Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.17 11:59

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/CNH and GOLD (based on the article)

AUD/USD - "Although Fed officials have claimed that every policy meeting may produce a rate hike, their clear desire not to trigger market panic suggests that they will not opt to change things without an opportunity to thoroughly explain in detail. This means that after this week’s outing, the next opportunity for stimulus withdrawal comes in December. Between now and then, another opportunity to update traders will come in November, offering the FOMC a chance to up- or down-shift the projected rate hike path and limit surprise risk. Keeping this flexibility will mean that the narrative emerging from the upcoming announcement will need to be cautious but unmistakably hawkish. This bodes ill for risk appetite as well as the Aussie’s yield advantage, threatening to deliver the currency a third consecutive weekly loss."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 07:26

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Meeting Minutes and 18 pips price movement

2016-09-20 01:30 GMT | [AUD - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From ABC News article:

"Interest rates are likely to remain on hold in the foreseeable future, with the Reserve Bank of Australia flagging that growth remains in line with expectations, and the RBA remains unperturbed by the housing market."

"Taking into account the recent data, and having eased monetary policy at its May and August meetings, the Board judged the current stance of monetary policy was consistent with sustainable growth in the Australian economy and achieving the inflation target over time," the Board said in its minutes.

"The Reserve Bank has an inflation target of between 2 to 3 per cent, and the rate cuts in May and August were prompted by weak inflation figures in the March and June quarters."

==========

AUD/USD M5: 18 pips price movement by RBA Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 15:14

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Residential Building Permits

2016-09-20 12:30 GMT | [USD - Building Permits]

- past data is 1.14M

- forecast data is 1.17M

- actual data is 1.14M according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From Business Insider article:

U.S. housing starts fell more than expected in August as building activity declined broadly after two straight months of solid increases, but a rebound in permits for single-family dwellings suggested demand for housing remained intact.

Groundbreaking decreased 5.8 percent to a seasonally adjusted

annual pace of 1.14 million units, the Commerce Department said

on Tuesday. July's starts were unrevised at a 1.21 million-unit

pace.

Permits for future construction slipped 0.4 percent to a 1.14 million-unit rate last month as approvals for the volatile multi-family homes segment tumbled 7.2 percent to a 402,000 unit-rate. Permits for single-family homes, the largest segment of the market, surged 3.7 percent to a 737,000-unit pace.

Economists polled by Reuters had forecast housing starts falling to a 1.19 million-unit pace last month and building permits rising to a 1.17 million-unit rate.

==========

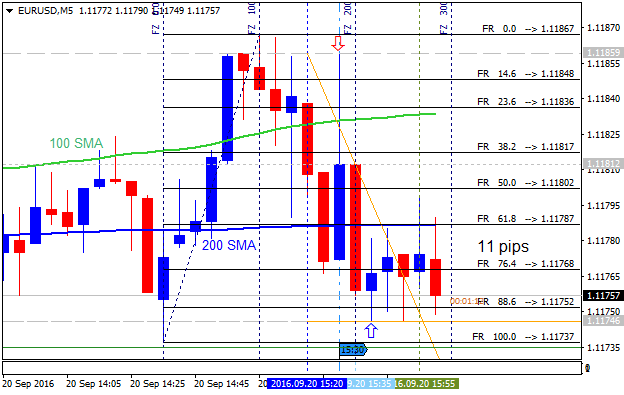

EUR/USD M5: 11 pips range price movement by U.S. Building Permits news events

==========

USD/CAD M5: 20 pips price movement by U.S. Building Permits news events

==========

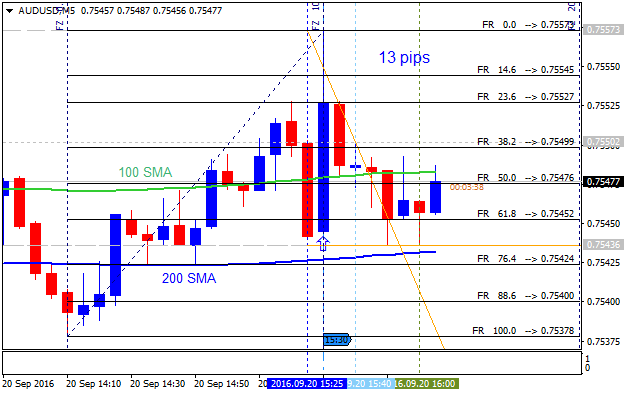

AUD/USD M5: 13 pips price movement by U.S. Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.21 20:48

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: FOMC Statement and Federal Funds Rate

2016-09-21 18:00 GMT | [USD - Federal Funds Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From ft article: Fed fund futures see 60% chance of 2016 rate hike"Fed fund futures, contracts that investors use to bet on interest rate movements, imply that there is a 60 per cent chance of a hike at the December meeting, up slightly from 59 per cent ahead of today’s decision, reports Robin Wigglesworth in New York."

==========

EUR/USD M5: 61 pips range price movement by Federal Funds Rate news events

==========

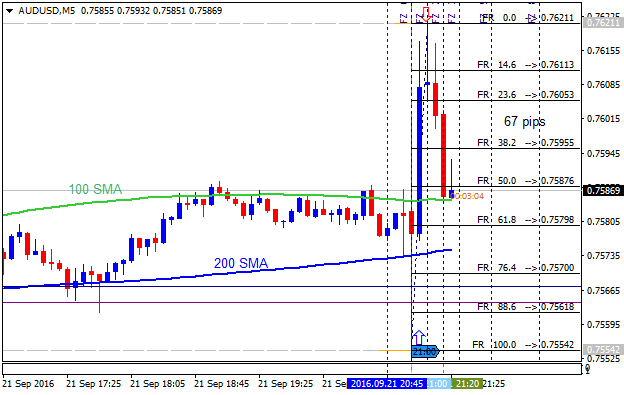

AUD/USD M5: 67 pips range price movement by Federal Funds Rate news events

==========

USD/CAD M5: 93 pips range price movement by Federal Funds Rate news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.22 09:08

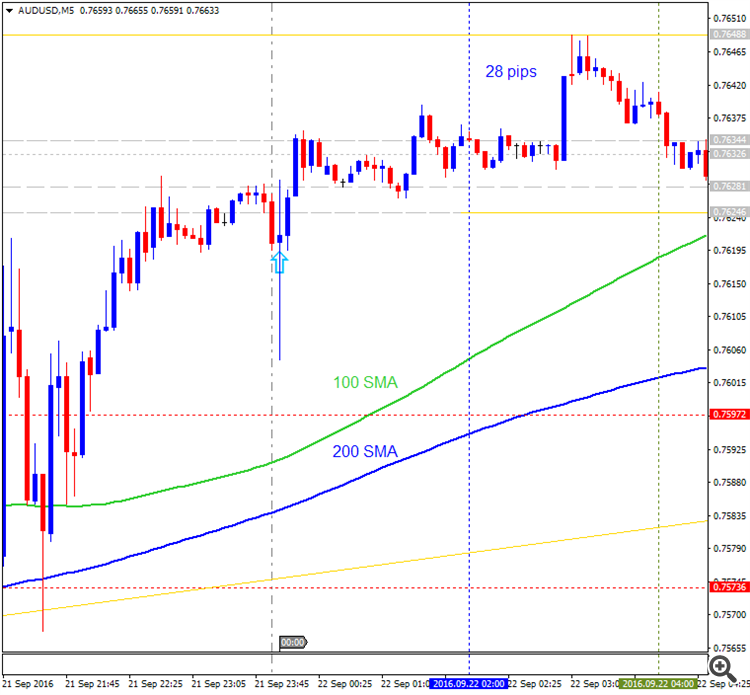

AUD/USD Intra-Day Fundamentals: RBA Gov Lowe Speaks and 28 pips range price movement

2016-09-22 00:00 GMT | [AUD - RBA Gov Lowe Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[AUD - RBA Gov Lowe Speaks] = Opening Statement to the House of Representatives Standing Committee on Economics, in Canberra

==========

From SBS article: RBA governor Philip Lowe says a lower Australian dollar would be helpful to amplify the positive effects of its falls in recent years

A lower Australian dollar would be helpful in amplifying the economic benefits of its recent falls, Philip Lowe has said at his first appearance as Reserve Bank governor.

"Of course most central banks say the same thing - most people would like a slightly lower exchange rate and I think it reflects the deficiency in aggregate demand in the global economy," Mr Lowe told a hearing of the House of Representatives economic committee in Sydney.

"Many of my peers think the same, but of course we can't all have a lower exchange rate," he said.

==========

AUD/USD M5: 28 pips range price movement by RBA Gov Lowe Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.22 14:51

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Jobless Claims

2016-09-22 12:30 GMT | [USD - Unemployment Claims]

- past data is 260K

- forecast data is 261K

- actual data is 252K according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From MarketWatch article: Jobless claims fall to lowest level since July- "Initial claims for U.S. unemployment-insurance benefits fell to the lowest tally since July, signaling a strong labor market, according to government data released Thursday."

- "The number of people who applied for U.S. unemployment-insurance benefits fell by 8,000 to 252,000 in the week that ended Sept. 17, the Labor Department reported."

- "That is the lowest level since mid-July and only modestly above the four-decade low of 248,000 hit in April."

- "The government said there were no special factors in the report. This marks 81 weeks that initial claims are below the key 300,000 level, the longest streak since 1970."

- "Economists polled by MarketWatch had expected the government to report that initial claims for regular state unemployment-insurance benefits would be just about unchanged in the week that ended Sept. 17, from the 260,000 in the prior week."

- "Longer-run trends also showed improvement, with the four-week average of new claims falling 2,250 to 258,500."

- "Economists say few layoffs alongside steady hiring rates implies that solid payroll employment growth lies ahead."

- "Fed Chairwoman Janet Yellen said Wednesday at her quarterly press conference that data suggests the labor market still has more room to improve without overheating the economy. That gives the Fed the ability to hold interest rates steady, she said."

==========

EUR/USD M5: 7 pips range price movement by U.S. Jobless Claims news events

==========

AUD/USD M5: 8 pips price movement by U.S. Jobless Claims news events

==========

USD/CAD M5: 11 pips range price movement by U.S. Jobless Claims news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

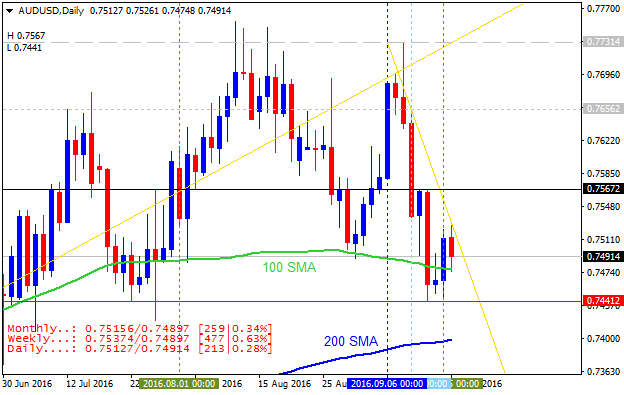

Daily price is located inside Ichimoku cloud for the ranging market condition. The price is traded near and above Senkou Span line of Ichimoku indicator which is the virtual border between the primary bearish and the primary bullish trend on the chart within the following support/resistance levels:

Absolute Strength indicator is estimating the ranging trend to be continuing, and Trend Strength indicator is evaluating the future possible trend as a bearish condition to be started.

If D1 price breaks 0.7441 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started with 0.7420 target to re-enter.If D1 price breaks 0.7656 resistance level on close bar from below to above so the bullish trend will be resumed.

If not so the price will be on ranging within the levels.

SUMMARY : ranging on bearish reversal

TREND : ranging