You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.19 08:32

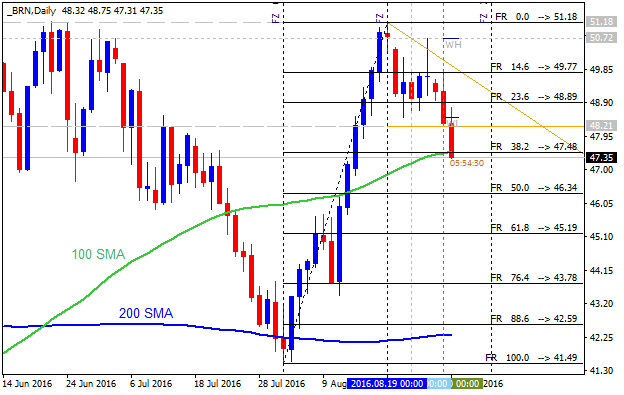

Crude Oil Price Action Analysis - Fibo resistance level to be breakign for the bullish trend to be continuing (adapted from the article)

Daily price is on bullish market condition located above 200 period SMA and 100 period SMA: the price is breaking Fibo resistance level at 51.16 for the bullish trend to be continuing with 52.82 as a nearest daily target.

"After failing at the topchannel in June, the price quickly dropped down to a pre-identified zone provided by the median line and the Fibonacci Retracement levels in focus between $41.85-$35.22/bbl. Key support that would deflate the confidence of the 22%+ August trend would be a break below the higher-low of $41.27/bbl from August 11."If the price breaks Fibo support level at 41.49 to below so the bearish reversal will be started.

If the price breaks Fibo support level at 47.47 to below so we may see the local downtrend as the secondary correction.

If the price breaks Fibo resistance level at 51.16 from below to above so the primary bullish trend will be continuing with 52.82 as a nearest daily target..

If not so the price will be on bullish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: intra-day bearish breakdown, daily correction

2016-08-24 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.5 million barrels from the previous week."

==========

Crude Oil M5: bearish breakdown. The price broke 100 SMA/200 SMA for the breakdown to the bearish area of the chart: price broke 100 SMA/200 SMA reversal area for the primary bearish market condition with 48.85 support level as a nearest intra-day bearish target.If the price breaks 49.46 resistance level so the reversal of the intra-day price movement from the primary bearish to the primary bullish market condition will be started.

If the price breaks 48.85 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: bullish ranging or correction to be started. The price is above 100 SMA/200 SMA reversal area in the bullish are of the chart: price is on ranging within 51.18 resistance level and 41.49 support level.If the price breaks 51.18 resistance on close daily bar so the primary bullish trend will be continuing.

If the price breaks 41.49 support level on close daily bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: intra-day bearish breakdown, daily ranging correction

2016-08-31 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.3 million barrels from the previous week."

==========

Crude Oil M5: bearish breakdown. The price was bounced from 100 SMA to below for the bearish breakdown:

If the price breaks 48.33 resistance level so the reversal of the intra-day price movement to the primary bullish market condition will be started.If the price breaks 47.31 support so the intra-day primary bearish trend will be continuing.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: daily correction. The price is breaking descending triangle pattern together with 48.21 support level to below for the daily correction. The price is testing 100 SMA value at 47.48 to below for the correction to be continuing in the secondary ranging way.

If the price breaks 51.18 resistance on close daily bar so the primary bullish trend will be resumed.If the price breaks 47.48 support level on close daily bar so the secondary correction within the primary bullish trend will be continuing.

If the price breaks 41.49 support level on close daily bar so the primary ebarish reversal will be started.

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.02 08:48

Play Oil Game: Infuriating News (based on the article)

Brent Crude oil is on intra-day bearish breakdown by crossing 100 SMA/200 SMA levels to below for the reversal of the price movement to the primary bearish market condition.

If H4 price breaks 45.30 support level to below so the bearish breakdown will be continuing.

If H4 price breaks 48.01 resistance level to above on close bar so the bullish trend will be resumed.

If not so the price will be on ranging within the level.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.08 17:25

U.S. Commercial Crude Oil Inventories news event: intra-day bullish breakout, daily bullish trend to be resumed

2016-09-08 15:00 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 14.5M million barrels from the previous week."

==========

Crude Oil M5: bullish breakout. The price was bounced from 100 SMA/200 SMA area to above for the bullish breakout. Price is on testing 49.83 resistance level for the bullish trend to be continuing.If the price breaks 49.83 resistance level on close M5 bar so the bullish market condition will be continuing.

If the price breaks 48.57 support level to below on close M5 bar so the reversal of the intra-day price movement from the bullish to the bearish market condition will be started.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: key resistence level to be broken for the daily bullish to be resumed. The price is above 100 SMA/200 SMA reversal area in the bullish are of the chart: price is testing 49.77 resistance level for the bullish trend to be resumed with 51.18 asa a nearest daily target.If the price breaks 49.77 resistance on close daily bar so the primary bullish trend will be continuing.

If the price breaks 45.19 support level on close daily bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If the price breaks 42.59 support level on close daily bar so we may see the reversal of the price movement from the primary bullish to the primary bearish market condition.

If not so the price will be on bullish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: intra-day ranging, daily correction

2016-09-14 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.6 million barrels from the previous week."

==========

Crude Oil M5: ranging on reversal. The price is on ranging near 100 SMA/200 SMA area for the direction of the trend to be started.If the price breaks 47.27 resistance level so the reversal of the intra-day price movement from the primary bearish to the primary bullish market condition will be started.

If the price breaks 45.98 support so the intra-day primary bearish trend will be resumed.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: ranging correction. The price is located above 200 SMA in the primary bullish area of the chart: price broke 100 SMA to below for the secondary correction to be started within the primary bullish market condition.If the price breaks 51.18 resistance on close daily bar so the primary bullish trend will be resumed.

If the price breaks 41.49 support level on close daily bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.

U.S. Commercial Crude Oil Inventories news event: intra-day ranging bullish, daily ranging for direction

2016-09-21 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.2 million barrels from the previous week."

==========

Crude Oil M5: ranging on the bullish area. The price is on ranging near 100 SMA and above 200 SMA area for the bullish trend to be resumed or for the bearish reversal to be started.If the price breaks 47.08 resistance level so the primary bullish trend will be resumed.

If the price breaks 46.48 support so the reversal of the intra-day price movement from the ranging bullish to the primary bearish market condition will be started.

If not so the price will be on ranging within the levels.

==========

Crude Oil Daily: ranging for direction. The price is located within 100 SMA/200 SMA ranging area ranging for the direction of the trend to be started.

If the price breaks 48.13 resistance on close daily bar so the primary bullish trend will be resumed.

If the price breaks 45.07 support level on close daily bar so the local downtrend as the secondary correction within the primary bullish trend will be continuing.

If the price breaks 41.49 support level on close daily bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.