Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.15 15:13

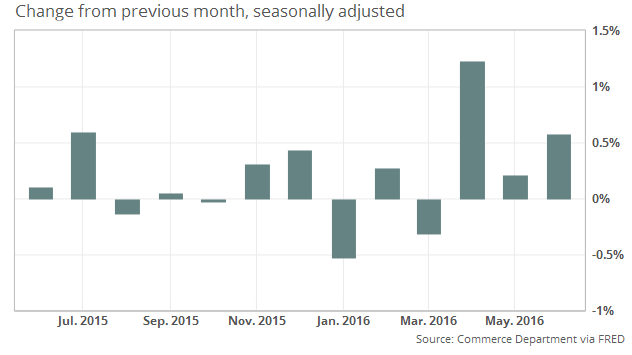

Intra-Day Fundamentals: U.S. Consumer Price Index and Advance Retail Sales

2016-07-15 12:30 GMT | [USD - CPI]

- past data is 0.2%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

- "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.0 percent before seasonal adjustment."

- "For the second consecutive month, increases in the indexes for energy and all items less food and energy more than offset a decline in the food index to result in the seasonally adjusted all items increase. The food index fell 0.1 percent, with the food at home index declining 0.3 percent. The energy index rose 1.3 percent, due mainly to a 3.3-percent increase in the gasoline index; the indexes for natural gas and electricity declined."

==========

2016-07-15 12:30 GMT | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.1%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

"Sales at U.S. retailers rose 0.6% in June, led by a surge in spending at home-and-garden centers and online stores, the government said Friday. Economists surveyed by MarketWatch had forecast a 0.1% increase. Stronger retail sales in June adds to evidence of a sharp rebound in U.S. growth in the recently ended second quarter."

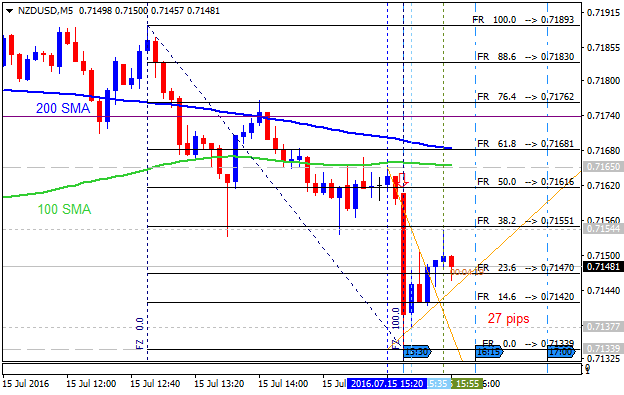

NZD/USD M5: 27 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

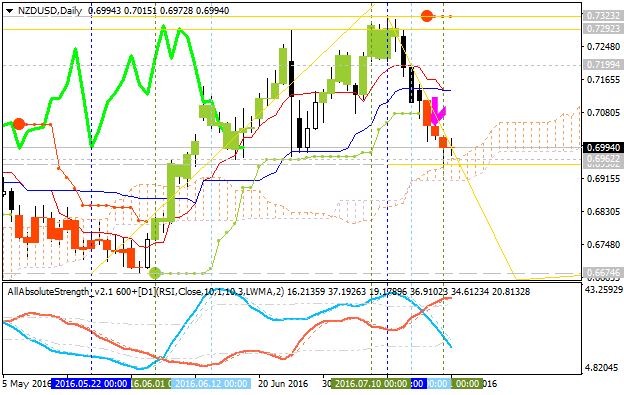

M5 intra-day price is on bearish breakdown: the price broke key support levels with 0.7133 level to be tested to below for the bearish trend to be continuing. Symmetric triangle pattern was formed by the price to be crossed for the direction:

if the price breaks 0.7133 support level to below so the bearish trend will be continuing;

if the price breaks Daily Pivot at 0.7174 to above so the bullish reversal will be started;

if not so the price will be on ranging for direction.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.16 11:34

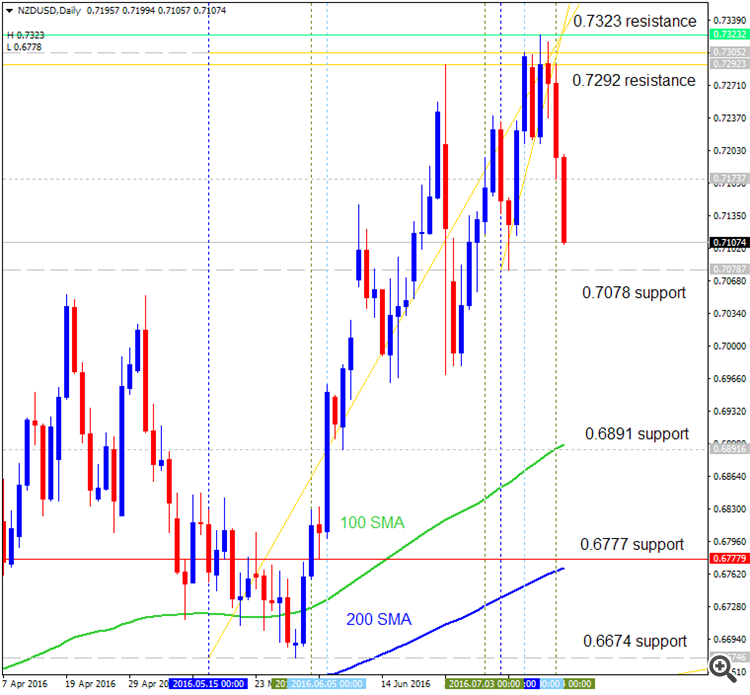

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CAD, USD/JPY, NZD/USD, AUD/USD, USD/CNH and GOLD (based on the article)

NZD/USD - "The recent China GDP could align with a further flight of global capital into New-Zealand’s Bond Market. While the correlation is messy, NZ 10-Yr Bonds have seen their yield fall (Yields trade inversely to price) over the last 3-months from 2.89% down to 2.21 % this week. That is a fall of ~25% in yields as the hunt for yield may have found a friend in the New Zealand Bond Market. Ironically, this may put further pressure on the RBNZ to hold or even discuss raising rates if the property price appreciation gets too far out of hand, as many argue it already has."

Daily price is located to be above 100 SMA/200 SMA reversal zone in the primary bullish area of the chart. The price is on ranging within 'bullish continuation' resistance level at 0.7323 and support level at 0.7078.

If the price breaks 0.7323 resistance to above on close daily bar so the primary bullish trend will be continuing.

If the price breaks 0.7078 support level on close daily bar so the secondary correction within the primary bullish trend will be started.

If the price breaks 0.6777 support to below so we may see the reversal of the price movement to the rpimary bearish market condition.

If not so the price will be on bullish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.18 07:43

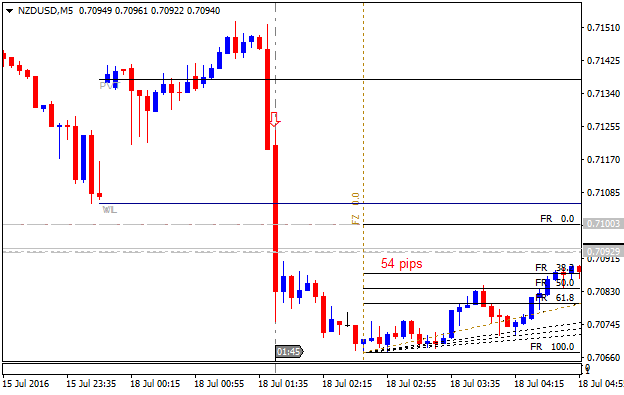

NZD/USD Intra-Day Fundamentals: New Zealand CPI and and 54 pips price movement

2016-07-17 22:45 GMT | [NZD - CPI]

- past data is 0.4%

- forecast data is 0.5%

- actual data is 0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers.

==========

- The consumers price index (CPI) rose 0.4 percent – to a level of 1205.

- Petrol prices rose 5.3 percent, making the largest upwards contribution.

- Housing-related prices rose, with purchase of new housing excluding land up 2.1 percent.

- Prices for tradable goods and services rose 0.6 percent, while prices for non-tradable goods and services rose 0.3 percent.

- After seasonal adjustment, the CPI rose 0.2 percent.

==========

NZD/USD M5: 54 pips price movement by New Zealand CPI news event

Next Week Forecast: the most interesting pair you can make money with - NZD/USD

NZD/USD: breakdown with the bearish reversal. The pair is on secondary correction within the primary bullish condition with 0.6950 support level to be testing to below for the reversal of the price movement to the primary bearish market condition. The price is located within the following key support/resistance levels:

- 0.7292 resistance level located far above Ichimoku cloud on the primary bullish area of the chart, and

- 0.6950 support level located near Senkou Span line of Ichimoku indicator in the beginning of the bearish trend to be started.

Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be started.

There are 2

simple scenarios for the price movement for the week:

- breakdown with the bearish reversal in case the price breaks 0.6950 support on close daily bar,

- or the bullish ranging within the levels.

Chinkou Span line is crossing the price to below on open daily bar for the possible daily breakdown.

| Resistance | Support |

|---|---|

| 0.7292 | 0.6950 |

| 0.7323 | 0.6674 |

Forum on trading, automated trading systems and testing trading strategies

Asif Naveed, 2016.07.27 12:02

TENDENCY FOR THE WEEK TENDENCY FOR THE MONTH JULY 27, 2016

DECLINE BEARISH

| NZD/USD Intraday: caution. | |

| Pivot: 0.7050 Our preference: short positions below 0.7050 with targets @ 0.6995 & 0.6970 in extension. Alternative scenario: above 0.7050 look for further upside with 0.7085 & 0.7125 as targets. Comment: the RSI is mixed and calls for caution. Supports and resistances: 0.7125 *** 0.7085 *** 0.7050 *** 0.7043 Last 0.6995 *** 0.6970 *** 0.6945 *** Copyright 1999 - 2016 TRADING CENTRAL | |

| KEY LEVELS 0.7125 0.7085 0.7050 0.7043 0.7050 0.6995 0.6970 0.6945 | COMMENTS Resistance Resistance Resistance Last Pivot Support Support Support |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.03 15:31

Intra-Day Fundamentals - EUR/USD, AUD/USD, NZD/USD and USD/CNH: ADP Non-Farm Employment Change

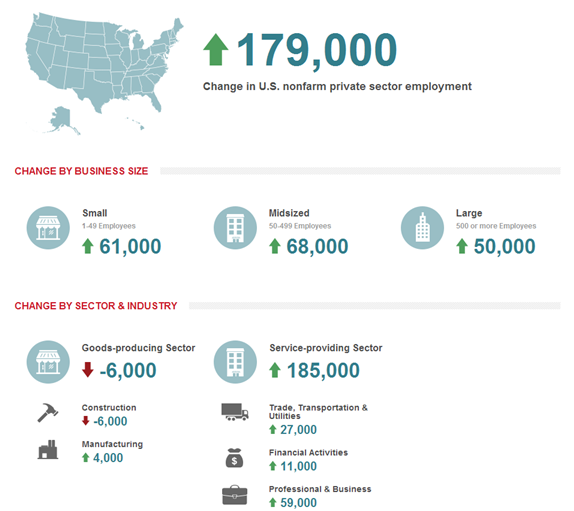

2016-08-03 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 176K

- forecast data is 171K

- actual data is 179K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

NZD/USD M5: 18 pips price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.09 14:45

Staying USD Bearish - Morgan Stanley (based on the article)

- "As long as US inflation expectations remain low, the Fed is unlikely to raise rates early."

- "Hence, the Fed is likely to stay behind the curve, suggesting US real yields coming down again. However, it is not only the Fed which makes us USD-bearish."

NZD/USD: unreasonable ranging.

The pair is located to be above 100 SMA/200 SMA reversal on the bullish area of the chart. price is on ranging within key support/resistance levels for the bullish trend to be continuing or for the secondary correction to be started.

- if the price breaks 0.7255 resistance so the primary bullish trend will be continuing with 0.7323 daily target to re-enter;

- if the price breaks 0.7060 support level so the secondary correction within the rpimary bullish trend will be started;

- if not so the price will be mon bullish ranging within the levels.

| Resistance | Support |

|---|---|

| 0.7255 | 0.7060 |

| 0.7323 | N/A |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.11 06:47

NZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 155 pips range price movement

2016-08-10 21:00 GMT | [NZD - Official Cash Rate]

- past data is 2.25%

- forecast data is 2.00%

- actual data is 2.00% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

==========

"The Reserve Bank today reduced the Official Cash Rate (OCR) by 25 basis points to 2.0 percent."

"Global growth is below trend despite being supported by unprecedented levels of monetary stimulus. Significant surplus capacity remains across many economies and, along with low commodity prices, is suppressing global inflation. Some central banks have eased policy further since the June Monetary Policy Statement, and long-term interest rates are at record lows. The prospects for global growth and commodity prices remain uncertain. Political risks are also heightened."

"Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is significantly higher than assumed in the June Statement. The high exchange rate is adding further pressure to the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. This makes it difficult for the Bank to meet its inflation objective. A decline in the exchange rate is needed."

==========

NZD/USD M5: 155 pips range price movement by RBNZ Official Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.12 07:10

NZD/USD Intra-Day Fundamentals: New Zealand Retail Sales and 31 pips range price movement

2016-08-11 22:45 GMT | [NZD - Retail Sales]

- past data is 1.0%

- forecast data is 1.0%

- actual data is 2.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

- "The total volume of retail sales rose 2.3 percent."

- "The total value of retail sales rose 2.2 percent."

- "Both total volumes and values recorded their largest dollar-value increases in the series."

- "Twelve of the 15 industries had higher sales in both volumes and values."

- "The hardware, building, and garden supplies industry had the largest volume and value sales increases."

==========

NZD/USD M5: 31 pips range price movement by New Zealand Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.13 06:39

Weekly Outlook: 2016, August 14 - August 21 (based on the article)

Japan GDP data, inflation figures from the UK and the US, Employment data from the UK the US, New Zealand and Australia, US FOMC Meeting Minutes release and Manufacturing Index. These are the highlights on forex calendar.

- Japan GDP data: Sun, 23:50. GDP growth in the second quarter is expected to be 0.2%.

- UK inflation data: Tuesday, 8:30. UK CPI forecast for July is expected to be 0.5%.

- Eurozone German ZEW Economic Sentiment: Tuesday, 9:00. German investor moral is expected to reach 2.1 in July.

- US Building Permits: Tuesday, 12:30. The number of permits os expected to rise to 1.16 million-unit pace.

- US CPI: Tuesday, 12:30. US inflation is expected to remain flat in July.

- NZ Employment data: Tuesday, 22:45. New Zealand’s job market is expected a gain of 0.6% in the second quarter while the unemployment rate is forecasted to decline to 5.3%.

- UK Employment data: Wednesday, 8:30. The number of unemployed is expected to grow by 5,200 this time.

- US Crude Oil Inventories: Wednesday, 14:30.

- US FOMC Meeting Minutes: Wednesday, 18:00. June’s FOMC focused on May’s poor employment report showing a small job gain of 38,000. This disappointing reading diminished any serious chance for a foreseeable rate hike. However, policymakers noted that future rate hikes will depend on improvements in the labor market as well as the Brexit vote consequences are handled. The members decided to wait for additional data before voting to raise rates.

- Australia employment data: Thursday, 1:30. The labor market is expected to expand by 10,200 jobs and the unemployment is expected to remain at 5.8%.

- US Philly Fed Manufacturing Index: Thursday, 12:30. August’s manufacturing index is expected to reach 1.4 points.

- US Unemployment claims: Thursday, 12:30. The number of new claims is expected to be 269,000 this week.

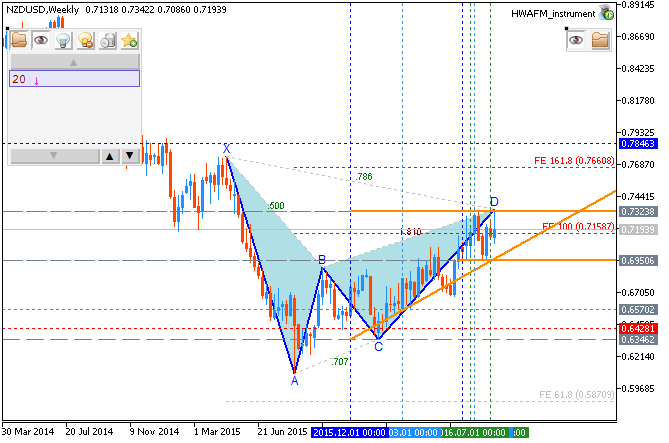

NZD/USD, W1 timeframe, bearish developing gartley pattern:

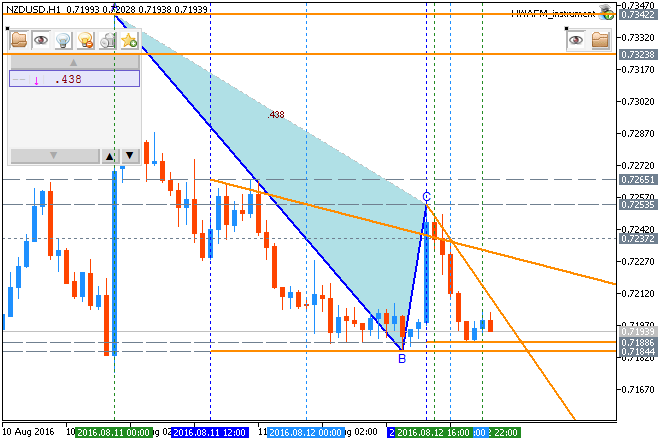

NZD/USD, H1 timeframe, bearish developing Retracement pattern:

So, seems - bearish ...

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.07 08:24

NZD/USD Intra-Day Fundamentals: RBNZ Deputy Governor Spencer Speaks and 42 pips price movement

2016-07-07 05:30 GMT | [NZD - RBNZ Deputy Governor Spencer Speaks]

[NZD - RBNZ Deputy Governor Spencer Speaks] = RBNZ Deputy Governor Spencer Speaks on Housing risks require a broad policy response.

==========

==========

NZD/USD M5: 42 pips price movement by RBNZ Deputy Governor Spencer Speaks news event :