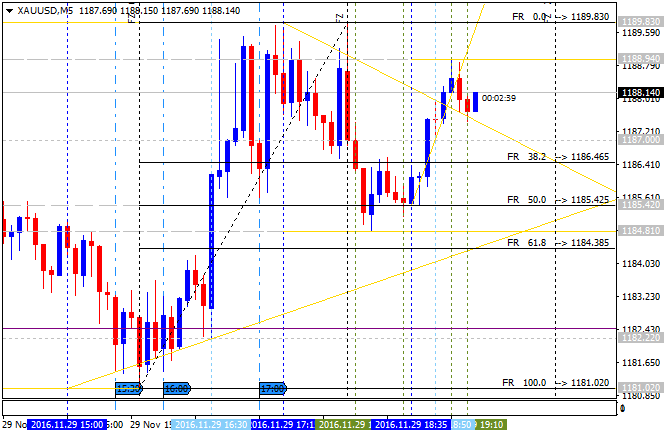

XAU/USD M5: range pips price movement by CB Consumer Confidence news events

==========

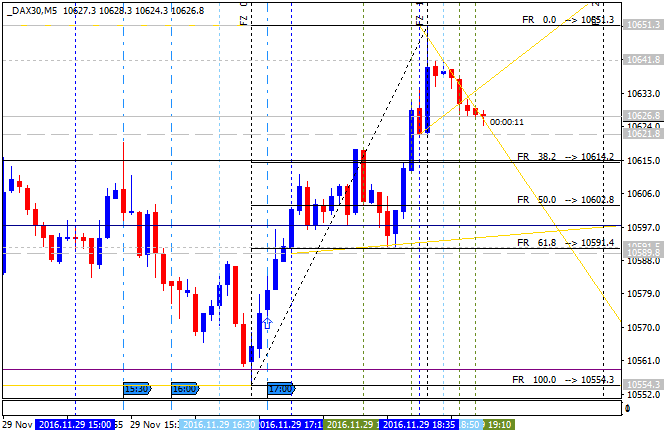

Dax Index M5: range pips price movement by CB Consumer Confidence news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

DAX Index October-December 2016 Forecast: ranging inside Ichimoku cloud waiting for direction of the trend

W1 price was on the local uptrend as a bear market rally within the primary bearish market condition: the price came to the Ichimoku cloud from below andSenkou Span line of Ichimoku indicator was tested from inside the cloud to above for the bullish reversal to be started. But the price was finally bounced from Senkou Span back to the Ichimoku cloud for the ranging bearish market condition. For now, the price is located near and below Senkou Span and 10,803 resistance level for the bullish reversal to be started or for the ranging bearish trend to be continuing.

Chinkou Span line is located above the price indicating the ranging condition, and Absolute Strength indicator is estimating the trend to be ranging as well in the future. By the way, Tenkan-sen line is above Kijun-sen line for the possible bullish reversal in the near future for example.

Trend:

W1 - ranging for direction of the trend to be started