Forum on trading, automated trading systems and testing trading strategies

Indicators: FX_Sniper_Ergodic_CCI

newdigital, 2013.12.19 07:55

- Since the July lows, GBPUSD has rallied 1671 pips in a strong uptrend.

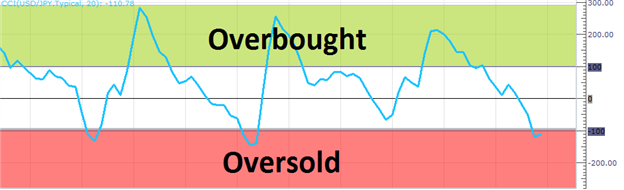

- The Commodity Channel Index (CCI) measures deviations from the moving average while showing overbought and oversold conditions

- When CCI crosses up above the -100 line, a buy signal is generated

Don’t get thrown off by the lengthy name “Commodity Channel Index” as it is not a new 24-hour cable broadcast devoted to pork bellies and soybeans; though you could use it to trade either of these. CCI is a popular indicator used by Forex traders to identify oversold and over bought conditions much in the same way that RSI or Stochastics is used. But instead of 30 and 70 representing oversold and overbought areas, CCI uses -100 and +100. Though Donald Lambert created CCI back in 1980 to identify cyclical turns in commodities it is very effective with currencies. By measuring the current price relative to the average price of a set period like 14, CCI is low during time prices are below their average and high when prices are above their average. This gives us the oversold and overbought regions.

Why is this important you

may ask? Well, it is simple. When we have a strong uptrend, the best

place to buy is at price point where traders are no longer selling or

selling pressure begins to subside. This is called being “oversold”. How

do we know when something is oversold? This is a great question too!

Forex traders have several tools and methods at their disposal to show

them when prices have fallen too far too fast and when bargain hunters

may step in sending prices higher. Candlestick

pattern, oscillators and support/resistance levels are the primary

tools. With CCI, Forex traders look to buy when CCI crosses above -100.

Similar to real estate investing, without the headache and a lot more fun, Forex traders want to buy the “worse house in the best neighborhood at the lowest price.” In our analogy, the best neighborhood is a strong trend; the “worse house” is the entry zone for our trade. Like the real estate investor, we look for the value of our holdings to increase over time. Since we have bought at a relatively low price, our risk is small relative to the potential gain. Unlike real estate fixer-uppers, Forex traders can forget remodeling as time and trend work to increase the value of the position

Trading Setup

The current trading setup below shows a GBPUSD daily chart uptrend from August 2013. The chart depicts four successful by signals given by CCI as it crossed down below the -100 line and turned up. Forex trend traders would filter out the sell signals generated when CCI crossed down below the +100 line as more pips are gained when trading with the trend than against it. In an uptrend, traders Forex Traders will take buy signals using CCI and use CCI sell signals to take profits. Waiting for CCI to turn above -100 and looking for price to confirm the move, traders will enter the market long and then place a protective stop order about 4-10 pips below the last swing low.

The Trading Plan

Currently, GBPUSD has just bounce from the 1.6220 area and CCI has generated a buy signal when it crossed above the -100 line. A stop could be placed just below that swing low for a target of 1.6671. Remember to always use stops and to only risk no more than 2% of your account equity on any trade. If the stop is hit, then we look for another trade! CCI is simple way to visually identify potential entries.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.02 18:43

Adapted from Backtesting to Find a More Reliable CCI Signal article

- CCI uses overbought and oversold levels to signal buy/sell entries.

- Only taking signals after a more extreme CCI reading could produce more reliable trades.

As traders, we should always be investigating ways to find a new edge or

to increase the edge that we already have in our strategies. When I

first began trading, this meant attempting to combine multiple

indicators together, adjusting parameters for each one, and creating

new, more complicated indicators in hopes of turning a profit. But after

my first two years of trading, I discovered that often times the

simplest strategies are the ones that give me the results I am looking

for.

Attempting to Increase Reliability

The CCI bases its signals on prices that reach extreme highs or extreme lows, and looks to take advantage of the inevitable pullback that occurs afterwards. No move will last forever, so CCI helps guide us on when the move will turn back around.

We traditionally look to enter trades when the CCI crosses under +100 or

above -100, but what if we also took into account how large the CCI

became before crossing the +/-100 level? For example, sometimes the CCI

will barely get beyond +/-100 before crossing back. But what about the

times when CCI reaches 150, 200 or even 300? Shouldn't that create a

more reliable signal for us? Because after all, the more extreme the

initial move, the more extreme the pullback could be. The image below

shows a CCI oscillator with CCI reaching levels beyond +/-100.

Testing Our Theory

To test this train of thought, we could go to the charts and manually see if there is a correlation between how far the CCI reaches and how successful each trade would have been, but that would take a very long time. Ideally, we want to look at hundreds of trades as efficiently and as quickly as possible.

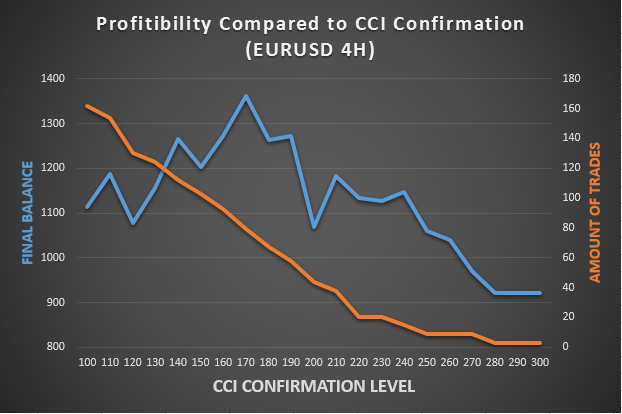

Here is a summary of all the parameters used in my backtests.

- Test account started with $1,000 and traded 1 microlot (1k) at a time.

- Tested 24 months of price data (Jan. 1st 2011 thru Dec. 31st 2012)

- Tested on EURUSD and AUDJPY.

- CCI based on 4-hour chart data

- No stops or limits. Each trade was closed when an opposing signal was given, opening a trade in the opposite direction.

- The trades were triggered when crossing below +100 or above -100, but were required to reach the Overbought/Oversold Confirmation Level before the trade triggered or else a trade would not be placed. (So in the image above, it required CCI to reach at least +/-150 before crossing back over the +/- 100 for the trade to be placed. With these settings applied, if the CCI only reached +135 and then crossed below the +100, a trade would not be placed.)

- Ran multiple backtests with Confirmation levels starting at the traditional +/- 100 as my base, and increased the Confirmation level used in increments of 10 for each additional backtest (so +/-110, +/-120, +/-130, +/-140, etc, up to +/-300).

- This gave me 21 data points to analyze.

The Results

While a traditional CCI (+/- 100) turned a $1,000 account into a $1,114

account, we can clearly see that using a confirmation level of 170

yielded much greater results, posting an ending balance of $1,362. But,

requiring larger confirmation levels led to diminishing returns,

rendering the strategy unprofitable above a confirmation level of 270.

You will also notice that as the confirmation level was increased, the

strategy placed less trades overall. This is logical sense the higher

levels of CCI are much more rare.

These results indicate that using a CCI confirmation level before

placing a trade on a CCI cross could be a viable trading strategy to

further research. Now, let's turn to the AUDJPY results.

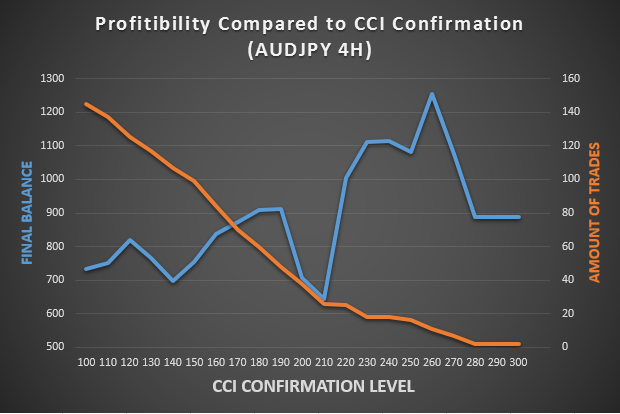

The traditional CCI turned a $1,000 account into $734. This was a much poorer result than what we saw on the EURUSD. But once again, we saw that the results on average were much higher when we filtered based on a higher Confirmation level. While the 170-180 level was an improvement, better still was using a higher Confirmation between 230-260. At those levels, this strategy would have turned a profit of 10-20% from our initial $1,000 account.

Looking Forward After a Backtest

Historical performance is not indicative of future results. This is

something we should all be aware of, but the tests shown today could

help lead us to some new ideas that might yield better results as we

move into the new year.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

CCI_DrawMode:

Implementation of the option to change the drawing mode, as exemplified by the CCI indicator.

Author: Сергей