You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.11 09:20

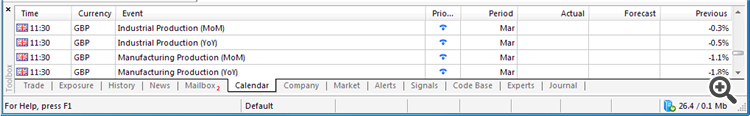

Trading News Events: U.K. Manufacturing Production (based on the article)

What’s Expected:

Why Is This Event Important:

Beyond the looming U.K. Referendum in June, positive data prints coming out of the region may put increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later as central bank officials see a risk of overshooting the 2% inflation target over the policy horizon.

However, waning demand from home and abroad may drag on business outputs, and an unexpected contraction in industrial & manufacturing production may drag on the British Pound as it gives the BoE greater scope to retain the record-low interest rate for an extended period of time.

How To Trade This Event Risk

Bullish GBP Trade: Industrial & Manufacturing Production Rebounds in March

- Need red, green-minute candle following the report to consider a long British Pound trade.

- If market reaction favors bullish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: U.K. Business Outputs Fall Short of Market Forecast- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBPUSD M5: 18 pips price movement by U.K. Manufacturing Production news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.11 16:20

GBP/USD Intra-Day Fundamentals: NIESR GDP Estimate and 25 pips price movement

2016-05-11 14:00 GMT | [GBP - NIESR GDP Estimate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - NIESR GDP Estimate] = Change in the estimated value of all goods and services produced by the economy during the previous 3 months.

==========

GBP/USD M5: 25 pips price movement by NIESR GDP Estimate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.12 10:42

Trading News Events: Bank of England Official Bank Rate (based on the article)What’s Expected:

Why Is This Event Important:

Indeed, Governor Mark Carney may continue to argue that the next move will be to normalize monetary policy, but the central bank may sound increasingly cautious this time around as the U.K. Referendum clouds the economic outlook for the region.

Nevertheless, sticky inflation paired signs of stronger wage growth may spur a dissent within the MPC, and a split vote to retain the current policy may generate a bullish reaction in the British Pound as it puts increased pressure on the BoE to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish GBP Trade: BoE Trims Growth & Inflation Forecast- Need red, five-minute candle following the GDP report to consider a short sterling trade.

- If market reaction favors bearish British Pound trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: MPC Adopts More Hawkish Outlook for Monetary Policy- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in the opposite direction.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.12 13:10

GBP/USD Intra-Day Fundamentals: BoE Official Bank Rate and 57 pips price movement

2016-05-12 11:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

Bank of England maintains Bank Rate at 0.5% and the size of the Asset Purchase Programme at £375 billion

==========

GBP/USD M5: 57 pips price movement by BoE Official Bank Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.17 12:28

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 38 pips price movement

2016-05-17 08:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

==========

GBP/USD M5: 38 pips price movement by U.K. Consumer Price Index news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.18 08:31

Trading the News: U.K. Jobless Claims Change (based on the article)

...

Anyway, if we look at GBP/USD chart so the price is located near 200 period SMA waiting for direction.

If the price breaks 1.4457 resistance to above on close bar so the bullish trend will be continuing;

If the price breaks 1.4410 support level to below so the bearish reversal will be started;

If not so the price will be on ranging condition within the channel of the levels.

If the price breaks 1.4457 resistance to above on close bar so the bullish trend will be continuing;

If the price breaks 1.4410 support level to below so the bearish reversal will be started;

If not so the price will be on ranging condition within the channel of the levels.

---

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.19 10:52

GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 40 pips price movement

2016-05-19 08:30 GMT | [GBP - Retail Sales]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

==========

GBP/USD M5: 40 pips price movement by U.K. Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.26 12:25

GBP/USD Intra-Day Fundamentals: U.K. Total Business Investment and 47 pips price movement

2016-05-26 08:30 GMT | [GBP - Total Business Investment]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Total Business Investment] = Change in the total inflation-adjusted value of capital investments made by businesses and the government.

==========

==========

GBP/USD M5: 47 pips price movement by U.K. Total Business Investment news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.04 12:06

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY, AUD/USD, and GOLD (based on the article)

GBP/USD - "A series of disappointing data prints may further undermine bets for two Fed rate-hikes in 2016 as the central bank remains ‘data-dependent,’ and the fresh batch of central bank rhetoric from Cleveland Fed President Loretta Mester, Boston Fed President Eric Rosengren and Fed Chair Janet Yellen may dampen the appeal of the greenback should the 2016 voting-members adopt a more dovish outlook for monetary policy. With Fed Funds Futures now highlighting a less than 10% probability for a rate-hike at the June meeting, the greenback may continue to trade on a weaker tone next week amid waning expectations for higher borrowing-costs."Daily price is located below 200-day SMA and above 100-day SMA for the ranging bearish market condition. The price is on ranging within the following support/resistance levels:

If the price breaks 1.4724 resistance to above on daily close bar so the reversal of the price movement from the ranging bearish to the primary bullish will be started with 1.4769 as a nearest bullish target.

If the price breaks 1.4385 support level to below on close bar so the primary bearish trend will be continuing with 1.4331 target to re-enter.

If not so the price will be on ranging bearish condition.

H4 price is located near 100 SMA/200 SMA reversal area waiting for ther direction of the trend.

If the price breaks 1.4581 resistance to above on H4 close bar so the primary bullish trend will be resumed for this timeframe.

If the price breaks 1.4398 support level to below on close H4 bar so the primary bearish trend will be continuing with 1.4331 target to re-enter.

If not so the price will be on ranging bearish condition.