Trading the Break (adapted from dailyfx article)

- Breakouts emanate from range-bound markets as new information pushes prices higher or lower.

- These breaks can often be accompanied with increased volatility that can prove devastating

- Risk-Reward ratios are of the upmost importance, so traders can mitigate the damage of false breakouts while maximizing the reward of successful entries.

Since future price movements are, in essence, unpredictable; identifying

with and trading in the direction of the trend gives the trader the

chance to jump on the side of any bias that may have been seen in the

market. And if those biases (trends) are to continue, the trader can

potentially make three, four, or five times the amount they put up to

risk.

Unfortunately, trends don’t always exist. More common is the condition with which prices aren’t displaying some element of a bias; when prices move in a range-bound fashion for an extended period of time. And because there is a lack of a bias, knowing how to trade in these situations can be quite a bit more difficult. But traders have two choices: They can trade as if the range is going to continue, or they can trade the range in the expectation of a breakout of those range-bound prices.

Breakouts

When prices do break-out from a range, the movement can be fast,

violent, and extremely large. Imagine a rubber band being pulled all the

way back, until eventually it pops; that’s somewhat similar to what can

happen when a breakout takes place.

Trading a breakout is not for the faint of heart. Often the breakout

will come from a news event, or a data announcement, or some other

reason that causes traders to push prices being the previously defined

support and resistance levels.

It often takes more than one attempt to catch a breakout

It’s this extreme pickup in volatility that makes trading breakouts so

difficult; as the accompanying price movements can swing dangerously in

both directions, and there will be many instances in which support

and/or resistance get broken, only to see prices reverse and move in the

opposite direction. This is the dreaded ‘false breakout.’

Because of the heightened volatility around such events, and given the

risk of false breakouts; traders often need to focus more heavily on

risk and reward while being more aggressive: cutting losers even quicker

while also looking for larger profit targets when they find themselves

on the right side of the trade.

Probabilities

Traders will often assign a lower probability of success to breakout

strategies because of the aforementioned reasons. If a trader thinks

they can usually win 1 out of every two trend trades, they will often

look to win 1 of every 4 breakout trades.

And because breakouts have a lower probability of success, traders need to adjust risk-reward ratios accordingly: Looking at even tighter stops, and even larger profit targets.

So, we’ve warned you against the risks of trading breakouts; a logical

question that follows is often ‘why would anyone trade breakouts when

there might be a trend somewhere that can be traded?’

Well, the beauty of the breakout is in the potential. When a breakout

does work, the upside can potentially be huge (just like the downside is

huge, but can be addressed or offset with tighter stops).

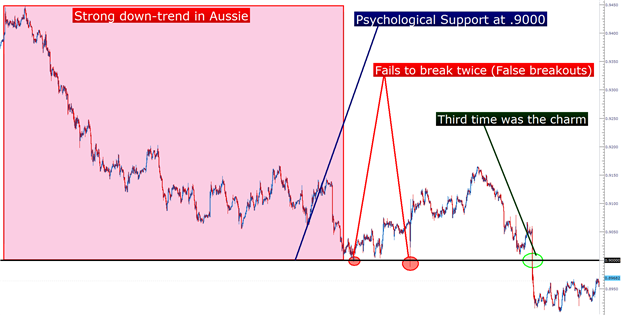

New trends often form from an initial breakout; and this is a very natural life-cycle in financial markets. Let’s look at an example to illustrate

How to Trade Breakouts

The key ingredient to trading a breakout is Support and/or Resistance.

These levels that may see changes in order flow are the same prices that

traders can look to enter upon breaks.

Pivot Points are an extremely common option for breakout traders.

Traders can look to these price levels for potential breakout moves,

while placing entry orders just outside of these prices so that once a

pivot point yields to a price surge, the entry is initiated and the

trader is in the position.

Another common option for trading breakouts is including the Price

Channels indicator (often called ‘Donchian Channels,’ after famed

breakout-trader Richard Donchian). Price Channels will show the highest

high, and the lowest low over the past x periods (x being the number of

candles input by the trader). When prices approach these levels, they

may go on to make higher highs, or lower lows; and this is the essence

of a breakout entry.

The same type of logic can be utilized around psychological whole

numbers, or round levels like 1.3500 on EURUSD or .9000 on AUDUSD. These

round-number price levels will often see a large number of stops or

limits, and this can stop a trend dead in its tracks, at least

temporarily. But when a subsequent approach towards that level takes

place, the number of stops or limits may not be able to hold back the

surge of selling (or buying in the case of an up-trend).

This leads to one of the more common ways of trading breakouts;

incorporating price action and previous market movements into the

analysis.

I've been using Dserg for a few days and it seems good to me; I think a warning would be useful when a Sell or Buy signal intervenes; how can you do it to insert it?

Greetings and thanks.

Roberto

Hi Nikolay

The indicator works really well on a live chart but when testing in the Startegy Tester it doesn't paint the arrows, something seems to be wrong with the way the Linear Regression is drawn. I've also tried to use it with iCustom in an EA and the painting is incorrect.

Any ideas how this could be fixed?

Hi Nikolay

The indicator works really well on a live chart but when testing in the Startegy Tester it doesn't paint the arrows, something seems to be wrong with the way the Linear Regression is drawn. I've also tried to use it with iCustom in an EA and the painting is incorrect.

Any ideas how this could be fixed?

Hi, I solved this bug adding a refresh function at the beggining of every bar.

Here is what I changed at the very last lines of the code:

Before:

if(!j) { B3_Buffer[barj]=res2; B4_Buffer[barj]=res3; } B0_Buffer[barj]=res2; B1_Buffer[barj]=res3; } } } //---- return(rates_total); } //+------------------------------------------------------------------+

After:

if(!j) { B3_Buffer[barj]=res2; B4_Buffer[barj]=res3; } B0_Buffer[barj]=res2; B1_Buffer[barj]=res3; } } } //---- int timeBar = timeBar(); if(timeBar == true) ChartSetSymbolPeriod(ChartID(), _Symbol, PERIOD_M1); return(rates_total); } datetime newTime = 0; bool timeBar() { datetime lastBar = iTime(_Symbol, _Period, 0); if(newTime != lastBar) { newTime = lastBar; return true; } else return false; } //+------------------------------------------------------------------+

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dserg - LinRegression Breakout:

The indicator for automatic drawing of consolidation areas and channels based on the linear regression

Fig.1 Dserg - LinRegression Breakout

Author: Nikolay Kositsin