Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.01.28 07:59

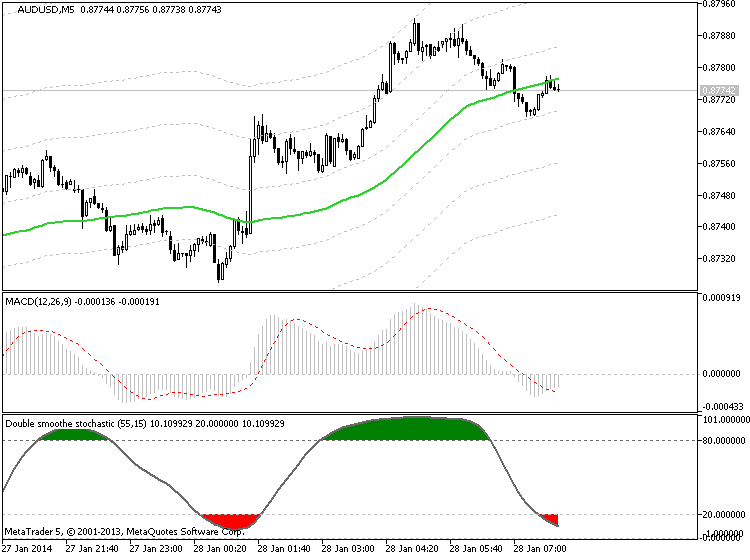

What is the MACD Indicator? How do I use it? (based on dailyforex article)

One of the most common technical indicators that is used by day traders in the financial markets can be seen in the Moving Average Convergence Divergence -- more commonly referred to as the MACD. But one mistake that many new traders make is that they will simply start using this indicator without really understanding how it functions or makes its calculations. This can lead to costly mistakes that should have been completely avoidable. So, it makes sense to study the logic and calculations behind the MACD (and all other indicators) in order to more accurately configure your day trading positions and generate gains on a consistent basis.

The Moving Average Convergence Divergence (MACD) Defined

Anyone with any experience in the forex markets and in technical

analysis strategies has likely heard a great deal about the Moving

Average Convergence Divergence (MACD). But what exactly does the MACD

tell us -- and how is it calculated? Without an understanding of these

areas, it can be difficult to see trading signals as they emerge. Here,

will deconstruct the MACD indicator and explain how and why it is

commonly used.

“In its most basic form,” said Haris Constantinou, markets analyst, “the

MACD is a momentum indicator that is designed to follow existing trends

and find new ones.” The MACD does this by showing the differences and

relationships between a two-level combination of moving averages and

price activity itself.

MACD Calculations

To determine and calculate the MACD, we must subtract a 26 period

Exponential Moving Average (EMA) from a 12 period EMA. Then, a 9 period

EMA of the MACD is plotted, and this becomes the Signal Line for the

indicator. The Signal Line is plotted over the MACD and this will be

used as the trigger reading for trading signals (both buy signals and

sell signals). These elements form the basis of the MACD construction,

and it is important to have a strong understanding of these elements if

you plan on using the indicator in your daily trading.

Three Common Approaches to the MACD

Now that we understand the basics of how the MACD is calculated, it is a

good idea to look at some of the common ways that the MACD is viewed by

traders so that we can get a sense of how exactly the indicator is used

to identify trading opportunities. There are a few different ways the

indicator can be interpreted, and the three of the most common methods

proven to be the most effective for traders include

- Crossovers,

- Divergences,

- and in identifying Overbought / Oversold conditions

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2014

Sergey Golubev, 2014.04.02 08:47

Technical Analysis Indicator MACD part one

Most technical analysis indicators are lagging. Let show you how to use MACD properly and its Leading indicator values.

MACD Oscillator Technical Analysis Fast Line and Signal Line

MACD is used in various ways to give technical analysis information.

- center line crosses indicate bullish or bearish markets; below zero is bearish, above zero is bullish.

- MACD crossovers indicate a buy or sell signal.

- MACD oscillations can be used to indicate oversold and overbought regions

- Used to look for divergence between price and indicator.

MACD Construction

The MACD is constructed using two exponential moving averages and MACD indicator plots two lines. The two default exponential moving averages used are 12 and 26. Then a smoothing factor of 9 is also applied when drawing.

Summary of how MACD is plotted

MACD uses 2 EMAs + a smoothing factor (12, 26 Exponential Moving Averages and 9 smoothing periods)

MACD only plots two lines- the fast line and the signal line

- The Fast Line is the difference between the 26 EMA and 12 EMA

- The signal line is the 9 period moving average of the MACD fast line.

Implementation

The MACD indicator implements the MACD line as a continuous line while the signal line is implemented as a histogram.

The fast line and signal line is used to generate trading signals using the crossover method.

There is also the center-line which is also known as the zero mark and it is a neutral point between buyers and sellers.

Values above the center-mark are considered bullish while those below are bearish.

The MACD being an oscillator indicator, oscillates above and below this center line.

MACD Indicator Fast Line and Center Line Crossover

MACD Center line crossovers generate Forex trading signals using the MACD center line. The sentiment of the Forex market can be confirmed using MACD crossovers. MACD crossover above the center mark generates bullish Forex market sentiment while crossover below the center line generates bearish market sentiment.

- When the MACD fast line crosses below the center mark it is an indication of a bearish market sentiment.

- When the MACD fast line crosses above the center mark going upwards, it is an indication that market sentiment is changing to bullish.

- MACD Center-line crossover signals will lag the market trend, but they are good for confirming MACD crossover signals.

Using the EURUSD Forex chart in the example below, when MACD fast line crossed below the zero line, the sell signal was confirmed and the market sentiment changed to bearish.

Also in the example below when MACD fast line later crosses above zero line a buy signal was generated and the market sentiment changed to bullish.

Oscillation of the MACD indicator

The MACD Forex indicator is an oscillation indicator that moves up and down around a zero mark. The center-line is the neutral measurement, values above zero will indicate bullish Forex market conditions while values below indicate bearish forex market region.

The MACD is also used to indicate overbought and oversold levels. When the MACD reaches overextended levels, then a currency is overbought or oversold. However, in a strong upward trending market prices will stay overbought in this case its better to buy.

Also in a strong down trending Forex market its better to sell, because prices will stay in the oversold region for a long time. Overbought conditions occur above the zero line while oversold conditions occur way below the zero mark.Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2014

Sergey Golubev, 2014.04.02 08:51

Technical Analysis Indicator MACD part twoPart two of the three part series on MACD

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2014

Sergey Golubev, 2014.04.02 08:57

Technical Analysis Indicator MACD part three

The final wrap up in the three part series on MACD

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

how to read MACD oscillator,how can intrepretations be made out of its reading

please suggest and educate.